Circular No. 122/2014/TT-BTC amendments import tax on chassis fitted with engine No. 164/2013/TT-BTC đã được thay thế bởi Circular No. 182/2015/TT-BTC preferential import and export tariff và được áp dụng kể từ ngày 01/01/2016.

Nội dung toàn văn Circular No. 122/2014/TT-BTC amendments import tax on chassis fitted with engine No. 164/2013/TT-BTC

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIETNAM |

|

No. 122/2014/TT-BTC |

Hanoi, August 27, 24 |

CIRCULAR

AMENDMENTS TO LIST OF HEADINGS AND RATES OF PREFERENTIAL IMPORT TAX ON ARTICLES OF CHASSIS FITTED WITH ENGINE, INCLUDING CABIN, WITH GROSS VEHICLE WEIGHT EXCEEDING 20 METRIC TONS BUT NOT EXCEEDING 45 METRIC TONS PRESCRIBED IN CIRCULAR NO. 164/2013/TT-BTC DATED NOVEMBER 15, 2013 OF THE MINISTRY OF FINANCE

Pursuant to the Law on imported and exported taxes dated June 14, 2005;

Pursuant to Resolution No. 295/2007/NQ-UBTVQH12 dated September 28, 2007 on issuance of Export tariff schedule imposed on taxable headings and tax rate bracket imposed on each heading, Import tariff schedule imposed on taxable headings and tax rate bracket imposed on each heading;

Pursuant to Decree No. 87/2010/ND-CP dated August 13, 2010 of the Government on providing guidance on the Law on Export and import tax;

Pursuant to Decree No. 215/2013/ND-CP dated December 23, 2013 of the Government on defining functions, tasks, entitlements, and organizational structure of the Ministry of Finance ;

At the request of the Director of the Tax Policy Department;

The Minister of Finance issue the Circular on amendments to list of headings and rates of preferential import tax on articles of chassis fitted with engine, including cabin, with gross vehicle weight exceeding 20 metric tons but not exceeding 45 metric tons in Chapter 98 of Preferential import tariff schedule issued together with Circular No. 164/2013/TT-BTC dated November 15, 2013 of the Ministry of Finance.

Article 1. Amendments to Section I – Annotation and requirements for application of special preferential import tax rates in Chapter 98

Clause 1.36 shall be added to Point 1of Section I – Annotation and requirements for application of special preferential import tax rates in Chapter 98 as follows

“1.36. Chassis fitted with engine, including cabin (car chassis, including cabin), with gross vehicle weight exceeding 20 metric tons but not exceeding 45 metric tons”.

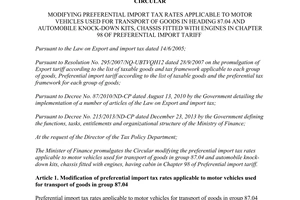

Article 2. Amendments to Section II – List of headings and rates of preferential import tax in Chapter 98

Heading 9836 – Chassis fitted with engine, including cabin (car chassis, including cabin) shall be added to Section II – List of headings and rates of preferential import tax in Chapter 98 as follows

|

HS code |

Description |

Equivalent heading in Section I of Appendix II |

Tax rate (%) |

||||

|

98.36 |

|

|

Chassis fitted with engine, including cabin (car chassis, including cabin) |

|

|

|

|

|

|

|

|

- For motor vehicles for the transport of goods |

|

|

|

|

|

|

|

|

- - For dumpers designed for off-highway use |

|

|

|

|

|

9836 |

10 |

00 |

- - - G.v.w exceeding 20 t but not exceeding 24 t |

8704 |

10 |

26 |

15 |

|

|

|

|

- - For other, with compression-ignition internal combustion piston engine (diesel or semi-diesel) |

|

|

|

|

|

9836 |

20 |

00 |

- - - G.v.w exceeding 20 t but not exceeding 24 t |

8704 |

23 |

29 |

15 |

|

9836 |

30 |

|

- - - G.v.w exceeding 24 t but not exceeding 45 t |

|

|

|

|

|

9836 |

30 |

10 |

- - - - Refrigerated lorries |

8704 |

23 |

61 |

15 |

|

9836 |

30 |

20 |

- - - - Refuse/garbage collection vehicles having a refuse compressing device |

8704 |

23 |

62 |

15 |

|

9836 |

30 |

30 |

- - - - Tanker vehicles; bulk-cement lorries |

8704 |

23 |

63 |

15 |

|

9836 |

30 |

90 |

- - - - Other |

8704 |

23 |

69 |

15 |

|

|

|

|

- - For other, with spark-ignition internal combustion piston engine |

|

|

|

|

|

9836 |

40 |

|

- - - G.v.w exceeding 20 t but not exceeding 24 t |

|

|

|

|

|

9836 |

40 |

10 |

- - - - Tanker vehicles; bulk-cement lorries |

8704 |

32 |

63 |

15 |

|

9836 |

40 |

90 |

- - - - Other |

8704 |

32 |

69 |

15 |

Article 3. Effect

This Circular shall take effect from October 11, 2014./.

|

|

PP. MINISTER |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed