Nội dung toàn văn Circular 22/2016/TT-BCT implementation rules of origins in the ASEAN Trade in Goods Agreement

|

MINISTRY OF

INDUSTRY AND TRADE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 22/2016/TT-BCT |

Hanoi, October 03, 2016 |

CIRCULAR

IMPLEMENTATION OF RULES OF ORIGINS IN THE ASEAN TRADE IN GOODS AGREEMENT

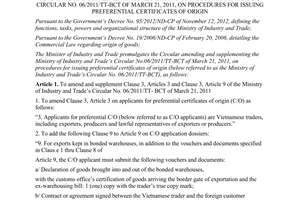

Pursuant to the Government's Decree No. 95/2012/NĐ-CP dated November 12, 2012, defining the functions, tasks, powers and organizational structure of the Ministry of Industry and Trade;

Pursuant to the Government's Decree No. 19/2006/NĐ-CP dated February 20, 2006 on guidelines for goods origins in the Law on Trade;

Pursuant to the ASEAN Trade in Goods Agreement concluded on February 26, 2009 at the 14th ASEAN summit in Cha-am, Thailand between member states of ASEAN;

Pursuant to Protocol on Legal framework to implement the ASEAN Single Window done at Hanoi, Vietnam on September 04, 2015;

At the request of Director of Export and Import Administration,

The Minister of Industry and Trade promulgates a Circular on implementation of rules of origins in the ASEAN Trade in Goods Agreement.

Article 1. Scope and regulated entities

1. This Circular provides for implementation of rules of origins in the ASEAN Trade In Goods Agreement (ATIGA)

2. This Circular applies to organizations and individuals involved in activities related to goods origins on the ATIGA.

Article 2. Rules of origin

The following Appendices are promulgated together with this Circular to provide guidance on implementation of Chapter 3 Rules of origins and procedures for issuance and verification of Certificate of Origin on the ATIGA:

1. Rules of origin (Appendix I).

2. Product-specific rules (Appendix II).

3. Substantial transformation criterion for textiles and textile products (Appendix III).

4. List of ITA products (Appendix IV).

5. Principles and guidelines for calculating regional value content (Appendix V).

6. Guidelines for partial cumulation (Appendix VI).

7. Issuance and verification of Certificates of Origin (Appendix VII).

8. Certificate of Origin Form D (Appendix VIII).

9. Certificate of Origin completion guidance (Appendix IX).

10. List of issuing authorities (Appendix X).

Article 3. Procedures for issuance and verification of Certificates of Origin and self-certification of goods origins

1. Procedures for issuance and verification of Certificates of Origin are specified in Appendix VII enclosed herewith and Circular No. 06/2011/TT-BCT dated March 21, 2011 on procedures for issuance of Certificates of Origin to goods eligible for incentives and Circular No. 01/2013/TT-BCT dated January 03, 2013 on amendments to Circular No. 06/2011/TT-BCT

2. The pilot mechanism for self-certification of goods origins on the ATIGA shall comply with applicable regulations of the Ministry of Industry and Trade. Goods whose origins are declared by traders under such mechanism must comply with the rules of origins specified in this Circular.

Article 4. Effect

1. This Circular comes into force from November 15, 2016.

2. Circular No. 21/2010/TT-BCT dated May 17, 2010 of the Minister of Industry and Trade and Circular No. 42/2014/TT-BCT dated November 18, 2014 are abrogated./.

|

|

MINISTER |

APPENDIX I

RULES OF ORIGINS

(Promulgated together with Circular No. 22/2016/TT-BCT dated October 03,

2016 of the Minister of Industry and Trade)

Article 1. Definitions

For the purposes of this Appendix:

1. “aquaculture” means the farming of aquatic organisms including fish, molluscs, crustaceans, other aquatic invertebrates and aquatic plants, from feedstock such as eggs, fry, fingerlings and larvae, by intervention in the rearing or growth processes to enhance production such as regular stocking, feeding, or protection from predators.

2. “CIF” means the value of the goods imported, and includes the costs of freight and insurance up to the port or place of entry into the country of importation. The valuation shall be made in accordance with Article VII of GATT 1994 and the Agreement on the Implementation of Article VII of GATT 1994 as contained in Annex 1A to the WTO Agreement.

3. “FOB” means the free-on-board value of the goods, inclusive of the costs of transport to the port or site of final shipment abroad. The valuation shall be made in accordance with Article VII of GATT 1994 and the Agreement on the Implementation of Article VII of GATT 1994 as contained in Annex 1A to the WTO Agreement;

4. “generally accepted accounting principles” means the recognized consensus or substantial authoritative support in the territory of a Member State, with respect to the recording of revenues, expenses, costs, assets and liabilities; the disclosure of information;

5. “goods” shall include materials and/or products, which can be wholly obtained or produced, even if they are intended for later use as materials in another production process. For the purposes of this Appendix, the terms “goods” and “products” can be used interchangeably.

6. “identical and interchangeable materials” means materials being of the same kind and quality, possessing the same technical and physical characteristics, and which after being incorporated into the finished product cannot be distinguished from one another for origin purposes by virtue of any markings, etc.

7. “materials” means any matter or substances used or consumed in the production of goods or physically incorporated into another good or are subject to a process in the production of another good;

8. “originating goods or originating material” means goods or material that qualifies as originating in accordance with the provisions of this Appendix.

9. “packing materials and containers for transportation” means the goods used to protect a good during its transportation, different from those containers or materials used for its retail sale.

10. "production” means methods of obtaining goods, including growing, mining, harvesting, raising, breeding, extracting, gathering, collecting, capturing, fishing, trapping, hunting, manufacturing, producing, processing or assembling goods.

11. “product specific rules” means rules that specify that the materials have undergone a change in tariff classification or a specific manufacturing or processing operation, or satisfy a Regional Value Content criterion or a combination of any of these criteria.

Article 2. Origin criteria

A good imported into the territory of a Member State from another Member State shall be treated as an originating good and eligible for tariff incentives if it conforms to any one of the following conditions:

1. A good which is wholly obtained or produced in the exporting Member State as set out and defined in Article 3 of this Appendix.

2. A good not wholly obtained or produced in the exporting Member State, provided that the said goods are eligible under Article 4 or Article 6 of this Appendix.

Article 3. Wholly obtained or produced goods

Goods specified in Clause 1 Article 2 of this Appendix shall be considered wholly obtained or produced in the exporting Member State in the following cases:

1. Plants and products thereof, including fruits, flowers, vegetables, trees, seaweed, fungi and other plants grown, harvested, picked or gathered in the exporting Member State.

2. Live animals, including mammals, birds, fish, crustaceans, molluscs, reptiles, bacteria and virus, born and raised in the exporting Member State.

3. Goods obtained from live animals in the exporting Member State.

4. Goods obtained from hunting, trapping, fishing, farming, aquaculture, gathering or capturing in the exporting Member State.

5. Minerals and other naturally occurring substances, not included in Clauses 1 to 4 of this Article, extracted or taken from its soil, waters, seabed or beneath its seabed.

6. Products of sea-fishing taken by vessels registered with a Member State and entitled to fly its flag and other products taken from the waters, seabed or beneath the seabed outside the territorial waters of that Member State, provided that Member State has the rights to exploit such waters, seabed and beneath the seabed in accordance with international law.

7. Products of sea-fishing and other marine products taken from the high seas by vessels registered with a Member State and entitled to fly the flag of that Member State.

8. Products processed and/or made on board factory ships registered with a Member State and entitled to fly the flag of that Member State, excluding products referred to in Clause 7 of this Article.

9. Articles collected there which can no longer perform their original purpose nor are capable of being restored or repaired and are fit only for disposal or recovery of parts of raw materials, or for recycling purposes.

10. Waste and scrap derived from:

a) production in the exporting Member State; or

b) used goods collected in the exporting Member State, provided that such goods are fit only for the recovery of raw materials.

11. Goods obtained or produced in the exporting Member State from products referred to in Clauses 1 to 10 of this Article.

Article 4. Not wholly obtained or produced goods

1. General origin criteria:

a) Goods specified in Clause 2 Article 2 of this Appendix shall be deemed to be originating in the Member State where working or processing of the goods has taken place if:

- the goods have a regional value content (hereinafter referred to as “ASEAN Value Content” or the “Regional Value Content (RVC)”) of not less than forty percent (40%) calculated using the formula set out in Article 29; or

- all non-originating materials used in the production of the goods have undergone a change in tariff classification (hereinafter referred to as “CTC”) at four-digit level (i.e. a change in tariff heading) of the Harmonized System.

b) Each Member State shall permit the exporter of the good to decide whether to use “RVC of not less than 40%) or “CTC at four-digit level” mentioned in Point a Clause 1 to determine origin of the goods.

2. Product specific rules:

Notwithstanding Clause 1 of this Article, goods listed in Appendix II shall qualify as originating goods if the goods satisfy the product specific rules set out therein;

b) Where a product specific rule provides a choice of rules from a RVC-based rule of origin, a CTC-based rule of origin, a specific manufacturing or processing operation, or a combination of any of these, each Member State shall permit the exporter of the goods to decide which rule to use in determining goods origins;

c) Where product specific rules specify a certain RVC, it is required that the RVC of a good is calculated using the formula set out in Article 5;

d) Where product specific rules requiring that the materials used have undergone CTC or a specific manufacturing or processing operation, the rules shall apply only to non-originating materials.

3. Notwithstanding Clause 1 and 2 of this Article, a good which is covered by Attachment A or B of the Ministerial Declaration on Trade in Information Technology Products adopted in the Ministerial Conference of the WTO on December 13, 1996, set out as Appendix 4, shall be deemed to be originating in a Member State if it is assembled from materials covered under the same Appendix.

Article 5. Calculation of RVC

1. RVC mentioned in Article 4 is calculated using one of the following formulae:

a) Direct formula

|

RVC = |

ASEAN material cost |

+ |

Direct labor cost |

+ |

Direct overhead |

+ |

Other cost |

+ |

Profit |

x 100 % |

|

FOB price |

||||||||||

or

b) Indirect formula

|

RVC = |

FOB price |

- |

Value of non-originating materials |

x 100 % |

|

FOB price |

||||

2. For the purposes of calculating the RVC provided in Clause 1 of this Article:

a) ASEAN material cost is the CIF value of originating materials, parts or goods that are acquired or self-produced by the producer;

b) Value of non-originating materials, parts or goods is:

- The CIF value at the time of importation of the goods or importation can be proven; or

- The earliest ascertained price paid for the goods of undetermined origin in the territory of the Member State where the working or processing takes place;

c) Direct labour cost includes wages, remuneration and other employee benefits associated with the manufacturing process;

d) The calculation of direct overhead cost shall include, but is not limited to, real property items associated with the production process (insurance, factory rent and leasing, depreciation on buildings, repair and maintenance, taxes, interests on mortgage); leasing of and interest payments for plant and equipment; factory security; insurance (plant, equipment and materials used in the manufacture of the goods); utilities (energy, electricity, water and other utilities directly attributable to the production of the goods); research, development, design and engineering; dies, moulds, tooling and the depreciation, maintenance and repair of plant and equipment; royalties or licences (in connection with patented machines or processes used in the manufacture of the goods or the right to manufacture the goods); inspection and testing of materials and the goods; storage and handling in the factory; disposal of recyclable wastes; and cost elements in computing the value of raw materials, i.e. port and clearance charges and import duties paid for dutiable component; and

dd) FOB price means the free-on-board value of the goods as defined in Article 25. FOB price shall be determined by adding the value of materials, production cost, profit and other costs.

3. Member States shall determine and adhere to only one method of calculating the RVC. Member States shall be given the flexibility to change their calculation method provided that such change is notified to the AFTA Council at least six months prior to the adoption of the new method. Any verification to the ASEAN Value Content calculation by the importing Member State shall be done on the basis of the method used by the exporting Member State.

4. In determining the RVC, Member States shall closely adhere to the guidelines for costing methodologies set out in Appendix V.

5. Locally-procured materials produced by established licensed manufacturers, in compliance with domestic regulations, shall be deemed to have fulfilled the origin requirement of this Agreement; locally-procured materials from other sources shall be subjected to the origin verification pursuant to Customs Valuation Agreement for the purpose of origin determination.

6. The value of goods under this Chapter shall be determined in accordance with the provisions of Customs Valuation Agreement.

7. Vietnam shall apply the indirect method specified in Point b Clause 1 of this Article for the purpose of determination of exports under the ATIGA.

Article 6. Accumulation

1. Unless otherwise provided in this Agreement, goods originating in a Member State, which are used in another Member State as materials for finished goods eligible for preferential tariff treatment, shall be considered to be originating in the latter Member State where working or processing of the finished goods has taken place.

2. If the RVC of the material is less than forty percent (40%), it shall be cumulated using the RVC criterion in direct proportion to the actual domestic content provided that it is equal to or more than twenty percent (20%). The implementing guidelines are set out in Appendix VI.

Article 7. Minimal operations and processes

1. Operations or processes undertaken, by themselves or in combination with each other for the purposes listed below, are considered to be minimal and shall not be taken into account in determining whether a good has been originating in one Member State:

a) Ensuring preservation of goods in good condition for the purposes of transport or storage;

b) Facilitating shipment or transportation; and

c) Packaging or presenting goods for sale.

2. A good originating in the territory of a Member State shall retain its initial originating status, when exported from another Member State, where operations undertaken have not gone beyond those referred to in Clause 1 of this Article.

Article 8. Direct consignment

1. Preferential tariff treatment shall be applied to goods satisfying the requirements of this Appendix and which are consigned directly between the territories of the exporting Member State and the importing Member State.

2. The following shall be considered direct consignment:

a) goods transported from an exporting Member State to the importing Member State; or

b) goods transported through one or more Member States, other than the exporting Member State and the importing Member State, or through a non- Member State, provided that:

- the transit entry is justified for geographical reason or by consideration related exclusively to transport requirements;

- the goods have not entered into trade or consumption there; and

- the goods have not undergone any operation there other than unloading and reloading or any other operation to preserve them in good condition.

Article 9. De minimis

1. A good that does not undergo a change in tariff classification shall be considered as originating if the value of all non-originating materials used in its production that do not undergo the required change in tariff classification does not exceed ten percent (10%) of the FOB value of the good and the good meets all other applicable criteria set forth in this Appendix for qualifying as an originating good.

2. The value of non-originating materials referred to in paragraph 1 of this Article shall, however, be included in the value of non-originating materials for any applicable RVC requirement for the good.

Article 10. Packages and packing materials

1. Packaging and Packing Materials for retail sale:

a) If a good is subject to the RVC-based rule of origin, the value of the packaging and packing materials for retail sale shall be taken into account in its origin assessment, where the packaging and packing materials for retail sale are considered to be forming a whole with the good.

b) Where Clause 1 (a) of this Article is not applicable, the packaging and packing materials for retail sale, when classified together with the packaged good shall not be taken into account in considering whether all non-originating materials used in the manufacture of a product fulfils the criterion corresponding to a change of tariff classification of the said good.

2. The containers and packing materials exclusively used for the transport of a good shall not be taken into account for determining the origin of the said good.

Article 11. Accessories, spare parts and tools

1. If a good is subject to the requirements of CTC or specific manufacturing or processing operation, the origin of accessories, spare parts, tools and instructional or other information materials presented with the good shall not be taken into account in determining whether the good qualifies as an originating good, provided that:

a) The accessories, spare parts, tools and instructional or other information materials are not invoiced separately from the good; and

b) The quantities and value of the accessories, spare parts, tools and instructional or other information materials are customary for the goods.

2. If a good is subject to the RVC-based rule of origin, the value of the accessories, spare parts, tools and instructional or other information materials shall be taken into account as the value of the originating or non-originating materials, as the case may be, in calculating the RVC of the originating good.

Article 12. Neutral elements

In order to determine whether a good originates, it shall not be necessary to determine the origin of the following which might be used in its production and not incorporated into the good:

1. Fuel and energy.

2. Tools, dies and moulds;

3. Spare parts and materials used in the maintenance of equipment and buildings.

4. Lubricants, greases, compounding materials and other materials used in production or used to operate equipment and buildings.

5. Gloves, glasses, footwear, clothing, safety equipment and supplies.

6. Equipment, devices and supplies used for testing or inspecting the good.

7. Catalyst and solvent.

8. Any other goods that are not incorporated into the good but of which use in the production of the good can reasonably be demonstrated to be a part of that production.

Article 13. Identical and interchangeable materials

1. The determination of whether identical and interchangeable materials are originating materials shall be made either by physical segregation of each of the materials or by the use of generally accepted accounting principles of stock control applicable, or inventory management practice, in the exporting Member States.

2. Once a decision has been taken on the inventory management method, that method shall be used throughout the fiscal year.

Article 14. Certificate of Origin

A claim that a good shall be accepted as eligible for preferential tariff treatment shall be supported by a Certificate of Origin (Form D) issued by a Government authority designated by the exporting Member State and notified to the other Member States in accordance with provisions of Appendix VII./.

APPENDIX II

PRODUCT SPECIFIC RULES

(Promulgated together with Circular No. 22/2016/TT-BCT dated October 03,

2016 of the Minister of Industry and Trade)

1. For the purposes of this Appendix:

a) RVC (40) or RVC (35) means that the goods must have a regional value content of not less than 40% or 35% respectively as calculated under Clause 1 Article 5 of Appendix I and the last stage of manufacturing takes place in a Member State;

b) “CC” means change in tariff classification from a chapter to another chapter, heading or subheading. This means all non-originating materials used in the production of the good have undergone a change in tariff classification at the 2-digit level;

c) “CTH” means change in tariff classification from a heading to another chapter, heading or subheading. This means all non-originating materials used in the production of the good have undergone a change in tariff classification at the 4-digit level;

c) “CTSH” means change in tariff classification from a subheading to another chapter, heading or subheading. This means all non-originating materials used in the production of the good have undergone a change in tariff classification at the 6-digit level;

dd) “WO” means that the goods must be wholly produced or obtained in the territory of a Member State.

e) Rules for textiles and textile products are specified in Appendix III

2. This Appendix is developed based on the Harmonized Commodity Description and Coding System 2012.

APPENDIX III

SUBSTANTIAL TRANSFORMATION CRITERION FOR TEXTILES

AND TEXTILE PRODUCTS

(Promulgated together with Circular No. 22/2016/TT-BCT dated October 03,

2016 of the Minister of Industry and Trade)

1. Textile material or article shall be deemed to be originating in a Member State, when it has undergone, prior to the importation to another Member State, any of the following:

a) Petrochemicals which have undergone the process of polymerization or polycondensation or any chemicals or physical processes to form a polymer;

b) Polymer which has undergone the process of melt spinning or extrusion to form a synthetic fiber;

c) Spinning fiber into yarn;

d) Weaving, knitting or otherwise forming fabric;

dd) Cutting fabric into parts and the assembly of those parts into a completed article;

e) Dyeing of fabric, if it is accompanied by any finishing operation which has the effect of rendering the dyed good directly;

g) Printing of fabric, if it is accompanied by any finishing operation which has the effect of rendering the printed good directly usable;

h) Impregnation or coating when such treatment leads to the manufacture of a new product falling within certain headings of customs tariffs;

i) Embroidery which represents at least 5% of the total area of the embroidered good.

2. An article or material shall not be considered to be originating in the territory of a Member State by virtue of merely having undergone any of the following:

a) Simple combining operations, labeling, pressing, cleaning or dry cleaning or packaging operations, or any combination thereof;

b) Cutting to length or width and hemming, stitching or overlocking fabrics which are readily identifiable as being intended for a particular commercial use;

c) Trimming and/or joining together by sewing, looping, linking, attaching of accessory articles such as straps, bands, beads, cords, rings and eyelets;

d) One or more finishing operations on yarns, fabrics or other textile articles, such as bleaching, waterproofing, decating, shrinking, mercerizing, or similar operations; or

dd) Dyeing or printing of fabrics or yarns.

3. The following items made of non-originating textile materials shall be considered as originating good if it has undergone the processes identified in Clause 1 but not merely performing the processes identified in Clause 2:

a) Handkerchiefs;

b) Shawls, scarves, veils, and the like;

c) Travelling rugs and blankets;

d) Bed linen, pillow cases, table linen, toilet linen and kitchen linen;

dd) Sacks and bags, of a kind used for packing of goods;

e) Tarpaulins, awnings and sunblinds;

g) Floor cloths, and dish cloths and other similar articles simply made up.

4. Notwithstanding the processes specified in Clauses 1 to 3, non-originating textile material covered in the list stated below shall be deemed to be originating in a Members State if it satisfies the working or processing set out therein.

A. Fibers and yarns

Working or processing carried out on non-originating materials that confer originating status:

Manufacture through process of fibre-making (polymerisation, polycondensation and extrusion) spinning, twisting, texturizing or braiding from a blend or any of following:

- Silk;

- Wool, fine/coarse animal hair

- Cotton fibers;

- Vegetable textile fibers;

- Synthetic or artificial filaments/man-made filaments;

- Synthetic or artificial staple fibers/man-made staple fibers.

|

Heading |

Subheading |

Product description |

|

50.04 |

5004.00 |

Silk yarn (other than yarn spun from silk waste) not put up for retail sale. |

|

50.05 |

5005.00 |

Yarn spun from silk waste, not put up for retail sale. |

|

50.06 |

5006.00 |

Silk yarn and yarn spun from silk waste, put up for retail sale; silk-worm gut. |

|

51.05 |

|

Wool and fine or coarse animal hair, carded or combed (including combed wool in fragments). |

|

|

5105.10 |

- Carded wool |

|

|

|

- Wool tops and other combed wool: |

|

|

5105.21 |

- - Combed wool in fragments |

|

|

5105.29 |

- - Other |

|

|

|

- Fine animal hair, carded or combed: |

|

|

5105.31 |

- - Of Kashmir (cashmere) goats |

|

|

5105.39 |

- - Other |

|

|

5105.40 |

- Coarse animal hair, carded or combed |

|

51.06 |

|

Yarn of carded wool, not put up for retail sale. |

|

|

5106.10 |

- Containing 85% or more by weight of wool |

|

|

5106.20 |

- Containing less than 85% by weight of wool |

|

51.07 |

|

Yarn of combed wool, not put up for retail sale. |

|

|

5107.10 |

- Containing 85% or more by weight of wool |

|

|

5107.20 |

- Containing less than 85% by weight of wool |

|

51.08 |

|

Yarn of fine animal hair (carded or combed), not put up for retail sale. |

|

|

5108.10 |

- Carded |

|

|

5108.20 |

- Combed |

|

51.09 |

|

Yarn of wool or of fine animal hair, put up for retail sale. |

|

|

5109.10 |

- Containing 85% or more by weight of wool or of fine animal hair |

|

|

5109.90 |

- Other |

|

51.10 |

5110.00 |

Yarn of coarse animal hair or of horsehair (including gimped horsehair yarn), whether or not put up for retail sale. |

|

52.04 |

|

Cotton sewing thread, whether or not put up for retail sale. |

|

|

|

- Not put up for retail sale: |

|

|

5204.11 |

- - Containing 85% or more by weight of cotton |

|

|

5204.19 |

- - Other |

|

|

5204.20 |

- Put up for retail sale |

|

52.05 |

|

Cotton yarn (other than sewing thread), containing 85% or more by weight of cotton, not put up for retail sale. |

|

|

|

- Single yarn, of uncombed fibres: |

|

|

5205.11 |

- - Measuring 714.29 decitex or more (not exceeding 14 metric number) |

|

|

5205.12 |

- - Measuring less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number) |

|

|

5205.13 |

- - Measuring less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number) |

|

|

5205.14 |

- - Measuring less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number) |

|

|

5205.15 |

- - Measuring less than 125 decitex (exceeding 80 metric number) |

|

|

|

- Single yarn, of combed fibres: |

|

|

5205.21 |

- - Measuring 714.29 decitex or more (not exceeding 14 metric number) |

|

|

5205.22 |

- - Measuring less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number) |

|

|

5205.23 |

- - Measuring less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number) |

|

|

5205.24 |

- - Measuring less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number) |

|

|

5205.26 |

- - Measuring less than 125 decitex but not less than 106.38 decitex (exceeding 80 metric number but not exceeding 94 metric number) |

|

|

5205.27 |

- - Measuring less than 106.38 decitex but not less than 83.33 decitex (exceeding 94 metric number but not exceeding 120 metric number) |

|

|

5205.28 |

- - Measuring less than 83.33 decitex (exceeding 120 metric number) |

|

|

|

- Multiple (folded) or cabled yarn, of uncombed fibres: |

|

|

5205.31 |

- - Measuring per single yarn 714.29 decitex or more (not exceeding 14 metric number per single yarn) |

|

|

5205.32 |

- - Measuring per single yarn less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number per single yarn) |

|

|

5205.33 |

- - Measuring per single yarn less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number per single yarn) |

|

|

5205.34 |

- - Measuring per single yarn less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number per single yarn) |

|

|

5205.35 |

- - Measuring per single yarn less than 125 decitex (exceeding 80 metric number per single yarn) |

|

|

|

- Multiple (folded) or cabled yarn, of combed fibres: |

|

|

5205.41 |

- - Measuring per single yarn 714.29 decitex or more (not exceeding 14 metric number per single yarn) |

|

|

5205.42 |

- - Measuring per single yarn less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number per single yarn) |

|

|

5205.43 |

- - Measuring per single yarn less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number per single yarn) |

|

|

5205.44 |

- - Measuring per single yarn less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number per single yarn) |

|

|

5205.46 |

- - Measuring per single yarn less than 125 decitex but not less than 106.38 decitex (exceeding 80 metric number but not exceeding 94 metric number per single yarn) |

|

|

5205.47 |

- - Measuring per single yarn less than 106.38 decitex but not less than 83.33 decitex (exceeding 94 metric number but not exceeding 120 metric number per single yarn) |

|

|

5205.48 |

- - Measuring per single yarn less than 83.33 decitex (exceeding 120 metric number per single yarn) |

|

52.06 |

|

Cotton yarn (other than sewing thread), containing less than 85% by weight of cotton, not put up for retail sale. |

|

|

|

- Single yarn, of uncombed fibres: |

|

|

5206.11 |

- - Measuring 714.29 decitex or more (not exceeding 14 metric number) |

|

|

5206.12 |

- - Measuring less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number) |

|

|

5206.13 |

- - Measuring less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number) |

|

|

5206.14 |

- - Measuring less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number) |

|

|

5206.15 |

- - Measuring less than 125 decitex (exceeding 80 metric number) |

|

|

|

- Single yarn, of combed fibres: |

|

|

5206.21 |

- - Measuring 714.29 decitex or more (not exceeding 14 metric number) |

|

|

5206.22 |

- - Measuring less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number) |

|

|

5206.23 |

- - Measuring less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number) |

|

|

5206.24 |

- - Measuring less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number) |

|

|

5206.25 |

- - Measuring less than 125 decitex (exceeding 80 metric number) |

|

|

|

- Multiple (folded) or cabled yarn, of uncombed fibres: |

|

|

5206.31 |

- - Measuring per single yarn 714.29 decitex or more (not exceeding 14 metric number per single yarn) |

|

|

5206.32 |

- - Measuring per single yarn less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number per single yarn) |

|

|

5206.33 |

- - Measuring per single yarn less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number per single yarn) |

|

|

5206.34 |

- - Measuring per single yarn less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number per single yarn) |

|

|

5206.35 |

- - Measuring per single yarn less than 125 decitex (exceeding 80 metric number per single yarn) |

|

|

|

- Multiple (folded) or cabled yarn, of combed fibres: |

|

|

5206.41 |

- - Measuring per single yarn 714.29 decitex or more (not exceeding 14 metric number per single yarn) |

|

|

5206.42 |

- - Measuring per single yarn less than 714.29 decitex but not less than 232.56 decitex (exceeding 14 metric number but not exceeding 43 metric number per single yarn) |

|

|

5206.43 |

- - Measuring per single yarn less than 232.56 decitex but not less than 192.31 decitex (exceeding 43 metric number but not exceeding 52 metric number per single yarn) |

|

|

5206.44 |

- - Measuring per single yarn less than 192.31 decitex but not less than 125 decitex (exceeding 52 metric number but not exceeding 80 metric number per single yarn) |

|

|

5206.45 |

- - Measuring per single yarn less than 125 decitex (exceeding 80 metric number per single yarn) |

|

52.07 |

|

Cotton yarn (other than sewing thread) put up for retail sale. |

|

|

5207.10 |

- Containing 85% or more by weight of cotton |

|

|

5207.90 |

- Other |

|

53.06 |

|

Flax yarn. |

|

|

5306.10 |

- Single |

|

|

5306.20 |

- Multiple (folded) or cabled |

|

53.07 |

|

Yarn of jute or of other textile bast fibres of heading 53.03. |

|

|

5307.10 |

- Single |

|

|

5307.20 |

- Multiple (folded) or cabled |

|

53.08 |

|

Yarn of other vegetable textile fibres; paper yarn. |

|

|

5308.20 |

- True hemp yarn |

|

|

5308.90 |

- Other |

|

54.01 |

|

Sewing thread of man-made filaments, whether or not put up for retail sale. |

|

|

5401.10 |

- Of synthetic filaments |

|

|

5401.20 |

- Of artificial filaments |

|

54.02 |

|

Synthetic filament yarn (other than sewing thread), not put up for retail sale, including synthetic monofilament of less than 67 decitex. |

|

|

|

- High tenacity yarn of nylon or other polyamides: |

|

|

5402.11 |

- - Of aramids |

|

|

5402.19 |

- - Other |

|

|

5402.20 |

- High tenacity yarn of polyesters |

|

|

|

- Textured yarn: |

|

|

5402.31 |

- - Of nylon or other polyamides, measuring per single yarn not more than 50 tex |

|

|

5402.32 |

- - Of nylon or other polyamides, measuring per single yarn more than 50 tex |

|

|

5402.33 |

- - Of polyesters |

|

|

5402.34 |

- - Of polypropylene |

|

|

5402.39 |

- - Other |

|

|

|

- Other yarn, single, untwisted or with a twist not exceeding 50 turns per metre: |

|

|

5402.44 |

- - Elastomeric |

|

|

5402.45 |

- - Other, of nylon or other polyamides |

|

|

5402.46 |

- - Other, of polyesters, partially oriented |

|

|

5402.47 |

- - Other, of polyesters |

|

|

5402.48 |

- - Other, of polypropylene |

|

|

5402.49 |

- - Other |

|

|

|

- Other yarn, single, with a twist exceeding 50 turns per metre: |

|

|

5402.51 |

- - Of nylon or other polyamides |

|

|

5402.52 |

- - Of polyesters |

|

|

5402.59 |

- - Other |

|

|

|

- Other yarn, multiple (folded) or cabled: |

|

|

5402.61 |

- - Of nylon or other polyamides |

|

|

5402.62 |

- - Of polyesters |

|

|

5402.69 |

- - Other |

|

54.03 |

|

Artificial filament yarn (other than sewing thread), not put up for retail sale, including artificial monofilament of less than 67 decitex. |

