Decree No. 24/2006/ND-CP of March 06, 2006 amending and supplementing a number of articles of Decree No. 57/2002/ND-CP of June 3, 2002, detailing the implementation of the ordinance on charges and fees đã được thay thế bởi Decree 120/2016/ND-CP detailing guiding implementation law fees charges và được áp dụng kể từ ngày 01/01/2017.

Nội dung toàn văn Decree No. 24/2006/ND-CP of March 06, 2006 amending and supplementing a number of articles of Decree No. 57/2002/ND-CP of June 3, 2002, detailing the implementation of the ordinance on charges and fees

|

THE GOVERNMENT |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 24/2006/ND-CP |

Hanoi, March 06, 2006 |

DECREE

AMENDING AND SUPPLEMENTING A NUMBER OF ARTICLES OF DECREE No. 57/2002/ND-CP OF JUNE 3, 2002, DETAILING THE IMPLEMENTATION OF THE ORDINANCE ON CHARGES AND FEES

THE GOVERNMENT

Pursuant

to the December 25, 2001 Law on Organization of the Government;

Pursuant to August 28, 2001 Ordinance No. 38/2001/PL-UBTVQH10 on Charges and

Fees;

Pursuant to the Government’s Resolution No. 08/2004/NQ-CP of June 30, 2004, on

further accelerating the decentralization of state management between the

Government and administrations of provinces and centrally run cities;

At the proposal of the Minister of Finance,

DECREES:

Article 1.- To amend and supplement a number of articles of the Government’s Decree No. 57/2002/ND-CP of June 3, 2002, detailing the implementation of the Ordinance on Charges and Fees as follows:

1. To amend, supplement Clauses 4 and 5 of Article 3 as follows:

“4. Fees, monthly dues and yearly dues collected under the charters of political organizations, socio-political organizations, social organizations, socio-professional organizations and clubs;

5. Other charges already prescribed in other legal documents, such as freights, postal and telecommunication charges, payment and money transfer charges collected by credit institutions…”

2. To amend, supplement Article 5 as follows:

“Article 5.- Competence to prescribe charges is as follows:

1. The Government shall prescribe a number of important charges to be collected in great amounts and related to many socio-economic policies of the State. For each particular type of charge prescribed by the Government, the Government may, on a case-by-case basis, authorize ministries or ministerial-level agencies to set charge rates suitable to the practical situation.

2. The People’s Councils of provinces and centrally run cities (hereinafter collectively referred to as provincial-level) shall prescribe a number of charges associated with land and natural resource management or with the State administrative management function of local administrations.

3. The Ministry of Finance shall prescribe other charges for uniform nationwide application.

4. The competence to prescribe charges is specified in the detailed list of charges and fees issued together with this Decree. The competence to prescribe charges covers setting charge rates and providing the regime of collection, remittance, management and use of each specific charge.

When a treaty to which Vietnam is a contracting party provides for a charge not yet specified in the detailed list of charges and fees issued together with this Decree, the Finance Ministry shall set charge rates and provide the regime of collection, remittance, management and use of collected charge money in accordance with that treaty.”

3. To amend and supplement Article 6 as follows:

“Article 6.- Competence to prescribe fees is as follows:

1. The Government shall prescribe a number of important fees to be collected in great amounts or international legal significance.

2. Provincial-level People’s Councils shall prescribe a number of fees associated with the state management function of local administrations, ensuring the implementation of socio-economic development policies suitable to local specific characteristics and conditions.

3. The Finance Ministry shall prescribe other fees for uniform nationwide application.

4. The competence to prescribe fees is provided for in the detailed list of charges and fees issued together with this Decree. The competence to prescribe fees covers setting fee rates and providing the regime of collection, remittance, management and use of each specific fee.

When a treaty to which Vietnam is a contracting party provides for a fee not yet specified in the detailed list of charges and fees issued together with this Decree, the Finance Ministry shall set fee rates and provide the regime of collection, remittance, management and use of collected fee money in accordance with that treaty.”

4. To amend and supplement Article 9 as follows:

“Article 9.- Principles for setting charge and fee rates are as follows:

Fee rates shall be pre-determined in certain sums of money for each state management job for which a fee is collected, not for the purpose of offsetting fee collection expenses. Particularly for registration fee, the rates shall be set in percentages (%) of the value of registered property according to the Government’s regulations.

The Finance Ministry shall guide the setting of rates for collection of fees falling under the competence of provincial-level People’s Councils in order to ensure the uniform nationwide collection .”

5. To amend, supplement Clause 2 of Article 12 as follows:

“2. The charge or fee amounts retained by collecting organizations under the provisions of Clause 1 of this Article shall be spent on the following:

a/ Payments to individuals directly involved in the performance of jobs, provision of services or collection of charges and fees, including salaries or remuneration, salary-based allowances and contributions calculated over salaries under regulations (except for salaries of cadres and civil servants provided by the state budget under the prescribed regime);

b/ Expenses in direct service of the performance of jobs, provision of services or collection of charges and fees, such as those for stationery, office supplies, communication, electricity, water, working trip allowance… according to current criteria and norms;

c/ Expenses for regular repairs and overhaul of assets, machinery and equipment directly used in the performance of jobs, provision of services or collection of charges and fees; depreciation of fixed assets used in the performance of jobs, provision of services or collection of charges and fees.

d/ Expenses for procurement of supplies, materials, and other expenses directly related to the performance of jobs, provision of services or collection of charges and fees;

e/ Contributions to the reward and welfare funds for cadres and employees directly engaged in the performance of jobs, provision of services or collection of charges and fees at the units, which shall be made on the principle that after all expenses specified at Points a, b, c and d of this Clause are ensured, the average maximum contribution for each person a year must not exceed three months’ salary actually paid to that person, if the collected amount of the current year is higher than that of the previous year, or must not exceed two months’ salary actually paid to that person, if the collected amount of the current year is lower than or equal to that of the previous year.

On the basis of the prescribed financial mechanism applicable to state agencies and non-business units with revenues and the provisions of this Article, the Finance Ministry shall guide in detail the management and use of charge and fee amounts retained by collecting organizations.”

6. To amend and supplement Clauses 1 and 2 of Article 14 as follows:

“1 For fees:

Fee rates shall be pre-determined, associated with each state management job, and fees, in principle, are non-exempt and non-reducible, except for a number of special cases as follows:

a/ For registration fee, the Government shall specify cases in which the fee needs to be exempted or reduced to contribute to implementing the State’s socio-economic policies in each period;

b/ To exempt the marriage and child adoption registration fee for ethnic minority people in deep-lying or remote areas; to exempt the birth registration fee for children of poor households;

c/ To exempt the fee for grant of business registration certificates for equitized enterprises which are converted from state enterprises into joint-stock companies;

d/ To exempt the fee for grant of permits for import of a number of unregistered drugs which are used for prevention of diseases, natural calamities or disasters; aid drugs; drugs in service of national target health programs; drugs to satisfy medical treatment need of hospitals in special cases; drugs for clinical tests; drugs for registration of participation in exhibitions or fairs; raw materials imported for the production of drugs. To exempt the fee for grant of drug export permits;

e/ To exempt or reduce court fees in accordance with law.

2. For charges:

Charge rates aim to offset expenses, ensure the retrieval of capital within a reasonable period of time; therefore charges, in principle, are non-exempt and non-reducible, except for a number of special cases specified in this Decree. To abrogate all charge exemption cards.

Charge exemption or reduction shall apply in the following cases:

a/ To exempt bridge and road tolls and boat and ferry fares for:

- Ambulances, including vehicles of other kinds carrying accident victims to emergency treatment places;

- Fire engines;

- Agricultural and forestrial vehicles, including mechanical ploughs, rakes, hoers, weeding machines, paddy pluckers;

- Dike protection vehicles; vehicles on emergency duty in service of flood and storm combat;

- Special-use vehicles in service of defense and security, including tanks, armored vehicles, artillery-hauling vehicles, vehicles carrying armed soldiers in operation;

- Hearses and vehicles in funeral processions;

- Motorcades with escort or leading cars;

- In places where traffic jams still occur, bridge and road tolls shall be temporarily not collected for two-wheeled and three-wheeled motorcycles and mopeds. To exempt national bridge and road tolls for two-wheeled and three-wheeled motorcycles and mopeds.

b/ To reduce bridge and land road tolls, boat and ferry fares for monthly and quarterly tickets.

The Finance Ministry shall specify kinds of tickets of bridge and land road tolls, boat and ferry fares as well as the regime of management and use thereof to suit the practical situation.

c/ To exempt or reduce school fees for a number of subjects, as specified by the Government in its document on school fees;

d/ To exempt or reduce hospital fees for a number of subjects, as specified by the Government in its document on hospital fees;

e/ To exempt or reduce irrigation charges in some certain cases, as specified by the Government in its document on irrigation charges;

f/ To exempt job-recommendation charges in certain cases, as specified by the Government in its documents on employment;

g/ To exempt or reduce judgment enforcement charges in some specific cases as specified by the Government in its documents on enforcement of civil judgments;

h/ To exempt or reduce court charges in accordance with law.

Article 2.-

1. To replace the word “pricing” in Article 10 of the Government’s Decree No. 57/2002/ND-CP of June 3, 2002, detailing the implementation of the Ordinance on Charges and Fees with the word “financial”.

2. To promulgate together with this Decree a detailed list of charges and fees in replacement of the list issued together with the Government’s Decree No. 57/2002/ND-CP of June 3, 2002, detailing the implementation of the Ordinance on Charges and Fees.

Article 3.- This Decree takes effect 15 days after its publication in “CONG BAO.”

Article 4.- The Minister of Finance shall guide the implementation of this Decree.

Article 5.- Ministers, heads of ministerial-level agencies, heads of government-attached agencies and presidents of the People’s Committees of provinces and centrally run cities shall implement this Decree.

|

|

ON BEHALF OF THE GOVERNMENT |

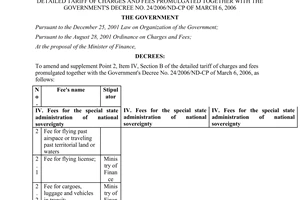

DETAILED LIST

OF CHARGES AND FEES

(Issued together with the Government’s Decree No. 24/2006/ND-CP of June 3,

2006)

A. LIST OF CHARGES

|

Ordinal number |

Name of charge |

Prescribing agency |

|

I. Charges in the domains of agriculture, forestry and fisheries |

||

|

1. |

Irrigation charges: |

|

|

1.1 |

Irrigation charge; |

The Government |

|

1.2. |

Water use charge (water charge). |

The Government |

|

2. |

Animal and plant quarantine charges: |

|

|

2.1. |

Animal and animal product quarantine charge; |

The Finance Ministry |

|

2.2. |

Plant quarantine charge; |

The Finance Ministry |

|

2.3. |

Charge for monitoring the sterilization of objects subject to plant quarantine. |

The Finance Ministry |

|

3. |

Animal and plant quality testing charges: |

|

|

3.1. |

Slaughter control charge; |

The Finance Ministry |

|

3.2. |

Charge for testing residues of plant protection drugs in plants and products thereof; |

The Finance Ministry |

|

3.3 |

Charge for testing the quality of animal feed |

The Finance Ministry |

|

4. |

Veterinary hygiene inspection charge. |

The Finance Ministry |

|

5. |

Aquatic resource protection charge. |

The Finance Ministry |

|

6. |

Charges for testing drugs used for animals and plants: |

|

|

6.1. |

Veterinary drug testing charge; |

The Finance Ministry |

|

6.2. |

Plant protection drug testing and assay charge. |

The Finance Ministry |

|

II. Charges in the domains of industry and construction |

||

|

1. |

Charges for testing the quality of products, goods, equipment, supplies, materials and raw materials: |

|

|

1.1. |

Charge for state inspection of goods quality; |

The Finance Ministry |

|

1.2. |

Charge for testing the quality of products, supplies, materials and raw materials. |

