Nội dung toàn văn Circular No. 36/2013/TT-BTC on providing for the collection level regime of col

|

THE MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 36/2013/TT-BTC |

Hanoi, April 04, 2013 |

CIRCULAR

ON PROVIDING FOR THE COLLECTION LEVEL, REGIME OF COLLECTION, REMITTANCE, MANAGEMENT AND USE APPLICABLE TO THE ROAD TOLL OF MY LOC TOLL STATION, NAM DINH PROVINCE

Pursuant to the 2001 Ordinance on Fees and Charges;

Pursuant to the Government’s Decree No. 57/2002/ND-CP of June 03, 2002 detailing the implementation of the Ordinance on charges and fees and the Decree No. 24/2006/ND-CP of March 06, 2006 amending and supplementing a number of articles of the Decree No. 57/2002/ND-CP of June 03, 2002;

Pursuant to the Government’s Decree No. 118/2008/ND-CP of November 27, 2008 defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

At the proposal of the Director of Tax Policy Department,

The Minister of Finance promulgates the Circular providing for the collection level, regime of collection, remittance, management and use applicable to the road toll of My Loc toll station, Nam Dinh province as follows:

Article 1. Subjects of application

Subjects applying to the collection road tool at My Loc toll station, Nam Dinh province shall comply with provisions in section III part I of the Circular No. 90/2004/TT-BTC of September 07, 2004 of the Ministry of Finance guiding the regime of road toll collection, payment, management and use (hereinafter abbreviated to the Circular No. 90/2004/TT-BTC).

Article 2. The toll rate table

To promulgate together with this Circular the toll rate table of My Loc toll station, Nam Dinh province (the toll rates included VAT tax).

Article 3. Toll collection vouchers

Toll collection vouchers used at the My Loc toll station, Nam Dinh province shall comply with provisions in section I, part III of the Circular No. 90/2004/TT-BTC and the Circular No. 153/2010/TT-BTC of September 28, 2010, of the Ministry of Finance, guiding the printing, issuance and use of goods sale and service provision invoices.

Article 4. Management and use of collected toll

1. The road toll of My Loc toll station, Nam Dinh province shall be collected, remitted, managed and used in accordance with regulation for road invested for business purpose as guided in section IV part II of the Circular 90/2004/TT-BTC The total annual collected toll amount, after subtracting the expenditure of collection organization, the tax amounts in accordance with regulation, shall be defined as the amount of toll collection for capital recovery in the financial plan on toll collection for BOT capital recovery.

2. The road toll collection, remittance, management, use, collection vouchers, publicity in regime of road toll collected when passing the My Loc toll station that are not mentioned in this Circular shall comply with guides in the Circular No. 63/2002/TT-BTC of July 24, 2002, of the Ministry of Finance guiding the implementation of the law provisions on charges and fees, the Circular No. 45/2006/TT-BTC of May 25, 2006, amending and supplementing the Circular No. 63/2002/TT-BTC of July 24, 2002, the Circular No. 90/2004/TT-BTC of September 07, 2004 of the Ministry of Finance guiding the regime of road toll collection, payment, management and use, the Circular No. 28/2011/TT-BTC of February 28, 2011, of the Ministry of Finance, guiding a number of articles of the law on tax administration, guiding the Government's Decree No. 85/2007/ND-CP of May 25, 2007, and Decree No. 106/2010/ND-CP of October 28, 2010, the Circular No. 153/2010/TT-BTC of September 28, 2010 of the Ministry of Finance guiding the printing, issuance and use of goods sale and service provision invoices and the amending and supplementing documents (if any).

Article 5. Implementation organization

1. This Circular takes effect on June 01, 2013.

2. Replacing the Circular No. 10/2010/TT-BTC of January 18, 2010, of the Ministry of Finance, providing for the collection level, regime of collection, payment, management and use applicable to road toll at My Loc toll station, Nam Dinh province.

3. In the course of implementation, any arising problems should be reported timely to the Ministry of Finance for study and additional guidance.

|

|

FOR THE

MINISTER OF FINANCE |

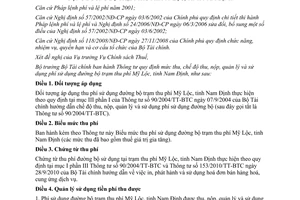

THE TOLL RATE TABLE OF MY LOC TOLL STATION, NAM DINH PROVINCE

(Promulgated together with the Circular No. 36/2013/TT-BTC, of April 04, 2013, of the Ministry of Finance)

|

Ordinal number |

Road toll-liable means |

Par value |

||

|

Single-trip ticket (VND/ticket/ |

Monthly ticket (VND/ticket/ |

Quarterly ticket (VND/ticket/ |

||

|

1 |

Cars of under 12 seats, trucks of a tonnage of under 2 tons and mass transit buses |

20,000 |

600,000 |

1,600,000 |

|

2 |

Cars of between 12 and 30 seats, trucks of a tonnage of between 2 tons and under 4 tons |

30,000 |

900,000 |

2,400,000 |

|

3 |

Cars of 31 seats or more; trucks of a tonnage of between 4 tons and under 10 tons |

44,000 |

1,300,000 |

3,600,000 |

|

4 |

Trucks of a tonnage of between 10 tons and under 18 tons and 20 ft-container lorries |

80,000 |

2,400,000 |

6,400,000 |

|

5 |

Trucks of a tonnage of 18 tons or over and 40 ft-container lorries |

160,000 |

4,800,000 |

13,000,000 |

Notes:

- The tonnage of each type of traffic means subject to the above toll rates shall be the designed tonnage, based on certificate of vehicle registration issued by competent agencies.

- For the application of toll rates to container lorries (including specialized trailer haulers): They shall be subject to the application of toll rates based on their designed tonnage, regardless of whether they are loaded with cargoes or not, including cases of carrying goods by containers with a tonnage lower than the designed tonnage.

------------------------------------------------------------------------------------------------------

This translation is translated by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments