Nội dung toàn văn Directive No. 790-TTg of October 26 , 1996, of the Prime Minister on enhancing the management of budget revenue collection, definitive settlement of tax arrears, and ensuring fulfilment of revenue collection plan for 1996

|

THE PRIME MINISTER OF GOVERNMENT |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 790-TTg |

Hanoi , October 26 , 1996 |

DIRECTIVE

ON ENHANCING THE MANAGEMENT OF BUDGET REVENUE COLLECTION, DEFINITIVE SETTLEMENT OF TAX ARREARS, AND ENSURING FULFILMENT OF REVENUE COLLECTION PLAN FOR 1996

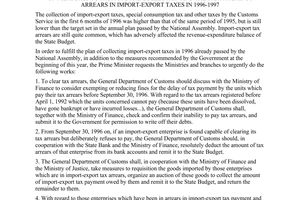

Compared with the previous years, the collection of revenues for the State budget in the first 9 months of 1996 made much progress thanks to the close and timely direction of the Government and the efforts of the different levels and branches. However, the tempo of fulfilling the plan was still low, and in the first 9 months, only 62.3% of the annual plan were fulfilled. The collection of many major sources of revenue was low: 59.9% from the State-owned economic sector, 55.3% from the industrial, commercial and non-State services sectors, 58.5% from import-export tariffs, and in particular, only 25.9% from the transfer of the land-use right. The evasion, delay and misappropriation of tax remittances to the State were still large and widespread.

In order to enhance the direction of the collection of revenues for the State budget, definitively settle tax arrears and misappropriation of tax remittances to the State budget, and fulfil the revenue collection plan for 1996, the Prime Minister requests:

1. The Ministries, branches and the People’s Committees of the provinces and cities to guide the units in organizing and defining the orientation of their production and business, promptly overcoming difficulties to push up production in the last months of 1996, particularly the production of vital products, to create major sources of revenue for the budget.

2. The various levels and branches to direct the units and dependent enterprises to strictly abide by the Tax Law by paying promptly and adequately the taxes and other revenues to the State budget; they should not keep back nor adjust any payment without permission from the Government; they should strictly comply with the accounting and statistical regime, and be economical in spending in order to raise the efficiency of production and business and increase accumulation for the State budget.

3. The General Department of Customs shall cooperate with the branches to strictly carry out Directive No.575-TTg of August 24, 1996 of the Prime Minister, and seek in time the Prime Minister�s opinion when any problem crops up while carrying out that Directive in order to definitively settle tax arrears from import and export in 1996.

4. With regard to the revenues from domestic production and business:

The Ministry of Finance shall have the tax arrears of each enterprise accurately recorded and classify each debt for settlement as follows:

a) With regard to those debts which are allowed to be carried over by law, the taxation service must follow and urge the debtor enterprise to pay adequately any amount it owes and collect it in time as provided for by law, thus preventing the debts transferrable by law from becoming tax arrears;

b) With regard to the tax debts which cannot be collected due to the merging or dissolution of units or to the inability of a losing enterprise to pay tax, each debt should be recorded and classified so that they may be put on record or written off as stipulated;

c) With regard to those tax debts which cannot be collected because the production units concerned have suffered losses and lack capital, and their products are uncompetitive and unsaleable, these debts must be classified for concrete settlement.

With regard to the special consumption taxes of local State-owned units, if these units face difficulties in production and in the marketing of their products due to their outdated equipment and therefore cannot adequately pay the taxes as stipulated by law, the Ministry of Finance should consider each specific case and recommend to the Prime Minister measures to neatly settle the tax arrears. From 1997 on, these units must re-organize their production and business with a view to greater efficiency and full tax payment to the State;

d) With regard to the tax arrears which the production and business units deliberately keep back for their own interests, the taxation service must take firm measures to collect them for the State budget, and at the same time, enhance their control to avoid losses to the budget and ensure strict observance of the tax laws.

5. With regard to the collection of revenues from the transfer of the land-use right, the Ministry of Finance should urgently classify them and recommend to the Prime Minister measures for definitive settlement.

6. The State Inspectors, the Financial Inspectors and the Tax Inspectors should check and ensure good financial management of such branches as Post and Telecommunications, Civil Aviation and Electricity.

The inspection and control of the enterprises should be undertaken in conformity with Directive No.424-TTg of August 23, 1993 of the Prime Minister stipulating the cooperation among the law enforcement agencies.

The People’s Committees of the provinces and cities, the Ministries and branches should work out concrete plans, closely and actively direct the collection of budget revenues, and in particular, definitively settle the tax arrears in order to fulfil the task assigned by the National Assembly of collecting budget revenues for 1996

|

|

FOR THE PRIME MINISTER |