The Finance Ministry |

|

2. |

Construction charge. |

Provincial-level People’s Councils |

|

3. |

Charge for measurement and making of cadastral maps. |

Provincial-level People’s Councils |

|

4. |

Charge for evaluation and grant of land use rights. |

Provincial-level People’s Councils |

|

III. Charges in the domains of trade and investment |

||

|

1. |

Charge for certifying goods origin (C/O). |

The Finance Ministry |

|

2. |

Market charge. |

Provincial-level People’s Councils |

|

3. |

Charges for evaluating conditional commercial business: |

|

|

3.1. |

Charge for evaluating conditional commercial business in the domain of culture; |

The Finance Ministry |

|

3.2. |

Charge for evaluating conditional commercial business in the domain of fisheries; |

The Finance Ministry |

|

3.3. |

Charge for evaluating conditional commercial business in the domains of agriculture and forestry; |

The Finance Ministry |

|

3.4. |

Charge for evaluating conditional commercial business in construction; |

The Finance Ministry |

|

3.5. |

Charge for evaluating conditional commercial business in commerce; |

The Finance Ministry |

|

3.6. |

Charge for evaluating conditional commercial business in security and defense; |

The Finance Ministry |

|

3.7. |

Charge for evaluating conditional commercial business in the financial and banking domain; |

The Finance Ministry |

|

3.8. |

Charge for evaluating conditional commercial business in the health domain; |

The Finance Ministry |

|

3.9. |

Charge for evaluating conditional commercial business in the industrial domain; |

The Finance Ministry |

|

3.10. |

Charge for evaluating conditional commercial business in science, technology and environment; |

The Finance Ministry |

|

3.11. |

Charge for evaluating conditional commercial business in educational. |

The Finance Ministry |

|

4. |

Charge for evaluating dossiers for purchase or sale of ships, boats or aircraft: |

|

|

4.1. |

Charge for evaluating dossiers for purchase or sale of ships or boats; |

The Finance Ministry |

|

4.2. |

Charge for evaluating dossiers for purchase or sale of aircraft. |

The Finance Ministry |

|

5. |

Investment evaluation charges: |

|

|

5.1. |

Investment project evaluation charge; |

The Finance Ministry |

|

5.2. |

Technical design evaluation charge; |

The Finance Ministry |

|

5.3. |

Planning blueprint evaluation charge; |

The Finance Ministry |

|

5.4. |

Mineral deposit evaluation charge; |

The Finance Ministry |

|

5.5. |

Charge for evaluating and classifying tourist accommodation establishments. |

The Finance Ministry |

|

6. |

Tender and auction charges. |

- The Finance Ministry shall prescribe charges for bidding activities carried out by central agencies - Provincial-level People’s Councils shall decide charges for bidding activities carried out by local agencies |

|

7. |

Bidding result evaluation charge |

- The Finance Ministry shall prescribe charges t collected by the central agencies - The provincial-level People’s Councils shall decide charges collected by local agencies |

|

8. |

Import and export goods expertise charge |

The Finance Ministry |

|

IV. Charges in communications and transport |

||

|

1. |

Road tolls. |

- The Finance Ministry shall prescribe tolls for centrally managed roads - Provincial-level People’s Councils shall decide tolls for locally managed roads |

|

2. |

Inland waterway tolls (waterway assurance charge). |

The Finance Ministry |

|

3. |

Sea route tolls. |

The Finance Ministry |

|

4. |

Bridge tolls. |

- The Finance Ministry shall prescribe tolls for centrally managed bridges. - Provincial-level People’s Councils shall decide tolls for locally managed bridges. |

|

5. |

Boat and ferry fares: |

|

|

5.1. |

Boat fares. |

The provincial-level People’s Councils |

|

5.2. |

Ferry fares. |

- The Finance Ministry shall prescribe fares for centrally managed ferries. - Provincial-level People’s Councils shall decide fares for locally managed ferries. |

|

6. |

Port or station charges: |

|

|

6.1. |

Charge for use of piers, wharves, anchor buoys in seaport areas; |

The Finance Ministry |

|

6.2. |

Charge for use of piers, wharves, anchor buoys in inland water ports and wharves; |

The Finance Ministry |

|

6.3. |

Charge for use of airports. |

Provincial-level People’s Councils |

|

7. |

Charge for use of moorage positions outside ports. |

The Finance Ministry |

|

8. |

Maritime assurance charge. |

The Finance Ministry |

|

9. |

Pilotage in: |

|

|

9.1. |

Marine navigation; |

The Finance Ministry |

|

9.2. |

Inland waterways; |

The Finance Ministry |

|

9.3. |

Aviation. |

The Finance Ministry |

|

10. |

Ship or boat tonnage charge. |

The Finance Ministry |

|

11. |

Charge for use of inland water passages. |

The Finance Ministry |

|

12. |

Charge for use of pavements, parks, yards or water surface. |

Provincial-level People’s Councils |

|

13. |

Charge for inspecting the technical safety and quality of equipment, supplies, means of transport and fishing means. |

The Finance Ministry |

|

V. Charges in domains of information and communication |

||

|

1. |

Radio frequency use and protection charges: |

|

|

1.1. |

Radio frequency use charge; |

The Finance Ministry |

|

1.2. |

Radio frequency protection charge. |

The Finance Ministry |

|

2. |

Charges for granting Internet domain names and use addresses: |

|

|

2.1. |

Charge for granting Internet domain names and addresses; |

The Finance Ministry |

|

2.2. |

Charge for use of the telecommunication number budget. |

The Finance Ministry |

|

3. |

Charges for exploitation and use of documents managed by the State: |

|

|

3.1. |

Charge for exploitation and use of oil and gas documents; |

The Finance Ministry |

|

3.2. |

Charge for exploitation and use of land-related documents; |

Provincial-level People’s Councils |

|

3.3. |

Charge for exploitation and use of geological and mining survey and prospecting documents; |

The Finance Ministry |

|

3.4. |

Charge for exploitation and use of documents on other natural resources and minerals; |

The Finance Ministry |

|

3.5. |

Charge for exploitation and use of documents on meteorology, hydrology, water and air environment. |

The Finance Ministry |

|

3.6. |

Library charge; |

- The Finance Ministry shall prescribe charges for centrally managed libraries. - Provincial-level People’s Council shall decide charges for locally managed libraries |

|

3.7. |

Charge for exploitation of materials at museums, historical and cultural relics; |

The Finance Ministry |

|

3.8. |

Charge for exploitation and use of archives. |

The Finance Ministry |

|

4. |

Charges for evaluating postal and telecommunication operation conditions: |

|

|

4.1. |

Charge for evaluating postal operation conditions; |

The Finance Ministry |

|

4.2. |

Charge for evaluating telecommunication operation conditions; |

The Finance Ministry |

|

4.3. |

Charge for evaluating Internet operation conditions |

The Finance Ministry |

|

VI. Charges in the domains of security, social order and safety |

||

|

1. |

Charge for technical inspection of machinery, equipment, supplies and substances subject to strict safety requirements. |

The Finance Ministry |

|

1.1. |

Charge for technical inspection of machinery, equipment, supplies and substances subject to strict requirements on labor safety; |

The Finance Ministry |

|

1.2. |

Charge for technical inspection of machinery, equipment, supplies and substances subject to strict requirements on industrial safety; |

The Finance Ministry |

|

2. |

Security, social order and safety charges: |

|

|

2.1. |

Security and order charge; |

Provincial-level People’s Councils |

|

2.2. |

Fire prevention and fighting charge. |

The Finance Ministry |

|

2.3. |

Charge for evaluation for granting industrial explosive use permits |

- The Finance Ministry shall prescribe charges for evaluation conducted by central agencies - Provincial-level People’s Councils shall decide charges for evaluation conducted by local agencies |

|

2.4. |

Charge for inspection, assessment and grant of international seagoing vessel security certificates |

The Finance Ministry |

|

2.5. |

Charge for evaluation, approval of assessment of seaport security, seaport security plans and grant of seagoing vessel synopsis books |

The Finance Ministry |

|

2.6. |

Charge for evaluation for grant of drug-detoxification practice permits |

The Finance Ministry |

|

2.7. |

Charge for evaluation for granting dangerous chemical activity permits, evaluation of reports on assessment of risks of chemicals newly produced or used in Vietnam. |

The Finance Ministry |

|

3. |

Charge for verifying papers and documents: |

|

|

3.1. |

Charge for verifying papers or documents at the request of domestic organizations or individuals |

The Finance Ministry |

|

3.2. |

Charge for verifying papers or documents at the request of foreign organizations or individuals |

The Finance Ministry |

|

4. |

Charges for bicycle, motorbike and car keeping |

Provincial-level People’s Councils |

|

VII. Charges in cultural and social domains |

||

|

1. |

Charges for assessment of national relics, antiques and precious objects. |

The Finance Ministry |

|

2. |

Sightseeing charges: |

|

|

2.1. |

Charge for sightseeing famous scenic places; |

- The Finance Ministry shall prescribe charges for centrally managed scenic places - The provincial-level People’s Councils shall decide charges for locally managed scenic places |

|

2.2. |

Charge for visiting historical relics; |

- The Finance Ministry shall prescribe charges for national historical relics and the world heritage - Provincial-level People’s Councils decide charges for local historical relics |

|

2.3. |

Charge for visiting cultural works. |

- The Finance Ministry shall prescribe charges for centrally managed cultural works - Provincial-level People’s Councils shall decide charges for locally managed cultural works |

|

3. |

Charges for evaluating cultural products: |

|

|

3.1. |

Charge for evaluating contents of imported or exported cultural products; |

The Finance Ministry |

|

3.2. |

Charge for evaluating film scripts and films; |

The Finance Ministry |

|

3.3. |

Charge for evaluating art performance programs; |

The Finance Ministry |

|

3.4. |

Charge for evaluating contents of publications, programmed tapes and discs, software and other objects. |

The Finance Ministry |

|

4. |

Job-recommendation charge. |

The Finance Ministry |

|

VIII. Charges in the domain of education and training |

||

|

1. |

School tuitions: |

|

|

1.1. |

Preschool education charge; |

The Government |

|

1.2. |

General education charge; |

The Government |

|

1.3. |

Vocational education charge; |

The Government |

|

1.4. |

Graduate and postgraduate education charge; |

The Government |

|

1.5 |

Non-formal education fee; |

The Government |

|

1.6. |

Charge for eligibility testing for grant of diplomas, certificates or practice permits. |

The Finance Ministry |

|

2. |

Examination and recruitment charges. |

- The Finance Ministry shall prescribe charges for centrally managed education and training institutions - Provincial-level People’s Councils shall decide charges for locally managed education and training institutions |

|

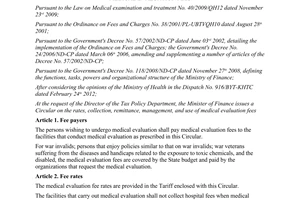

IX. Charges in the health domain |

||

|

1. |

Hospital charges and assorted medical examination and treatment charges. |

The Government |

|

2. |

Epidemic prevention and fight charges: |

|

|

2.1. |

Charge for preventing and fighting animal epidemics and diseases; |

The Finance Ministry |

|

2.2. |

Veterinary diagnosis charge; |

The Finance Ministry |

|

2.3. |

Preventive medicine charge; |

The Finance Ministry |

|

3. |

Medical assessment charge. |

The Finance Ministry |

|

4. |

Charges for testing drug samples, drug materials and drugs: |

|

|

4.1. |

Charge for testing drug samples; |

The Finance Ministry |

|

4.2. |

Charge for testing drug materials; |

The Finance Ministry |

|

4.3. |

Charge for testing drugs; |

The Finance Ministry |

|

4.4. |

Charge for testing cosmetics. |

The Finance Ministry |

|

5. |

Medical quarantine charge |

The Finance Ministry |

|

6. |

Charge for testing medical equipment |

The Finance Ministry |

|

7. |

Charge for inspecting and testing food hygiene and safety |

The Finance Ministry |

|

8. |

Charges for evaluation of medical or pharmaceutical practice criteria and conditions: |

|

|

8.1. |

Charge for evaluation of medical practice criteria and conditions |

The Finance Ministry |

|

8.2. |

Charge for evaluation of drug trading registration |

The Finance Ministry |

|

8.3. |

Charge for evaluation of dossiers for import of drugs being finished products without registration numbers |

The Finance Ministry |

|

X. Charges in the domain of science, technology and environment |

||

|

1. |

Environmental protection charges: |

|

|

1.1. |

Environmental protection charge for wastewater; |

The Government |

|

1.2. |

Environmental protection charge for exhaust gases |

The Government |

|

1.3. |

Environmental protection charge for solid waste; |

The Government |

|

1.4. |

Environmental protection charge for mineral exploitation. |

The Government |

|

2. |

Charge for evaluation of environmental impact assessment reports. |

- The Finance Ministry shall prescribe charges for evaluation conducted by central agencies; - Provincial-level People’s Councils shall decide charges for evaluation conducted by local agencies. |

|

3. |

Sanitation charge. |

Provincial-level People’s Councils |

|

4. |

Natural disaster prevention and control charge. |

Provincial-level People’s Councils |

|

5. |

Industrial property charges: |

|

|

5.1. |

Charge for industrial property testing, evaluation and expertise; |

The Finance Ministry |

|

5.2. |

Charge for searching and supplying information on industrial property; |

The Finance Ministry |

|

5.3. |

Charge for issuing duplicates and copies of industrial property documents and for re-issuance thereof; |

The Finance Ministry |

|

5.4. |

Charge for making and sending applications for international registration of industrial property; |

The Finance Ministry |

|

5.5. |

Charge for provision of industrial property complaint-settlement services; |

The Finance Ministry |

|

5.6. |

Charge for evaluation and supply of information and services related to new plant variety protection titles. |

The Finance Ministry |

|

6. |

Charges for granting number and bar codes: |

|

|

6.1. |

Charge for granting, and guiding the use of, number and bar codes; |

The Finance Ministry |

|

6.2. |

Charge for preserving the use of number and bar codes. |

The Finance Ministry |

|

7. |

Charge for using radiation safety services. |

The Finance Ministry |

|

8. |

Charge for assessing radiation safety. |

The Finance Ministry |

|

9. |

Charge for evaluating scientific, technological and environmental operation conditions: |

|

|

9.1. |

Charge for evaluating scientific and technological operation conditions |

The Finance Ministry |

|

9.2. |

Charge for evaluating environmental operation conditions |

The Finance Ministry |

|

9.3. |

Charge for evaluation of schemes and reports on ground water exploration, exploitation and use; exploitation and use of surface water; discharge of wastewater into water sources or irrigation works |

- The Finance Ministry shall prescribe charges for evaluation conducted by central agencies; - Provincial-level People’s Councils shall decide charges for evaluation conducted by local agencies. |

|

9.4. |

Charge for evaluation of reports on results of exploration and assessment of groundwater reserves |

- The Finance Ministry shall prescribe charges for evaluation conducted by central agencies; - Provincial-level People’s Councils shall decide on charges for evaluation conducted by local agencies. |

|

9.5. |

Charge for evaluation of dossiers and conditions for groundwater drilling |

- The Finance Ministry shall prescribe charges for evaluation conducted by central agencies; - The provincial-level People’s Councils shall decide charges for evaluation conducted by local agencies. |

|

10. |

Charge for evaluation of technology transfer contracts. |

The Finance Ministry |

|

11. |

Charge for evaluation of gauging devices. |

The Finance Ministry |

|

XI. Charges in the financial, banking and customs domains |

||

|

1. |

Charge for supply of information on enterprise finance. |

The Finance Ministry |

|

2. |

Charges of guaranty or payment services provided by agencies or organizations: |

|

|

2.1. |

Charge for issuance and payment of treasury bills; |

The Government |

|

2.2. |

Charge for issuance and payment of treasury bonds; |

The Government |

|

2.3. |

Charge for organizing the issuance and payment of investment bonds to mobilize capital for projects, which are secured by the state budget; |

The Government |

|

2.4. |

Charge for issuing and paying investment bonds to raise capital for the Development Assistance Fund under the State’s development investment credit plan; government bonds, government-guaranteed bonds; local administration bonds, and enterprise shares and bonds; |

The Finance Ministry |

|

2.5. |

Charge for preservation and safekeeping of precious and rare property and valuable papers at the State Treasury; |

The Finance Ministry |

|

2.6. |

Charge for the Government’s guaranty (provided by the Ministry of Finance or the Vietnam State Bank); |

The Government |

|

2.7. |

Charge for loan management by the Development Assistance Fund. |

The Finance Ministry |

|

3. |

Charge for using stock exchange equipment and infrastructures. |

The Finance Ministry |

|

4. |

Securities operation charge. |

The Finance Ministry |

|

5. |

Charge for customs sealing, lead-sealing and warehousing. |

The Finance Ministry |

|

XII. Charges in the domain of justice |

||

|

1. |

Court charges: |

|

|

1.1. |

Criminal charge; |

The Government |

|

1.2. |

Civil charge; |

The Government |

|

1.3. |

Economic charge; |

The Government |

|

1.4. |

Labor charge; |

The Government |

|

1.5. |

Administrative charge. |

The Government |

|

2. |

Judicial assessment charge. |

The Finance Ministry |

|

3. |

Charges for supplying information on security transactions: |

|

|

3.1. |

Charge for supplying information on pledge of property registered for security transactions. |

The Finance Ministry |

|

3.2. |

Charge for supplying information on mortgage of property registered for security transactions. |

The Finance Ministry |

|

3.3. |

Charge for supplying information on guaranty of property registered for security transactions; |

The Finance Ministry |

|

3.4. |

Charge for supplying information on financial-leasing property. |

The Finance Ministry |

|

4. |

Charges in the legal field and other legal services: |

|

|

4.1. |

Charge for issuing extracts of judgments or decisions; |

The Finance Ministry |

|

4.2. |

Charge for issuing copies of judgments or decisions; |

The Finance Ministry |

|

4.3. |

Charge for issuing copies of criminal record remission certificates; |

The Finance Ministry |

|

4.4. |

Judgment enforcement charge; |

The Government |

|

4.5. |

Charge for judicial notification or entrustment at the request of foreign competent authorities. |

The Finance Ministry |

|

4.6. |

Labor export charge |

The Finance Ministry |

|

4.7. |

Bankruptcy charge |

The Government |

|

4.8. |

Charge for evaluating dossiers for entitlement to immunities from restricted competition agreements or economic concentration banned under the competition law. |

The Government |

|

4.9. |

Charge for selecting and recognizing parental trees, prototypal trees, seedling gardens and forests |

- The Finance Ministry shall prescribe charges for selection and recognition conducted by central agencies; - Provincial-level People’s Councils shall decide charges for selection and recognition conducted by local agencies; |

|

4.10. |

Charge for settlement of child adoption for foreigners |

The Finance Ministry |

|

4.11. |

Charge for settlement of competition cases |

The Government |

B. LIST OF FEES

|

Ordinal number |

Name of fee |

Prescribing agency |

|

I. State management fees related to citizen’s rights and obligations |

||

|

1. |

Nationality fee. |

The Finance Ministry |

|

2. |

Civil status, permanent address registration and people’s identity card-granting fees. |

The Finance Ministry |

|

3. |

Fee for granting passports, visas, and laissez- passer through border gates. |

The Finance Ministry |

|

4. |

Fees applicable at overseas Vietnamese diplomatic representations and consular offices. |

The Finance Ministry |

|

5. |

Court fees: |

|

|

5.1. |

Fee for filing petitions to Vietnamese courts for recognition and enforcement in Vietnam of civil judgments or decisions of foreign courts; |

The Government |

|

5.2. |

Fee for filing petitions to Vietnamese courts for non- recognition of civil judgments or decisions of foreign courts which are not required to be enforced in Vietnam; |

The Government |

|

5.3. |

Fee for filing petitions to Vietnamese courts for recognition and enforcement in Vietnam of foreign arbitral awards; |

The Government |

|

5.4. |

Fee for filing petitions to courts for making conclusion that strikes are lawful or unlawful; |

The Government |

|

5.5. |

Appeal fee |

The Government |

|

5.6. |

Court fee related to arbitration |

The Finance Ministry |

|

6. |

Fee for granting work permits to foreigners working in Vietnam. |

The Finance Ministry |

|

7. |

Fee for granting judicial record cards. |

The Finance Ministry |

|

II. State management fees related to property ownership and use rights |

||

|

1. |

Registration fee. |

The Government |

|

2. |

Cadastral fee. |

The provincial-level People’s Councils |

|

3. |

Security transaction registration fee. |

The Finance Ministry |

|

4. |

Copyright certificate granting fee. |

The Finance Ministry |

|

5. |

Industrial property protection fees: |

|

|

5.1. |

Fee for filing applications for grant of protection titles, or for registration of industrial property right transfer contracts; |

The Finance Ministry |

|

5.2. |

Fee for granting protection titles or certificates of registration of industrial property right transfer contracts; |

The Finance Ministry |

|

5.3. |

Fee for maintaining, extending, terminating or restoring the validity of protection titles; |

The Finance Ministry |

|

5.4. |

Fee for registering, publicizing industrial property information; |

The Finance Ministry |

|

5.5. |

Fee for granting industrial property practice or representation registration certificates; |

The Finance Ministry |

|

5.6. |

Fee for registering, issuing, publicizing and maintaining validity of protection titles of new plant varieties. |

The Finance Ministry |

|

6. |

Fee for granting construction permits. |

The Finance Ministry |

|

7. |

Fees for management of vehicles: |

|

|

7.1. |

Fee for registering vehicles and granting their number plates; |

The Finance Ministry |

|

7.2. |

Fee for registering special-use motorbikes and granting their number plates; |

The Finance Ministry |

|

7.3. |

Fee for granting aircraft certificates. |

The Finance Ministry |

|

8. |

Fee for granting house number plates. |

The Finance Ministry |

|

III. State management fees related to production and business |

||

|

1. |

Fees for granting business registration certificates and supplying business registration information for: |

|

|

1.1. |

Individual business households; |

Provincial-level People’s Councils |

|

1.2. |

Private enterprises; |

Provincial-level People’s Councils |

|

1.3. |

Limited liability companies; |

Provincial-level People’s Councils |

|

1.4. |

Joint-stock companies; |

Provincial-level People’s Councils |

|

1.5. |

Partnerships; |

Provincial-level People’s Councils |

|

1.6. |

State enterprises; |

Provincial-level People’s Councils |

|

1.7. |

Cooperatives, unions of cooperatives; |

Provincial-level People’s Councils |

|

1.8. |

Private, people-founded, semi-public education and training institutions; private and people-founded medical establishments; cultural and information establishments. |

Provincial-level People’s Councils |

|

2. |

Fees for granting professional practice permits under the provisions of law: |

|

|

2.1. |

Fee for granting certificates of animal quarantine, slaughter control and veterinary hygiene inspection; |

The Finance Ministry |

|

2.2. |

Fee for granting certificates of the results of monitoring the sterilization of objects subject to plant quarantine; |

The Finance Ministry |

|

2.3. |

Fee for issuing sterilization steaming-practice certificates |

The Finance Ministry |

|

2.4. |

Fee for granting veterinary drug production and trading permits; |

The Finance Ministry |

|

2.5. |

Fee for granting veterinary medicine-practice certificates; |

The Finance Ministry |

|

2.6. |

Fee for granting permits to assay plant protection drugs; |

The Finance Ministry |

|

2.7. |

Fee for granting certificates of registration of plant protection drugs in Vietnam; |

The Finance Ministry |

|

2.8. |

Fee for granting plant protection drug production and trading certificates; |

The Finance Ministry |

|

2.9. |

Fee for granting aquatic resource exploitation and activity permits; |

The Finance Ministry |

|

2.10. |

Fee for granting permits to conduct geological surveys and mining; |

The Finance Ministry |

|

2.11. |

Fee for licensing mining activities; |

The Finance Ministry |

|

2.12. |

Fee for granting permits to practice exploration drilling, geological survey, prospecting and construction of groundwater exploitation works; |

The Finance Ministry |

|

2.13. |

Fee for granting certificates of construction designing practice; architecture or construction and construction supervision; |

The Finance Ministry |

|

2.14. |

Fee for granting permits to contract consultancy and construction to foreign contractors; |

The Finance Ministry |

|

2.15. |

Fee for granting electricity operation permits; |

- The Finance Ministry shall prescribe fee for permits granted by central agencies; - Provincial-level People’s Councils shall decide permits granted by local agencies. |

|

2.16. |

Fee for granting advertising permits; |

The Finance Ministry |

|

2.17. |

Fee for granting certificates of eligibility for commercial business; |

The Finance Ministry |

|

2.18. |

Fee for granting certificates of international travel business; |

The Finance Ministry |

|

2.19. |

Fee for granting tourist guide’s cards; |

The Finance Ministry |

|

2.20. |

Fee for granting law practice permits; |

The Finance Ministry |

|

2.21. |

Fee for granting inland water port operation permits; |

The Finance Ministry |

|

2.22. |

Fee for granting international transport permits; |

The Finance Ministry |

|

2.23. |

Fee for inspection and announcement of wharves or ports; |

The Finance Ministry |

|

2.24. |

Fee for granting permits, certificates of air transport techniques and safety; |

The Finance Ministry |

|

2.25. |

Fee for granting radio frequency permits; |

The Finance Ministry |

|

2.26. |

Fee for granting postage stamp-printing permits; |

The Finance Ministry |

|

2.27. |

Fee for granting permits to use, transport, purchase and repair assorted weapons, explosive materials and support instruments; |

The Finance Ministry |

|

2.28. |

Fee for granting operation permits to radiation establishments; |

The Finance Ministry |

|

2.29. |

Fee for granting permits to conduct radiation-related jobs |

The Finance Ministry |

|

2.30. |

Fee for granting permits to workers engaged in special radiation jobs; |

The Finance Ministry |

|

2.31. |

Fee for granting permits for sending laborers to work abroad for definite terms; |

The Finance Ministry |

|

2.32. |

Fee for licensing the export and import of cultural products; |

The Finance Ministry |

|

2.33. |

Fee for granting cards or practice permits to conduct cultural and information activities; |

The Finance Ministry |

|

2.34. |

Fee for granting scientific and technological operation permits; |

The Finance Ministry |

|

2.35. |

Fee for granting permits for manufacture of gauging devices; |

The Finance Ministry |

|

2.36. |

Fee for registering the authorized inspection of gauging devices; |

The Finance Ministry |

|

2.37. |

Fee for granting founding and operation permits to credit institutions; |

The Finance Ministry |

|

2.38. |

Fee for granting banking operation permits to organizations other than credit institutions; |

The Finance Ministry |

|

2.39. |

Fee for granting founding and operation permits to insurance enterprises and insurance brokerage enterprises; |

The Finance Ministry |

|

2.40. |

Fee for granting or renovating permits of arbitration centers, registering their operation or operation of their branches |

The Finance Ministry |

|

2.41. |

Fee for granting drug detoxification practice permits; |

The Finance Ministry |

|

2.42. |

Fee for granting multi-modal transport business permits; |

The Finance Ministry |

|

2.43. |

Fee for granting transport means-designing service certificates; |

The Finance Ministry |

|

2.44. |

Fee for granting certificates for trading of national relics, antiques and precious objects |

The Finance Ministry |

|

2.45. |

Fee for granting permits for activities requiring such permits within the scope of protection of irrigation works; |

The Finance Ministry |

|

2.46. |

Fee for registration of declaration of dangerous and hazardous chemicals, machines and equipment subject to specific industrial safety requirements; |

The Finance Ministry |

|

2.47. |

Fee for granting dwelling house or construction work ownership certificates; |

The Government |

|

2.48. |

Fee for granting gauging and mapping activity permits; |

The Finance Ministry |

|

2.49. |

Fee for granting registration papers for multi-level sale organizations |

The Finance Ministry |

|

3. |

Fee for opening branches or representative offices of foreign economic organizations in Vietnam. |

The Finance Ministry |

|

4. |

Fee for granting certificates of eligibility for security service business. |

The Finance Ministry |

|

5. |

Fee for granting diplomas or certificates for working aboard assorted means of transport. |

The Finance Ministry |

|

6. |

Fee for granting permits to use equipment, means, explosive devices, explosives, weapons and military equipment under the provisions of law. |

The Finance Ministry |

|

7. |

Fee for granting certificates of assurance of technical quality and safety of machinery, equipment, supplies, means and substances subject to strict safety requirements. |

The Finance Ministry |

|

8. |

Fee for granting permits to install underground works. |

The Finance Ministry |

|

9. |

Fees for granting import or export quotas and permits: |

|

|

9.1. |

Fee for granting import or export quotas; |

The Finance Ministry |

|

9.2. |

Fee for granting import or export permits; |

The Finance Ministry |

|

9.3. |

Fee for registering the import of gauging devices. |

The Finance Ministry |

|

10. |

Fees for granting special permits to transport precious and rare animals and forest plants: |

|

|

10.1. |

Fee for granting special permits to transport precious and rare animals and products thereof; |

The Finance Ministry |

|

10.2. |

Fee for granting special permits to transport precious and rare forest plants and products thereof; |

The Finance Ministry |

|

11. |

Fees for post quality management: |

|

|

11.1. |

Fee for granting standard conformity certificates for post and telecommunication equipment and supplies; |

The Finance Ministry |

|

11.2. |

Fee for granting quality registration certificates for post and telecommunication services; |

The Finance Ministry |

|

11.3. |

Fee for granting quality registration certificates for telecommunication networks; |

The Finance Ministry |

|

11.4. |

Fee for granting quality certificates for private telecommunication networks before they are connected to the public telecommunication network; |

The Finance Ministry |

|

11.5. |

Fee for granting quality certificates for systems of post and telecommunication equipment of works before they are put to use. |

The Finance Ministry |

|

12. |

Fees for granting permits for use of the number budget in telecommunications network numbering and subscription: |

|

|

12.1. |

Fee for granting network establishment permits; |

The Finance Ministry |

|

12.2. |

Fee for granting permits to provide post, telecommunication and Internet services; |

The Finance Ministry |

|

12.3. |

Fee for granting permits for manufacture of radio transmitters and electronic switchboards; |

The Finance Ministry |

|

12.4. |

Fee for granting permits for use of the number budget in telecommunications network numbering and subscription; use of domain names, addresses and postal codes. |

The Finance Ministry |

|

13. |

Fees for issuing and sticking control stamps on programmed tapes and discs |

The Finance Ministry |

|

14. |

Fees for granting permits for use of water sources: |

|

|

14.1. |

Fee for granting permits to prospect, exploit and use groundwater; |

- The Finance Ministry shall prescribe fee for permits granted by central agencies; - Provincial-level People’s Councils shall decide fee for permits granted by local agencies. |

|

14.2. |

Fee for granting permits to exploit and use surface water. |

- The Finance Ministry shall decide on fee for permits granted by central agencies; - Provincial-level People’s Councils shall decide fee for permits granted by local agencies. |

|

15. |

Fees for granting permits to discharge wastewater into water sources: |

|

|

15.1. |

Fee for granting permits to discharge wastewater into water sources; |

- The Finance Ministry shall prescribe fee for permits granted by central agencies; - Provincial-level People’s Councils shall decide fee for permits granted by local agencies. |

|

15.2. |

Fee for granting permits to discharge wastewater into irrigation works. |

- The Finance Ministry shall prescribe fee for permits granted by central agencies; - The provincial-level People’s Councils shall decide fee for permits granted by local agencies. |

|

16. |

Fee for granting product or goods quality certificates. |

The Finance Ministry |

|

17. |

Fee for licensing securities trading, practice and issuance. |

The Finance Ministry |

|

18. |

Fees for exclusive operation in a number of branches and trades related to: |

|

|

18.1. |

Petroleum; |

The Finance Ministry |

|

18.2. |

Other natural resources and minerals as prescribed by law. |

The Finance Ministry |

|

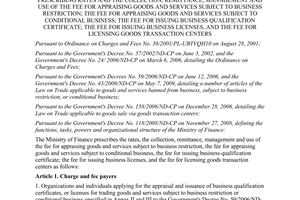

IV. Special state management fees regarding national sovereignty |

||

|

1. |

Port entry and exit fees: |

|

|

1.1. |

Seaport entry and exit fee; |

The Finance Ministry |

|

1.2. |

Inland water port entry and exit fee; |

The Finance Ministry |

|

1.3. |

Airport entry and exit fee. |

The Finance Ministry |

|

2. |

Fee for flights through the airspace or passage through land and sea areas: |

|

|

2.1. |

Fee for granting flight permits; |

The Finance Ministry |

|

2.2. |

Fee for goods, luggage and means of transport in transit; |

The Finance Ministry |

|

2.3. |

Fee for licensing activities of surveying, designing, installing, repairing and maintaining postal communication, oil and gas and transport works running through land and sea areas of Vietnam; |

The Finance Ministry |

|

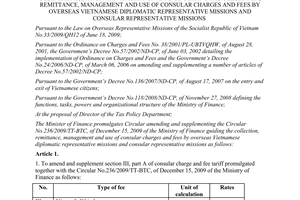

3. |

Signature commission fees: |

|

|

3.1. |

Signature commission fee; |

The Government |

|

3.2. |

Production commission fee. |

The Government |

|

V. State management fees in other domains |

||

|

1. |

Fees for granting stamp-use permits. |

The Finance Ministry |

|

2. |

Customs fees: |

|

|

2.1. |

Customs clearance fee; |

The Finance Ministry |

|

2.2. |

Customs escort fee. |

The Finance Ministry |

|

3. |

Fees for granting papers of registration of radiation sources and radiators: |

|

|

3.1. |

Fee for granting papers of registration of radiation sources and radiators; |

The Finance Ministry |

|

3.2. |

Fee for granting papers of registration of places for storing radiation wastes. |

The Finance Ministry |

|

4. |

Diploma- or certificate-granting fee. |

The Finance Ministry |

|

5. |

Authentication fees: |

|

|

5.1. |

Fee for authentication upon request or required by law; |

The Finance Ministry |

|

5.2. |

Fee for consular legalization and certification; |

The Finance Ministry |

|

6. |

Notarization fee. |

The Finance Ministry |