|

|

5403.10 |

- High tenacity yarn of viscose rayon |

|

|

|

- Other yarn, single: |

|

|

5403.31 |

- - Of viscose rayon, untwisted or with a twist not exceeding 120 turns per metre |

|

|

5403.32 |

- - Of viscose rayon, with a twist exceeding 120 turns per metre |

|

|

5403.33 |

- - Of cellulose acetate |

|

|

5403.39 |

- - Other |

|

|

|

- Other yarn, multiple (folded) or cabled: |

|

|

5403.41 |

- - Of viscose rayon |

|

|

5403.42 |

- - Of cellulose acetate |

|

|

5403.49 |

- - Other |

|

54.04 |

|

Synthetic monofilament of 67 decitex or more and of which no cross-sectional dimension exceeds 1 mm; strip and the like (for example, artificial straw) of synthetic textile materials of an apparent width not exceeding 5 mm. |

|

|

|

- Monofilament: |

|

|

5404.11 |

- - Elastomeric |

|

|

5404.12 |

- - Other, of polypropylene |

|

|

5404.19 |

- - Other |

|

|

5404.90 |

- Other |

|

54.05 |

5405.00 |

Artificial monofilament of 67 decitex or more and of which no cross-sectional dimension exceeds 1 mm; strip and the like (for example, artificial straw) of artificial textile materials of an apparent width not exceeding 5 mm. |

|

54.06 |

5406.00 |

Man-made filament yarn (other than sewing thread), put up for retail sale. |

|

55.01 |

|

Synthetic filament tow. |

|

|

5501.10 |

- Of nylon or other polyamides |

|

|

5501.20 |

- Of polyesters |

|

|

5501.30 |

- Acrylic or modacrylic |

|

|

5501.40 |

- Of polypropylene |

|

|

5501.90 |

- Other |

|

55.02 |

5502.00 |

Artificial filament tow. |

|

55.03 |

|

Synthetic staple fibres, not carded, combed or otherwise processed for spinning. |

|

|

|

- Of nylon or other polyamides: |

|

|

5503.11 |

- - Of aramids |

|

|

5503.19 |

- - Other |

|

|

5503.20 |

- Of polyesters |

|

|

5503.30 |

- Acrylic or modacrylic |

|

|

5503.40 |

- Of polypropylene |

|

|

5503.90 |

- Other |

|

55.04 |

|

Artificial staple fibres, not carded, combed or otherwise processed for spinning. |

|

|

5504.10 |

- Of viscose rayon |

|

|

5504.90 |

- Other |

|

55.05 |

|

Waste (including noils, yarn waste and garnetted stock) of man-made fibres. |

|

|

5505.10 |

- Of synthetic fibres |

|

|

5505.20 |

- Of artificial fibres |

|

55.06 |

|

Synthetic staple fibres, carded, combed or otherwise processed for spinning. |

|

|

5506.10 |

- Of nylon or other polyamides |

|

|

5506.20 |

- Of polyesters |

|

|

5506.30 |

- Acrylic or modacrylic |

|

|

5506.90 |

- Other |

|

55.07 |

5507.00 |

Artificial staple fibres, carded, combed or otherwise processed for spinning. |

|

55.08 |

|

Sewing thread of man-made staple fibres, whether or not put up for retail sale. |

|

|

5508.10 |

- Of synthetic staple fibres |

|

|

5508.20 |

- Of artificial staple fibres |

|

55.09 |

|

Yarn (other than sewing thread) of synthetic staple fibres, not put up for retail sale. |

|

|

|

- Containing 85% or more by weight of staple fibres of nylon or other polyamides: |

|

|

5509.11 |

- - Single yarn |

|

|

5509.12 |

- - Multiple (folded) or cabled yarn |

|

|

|

- Containing 85% or more by weight of polyester staple fibres: |

|

|

5509.21 |

- - Single yarn |

|

|

5509.22 |

- - Multiple (folded) or cabled yarn |

|

|

|

- Containing 85% or more by weight of acrylic or modacrylic staple fibres: |

|

|

5509.31 |

- - Single yarn |

|

|

5509.32 |

- - Multiple (folded) or cabled yarn |

|

|

|

- Other yarn, containing 85% or more by weight of synthetic staple fibres: |

|

|

5509.41 |

- - Single yarn |

|

|

5509.42 |

- - Multiple (folded) or cabled yarn |

|

|

|

- Other yarn, of polyester staple fibres: |

|

|

5509.51 |

- - Mixed mainly or solely with artificial staple fibres |

|

|

5509.52 |

- - Mixed mainly or solely with wool or fine animal hair |

|

|

5509.53 |

- - Mixed mainly or solely with cotton |

|

|

5509.59 |

- - Other |

|

|

|

- Other yarn, of acrylic or modacrylic staple fibres: |

|

|

5509.61 |

- - Mixed mainly or solely with wool or fine animal hair |

|

|

5509.62 |

- - Mixed mainly or solely with cotton |

|

|

5509.69 |

- - Other |

|

|

|

- Other yarn: |

|

|

5509.91 |

- - Mixed mainly or solely with wool or fine animal hair |

|

|

5509.92 |

- - Mixed mainly or solely with cotton |

|

|

5509.99 |

- - Other |

|

55.10 |

|

Yarn (other than sewing thread) of artificial staple fibres, not put up for retail sale. |

|

|

|

- Containing 85% or more by weight of artificial staple fibres: |

|

|

5510.11 |

- - Single yarn |

|

|

5510.12 |

- - Multiple (folded) or cabled yarn |

|

|

5510.20 |

- Other yarn, mixed mainly or solely with wool or fine animal hair |

|

|

5510.30 |

- Other yarn, mixed mainly or solely with cotton |

|

|

5510.90 |

- Other yarn |

|

55.11 |

|

Yarn (other than sewing thread) of man-made staple fibres, put up for retail sale. |

|

|

5511.10 |

- Of synthetic staple fibres, containing 85% or more by weight of such fibres |

|

|

5511.20 |

- Of synthetic staple fibres, containing less than 85% by weight of such fibres |

|

|

5511.30 |

- Of artificial staple fibres |

B. Fabric/carpets and other textile floor coverings; special yarns, twine, cordage and ropes and cables and articles thereof.

Working or processing carried out on non-originating materials that confer originating status:

1. Manufacture from:

- Polymer (non-woven);

- Fibres (non-woven);

- Yarns (fabrics)

- Raw or unbleached fabrics (finished fabrics).

2. Through substantial transformation process of either:

- needle punching/spin bonding/chemical bonding;

- Weaving or knitting;

- Crocheting or wadding or tufting; or

- Dyeing or printing and finishing; or impregnation, coating, coating or lamination.

|

Heading |

Subheading |

Product description |

|

30.06 |

|

Pharmaceutical goods specified in Note 4 to this Chapter. |

|

|

3006.10 |

- Sterile surgical catgut, similar sterile suture materials (including sterile absorbable surgical or dental yarns) and sterile tissue adhesives for surgical wound closure; sterile laminaria and sterile laminaria tents; sterile absorbable surgical or dental haemostatics; sterile surgical or dental adhesion barriers, whether or not absorbable |

|

50.07 |

|

Woven fabrics of silk or of silk waste. |

|

|

5007.10 |

- Fabrics of noil silk |

|

|

5007.20 |

- Other fabrics, containing 85% or more by weight of silk or of silk waste other than noil silk |

|

|

5007.90 |

- Other fabrics |

|

51.11 |

|

Woven fabrics of carded wool or of carded fine animal hair. |

|

|

|

- Containing 85% or more by weight of wool or of fine animal hair: |

|

|

5111.11 |

- - Of a weight not exceeding 300 g/m2 |

|

|

5111.19 |

- - Other |

|

|

5111.20 |

- Other, mixed mainly or solely with man-made filaments |

|

|

5111.30 |

- Other, mixed mainly or solely with man-made staple fibres |

|

|

5111.90 |

- Other |

|

51.12 |

|

Woven fabrics of combed wool or of combed fine animal hair. |

|

|

|

- Containing 85% or more by weight of wool or of fine animal hair: |

|

|

5112.11 |

- - Of a weight not exceeding 200 g/m2 |

|

|

5112.19 |

- - Other |

|

|

5112.20 |

- Other, mixed mainly or solely with man-made filaments |

|

|

5112.30 |

- Other, mixed mainly or solely with man-made staple fibres |

|

|

5112.90 |

- Other |

|

51.13 |

5113.00 |

Woven fabrics of coarse animal hair or of horsehair. |

|

52.08 |

|

Woven fabrics of cotton, containing 85% or more by weight of cotton, weighing not more than 200 g/m2. |

|

|

|

- Unbleached: |

|

|

5208.11 |

- - Plain weave, weighing not more than 100 g/m2 |

|

|

5208.12 |

- - Plain weave, weighing more than 100 g/m2 |

|

|

5208.13 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5208.19 |

- - Other fabrics |

|

|

|

- Bleached: |

|

|

5208.21 |

- - Plain weave, weighing not more than 100 g/m2 |

|

|

5208.22 |

- - Plain weave, weighing more than 100 g/m2 |

|

|

5208.23 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5208.29 |

- - Other fabrics |

|

|

|

- Dyed: |

|

|

5208.31 |

- - Plain weave, weighing not more than 100 g/m2 |

|

|

5208.32 |

- - Plain weave, weighing more than 100 g/m2 |

|

|

5208.33 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5208.39 |

- - Other fabrics |

|

|

|

- Of yarns of different colours: |

|

|

5208.41 |

- - Plain weave, weighing not more than 100 g/m2 |

|

|

5208.42 |

- - Plain weave, weighing more than 100 g/m2 |

|

|

5208.43 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5208.49 |

- - Other fabrics |

|

|

|

- Printed: |

|

|

5208.51 |

- - Plain weave, weighing not more than 100 g/m2 |

|

|

5208.52 |

- - Plain weave, weighing more than 100 g/m2 |

|

|

5208.59 |

- - Other fabrics |

|

52.09 |

|

Woven fabrics of cotton, containing 85% or more by weight of cotton, weighing more than 200 g/m2. |

|

|

|

- Unbleached: |

|

|

5209.11 |

- - Plain weave |

|

|

5209.12 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5209.19 |

- - Other fabrics |

|

|

|

- Bleached: |

|

|

5209.21 |

- - Plain weave |

|

|

5209.22 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5209.29 |

- - Other fabrics |

|

|

|

- Dyed: |

|

|

5209.31 |

- - Plain weave |

|

|

5209.32 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5209.39 |

- - Other fabrics |

|

|

|

- Of yarns of different colours: |

|

|

5209.41 |

- - Plain weave |

|

|

5209.42 |

- - Denim |

|

|

5209.43 |

- - Other fabrics of 3-thread or 4-thread twill, including cross twill |

|

|

5209.49 |

- - Other fabrics |

|

|

|

- Printed: |

|

|

5209.51 |

- - Plain weave |

|

|

5209.52 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5209.59 |

- - Other fabrics |

|

52.10 |

|

Woven fabrics of cotton, containing less than 85% by weight of cotton, mixed mainly or solely with man-made fibres, weighing not more than 200 g/m2. |

|

|

|

- Unbleached: |

|

|

5210.11 |

- - Plain weave |

|

|

5210.19 |

- - Other fabrics |

|

|

|

- Bleached: |

|

|

5210.21 |

- - Plain weave |

|

|

5210.29 |

- - Other fabrics |

|

|

|

- Dyed: |

|

|

5210.31 |

- - Plain weave |

|

|

5210.32 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5210.39 |

- - Other fabrics |

|

|

|

- Of yarns of different colours: |

|

|

5210.41 |

- - Plain weave |

|

|

5210.49 |

- - Other fabrics |

|

|

|

- Printed: |

|

|

5210.51 |

- - Plain weave |

|

|

5210.59 |

- - Other fabrics |

|

52.11 |

|

Woven fabrics of cotton, containing less than 85% by weight of cotton, mixed mainly or solely with man-made fibres, weighing more than 200 g/m2. |

|

|

|

- Unbleached: |

|

|

5211.11 |

- - Plain weave |

|

|

5211.12 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5211.19 |

- - Other fabrics |

|

|

5211.20 |

- Bleached |

|

|

|

- Dyed: |

|

|

5211.31 |

- - Plain weave |

|

|

5211.32 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5211.39 |

- - Other fabrics |

|

|

|

- Of yarns of different colours: |

|

|

5211.41 |

- - Plain weave |

|

|

5211.42 |

- - Denim |

|

|

5211.43 |

- - Other fabrics of 3-thread or 4-thread twill, including cross twill |

|

|

5211.49 |

- - Other fabrics |

|

|

|

- Printed: |

|

|

5211.51 |

- - Plain weave |

|

|

5211.52 |

- - 3-thread or 4-thread twill, including cross twill |

|

|

5211.59 |

- - Other fabrics |

|

52.12 |

|

Other woven fabrics of cotton. |

|

|

|

- Weighing not more than 200 g/m2: |

|

|

5212.11 |

- - Unbleached |

|

|

5212.12 |

- - Bleached |

|

|

5212.13 |

- - Dyed |

|

|

5212.14 |

- - Of yarns of different colours |

|

|

5212.15 |

- - Printed |

|

|

|

- Weighing more than 200 g/m2: |

|

|

5212.21 |

- - Unbleached |

|

|

5212.22 |

- - Bleached |

|

|

5212.23 |

- - Dyed |

|

|

5212.24 |

- - Of yarns of different colours |

|

|

5212.25 |

- - Printed |

|

53.09 |

|

Woven fabrics of flax. |

|

|

|

- Containing 85% or more by weight of flax: |

|

|

5309.11 |

- - Unbleached or bleached |

|

|

5309.19 |

- - Other |

|

|

|

- Containing less than 85% by weight of flax: |

|

|

5309.21 |

- - Unbleached or bleached |

|

|

5309.29 |

- - Other |

|

53.10 |

|

Woven fabrics of jute or of other textile bast fibres of heading 53.03. |

|

|

5310.10 |

- Unbleached |

|

|

5310.90 |

- Other |

|

53.11 |

5311.00 |

Woven fabrics of other vegetable textile fibres; woven fabrics of paper yarn. |

|

54.07 |

|

Woven fabrics of synthetic filament yarn, including woven fabrics obtained from materials of heading 54.04. |

|

|

5407.10 |

- Woven fabrics obtained from high tenacity yarn of nylon or other polyamides or of polyesters |

|

|

5407.20 |

- Woven fabrics obtained from strip or the like |

|

|

5407.30 |

- Fabrics specified in Note 9 to Section XI |

|

|

|

- Other woven fabrics, containing 85% or more by weight of filaments of nylon or other polyamides: |

|

|

5407.41 |

- - Unbleached or bleached |

|

|

5407.42 |

- - Dyed |

|

|

5407.43 |

- - Of yarns of different colours |

|

|

5407.44 |

- - Printed |

|

|

|

- Other woven fabrics, containing 85% or more by weight of textured polyester filaments: |

|

|

5407.51 |

- - Unbleached or bleached |

|

|

5407.52 |

- - Dyed |

|

|

5407.53 |

- - Of yarns of different colours |

|

|

5407.54 |

- - Printed |

|

|

|

- Other woven fabrics, containing 85% or more by weight of polyester filaments: |

|

|

5407.61 |

- - Containing 85% or more by weight of non-textured polyester filaments |

|

|

5407.69 |

- - Other |

|

|

|

- Other woven fabrics, containing 85% or more by weight of synthetic filaments: |

|

|

5407.71 |

- - Unbleached or bleached |

|

|

5407.72 |

- - Dyed |

|

|

5407.73 |

- - Of yarns of different colours |

|

|

5407.74 |

- - Printed |

|

|

|

- Other woven fabrics, containing less than 85% by weight of synthetic filaments, mixed mainly or solely with cotton: |

|

|

5407.81 |

- - Unbleached or bleached |

|

|

5407.82 |

- - Dyed |

|

|

5407.83 |

- - Of yarns of different colours |

|

|

5407.84 |

- - Printed |

|

|

|

- Other woven fabrics: |

|

|

5407.91 |

- - Unbleached or bleached |

|

|

5407.92 |

- - Dyed |

|

|

5407.93 |

- - Of yarns of different colours |

|

|

5407.94 |

- - Printed |

|

54.08 |

|

Woven fabrics of artificial filament yarn, including woven fabrics obtained from materials of heading 54.05. |

|

|

5408.10 |

- Woven fabrics obtained from high tenacity yarn of viscose rayon |

|

|

|

- Other woven fabrics, containing 85% or more by weight of artificial filament or strip or the like: |

|

|

5408.21 |

- - Unbleached or bleached |

|

|

5408.22 |

- - Dyed |

|

|

5408.23 |

- - Of yarns of different colours |

|

|

5408.24 |

- - Printed |

|

|

|

- Other woven fabrics: |

|

|

5408.31 |

- - Unbleached or bleached |

|

|

5408.32 |

- - Dyed |

|

|

5408.33 |

- - Of yarns of different colours |

|

|

5408.34 |

- - Printed |

|

55.12 |

|

Woven fabrics of synthetic staple fibres, containing 85% or more by weight of synthetic staple fibres. |

|

|

|

- Containing 85% or more by weight of polyester staple fibres: |

|

|

5512.11 |

- - Unbleached or bleached |

|

|

5512.19 |

- - Other |

|

|

|

- Containing 85% or more by weight of acrylic or modacrylic staple fibres: |

|

|

5512.21 |

- - Unbleached or bleached |

|

|

5512.29 |

- - Other |

|

|

|

- Other: |

|

|

5512.91 |

- - Unbleached or bleached |

|

|

5512.99 |

- - Other |

|

55.13 |

|

Woven fabrics of synthetic staple fibres, containing less than 85% by weight of such fibres, mixed mainly or solely with cotton, of a weight not exceeding 170 g/m2. |

|

|

|

- Unbleached or bleached: |

|

|

5513.11 |

- - Of polyester staple fibres, plain weave |

|

|

5513.12 |

- - 3-thread or 4-thread twill, including cross twill, of polyester staple fibres |

|

|

5513.13 |

- - Other woven fabrics of polyester staple fibres |

|

|

5513.19 |

- - Other woven fabrics |

|

|

|

- Dyed: |

|

|

5513.21 |

- - Of polyester staple fibres, plain weave |

|

|

5513.23 |

- - Other woven fabrics of polyester staple fibres |

|

|

5513.29 |

- - Other woven fabrics |

|

|

|

- Of yarns of different colours: |

|

|

5513.31 |

- - Of polyester staple fibres, plain weave |

|

|

5513.39 |

- - Other woven fabrics |

|

|

|

- Printed: |

|

|

5513.41 |

- - Of polyester staple fibres, plain weave |

|

|

5513.49 |

- - Other woven fabrics |

|

55.14 |

|

Woven fabrics of synthetic staple fibres, containing less than 85% by weight of such fibres, mixed mainly or solely with cotton, of a weight exceeding 170 g/m2. |

|

|

|

- Unbleached or bleached: |

|

|

5514.11 |

- - Of polyester staple fibres, plain weave |

|

|

5514.12 |

- - 3-thread or 4-thread twill, including cross twill, of polyester staple fibres |

|

|

5514.19 |

- - Other woven fabrics |

|

|

|

- Dyed: |

|

|

5514.21 |

- - Of polyester staple fibres, plain weave |

|

|

5514.22 |

- - 3-thread or 4-thread twill, including cross twill, of polyester staple fibres |

|

|

5514.23 |

- - Other woven fabrics of polyester staple fibres |

|

|

5514.29 |

- - Other woven fabrics |

|

|

5514.30 |

- Of yarns of different colours |

|

|

|

- Printed: |

|

|

5514.41 |

- - Of polyester staple fibres, plain weave |

|

|

5514.42 |

- - 3-thread or 4-thread twill, including cross twill, of polyester staple fibres |

|

|

5514.43 |

- - Other woven fabrics of polyester staple fibres |

|

|

5514.49 |

- - Other woven fabrics |

|

55.15 |

|

Other woven fabrics of synthetic staple fibres. |

|

|

|

- Of polyester staple fibres: |

|

|

5515.11 |

- - Mixed mainly or solely with viscose rayon staple fibres |

|

|

5515.12 |

- - Mixed mainly or solely with man-made filaments |

|

|

5515.13 |

- - Mixed mainly or solely with wool or fine animal hair |

|

|

5515.19 |

- - Other |

|

|

|

- Of acrylic or modacrylic staple fibres: |

|

|

5515.21 |

- - Mixed mainly or solely with man-made filaments |

|

|

5515.22 |

- - Mixed mainly or solely with wool or fine animal hair |

|

|

5515.29 |

- - Other |

|

|

|

- Other woven fabrics: |

|

|

5515.91 |

- - Mixed mainly or solely with man-made filaments |

|

|

5515.99 |

- - Other |

|

55.16 |

|

Woven fabrics of artificial staple fibres. |

|

|

|

- Containing 85% or more by weight of artificial staple fibres: |

|

|

5516.11 |

- - Unbleached or bleached |

|

|

5516.12 |

- - Dyed |

|

|

5516.13 |

- - Of yarns of different colours |

|

|

5516.14 |

- - Printed |

|

|

|

- Containing less than 85% by weight of artificial staple fibres, mixed mainly or solely with man-made filaments: |

|

|

5516.21 |

- - Unbleached or bleached |

|

|

5516.22 |

- - Dyed |

|

|

5516.23 |

- - Of yarns of different colours |

|

|

5516.24 |

- - Printed |

|

|

|

- Containing less than 85% by weight of artificial staple fibres, mixed mainly or solely with wool or fine animal hair: |

|

|

5516.31 |

- - Unbleached or bleached |

|

|

5516.32 |

- - Dyed |

|

|

5516.33 |

- - Of yarns of different colours |

|

|

5516.34 |

- - Printed |

|

|

|

- Containing less than 85% by weight of artificial staple fibres, mixed mainly or solely with cotton: |

|

|

5516.41 |

- - Unbleached or bleached |

|

|

5516.42 |

- - Dyed |

|

|

5516.43 |

- - Of yarns of different colours |

|

|

5516.44 |

- - Printed |

|

|

|

- Other: |

|

|

5516.91 |

- - Unbleached or bleached |

|

|

5516.92 |

- - Dyed |

|

|

5516.93 |

- - Of yarns of different colours |

|

|

5516.94 |

- - Printed |

|

56.01 |

|

Wadding of textile materials and articles thereof; textile fibres, not exceeding 5 mm in length (flock), textile dust and mill neps. |

|

|

|

- Wadding; other articles of wadding: |

|

|

5601.21 |

- - Of cotton |

|

|

5601.22 |

- - Of man-made fibres |

|

|

5601.29 |

- - Other |

|

|

5601.30 |

- Textile flock and dust and mill neps |

|

56.02 |

|

Felt, whether or not impregnated, coated, covered or laminated. |

|

|

5602.10 |

- Needleloom felt and stitch-bonded fibre fabrics |

|

|

|

- Other felt, not impregnated, coated, covered or laminated: |

|

|

5602.21 |

- - Of wool or fine animal hair |

|

|

5602.29 |

- - Of other textile materials |

|

|

5602.90 |

- Other |

|

56.03 |

|

Nonwovens, whether or not impregnated, coated, covered or laminated. |

|

|

|

- Of man-made filaments: |

|

|

5603.11 |

- - Weighing not more than 25 g/m2 |

|

|

5603.12 |

- - Weighing more than 25 g/m2 but not more than 70 g/m2 |

|

|

5603.13 |

- - Weighing more than 70 g/m2 but not more than 150 g/m2 |

|

|

5603.14 |

- - Weighing more than 150 g/m2 |

|

|

|

- Other: |

|

|

5603.91 |

- - Weighing not more than 25 g/m2 |

|

|

5603.92 |

- - Weighing more than 25 g/m2 but not more than 70 g/m2 |

|

|

5603.93 |

- - Weighing more than 70 g/m2 but not more than 150 g/m2 |

|

|

5603.94 |

- - Weighing more than 150 g/m2 |

|

56.04 |

|

Rubber thread and cord, textile covered; textile yarn, and strip and the like of heading 54.04 or 54.05, impregnated, coated, covered or sheathed with rubber or plastics. |

|

|

5604.10 |

- Rubber thread and cord, textile covered |

|

|

5604.90 |

- Other |

|

56.05 |

5605.00 |

Metallised yarn, whether or not gimped, being textile yarn, or strip or the like of heading 54.04 or 54.05, combined with metal in the form of thread, strip or powder or covered with metal. |

|

56.06 |

5606.00 |

Gimped yarn, and strip and the like of heading 54.04 or 54.05, gimped (other than those of heading 56.05 and gimped horsehair yarn); chenille yarn (including flock chenille yarn); loop wale-yarn. |

|

56.07 |

|

Twine, cordage, ropes and cables, whether or not plaited or braided and whether or not impregnated, coated, covered or sheathed with rubber or plastics. |

|

|

|

- Of sisal or other textile fibres of the genus Agave: |

|

|

5607.21 |

- - Binder or baler twine |

|

|

5607.29 |

- - Other |

|

|

|

- Of polyethylene or polypropylene: |

|

|

5607.41 |

- - Binder or baler twine |

|

|

5607.49 |

- - Other |

|

|

5607.50 |

- Of other synthetic fibres |

|

|

5607.90 |

- Other |

|

56.08 |

|

Knotted netting of twine, cordage or rope; made up fishing nets and other made up nets, of textile materials. |

|

|

|

- Of man-made textile materials: |

|

|

5608.11 |

- - Made up fishing nets |

|

|

5608.19 |

- - Other |

|

|

5608.90 |

- Other |

|

56.09 |

5609.00 |

Articles of yarn, strip or the like of heading 54.04 or 54.05, twine, cordage, rope or cables, not elsewhere specified or included. |

|

57.01 |

|

Carpets and other textile floor coverings, knotted, whether or not made up. |

|

|

5701.10 |

- Of wool or fine animal hair |

|

|

5701.90 |

- Of other textile materials |

|

57.02 |

|

Carpets and other textile floor coverings, woven, not tufted or flocked, whether or not made up, including “Kelem”, “Schumacks”, “Karamanie” and similar hand-woven rugs. |

|

|

5702.10 |

- “Kelem”, “Schumacks”, “Karamanie” and similar hand-woven rugs |

|

|

5702.20 |

- Floor coverings of coconut fibres (coir) |

|

|

|

- Other, of pile construction, not made up: |

|

|

5702.31 |

- - Of wool or fine animal hair |

|

|

5702.32 |

- - Of man-made textile materials |

|

|

5702.39 |

- - Of other textile materials |

|

|

|

- Other, of pile construction, made up: |

|

|

5702.41 |

- - Of wool or fine animal hair |

|

|

5702.42 |

- - Of man-made textile materials |

|

|

5702.49 |

- - Of other textile materials |

|

|

5702.50 |

- Other, not of pile construction, not made up |

|

|

|

- Other, not of pile construction, made up: |

|

|

5702.91 |

- - Of wool or fine animal hair |

|

|

5702.92 |

- - Of man-made textile materials |

|

|

5702.99 |

- - Of other textile materials |

|

57.03 |

|

Carpets and other textile floor coverings, tufted, whether or not made up. |

|

|

5703.10 |

- Of wool or fine animal hair |

|

|

5703.20 |

- Of nylon or other polyamides |

|

|

5703.30 |

- Of other man-made textile materials |

|

|

5703.90 |

- Of other textile materials |

|

57.04 |

|

Carpets and other textile floor coverings, of felt, not tufted or flocked, whether or not made up. |

|

|

5704.10 |

- Tiles, having a maximum surface area of 0.3 m2 |

|

|

5704.90 |

- Other |

|

57.05 |

5705.00 |

Other carpets and other textile floor coverings, whether or not made up. |

|

58.01 |

|

Woven pile fabrics and chenille fabrics, other than fabrics of heading 58.02 or 58.06. |

|

|

5801.10 |

- Of wool or fine animal hair |

|

|

|

- Of cotton: |

|

|

5801.21 |

- - Uncut weft pile fabrics |

|

|

5801.22 |

- - Cut corduroy |

|

|

5801.23 |

- - Other weft pile fabrics |

|

|

5801.26 |

- - Warp pile fabrics |

|

|

5806.27 |

- - Chenille fabrics |

|

|

|

- Of man-made fibres: |

|

|

5801.31 |

- - Uncut weft pile fabrics |

|

|

5801.32 |

- - Cut corduroy |

|

|

5801.33 |

- - Other weft pile fabrics |

|

|

5801.36 |

- - Warp pile fabrics |

|

|

5806.37 |

- - Chenille fabrics |

|

|

5801.90 |

- Of other textile materials |

|

58.02 |

|

Terry towelling and similar woven terry fabrics, other than narrow fabrics of heading 58.06; tufted textile fabrics, other than products of heading 57.03. |

|

|

|

- Terry towelling and similar woven terry fabrics, of cotton: |

|

|

5802.11 |

- - Unbleached |

|

|

5802.19 |

- - Other |

|

|

5802.20 |

- Terry towelling and similar woven terry fabrics, of other textile materials |

|

|

5802.30 |

- Tufted textile fabrics |

|

58.03 |

5803.00 |

Gauze, other than narrow fabrics of heading 58.06. |

|

58.04 |

|

Tulles and other net fabrics, not including woven, knitted or crocheted fabrics; lace in the piece, in strips or in motifs, other than fabrics of headings 60.02 to 60.06. |

|

|

5804.10 |

- Tulles and other net fabrics |

|

|

|

- Mechanically made lace: |

|

|

5804.21 |

- - Of man-made fibres |

|

|

5804.29 |

- - Of other textile materials |

|

|

5804.30 |

- Hand-made lace |

|

58.05 |

5805.00 |

Hand-woven tapestries of the types Gobelins, Flanders, Aubusson, Beauvais and the like, and needle-worked tapestries (for example, petit point, cross stitch), whether or not made up. |

|

58.06 |

|

Narrow woven fabrics, other than goods of heading 58.07; narrow fabrics consisting of warp without weft assembled by means of an adhesive (bolducs). |

|

|

5806.10 |

- Woven pile fabrics (including terry towelling and similar terry fabrics) and chenille fabrics |

|

|

5806.20 |

- Other woven fabrics, containing by weight 5% or more of elastomeric yarn or rubber thread |

|

|

|

- Other woven fabrics: |

|

|

5806.31 |

- - Of cotton |

|

|

5806.32 |

- - Of man-made fibres |

|

|

5806.39 |

- - Of other textile materials |

|

|

5806.40 |

- Fabrics consisting of warp without weft assembled by means of an adhesive (bolducs) |

|

58.07 |

|

Labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered. |

|

|

5807.10 |

- Woven |

|

|

5807.90 |

- Other |

|

58.08 |

|

Braids in the piece; ornamental trimmings in the piece, without embroidery, other than knitted or crocheted; tassels, pompons and similar articles. |

|

|

5808.10 |

- Braids in the piece |

|

|

5808.90 |

- Other |

|

58.09 |

5809.00 |

Woven fabrics of metal thread and woven fabrics of metallised yarn of heading 56.05, of a kind used in apparel, as furnishing fabrics or for similar purposes, not elsewhere specified or included. |

|

58.10 |

|