Circular No. 58/2005/TT-BTC of July 18, 2005 guiding the regime of collection, remittance, management and use of inland waterway port fees and charges đã được thay thế bởi Circular No. 101/2008/TT-BTC of November 11, 2008, guiding the collection, remittance and management of use of charges and dues levied by inland waterway port authorities và được áp dụng kể từ ngày 09/12/2008.

Nội dung toàn văn Circular No. 58/2005/TT-BTC of July 18, 2005 guiding the regime of collection, remittance, management and use of inland waterway port fees and charges

|

THE

MINISTRY OF FINANCE |

OF VIET |

|

No. 58/2005/TT-BTC |

, July 18, 2005 |

CIRCULAR

GUIDING THE REGIME OF COLLECTION, REMITTANCE, MANAGEMENT AND USE OF INLAND WATERWAY PORT FEES AND CHARGES

Pursuant to the Law on Inland

Waterway Navigation;

Pursuant to the August 28, 2001 Ordinance on Fees and Charges and the

Government's Decree No. 57/2002/ND-CP of June 3, 2002, detailing the

implementation of the Ordinance on Fees and Charges;

After consulting the Transport Ministry, the Finance Ministry hereby guides the

regime of collection, remittance, management and use of inland waterway port

fees and charges as follows:

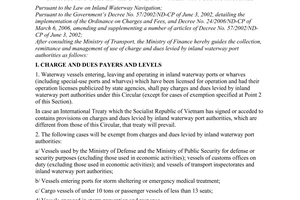

I. OBJECTS LIABLE TO AND RATES OF FEES AND CHARGES:

1. Waterway vessels entering, leaving and operating in inland waterway ports and facilities (including special-use ones) already publicized or licensed for operation by state agencies must pay inland waterway port fees and charges according to the provisions of this Circular (except for cases of exemption specified at Point 2 of this Section).

Where treaties which the Socialist Republic of Vietnam has signed or acceded to otherwise provide for, such treaties shall apply.

2. The following objects shall not be liable to inland waterway port fees and charges:

a/ Vessels used for defense and security purposes owned by the Defense Ministry and the Public Security Ministry (other than those used in economic activities).

b/ Vessels sheltering from storms or calling for emergency medical attendance.

c/ Vessels carrying cargoes with a gross tonnage (GT) of under 10 tons or carrying passengers with a seating capacity of under 13.

d/ Vessels in service of flood and storm prevention and combat;

e/ Vessels of customs offices on duty (other than those used in economic activities).

f/ Vessels of traffic inspection bodies and inland waterway port authorities on duty (other than those used in economic activities).

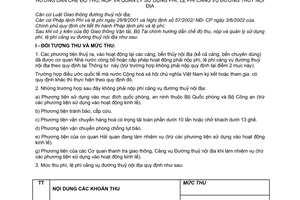

3. Rates of inland waterway post fees and charges are specified as follows:

|

Ordinal number |

Payable fees and charges |

Rates |

|

1 |

Tonnage fees |

|

|

|

In which: - For each entry (laden or unladen) - For each departure (laden or unladen) |

VND 150/GT ton VND 150/GT ton |

|

2 |

Inland waterway port and facility clearance fees: - For cargo vessels of a GT of between 10 and 50 tons |

VND 5,000/trip |

|

|

- For cargo vessels of a GT of between 51 and 200 tons or passenger vessels of a seating capacity of between 13 and 50 |

VND 10,000/trip |

|

|

- For cargo vessels or convoys of tug boats of a GT of between 201 and 500 tons or passenger vessels of a seating capacity of between 51 and 100 |

VND 20,000/trip |

|

|

- For cargo vessels or convoys of tug boats of a GT of 501 tons or more or passenger vessels of a seating capacity of 101 or more, seagoing vessels of a GT of up to 200 |

VND 30,000/trip |

|

|

- For seagoing vessels of a GT of between 200 and under 1,000 tons |

VND 50,000/trip |

|

|

- For seagoing vessels of a GT of between 1,000 and under 5,000 tons |

VND 100,000/trip |

|

|

- For seagoing vessels of a GT of over 5,000 tons |

VND 200,000/trip |

- For seagoing vessels entering or leaving inland waterway ports and facilities, tonnage fees and maritime safety maintenance dues must be paid according to the provisions of the Finance Minister's Decision No. 88/2004/QD-BTC of November 19, 2004, promulgating maritime fees and charge rates. Particularly for a seagoing vessel which, in a single trip, enters and leaves many seaports and inland waterway ports and facilities within a maritime area, tonnage and maritime safety maintenance fees must be paid only once. In this case, the vessel owner shall produce to inland waterway port authorities receipts of payment of tonnage and maritime safety maintenance fees at the first port of entry.

- For a waterway vessel which, in a single trip, enters and leaves several inland waterway ports and facilities within an area managed by an inland waterway port authority, tonnage fees shall be paid only once at the rate specified at Point 3 of this Section.

- For waterway vessels which enter or leave ports for replenishing bunker, provisions, changing crewmembers without loading/unloading cargoes or embarking/disembarking passengers, the tonnage fees rate equal to 70% of that specified at Point 3 of this Section shall apply.

- For waterway vessels which enter or leave ports within an area managed by a waterway port authority for more than 3 trips/month, the tonnage fees rate equal to 60% of that specified at Point 3 of this Section shall apply from the 4th trip on.

- Organizations or individuals whose cargo vessels enter or leave ports within an area managed by an inland waterway port authority for more than 8 trips/month, the tonnage fees rate equal to 60% of that specified at Point 3 of this Section shall apply from the 9th trip on.

- Tonnage of vessels other than river-going cargo ships shall be converted as follows for the purpose of calculation of tonnage fees:

+ For special-use ships: One horse power is treated as one GT ton.

+ For passenger ships: One passenger seat is treated as one GT ton.

4. Inland waterway port fees and charges shall be collected in dong. Where foreign organizations or individuals wish to pay fees and charges in foreign currencies, such fees and charges may be collected in US dollar at the average exchange rate on the inter-bank foreign currency market announced by the State Bank of at the time of collection.

II. ORGANIZATION OF COLLECTION, REMITTANCE, MANAGEMENT AND USE:

1. Inland waterway port fees and charge-collecting agencies shall be inland waterway port authorities defined in Article 71 and Clause 10, Article 72 of the Law on Inland Waterway Navigation. Fees and charge-collecting agencies shall be responsible for making registration and declaration for the remittance of fees and charges into the state budget according to the provisions of the Finance Ministry's Circular No. 63/2002/TT-BTC of July 24, 2002, guiding the implementation of the provisions of ordinance on charges and fees.

2. Fees and charge-collecting agencies may set aside and retain 95% of the total collected fees and charge amount before remitting the remainder into the state budget, and spend such retained amount to cover operations of port authorities according to expenditure estimates approved by competent authorities defined at Items a, b and c below:

a/ Regular expenses to ensure operation of the organizational apparatus of port authorities:

Expenses according to current state management expenditure norms applicable to port authority payrolls, including: salaries, wages and salary- and wage-based allowances; labor protection devices or uniforms according to the set regime (if any), social and medical insurance premiums; working mission allowances; information and communication charges; public service charges (office electricity and water); expenses for meetings, regular repairs of houses, means and office equipment, professional training; mid-shift meal allowances for laborers at the minimum level set by the State; other expenses for fees and charge collection. Payrolls of port authorities shall be assigned by the Transport Ministry.

b/ Particular expenses, including:

- Expenses for purchase of fuel in direct service of professional activities of port authorities.

- Expenses for procurement or overhaul of special-use means and equipment in service of fees and charge collection.

- Expenses for search and rescue of shipwrecks and victims within the area of responsibility, or on jobs related to environmental protection such as treating waste oil discharged by vessels in port waters.

- Expenses for rent of offices (if any).

- Expenses for purchase of receipts.

c/ Deductions for setting up reward and welfare funds for officials and staff members collecting inland waterway port fees and charges. The annual per-capita amount for setting up these funds shall not exceed 3 (three) months' paid salary if this year's collected amount is higher than that of previous year or 2 (two) months' actually paid salary if this year's collected amount is equal to or lower than that of previous year.

d/ Inland waterway port authorities shall remit the difference, if positive, between the amount set aside in service of fees and charge collection (95%) and the amount spent according to the approved expenditure estimates (annual estimates divided by months or quarters) into the account of Vietnam Inland Waterway Administration for subsequent transfer by the latter to its attached port authorities which lack sources to pay the minimum salary to their officials and staff members engaged in charge collection and cover expenses for operation of port authorities according to the prescribed regime.

Vietnam Inland Waterway Administration shall open a separate account at the State Treasury for monitoring revenues and expenditures related to the above-said amount transferred between charge-collecting units in service of charge collection, and at the same time open a book for separately accounting each fund and carry forward unused amounts to subsequent years for further use, and make annual settlement thereof with the Finance Ministry.

3. The remainder (5%) of the total actually collected fees and charge amount after subtracting the amount set aside at the percentage specified at Point 2 above shall be remitted by the collecting agencies into the state budget (in corresponding chapter, type, section, item and sub-item of the current state budget index).

4. The fees and charge settlement shall be made together with the state budget settlement. Annually, collecting agencies shall settle with tax offices the used fees and charge receipts, collected amounts, amounts retained at units, amounts remittable, amounts already remitted and amounts to be remitted into the state budget; settle the retained amounts with finance offices of the same level in compliance with regulations.

III. ORGANIZATION OF IMPLEMENTATION

1. This Circular takes effect 15 days after its publication in "CONG BAO," and replaces the Finance Ministry's Circular No. 50/2000/TT-BTC of June 2, 2000, guiding the regime of management and use of inland waterway port fees and charges and the Finance Minister's Decision No. 142/1999/QD-BTC of November 19, 1999, promulgating inland waterway port fees and charge rates.

2. Organizations and individuals liable to pay inland waterway port fees and charges and concerned agencies shall have to strictly implement the provisions of this Circular.

Any problems arising in the course of implementation should be promptly reported by agencies, organizations and individuals to the Finance Ministry for study and additional guidance.