Circular No. 99/2002/TT-BTC of October 25, 2002 guiding the regime of collection, remittance, management and use of fees to be applied at the foreign-based Vietnamese diplomatic missions and consulates đã được thay thế bởi Decision no. 40/2005/QD-BTC of July 06, 2005 on release of the list of legal documents issued by the ministry of finance that had lapsed, abrogated or replaced và được áp dụng kể từ ngày 15/08/2005.

Nội dung toàn văn Circular No. 99/2002/TT-BTC of October 25, 2002 guiding the regime of collection, remittance, management and use of fees to be applied at the foreign-based Vietnamese diplomatic missions and consulates

|

THE

MINISTRY OF FINANCE |

OF VIET |

|

No: 99/2002/TT-BTC |

, October 25, 2002 |

CIRCULAR

GUIDING THE REGIME OF COLLECTION, REMITTANCE, MANAGEMENT AND USE OF FEES TO BE APPLIED AT THE FOREIGN-BASED VIETNAMESE DIPLOMATIC MISSIONS AND CONSULATES

Pursuant to the National Assembly Standing

Committee’s Charge and Fee Ordinance No. 38/2001/PL-UBTVQH10 of August 28,

2001;

Pursuant to Decree No. 189/HDBT of June 4, 1992 of the Council of Ministers

(now the Government) detailing the implementation of the Consular Ordinance;

Pursuant to the Government’s Decree No. 57/2002/ND-CP of June 3, 2002 detailing

the implementation of the Charge and Fee Ordinance;

Pursuant to the Prime Minister’s Official Dispatch No. 398/CP-KTTH of May 14,

2002 on the mechanism of using the overseas consular fee;

The Finance Ministry hereby guides the regime of collection, remittance,

management and use of fees to be applied at the foreign-based Vietnamese

diplomatic missions and consulates (hereinafter referred collectively to as the

consular fee), as follows:

I. APPLICATION SCOPE AND FEE PAYERS

1. Application scope: This Circular shall only apply from its effective date till the end of December 31, 2005. As from January 1, 2006, there will be specific guidance.

2. Fee payers:

Vietnamese and foreign organizations and individuals, that are provided services in the State management domain at their own requests or under the provisions of law by the foreign-based diplomatic missions or consulates of the Socialist Republic of Vietnam, shall have to pay the fees

3. The consular fee shall not be collected in the following cases:

a/ Foreigners being guests (including their accompanying spouses and/or children) invited by the Party, the National Assembly, the State and the Government or by the leaders of the Party, the National Assembly, the State and the Government of the Socialist Republic of Vietnam in their personal capacity.

but have unilaterally given visa fee exemption to Vietnamese citizens bearing diplomatic, official or general passports, shall also be exempt from the visa fee on the principle of reciprocity.

to carry out relief work or humanitarian assistance to Vietnamese organizations and/or individuals.

II. FEE LEVELS

1. The consular fee levels specified in the Fee Table promulgated together with this Circular shall be applied at the foreign-based Vietnamese diplomatic missions and consulates.

For the following cases, the specific fee levels shall be applied as follows:

a/ Vietnamese permanently residing in China, Laos and Thailand shall pay the fees at a level equal to 50% of the prescribed one; Vietnamese permanently residing in Cambodia shall pay the fee at a level equal to 20% of the prescribed one corresponding to the services specified in the Fee Table.

b/ On the principle of reciprocity and according to practices in each foreign country, the Ministry for Foreign Affairs shall consider and decide to readjust (increase or reduce) by up to 20% the fee levels prescribed in the Fee Table promulgated together with this Circular, to be applied at the Vietnamese diplomatic mission or consular office in each specific country. In cases where it is necessary to readjust (increase or reduce) by over 20%, the Ministry for Foreign Affairs shall request in writing the Finance Ministry to decide.

2. The consular fees shall be collected in US dollar (USD) or in local currencies which are converted from USD at the exchange rates set by banks where the Vietnamese representation offices open their accounts and kept stable for 6 months. Within the said duration, if the exchange rates fluctuate (increase or reduce) by 20%, the heads of the representation offices shall have to report such to the Finance Ministry for consideration and resetting of the fee levels in local currencies, which shall also be kept stable according to such principle.

III. FEE COLLECTION, REMITTANCE AND MANAGEMENT

1. The consular fee-collecting agencies shall be the foreign-based Vietnamese diplomatic missions and consulates directly providing to organizations and individuals the State management-related services at the latter�s requests or according to the provisions of law. The consular fee-collecting agencies shall have to:

- Organize the fee collection and remittance strictly according to the provisions of this Circular. When collecting and remitting the fees, they must use fee collection and remittance vouchers printed and issued by the Ministry for Foreign Affairs in conformity with management requirements of the branch after obtaining the written agreement of the Finance Ministry (the General Tax Department).

- Open accounting books to monitor the collected fee amounts and amounts remitted into the State budget, and spend fee amounts in strict compliance with the prescribed regime.

2. Procedures for collecting and remitting the fees into the State budget

During the 2001-2005 five-year period, the Ministry for Foreign Affairs shall be entitled to deduct 70% of the total actually collected fee amount before remitting the remainder into the State budget, for spending according to the contents prescribed in Section IV of this Circular. The remainder (30%) shall be monthly (on the 25th of each month at the latest) remitted by the collecting agencies into the State budget depository fund according to the provisions of the Finance Ministry’s Circular No. 29/2000/TT-BTC of April 24, 2000 prescribing the management of the State budget depository funds at the foreign-based Vietnamese representation offices. From the year 2006 on, the Finance Ministry shall provide specific guidance thereon.

IV. USE OF COLLECTED FEE AMOUNT

The retained amount of 70% of the collected fee amount shall be used by the Ministry for Foreign Affairs for the following spending contents:

1. During the 2001-2005 five-year 85/2001/TT-BTC of October 25, 2001 guiding the management and use of the overseas consular fee source left to the Ministry for Foreign Affairs for investment in projects on purchase of houses, upgrading of material foundations and working facilities for the overseas Vietnamese representation offices.

2. The remainder of 30% of the collected consular fee amount shall be spent on the following:

+ 1/3 thereof shall be supplemented to regular funding for the repair of offices, residential houses and procurement of equipment and facilities for the overseas Vietnamese representation offices.

+ 2/3 thereof shall be deducted for:

- Payment of allowance to officials involved in the collection work.

- Regulation and distribution of incomes among the foreign-based Vietnamese representation offices.

- Setting up of reward fund and welfare fund at the average per-head annual level not exceeding three months actually paid cost-of-living allowance.

The Finance Ministry shall make credit entries into the State budget and debit entries for estimated budgetary allocations to the Ministry for Foreign Affairs for such retained 30% of the collected fee amount.

The diplomatic missions and consulates shall have to use the whole deducted fee amount according to the prescribed regime and make annual settlements thereof. The amount not used up in a year shall be carried forward to the subsequent year for further spending according to regulations.

V. SETTLEMENT OF FEE REVENUES AND EXPENDITURES

1. The foreign-based Vietnamese representation offices shall have to open accounting books for recording and accounting the fee revenue and expenditure amounts strictly according to the Finance Minister’s Decision No. 999/TC/QD/CDKT of November 2, 1996 promulgating the system of administrative and non-business accounting regimes.

2. The Ministry for Foreign Affairs shall have to examine and certify the consular fee revenue and expenditure settlements of the foreign-based Vietnamese representation offices (Appendix 1) and incorporate them in the annual settlement report to be sent to the Finance Ministry for appraisal (Appendices 2 and 3) and notification of approval of such settlement together with the Ministry for Foreign Affairs settlement of funding for the foreign-based Vietnamese representation offices.

3. The Ministry for Foreign Affairs shall have to coordinate with the Finance Ministry in organizing periodical inspection of the overseas Vietnamese representation offices in order to ensure that revenues and expenditures are

IV. ORGANIZATION OF IMPLEMENTATION

1. This Circular takes effect 15 days after its signing and replaces the Finance Ministry�s Circular No. 64/2000/TT-BTC of July 3, 2000 and Circular No. 90/2000/TT-BTC of September 1, 2000, and Joint Circular No. 08/TTLT-BTP-BNG of December 31, 1998 of the Finance Ministry, the Justice Ministry and the Ministry for Foreign Affairs.

2. The Ministry for Foreign Affairs shall guide the overseas Vietnamese diplomatic missions and consular offices to collect, remit and use the consular fees according to the provisions of this Circular.

3. Organizations and individuals liable to pay the consular fees and the concerned agencies shall have to implement this Circular.

|

|

FOR THE FINANCE MINISTER |

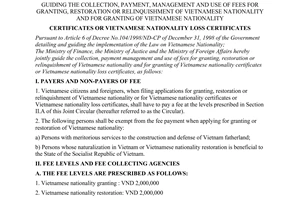

TABLE OF CONSULAR (Promulgated together with the Finance Ministry’s Circular No. 99/2002/TT-BTC of October 25, 2002)

|

|

|

Fee levels (USD) |

|

|

Ordinal number |

List |

Vietnamese bearing Vietnamese passports |

Foreigners and Vietnamese bearing foreign passports |

|

A |

Fees for granting passports and visas: |

|

|

|

1 |

Passports: |

|

|

|

|

- New granting |

50 |

|

|

|

- Extension |

20 |

|

|

|

- Supplement, amendment or sticking of children�s photos |

10 |

|

|

|

- Re-granting in replacement of damaged or lost ones |

100 |

|

|

2 |

a/ Laissez-passers: |

|

|

|

|

- New granting |

20 |

|

|

|

- Extension |

10 |

|

|

|

- Re-granting in replacement of damaged or lost ones |

30 |

|

|

|

b/ Repatriation laissez-passers: |

|

|

|

|

- New granting |

100 |

|

|

|

- Re-granting in replacement of damaged or lost ones |

120 |

|

|

3 |

Visas of all kinds: |

|

|

|

|

a/ Those for single entry, exit or transit |

|

25 |

|

|

b/ Those for double entry, exit or transit |

|

40 |

|

|

c/ Those for multiple entry, exit or transit: |

|

|

|

|

- Valid for less than 6 months |

|

70 |

|

|

- Valid for between 6 months and one year |

|

100 |

|

|

d/ Granting of AB stamp (for general passport holders on public missions) |

10 |

|

|

|

e/ Issuance of consular certifications at citizens� requests |

10 |

|

|

|

f/ Issuance of citizenship registration certificates |

5 |

|

|

B |

Other fees: |

|

|

|

1 |

For authentication of contracts |

50 |

50 |

|

2 |

For authentication of testaments, authorization letters, document excerpts, duplicates or copies of papers, documents and translations |

5 |

10 |

|

3 |

For legalization of papers, documents (per one paper, one document or one title) |

5 |

10 |

|

4 |

For forwarding of judicial mandate dossiers. For verification of papers and documents (freights excluded) |

15 |

20 |

|

5 |

For granting or authentication of papers or documents related to ships, airplanes and other transport means |

10 |

0 |

|

6 |

For compilation of dossiers and carrying out of procedures for inheriting property: |

|

|

|

|

- For inheritance property valued at under USD 1,000 |

50 |

|

|

|

- For inheritance property valued at USD 1,000 or more |

2% of the property value |

|

|

C |

Nationality fees: |

|

|

|

|

- For naturalization |

|

150 |

|

|

- For nationality restoration |

|

150 |

|

|

- For nationality relinquishment |

150 |

|

|

|

- For granting of nationality certificate |

35 |

|

|

|

- For granting of nationality loss certificate |

35 |

|

|

|

FOR THE FINANCE MINISTER |