Circular 242/2016/TT-BTC prices of securities related services applied securities trading organization banks đã được thay thế bởi Circular 128/2018/TT-BTC prices securities related services rendered by securities trading organizations và được áp dụng kể từ ngày 15/02/2019.

Nội dung toàn văn Circular 242/2016/TT-BTC prices of securities related services applied securities trading organization banks

|

MINISTRY OF

FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No.: 242/2016/TT-BTC |

Hanoi, November 11, 2016 |

CIRCULAR

REGULATIONS ON PRICES OF SECURITIES-RELATED SERVICES APPLIED AT SECURITIES TRADING ORGANIZATIONS AND COMMERCIAL BANKS JOINING VIETNAM’S SECURITIES MARKET

Pursuant to the Law on securities dated June 29, 2006 and the Law dated November 24, 2010 on amendments to a number of articles of the Law on securities;

Pursuant to the Law on fees and charges dated November 25, 2015;

Pursuant to the Law on pricing dated June 20, 2012;

Pursuant to the Decree No. 177/2013/ND-CP dated November 14, 2013 and the Decree No. 149/2016/ND-CP dated November 11, 2016 by the Government on amendments to some articles of the Government’s Decree No. 177/2013/ND-CP dated November 14, 2013 elaborating and guiding the implementation of some articles of the Law on pricing;

Pursuant to the Decree No. 58/2012/ND-CP dated July 20, 2012 and the Decree No. 60/2015/ND-CP dated June 26, 2015 by the Government on amendments to some articles of the Government’s Decree No. 58/2012/ND-CP dated July 20, 2012 elaborating and guiding the implementation of some articles of the Law on securities and the Law on amendments to some articles of the Law on securities;

Pursuant to the Government’s Decree No. 86/2016/ND-CP dated July 01, 2016 on requirements for investment and trading in securities;

Pursuant to the Government’s Decree No.215/2013/ND-CP dated 23 December 2013 defining the functions, tasks, powers and organizational structure of Ministry of Finance;

At the request of Director of Department of Price Management and Chairman of the State Securities Commission of Vietnam,

Minister of Finance promulgates a Circular providing for prices of securities-related services applied at securities trading organizations and commercial banks joining the Vietnam’s securities market.

Article 1. Scope

This Circular deals with regulations on prices of securities-related services applied at securities trading organizations and commercial banks joining the Vietnam’s securities market.

Article 2. Regulated entities

1. Providers of services in securities trading sector, including securities trading organizations (including securities companies, fund management companies, branches of foreign securities companies in Vietnam, and branches of foreign fund management companies in Vietnam), and commercial banks joining the Vietnam’s securities market in accordance with prevailing laws.

2. Organizations and individuals using securities-related services provided by service providers mentioned in Clause 1 of this Article.

3. Other organizations and individuals concerned.

Article 3. Prices of securities-related services

1. The prices of services in securities trading sector applied at securities trading organizations and commercial banks joining the Vietnam’s securities market are elaborated in the Price Schedule and Appendix enclosed to this Circular.

Providers of services in securities trading sector mentioned in Article 2 hereof shall, based on the maximum price and the price bracket prescribed in this Circular, decide specific prices in conformity with their provision of services and in accordance with regulations of the Law on pricing and relevant laws.

2. Prices of securities-related services prescribed hereof are not subject to value-added tax in accordance with regulations in Point c Clause 8 Article 5 of the Law on value-added tax and related amendment documents (if any).

3. When collecting services fees in securities trading sector, securities trading organizations and commercial banks must use service invoices in accordance with regulations in the Government’s Decree No. 51/2010/ND-CP dated May 14, 2010 on goods and services invoices, the Government’s Decree No. 04/2014/ND-CP dated January 17, 2014 on amendments to the Government’s Decree No. 51/2010/ND-CP dated May 14, 2010 on goods and services invoices, the Circular No. 39/2014/TT-BTC dated March 31, 2014 by Minister of Finance guiding the implementation of the Decree No. 51/2010/ND-CP dated May 14, 2010 and the Decree No. 04/2014/ND-CP dated January 17, 2014 by the Government on regulations on goods and services invoices, and their superseding or amending documents (if any).

4. Securities trading organizations and commercial banks joining the securities market shall manage and use the proceeds from their provision of securities-related services after deduction of amount payable to state budget as regulated by law in accordance with regulations of prevailing laws.

5. Securities trading organizations and commercial banks joining the securities market may themselves decide the prices of their services other than those prescribed in the Price Schedule hereof in conformity with actually provided services and in accordance with regulations of the Law on pricing and relevant laws.

6. Providers of services in securities trading sector must post and announce prices of their services, and comply with regulations of the Law on pricing, the Law on securities and their instructional documents.

Article 4. Implementation

1. This Circular shall come into force as from January 01, 2017 and supersede the Circular No. 38/2011/TT-BTC dated March 16, 2011 by Minister of Finance on securities-related service fees applied at securities service providers, the collection, management and use thereof; the Circular No. 216/2013/TT-BTC dated December 31, 2013 by Minister of Finance on amendments to the Circular No. 38/2011/TT-BTC dated March 16, 2011; Clause 4 Article 14 of the Circular No. 183/2011/TT-BTC dated December 16, 2011 by Minister of Finance providing guidance on the establishment and management of open funds and Clause 8 Article 1 of the Circular No. 15/2016/TT-BTC dated January 20, 2016 by Minister of Finance on amendments to some articles of the Circular No. 183/2011/TT-BTC

2. Difficulties that arise during the implementation of this Circular should be reported to the Ministry of Finance for consideration./.

|

|

PP MINISTER |

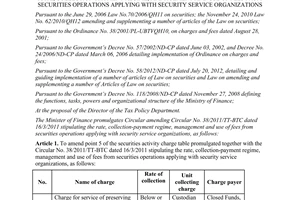

PRICE SCHEDULE OF SERVICES IN SECURITIES TRADING SECTOR APPLIED AT SECURITIES TRADING ORGANIZATIONS AND COMMERCIAL BANKS JOINING VIETNAM’S SECURITIES MARKET

(Enclosed to the Circular No. 242/2016/TT-BTC dated November 11, 2015 by Minister of Finance)

|

No. |

SERVICE |

PRICE |

SERVICE PROVIDER |

PAYER |

|

1 |

Price of underwriting service |

From 0.5% to 2% of total value of shares issued through a guaranteed offering |

Securities companies, commercial banks |

Issuers |

|

2 |

a) Price of brokerage service to buy/sell shares or fund certificates (inclusive of securities registered for trading on Upcom) |

From 0.15% to 0.5% of trading value. |

Securities companies |

Clients |

|

b) Price of brokerage service to buy/sell shares or fund certificates in case of withdrawal of state capital |

Not exceeding 0.03% of trading value and not exceeding VND 03 billion per transaction. In special cases where the service fee exceeds the maximum price, service provider must submit report thereof to the Minister of Finance for consideration and decision in accordance with regulations of the Law on pricing and relevant laws. |

|||

|

3 |

Price of service of managing public securities investment funds or public securities investment companies |

Not exceeding 2% of the Net Asset Value (NAV) of the fund or the portfolio per year |

Fund management companies |

Public securities investment funds or public securities investment companies |

|

4 |

Price of service of supervising assets of closed-end funds or public securities investment companies |

Not exceeding 0.15% of the value of managing assets |

Supervisory banks |

Closed-end funds or public securities investment companies |

|

5 |

Price of service of representing bondholders |

Not exceeding 0.1% of total value of issued bonds |

Commercial banks joining bond market |

Bond issuers |

|

6 |

Price of service of issuance of certificates of closed-end funds or shares of public securities investment companies |

|

Fund management companies |

Closed-end funds or public securities investment companies |

|

a) |

Total value of fund certificates or shares issued for sale is less than VND 500 billion |

2% of the mobilized capital per issuance of fund certificates or shares |

|

|

|

b) |

Total value of fund certificates or shares issued for sale is from VND 500 billion to less than VND 1000 billion |

1.5% of the mobilized capital per issuance of fund certificates or shares |

|

|

|

c) |

Total value of fund certificates or shares issued for sale is VND 1000 billion or above |

1% of the mobilized capital per issuance of fund certificates or shares |

|

|

|

7 |

Price of service of issuance of certificates of open-end funds or ETFs |

Not exceeding 5% of trading value |

Fund management companies |

Clients |

|

8 |

Price of service of redemption or switch of certificates of open-end funds or ETFs |

Not exceeding 3% of trading value |

Fund management companies |

Clients |

|

9 |

Price of offsetting service |

|

Settlement banks |

Depository members, organizations directly opening accounts |

|

a) |

Shares, fund certificates |

0.01% of the netting value of each member/ method of settlement/ day of settlement provided it shall not be lower than VND 5,000/day/member and shall not exceed VND 300,000/day/member |

|

|

|

b) |

Bonds |

0.001% of the netting value of each member/ method of settlement/ day of settlement provided it shall not be lower than VND 5,000/day/member and shall not exceed VND 300,000/day/member |

|

|

|

10 |

Price of auction service |

From VND 20 million per auction of shares or each type of securities to 0.3% of total value of shares or securities of a type actually sold out. |

Organizations (other than stock exchanges) licensed to organize auction of shares and other securities as regulated by laws |

Enterprises, organizations or individuals having shares or securities sold out in auction as regulated by laws |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed