Nội dung toàn văn Circular No. 07/2008/TT-BTC of January 15, 2008 providing guidance on the residence registration fee

|

THE

MINISTRY OF FINANCE |

OF VIET |

|

No. 07/2008/TT-BTC |

, January 15, 2008 |

CIRCULAR

PROVIDING GUIDANCE ON THE RESIDENCE REGISTRATION FEE

Pursuant to the Law on

Residence dated November 29, 2006 ;

Pursuant to the Government Decree No. 107/2007/ND-CP of June 25, 2007,

detailing and guiding the implementation of a number of articles of the Law on

Residence;

Pursuant to the Government Decree No. 57/2002/ND-CP of June 3, 2002, detailing

the implementation of the Ordinance on Charges and Fees;

Pursuant to the Government Decree No. 24/2006/ND-CP of March 6, 2006, amending

and supplementing a number of articles of Decree No. 57/2002/ND-CP of June 3,

2002, detailing the implementation of the Ordinance on Charges and Fees;

Pursuant to the Government Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, tasks, powers and organizational structure of the Finance

Ministry;

Pursuant to the Prime Minister Directive No. 24/2007/CT-TTg of November 1,

2007, on further rectifying the implementation of legal provisions on charges

and fees, and policies on mobilization and use of people’s contributions;

After exchanging opinions with the Public Security Ministry, the Finance

Ministry issues the following guidance on the residence registration fee:

I. SCOPE OF APPLICATION

1. Residence registration fee means a revenue payable by persons registering their residence for management to the residence registration and management agency under the residence law.

2. Agencies performing the residence registration and management under the residence law shall collect the residence registration fee.

3. Parents, spouses and under-18 children of fallen soldiers; war invalids and their under-18 children; Vietnamese heroic mothers; households covered by the hunger eradication and poverty alleviation program; citizens in highland communes or townships under the Nationality Committee’s regulations are exempt from the residence registration

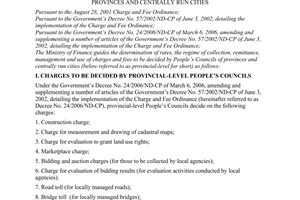

III. LEVELS OF THE RESIDENCE REGISTRATION FEE

1. Maximum levels of the fee for residence registration and management in urban districts of centrally run cities or inner city wards of provincial cities are as follows:

c/ For recording of changes in household registration books or temporary residence books (change of addresses of houses when the State adjusts administrative geographical boundaries or changes street names or house numbers, or deletion of names of household members from household registration books or temporary residence books is exempt from the fee): not excedding VND 5,000/time;

2. For other areas, the maximum applicable fee level is equal to 50% (fifty per cent) of the fee level specified in Clause 1 of this Section.

3. Specific residence registration fee levels shall be decided by provincial/municipal People’s Councils to suit the practical conditions of their localities, provided that these levels must not exceed the fee level specified in Clauses 1 and 2 of this Section.

III. EXEMPTION FROM THE RESIDENCE REGISTRATION FEE

Grantees of new household registration books or temporary residence books are exempt from the residence registration fee under regulations of competent state agencies.

IV. ORGANIZATION OF IMPLEMENTATION

1. This Circular takes effect 15 days after its publication in “OFFICIAL GAZETTE”.

2. To annul provisions on the household registration fee in the second em rule, Point b.1, Clause 4, Section III of the Finance Ministry’s Circular No. 97/2007/TT-BTC of October 16, 2007, guiding charges and fees under deciding competence of provincial/municipal People’s Councils.

3. For household registration and management jobs which continue to be performed under the Law on Residence, the fee levels specified in documents of provincial-level People’s Councils provisionally continue to apply until new documents are issued under this Circular’s guidance.

4. For jobs of new residence registration guided in this Circular, on which there are not yet guiding documents of provincial-level People’s Council, the residence registration fee is not allowed to be collected until such guiding documents are issued by the provincial-level People’s Councils.

5. Other contents related to the registration, declaration, collection, remittance, management and use of the residence registration fee and public notification of regulations on collection of this fee not specified in this Circular must comply with the guidance in the Finance Ministry’s Circular No. 63/2002/TT-BTC of July 22, 2002, guiding the implementation of legal provisions on charges and fees, Circular No. 45/2006/TT-BTC of May 25, 2006, amending and supplementing Circular No. 63/2002/TT-BTC and Circular No. 97/2006/TT-BTC of October 16, 2006, guiding charges and fees falling under the competence of provincial/municipal People’s Councils.

6. Any problems arising in the course of implementation should be promptly reported by concerned agencies, organizations and individuals to the Finance Ministry for study and additional guidance.

|

|

FOR THE

FINANCE MINISTER |