Circular No. 184/2009/TT-BTC, providing for the collection, remittance, management and use of the fee for issuance of mining licenses and đã được thay thế bởi Circular No. 155/2010/TT-BTC guiding rates, collection, remittance, management và được áp dụng kể từ ngày 25/11/2010.

Nội dung toàn văn Circular No. 184/2009/TT-BTC, providing for the collection, remittance, management and use of the fee for issuance of mining licenses and

|

THE

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 184/2009/TT-BTC |

Hanoi, September 15, 2009 |

CIRCULAR

PROVIDING FOR THE COLLECTION, REMITTANCE, MANAGEMENT AND USE OF THE FEE FOR ISSUANCE OF MINING LICENSES AND THE FEE FOR EXCLUSIVE EXPLORATION OF MINERALS

THE MINISTRY OF FINANCE

Pursuant to the Government s

Decree No. 57/2002/ND-CP of June 3, 2002, detailing the Ordinance on Charges

and Fees; and Decree No. 24/2006/ND-CP of March 6, 2006, amending and

supplementing a' number of articles of Decree No. 57/2002/ND-CP of June 3,

2002;

Pursuant to the Government's Decree No. 118/2008/ND-CP of November 27, 2008,

defining the functions, tasks, powers and organizational structure of the

Ministry of Finance;

Pursuant to the Government's Decree No. 160/2005/ND-CP of December 27, 2005,

detailing the Law on Minerals and the Law Amending and Supplementing a Number

of Articles of the Law on Minerals; and Decree No. 07/2009/ND-CP of January 21,

2009. amending and supplementing a number of articles of Decree No.

160/2005/ND-CP of December 27, 2005;

The Ministry of Finance guides the collection, remittance, management and use

of the fee for the grant of mining licenses and the fee for exclusive mineral

exploration as follows:

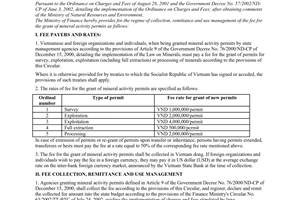

Article 1. Fee payers

1. When being issued by competent agencies mining licenses under the Law on Minerals and the Law Amending and Supplementing a Number of Articles of the Law on Minerals, Vietnamese organizations and individuals and foreigners shall pay the fee for mining licenses under this Circular.

2. When obtaining licenses for mineral exploration issued by competent state agencies, Vietnamese organizations and individuals and foreigners shall pay the fee for exclusive mineral exploration under this Circular.

3. A fee payer that returns the exploration license or returns part of the area under exclusive mineral exploration under the license issued by a competent state agency is not required to pay the fee for exclusive mineral exploration for the remaining period, counting from the date the exploration license expires.

Article 2. Fee rates

1. The fee rate for a mining license is specified as follows:

a/ VND 2,000.000/license, for survey activities.

b/ For exploration activities:

- VND 4,000,000/license, for a to be-explored area smaller than 100 ha;

- VND 10,000,000/license, for a to be-explored area of between 100 ha and 50,000 ha;

- VND 15,000,000/license. for a to be-explored area larger than 50,000 ha.

c/ VND 10,000,000/license. for mineral processing activities.

d/ For exploitation activities, fee rates are specified in the Table attached to this Circular.

e/ VND 5,000,000/license, for salvage exploitation activities.

In case of extension of licenses or re-issuance of licenses upon transfer or inheritance, persons having their licenses extended or transferees or heirs shall pay the fee at rates equal to 50% of the above corresponding fee rates.

2. Fee rates for exclusive mineral exploration under Decree No. 07/2009/ND-CP amending and supplementing a number of articles of Decree No. 160/2005/ND-CP of December 27, 2005, are as follows:

a/ Fee rates:

|

No. |

Year |

Fee rate (VND/ha/year) |

|

1 |

First year |

50,000 |

|

2 |

Second year |

80,000 |

|

3 |

Third and fourth years and afterwards |

100,000 |

The payable fee amount for exclusive mineral exploration per license shall be calculated based on the area and duration indicated in the license (including the extended duration). To ensure simplicity, the fee rate for a license is calculated as follows:

- For a license with a validity duration of up to 12 months, the fee rate shall be calculated based on the fee rate applicable in the first year. Upon the issuance of an extended license, the fee rate is equal to:

+ Half (1/2) of the fee rate applicable in the second year, for an extended duration of up to 6 months;

+ The fee rate applicable in the second year, for an extended duration of up to 12 months.

- For a license with a validity duration longer than 12 months, the fee rate shall be calculated as follows:

For a license with a validity duration of up to 18 months, it is the fee rate applicable in the first year plus half (1/2) of the fee rate applicable in the second year;

For a license with a validity duration of up to 24 months, it is the fee rate applicable in the first year plus the fee rate applicable in the second year.

Upon the issuance of an extended license with a validity duration of over 24 months, the fee rate is equal to:

The fee rate applicable in the third year, for an extended duration of between 2 and 12 months:

One and a half the fee rate applicable in the third year, for an extended duration of between over 12 and 18 months;

The fee rate applicable in the third year plus that applicable in the fourth year, for an extended duration of over 18 months.

3. The fee for mining licenses and the fee for exclusive mineral exploration shall be paid in Vietnam dong. Foreign organizations or individuals that wish to pay fees in foreign currencies shall pay them at the average inter-bank foreign exchange rate announced by the State Bank of Vietnam at the time of payment.

Article 3. Fee collection and remittance

1. Agencies competent to issue mining licenses shall collect the fee for mining licenses and the fee for exclusive mineral exploration.

2. Fee-collecting agencies shall register, declare and remit fees into the state budget under the Finance Ministry's Circular No. 63/2002/TT-BTC of July 24,2002, guiding the law on charges and fees; Circular No. 45/2006/TT-BTC of May 25, 2006. amending and supplementing Circular No. 63/2002/TT-BTC of July 24. 2002: and Circular No. 60/2007AT-BTC of June 14, 2007, guiding a number of articles of the Tax Administration Law and guiding the Governments Decree No. 85/2007/ND-CP of May 25, 2007, which details a number of articles of the Tax Administration Law.

3. The fee for mining licenses and the fee for exclusive exploration of minerals constitute state budget revenues. Fee-collecting agencies shall remit the whole collected fee amounts into the state budget according to the corresponding chapter, category, clause, item and sub-item of the current State Budget Index. In case of authorized collection, organizations authorized to collect the fees may retain 5% of the collected fee amounts to cover fee collection expenses and shall remit the remainder into the state budget.

Article 4. Effect

1. This Circular takes effect 45 days from the date of its signing. This Circular replaces the Finance Ministry's Circular No. 20/2005/TT-BTC of March 16. 2005, guiding the collection, remittance, management and use of the fee for issuance of mining licenses: and Circular No. 18/2003/TT-BTC of January 10, 2003, guiding the collection, remittance, management and use of the fee for exclusive exploration of minerals.

2. Any problems arising in the course of implementation should be promptly reported to the Ministry of Finance for study and guidance.

|

|

FOR

THE MINISTER OF FINANCE |

TABLE

OF

FEE RATES FOR ISSUANCE OF MINING LICENSES

(Attached to the Finance Ministry's Circular No. 184/2009/TT-BTC of

September 15. 2009)

|

No. |

Groups of mining activities |

Fee

rate |

|

1 |

Exploitation of sand and gravel on the bed of streams: |

|

|

1.1 |

Of an exploited output of under 5,000 m3 |

1 |

|

1.2 |

Of an exploited output of between 5,000 m3 and 10,000 m3 |

10 |

|

1.3 |

Of an exploited output of over 10,000 m3 |

15 |

|

2 |

Exploitation of minerals for use as ordinary construction materials, without using industrial explosive materials: |

|

|

2.1 |

Exploitation of minerals for use as ordinary construction materials on an area of under 10 ha and of an exploited output of under 100,000 m3/year |

15 |

|

2.2 |

Exploitation of minerals for use as ordinary construction, and peat, except minerals listed at Points 1 and 2.1 |

20 |

|

3 |

Exploitation of minerals for use as cement materials or ordinary construction materials, without using industrial explosive materials, except those mentioned at Points 1 and 2 of this Table |

30 |

|

4 |

Exploitation of minerals for use as cement materials or ordinary construction materials, using industrial explosive materials; ashlar facing stones and mineral water |

40 |

|

5 |

Exploitation of surface minerals, except minerals listed at Points 1,2, 3, 4, 7 and 8 of this Table: |

|

|

5.1 |

Without using industrial explosive materials |

40 |

|

5.2 |

Using industrial explosive materials |

50 |

|

6 |

Exploitation of pit minerals, except minerals mentioned at Points 2, 3, 4 and 7 of this Table |

60 |

|

7 |

Exploitation of precious and rare minerals |

80 |

|

8 |

Exploitation and special and hazardous minerals |

100 |