Circular No. 166/1998/TT-BTC of December 19, 1998 guiding the regime of collection of fees on registration of copyright đã được thay thế bởi Circular No. 29/2009/TT-BTC of February 10, 2009, prescribing rates and the collection, remittance, management and use of the fee for grant of copyright and related rights certificates. và được áp dụng kể từ ngày 27/03/2009.

Nội dung toàn văn Circular No. 166/1998/TT-BTC of December 19, 1998 guiding the regime of collection of fees on registration of copyright

|

THE MINISTRY OF

FINANCE |

OF VIET |

|

No.166/1998/TT-BTC |

, December 19, 1998 |

CIRCULAR

GUIDING THE REGIME OF COLLECTION OF FEES ON REGISTRATION OF COPYRIGHT

In furtherance of Article 24 of Decree

No.76/CP of November 29, 1996 of the Government guiding the implementation of a

number of regulations on copyright in the Civil Code;

In furtherance of Decision No.276/CT of July 28, 1992 of the Chairman of the

Council of Ministers (now the Prime Minister) on the unified management of

charges and fees;

The Ministry of Finance provides the following guidance on the regime of

collection, remittance and management of fees on the granting of certificates

of registration of copyright:

SUBJECT TO PAYMENT:

Organizations and individuals in the country and organizations and individuals in foreign countries shall all have to pay fees as stipulated in this Circular when they are granted certificates of registration of copyright by the State management agency for copyright protection.

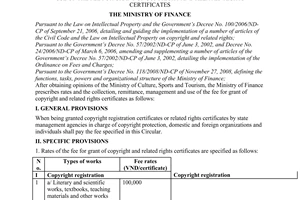

II. FEE LEVELS:

1. The levels of collection of fees on the granting of certificates of registration of copyright are stipulated as follows:

|

Order |

Type of work |

Unit |

Fee levels |

|

1 |

2 |

3 |

4 |

|

1 |

Work realized on paper or similar materials |

Dong/work |

50,000 |

|

2 |

Plastic work |

Dong/work |

50,000 |

|

3 |

Work realized on sound recording disk |

Dong/tape |

50,000 |

|

4 |

Work realized on sound recording disk |

Dong/disk |

100,000 |

|

5 |

Architectural design |

Dong/work |

150,000 |

|

6 |

Applied art work |

Dong/work |

200,000 |

|

7 |

Work realized on celluloid film, video tape or video disk |

Dong/work |

250,000 |

|

8 |

Computer software work or software program on computer |

Dong/work |

400,000 |

2. The above levels of collection apply to the granting of certificates of registration of copyright for the first time. A re-application for issue shall have to pay 50 per cent of the first collection for each kind of corresponding works.

3. The collecting agency shall not have to return the fees on certificates of registration of copyright which are withdrawn or revoked.

III. ORGANIZATION OF COLLECTION

1. Agency organizing the collection of fees:

The State management agency on the protection of copyright as stipulated in Decree No.76/CP of November 29, 1996 of the Government shall organize the collection of fees on the granting of certificates of registration of copyright as provided for in this Circular (hereunder collectively called collecting agency).

2. Procedures of collecting and remitting fees:

a/ Organizations and individuals registering for copyright shall have to pay fees on the issue of certificates of registration of copyright to the collecting agency before being granted the certificates; when paying the fee, they have the responsibility to ask the receiver to issue to them the voucher on the collection of fees in conformity with the relevant regulations of the Ministry of Finance.

In case the organization or individual fails to pay the fee or does not fully pay the fee as prescribed in this Circular, they shall not be granted with the certificate of registration of copyright.

The fee collecting agency is allowed to open a custody account for managing separately the fees on registration of copyright at the State Treasury where the collecting agency has its office. Depending on the amount collected, big or small, the collecting agency shall periodically once daily, every five days or 15 days, remit the fee already collected to that custody account.

- Prior to the 5th day each month, the collecting agency must make a declaration of the amount of fees already collected and the amount of the previous month to be remitted to the budget and send them to the direct managing tax agency.

- Upon receiving the declaration of the collecting agency, the tax agency shall inspect the declaration, compare it with the collecting vouchers already issued and used in order to determine the amount already collected and the amount to be paid to the budget within the period and inform the collecting agency of the amount to be remitted, the time limit of remittance, the corresponding chapter, type and clause in entry 37, sub-entry 15 as stipulated in the index of the State budget. The notice must be sent to the fee collecting agency three days prior to the date when the fee must be remitted as written in the notice. The time-limit for remittance of the fee of the previous monthly to the budget written in the notice must not exceed 15 days of the subsequent month at the latest.

- Basing itself on the notice of the Tax agency, the collecting agency shall fill the procedures to transfer the money from the provisional holding account to the account of the Sate budget at the State Treasury where the agency has its office.

3. Management of the money provisionally deducted:

The agency which directly collects the fee is allowed to deduct provisionally 40per cent (forty per cent) of the fee collected in the period to spend on the organization of the collection of fees on registration of copyright including the following tasks:

- Printing (or buying) forms, forms of declaration, certificates and dossiers directly related to the collection of fees.

- Other regular expenses in service of the collection of fees on registration of copyright.

- Bonuses paid to the personnel of the agency directly collecting fees on registration of copyright, the maximum bonus in a year not exceeding three months of real wages.

The collecting agency must use the whole amount of fees allowed for provisional deduction (40per cent) for the right purpose and according to the spending norms stipulated by the State and must ensure valid vouchers. Periodically each quarter and each year, the fee collecting agency must settle the accounts with the higher

IV. ORGANIZATION OF IMPLEMENTATION

1. The agency collecting fees on registration of copyright has the following tasks and powers:

b/ To declare the collection and remittance of fees to the Tax Department in the province and city where the collecting agency has its office; to remit fully and on schedule the amount to be paid into the State budget at the notice of the Tax agency;

c/ To comply with the regime of book keeping, vouchers and accountancy reporting, to monitor the collection and remittance of fees strictly according to the current accountancy and statistics regime.

2. The tax agency of the locality where the collecting agency has its office, has the responsibility to provide receipts on collection of fees at the request of the collecting agency, inspect and urge the fee collecting agency to observe the regime of collecting, remitting and using fees strictly as directed at this Circular, manage and use the receipts of the money collected and the regime of book keeping and accountancy vouchers strictly as provided for by the Ministry of Finance.

3. This Circular likes effect 15 days after its signing. All earlier regulations which are contrary to this Circular are now annulled.

In the process of implementation should any difficulty arise, it must be reported in time to the Ministry of Finance for study and settlement.

|

|

FOR THE MINISTER OF

FINANCE |