Joint circular No. 08/1998/TTLT-BTC-BTP-BNG of December 31, 1998 guiding the col đã được thay thế bởi Circular No. 99/2002/TT-BTC of October 25, 2002 guiding the regime of collection, remittance, management and use of fees to be applied at the foreign-based Vietnamese diplomatic missions and consulates và được áp dụng kể từ ngày 09/11/2002.

Nội dung toàn văn Joint circular No. 08/1998/TTLT-BTC-BTP-BNG of December 31, 1998 guiding the col

|

THE MINISTRY OF

FINANCE - THE MINISTRY OF JUSTICE - THE MINISTRY OF FOREIGN AFFAIRS |

SOCIALIST REPUBLIC OF VIET NAM |

|

No.08/1998/BTC-BTP-BNG |

Hanoi, December 31, 1998 |

JOINT CIRCULAR

GUIDING THE COLLECTION, PAYMENT, MANAGEMENT AND USE OF FEES FOR GRANTING, RESTORATION OR RELINQUISHMENT OF VIETNAMESE NATIONALITY AND FOR GRANTING OF VIETNAMESE NATIONALITY

CERTIFICATES OR VIETNAMESE NATIONALITY LOSS CERTIFICATES

Pursuant to Article 6 of Decree

No.104/1998/ND-CP of December 31, 1998 of the Government detailing and guiding

the implementation of the Law on Vietnamese Nationality;

The Ministry of Finance, the Ministry of Justice and the Ministry of Foreign

Affairs hereby jointly guide the collection, payment management and use of fees

for granting, restoration or relinquishment of Vietnamese nationality and for

granting of Vietnamese nationality certificates or Vietnamese nationality loss

certificates, as follows:

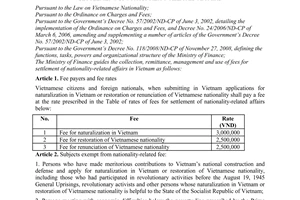

I. PAYERS AND NON-PAYERS OF FEE

1. Vietnamese citizens and foreigners, when filing applications for granting, restoration or relinquishment of Vietnamese nationality or for Vietnamese nationality certificates or Vietnamese nationality loss certificates, shall have to pay a fee at the levels prescribed in Section II.A of this Joint Circular (hereafter referred to as the Circular).

2. The following persons shall be exempt from the fee payment when applying for granting or restoration of Vietnamese nationality:

a) Persons with meritorious services to the construction and defense of Vietnam fatherland;

b) Persons whose naturalization in Vietnam or Vietnamese nationality restoration is beneficial to the State of the Socialist Republic of Vietnam.

II. FEE LEVELS AND FEE COLLECTING AGENCIES

A. THE FEE LEVELS ARE PRESCRIBED AS FOLLOWS:

1. Vietnamese nationality granting : VND 2,000,000

2. Vietnamese nationality restoration: VND 2,000,000

3. Vietnamese nationality relinquishment: VND 2,000,000

4. Granting of a Vietnamese nationality certificate: VND 500,000

5. Granting of a Vietnamese nationality loss certificate: VND 500,000.

The fee levels prescribed in Section II.A.5 of this Circular shall also apply to cases of granting certificates of non-holding of Vietnamese nationality.

B. THE FEE COLLECTING AGENCIES:

- The fees for Vietnamese nationality granting, restoration or relinquishment and for granting of Vietnamese nationality certificates, Vietnamese nationality loss certificates or certificates of non-holding of Vietnamese nationality constitute the State budget’s revenues collected by the Justice Services of provinces and centrally-run cities and the Vietnamese diplomatic missions or consular offices abroad (hereafter referred collectively to as the collecting agencies) when receiving dossiers from the applicants.

- In the country, the collecting agencies shall collect fees in Vietnamese currency; if the applicants pay the fees in foreign currency(ies), such foreign currency(ies) shall be converted into Vietnamese currency at the exchange rate(s) announced by the State Bank of Vietnam at the time of payment.

- Outside the country, the collecting agencies shall base themselves on the fee levels prescribed in Section A above to determine the fee collection levels in US dollar and calculate them in integral numbers.

III. MANAGEMENT AND USE OF THE COLLECTED FEES

1. When collecting the fees, the collecting agencies shall have to use receipts and vouchers uniformly issued by the Ministry of Finance (the General Department of Tax) and open books to monitor the collection, payment and use of fees. The shall also have to make annual settlement reports according to the current regime.

2. The collecting agencies shall be entitled to deduct 10 per cent of the total collected fee amount to add their operating funds (considered as operating funds additionally allocated by the State budget) in service of the verification and examination of dossiers, and cover other expenses relating to the settlement of dossiers applying for Vietnamese nationality granting, restoration or relinquishment and for Vietnamese nationality certificates, Vietnamese nationality loss certificates or certificates of non-holding of Vietnamese nationality. At the end of each year, the collecting agencies shall have to report the settlement of the spent fee amount to the finance agencies in their respective annual settlement reports. The fee amount which remains unused till December 31 shall be remitted into the State budget.

3. The remainder (90per cent) after making the deduction according to the percentage prescribed in Point 2, Section III of this Circular shall be remitted into the State budget by the collecting agencies under the following guidance:

- In the country, it shall be remitted into Item No.046 "Administrative fees" sub-item No.15 according to the corresponding chapter, category and item of the collecting agency. The collecting agency shall have to remit such amount within the time limit set by the local tax agency; and each month’s remitable amount must be fully remitted not later than the 5th of the following months;

- In foreign countries, it shall be remitted into the temporary custody fund of the State budget according to provisions of Circular No.11-TC/TCDN of April 20, 1992 of the Ministry of Finance stipulating the management of temporary custody funds of the State budget at Vietnamese diplomatic missions in foreign countries.

IV. IMPLEMENTATION PROVISIONS

1. If the market prices rise by 20per cent as compared with those at the time when this Circular was issued, the Ministry of Finance shall coordinate with the Ministry of Justice and the Ministry of Foreign Affairs in readjusting the collection levels prescribed in Section II.A of this Circular.

2. This Circular takes effect from January 1st, 1999.

Any problems arising in the course of implementation of this Circular shall be reported by the collecting agencies to the Ministry of Finance, the Ministry of Justice and the Ministry of Foreign Affairs for consideration and solution.

|

FOR THE MINISTER OF

FINANCE |

FOR THE MINISTER OF

JUSTICE |

FOR THE MINISTER OF

FOREIGN AFFAIRS |