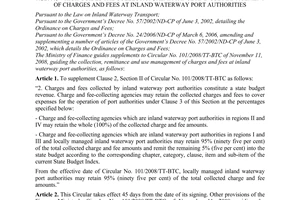

Circular No. 101/2008/TT-BTC of November 11, 2008, guiding the collection, remittance and management of use of charges and dues levied by inland waterway port authorities đã được thay thế bởi Circular No. 177/2012/TT-BTC guiding the collection payment management and use và được áp dụng kể từ ngày 10/12/2012.

Nội dung toàn văn Circular No. 101/2008/TT-BTC of November 11, 2008, guiding the collection, remittance and management of use of charges and dues levied by inland waterway port authorities

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 101/2008/TT-BTC |

Hanoi, November 11, 2008 |

CIRCULAR

GUIDING THE COLLECTION, REMITTANCE AND MANAGEMENT OF USE OF CHARGES AND DUES LEVIED BY INLAND WATERWAY PORT AUTHORITIES

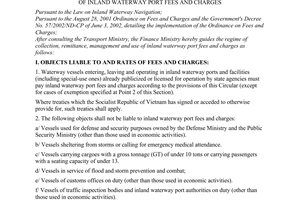

Pursuant to the Law on Inland

Waterway Navigation;

Pursuant to the Government’s Decree No. 57/2002/ND-CP of June 3, 2002,

detailing the implementation of the Ordinance on Charges and Fees, and Decree

No. 24/2006/ND-CP of March 6, 2006, amending and supplementing a number of

articles of Decree No. 57/2002/ND-CP of June 3, 2002;

After consulting the Ministry of Transport, the Ministry of Finance hereby

guides the collection, remittance and management of use of charge and dues

levied by inland waterway port authorities as follows:

I. CHARGE AND DUES PAYERS AND LEVELS

1. Waterway vessels entering, leaving and operating in inland waterway ports or wharves (including special-use ports and wharves) which have been licensed for operation and had their operation licenses publicized by state agencies, shall pay charges and dues levied by inland waterway port authorities under this Circular (except for cases of exemption specified at Point 2 of this Section).

In case an International Treaty which the Socialist Republic of Vietnam has signed or acceded to contains provisions on charges and dues levied by inland waterway port authorities, which are different from those of this Circular, that treaty will prevail.

2. The following cases will be exempt from charges and dues levied by inland waterway port authorities:

a/ Vessels used by the Ministry of Defense and the Ministry of Public Security for defense or security purposes (excluding those used in economic activities); vessels of customs offices on duty (excluding those used in economic activities); and vessels of transport inspectorates and inland waterway port authorities;

b/ Vessels entering ports for storm sheltering or emergency medical treatment;

c/ Cargo vessels of under 10 tons or passenger vessels of less than 13 seats;

d/ Vessels engaged in storm prevention and response.

3. The rates of charges and dues levied by inland waterway port authorities are as follows:

|

No. |

Charges and dues |

Rates |

|

1 |

Tonnage charge |

|

|

a/ |

Entering (for loaded or unloaded vessels) |

VND 165/gross ton |

|

b/ |

Leaving (for loaded or unloaded vessels) |

VND 165/gross ton |

|

2 |

Dues for entering and leaving inland waterway ports or wharves |

|

|

a/ |

For cargo vessels of a gross tonnage of 10-50 tons |

VND 5,000/time |

|

b/ |

For cargo vessels of 51-200 tons or passenger vessels of 13-50 seats |

VND 10,000/time |

|

c/ |

For cargo vessels or towage convoys of 201-500 tons or passenger vessels of 51-100 seats |

VND 20,000/time |

|

d/ |

For cargo vessels or towage convoys of 501 tons or more or passenger vessels of 101 seats or more |

VND 30,000/time |

|

|

|

|

|

|

|

|

a/ For seagoing ships entering and leaving inland waterway ports or wharves, charges and dues must be paid under the Ministry of Finance’s regulations on maritime charges and dues.

b/ In case a seagoing ship enters and leaves, in the same voyage, many inland waterway ports or wharves managed by the same inland waterway port authority, charges and dues specified in Clause 3 of this Section shall be paid only once.

c/ Vessels entering and leaving ports not for the purpose of loading or unloading cargoes or embarking or disembarking passengers are liable to a tonnage charge equal to 70% (seventy percent) of that specified in Clause 3 of this Section.

d/ For vessels other than cargo vessels, the following conversion will apply:

- Special-use vessels: One horse power is treated as one gross ton;

- Passenger vessels: One passenger seat is treated as one gross ton.

4. Charges and dues levied by inland waterway port authorities shall be collected in Vietnam dong. In case foreign organizations and individuals wish to pay charges and dues in foreign currencies, these charges and dues will be collected in US dollars (USD) converted at the average exchange rate on the inter-bank foreign currency market announced by the State Bank of Vietnam at the time of collection.

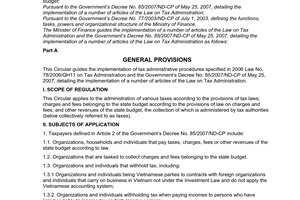

II. ORGANIZATION OF COLLECTION, REMITTANCE AND USE MANAGEMENT

1. Agencies collecting charges and dues levied by inland waterway port authorities are port authorities defined in Article 71 and Clause 10, Article 72 of the Law on Inland Waterway Navigation. Collecting agencies shall make registration and declaration for remitting charges and dues into the State budget under the Ministry of Finance’s Circular No. 60/2007/TT-BTC of June 14, 2007, guiding the implementation of a number of articles of the Law on Tax Administration and guiding the implementation of the Government’s Decree No. 85/2007/ND-CP of May 25, 2007, detailing the implementation of a number of articles of the Law on Tax Administration.

2. Charges and dues levied by inland waterway port authorities are State budget revenues. Collecting agencies may retain collected charge and dues amounts to cover expenses for their operation under Clause 3 of this Section at the following percentage:

- Inland waterway port authorities in region II and region IV may retain the whole (100%) of collected charge and dues amounts.

- Inland waterway port authorities in region I and region III may retain 95% (ninety five percent) of total collected charge and dues amounts before remitting the remaining 5% (five percent) into the State budget according to the corresponding chapter, category, clause, item and sub-item of the current State budget index.

3. Expenses for operations of an inland waterway port authority:

a/ Regular expenses for ensuring regular operations of the organizational apparatus of the inland waterway port authority, including:

- Regular expenses on the basis of the allocation limit of the payroll-based State budget expenditure estimate assigned by the Ministry of Transport (at the level applicable to state management agencies with equivalent organizations).

- Expenses for special professional operations:

+ Expense for labor protection or uniforms under regulations (if any);

+ Expense for fuels used for professional operation of the port authority;

+ Expense for purchase of receipts and printed forms used for the collection of charges and dues levied by the inland waterway port authority;

+ Other special expenses.

b/ Irregular expenses:

- Expense for lease of representative offices (if any);

- Expense for search, salvage and rescue of people, cargoes and seagoing vessels in distress; expense for the prevention of environmental pollution in the inland waterway ports or wharf’s water areas;

- Expense for procurement and overhaul of vessels, equipment and working offices.

c/ Expenses for performance of the specialized state management of inland waterway navigation and transportation in inland waterway ports and wharves in order to ensure the observance of the law on inland waterway navigation order and safety and environmental pollution prevention, under a financial autonomy plan assigned by a competent authority.

- In case the retained amount is not enough to cover expenses, the port authority may receive the state budget’s additional allocation from the source for inland waterway economic activities.

- In case the actually collected charge and dues amount is larger than the assigned estimate, collecting agencies may use the retained charge and dues amount to additionally pay for their regular operations (in case the State increase the minimum wage or petrol and oil prices rise) and irregular operations (for procurement and repair of inland waterway equipment and vessels). The unused amount may be carried forward to the subsequent year for funding these agencies’ operations.

4. Annually, collecting agencies shall make the finalization with tax agencies the use of charge and dues receipts; collected charge and dues amounts; and charge and dues amounts they have retained; charge and dues amounts remitted into the state budget; and charge and dues amounts already paid and to be paid; and make the finalization the use of retained amounts with finance offices at the same level under current regulations.

III. ORGANIZATION OF IMPLEMENTATION

1. This Circular takes effect 15 days after its publication in the Gazette and replaces the Ministry of Finance’s Circular No. 58/2005/TT-BTC of July 18, 2005, guiding the collection, remittance and management of use of charges and dues levied by inland waterway port authorities.

2. Organizations and individuals liable to pay charges and dues levied by inland waterway port authorities and concerned agencies shall strictly implement the provisions of this Circular.

3. Any problems arising during the implementation should be promptly reported to the Ministry of Finance for study and additional guidance.

|

|

FOR

THE MINISTRY OF FINANCE |