Decision No. 03/2008/QD-NHNN of February 1, 2008, on the lending, discount of valuable papers for securities investment and trading. đã được thay thế bởi Circular No. 36/2014/TT-NHNN minimum safety limits ratios for credit institutions branches foreign banks và được áp dụng kể từ ngày 01/02/2015.

Nội dung toàn văn Decision No. 03/2008/QD-NHNN of February 1, 2008, on the lending, discount of valuable papers for securities investment and trading.

|

THE STATE BANK OF VIETNAM |

SOCIALIST REPUBLIC OF VIETNAM |

|

No. 03/2008/QD-NHNN |

Hanoi, February 1, 2008 |

DECISION

ON THE LENDING, DISCOUNT OF VALUABLE PAPERS FOR SECURITIES INVESTMENT AND TRADING

THE GOVERNOR OF THE STATE BANK OF VIETNAM

- Pursuant to the Law on the State Bank of Vietnam in 1997 and the Law

on the amendment, supplement of several articles of the Law on the State Bank

of Vietnam in 2003;

- Pursuant to the Law on Credit Institutions in 1997 and the Law on the

amendment, supplement of several articles of the Law on Credit Institutions in

2004;

- Pursuant to the Decree No. 52/2003/ND-CP dated May 19th, 2003 of the

Government providing for the function, assignment, authority and organizational

structure of the State Bank of Vietnam;

Upon the proposal of the Director of Monetary Policy Department,

DECIDES:

Article 1. Credit institutions shall provide loans, perform the discount of valuable papers for securities investment and trading in compliance with provisions of applicable laws on banking credit, provisions in this Decision and other provisions of related laws.

Article 2. Credit institutions shall be entitled to provide loans, perform the discount of valuable papers for securities investment and trading upon fully satisfying following conditions:

1. To issue a Regulation on operation of lending, discount of valuable papers for securities investment and trading, which contains following contents:

a. Limit of loan, discount for a single customer;

b. Limit of loan, discount for a group of related customers;

c. Ratio of outstanding loan, discount over total outstanding credit;

d. Maximum lending period, maximum period of time discount;

dd. Loan security asset;

e. Measures for controlling and preventing credit risks;

2. To send the Regulation stipulated in paragraph 1 of this Article to State Bank Inspectorate right after its issuance to make foundation for inspection, supervision over lending activity, discount of valuable papers for securities investment and trading;

3. To ensure prudential ratios in operation of credit institutions in accordance with applicable provisions of the State Bank of Vietnam;

4. The ratio of bad debt over total outstanding credit is 5%;

5. To carry out accurate accounting, statistics of loans, discounts of valuable papers for securities investment and trading; to send reports to the State Bank of Vietnam on time in line with the form stipulated in the Appendix attached to this Decision.

Article 3. Lending, discount of valuable papers for securities investment and trading includes:

1. Lending, discount of valuable papers for securities company;

2. Providing loan mortgaged by securities and/or secured by other asset to customers using loan capital for buying securities;

3. Providing loan by making advance to customers who have sold securities and use loan capital for buying securities;

4. Providing loan to customers to supplement the deficit upon matching securities buying orders;

5. Providing loan to laborers for buying shares issued in the first time upon transforming state owned company into joint stock company;

6. Providing loan for making capital contribution to, buying shares from joint stock company, buying fund certificate of investment fund;

7. Performing the discount of valuable papers so as customers can use discounted amount to buy securities;

8. Loans and discounts of valuable papers in other forms which customers use those amounts to buy securities;

Securities shall consists of those stipulated in paragraph 1 Article 6 of the Law on Securities, including stocks, bonds of public companies in accordance with provisions in paragraph 1, Article 25 of the Law on Securities.

Article 4. Risky coefficient and limit of loan, discount of valuable papers for securities investment and trading are as follows:

1. Risky coefficient of loans, discounts of valuable papers for securities investment, trading belonging to “Assets” group shall be 250%;

2. Total outstanding loans, discount of valuable papers for securities investment, trading shall not be in excess of 20% (twenty per cent) of charter capital of credit institution.

Article 5. Implementing provisions

1. This Decision shall be effective after 15 days since its publication in Official Gazette.

2. Following provisions shall cease their effectiveness: Point 1.3, paragraph 1 of the Directive No. 03/2007/CT-NHNN dated 28 May 2007 of the Governor of the State Bank of Vietnam on the control over credit scale, quality and lending for securities investment, trading for monitoring inflation, enhancement of economic growth and other documents of the State Banks of Vietnam guiding the implementation of this Directive; point a, b paragraph 5, Article 6 providing for prudential ratios in operation of credit institutions issued in conjunction with the Decision No. 457/2005/QD-NHNN dated 19 April 2005 of the Governor of the State Bank of Vietnam (supplemented under paragraph 7, Article 1 of the Decision No. 03/2007/QD-NHNN dated 19 January 2007 of the Governor of the State Bank); other provisions of the State Bank of Vietnam which are contrary to this Decision.

3. Since the effective date of this Decision, credit institutions satisfying the provisions in Article 2 and paragraph 2, Article 4 of this Decision shall provide credits in accordance with provisions in this Decision. Credit Institutions which have not yet satisfied provisions in Article 2 and paragraph 2 Article 4 of this Decision shall not be entitled to provide loans, perform the discount of valuable papers for securities investment and trading; they shall be entitled to continue to provide loans, perform the discount within the permitted limit upon satisfying provisions in Article 2 and paragraph 2 Article 4.

Article 6. Director of Administrative Department, Director of Monetary Policy Department and Heads of units of the State Bank of Vietnam, General Managers of State Bank branches in provinces, cities under the central Government’s management; Board of Directors and General Directors (Directors) of credit institutions shall be responsible for the implementation of this Decision.

|

|

THE GOVERNOR OF THE STATE BANK OF VIETNAM |

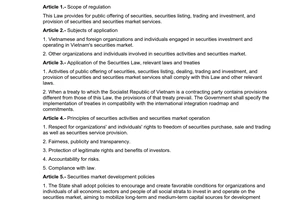

NAME

OF REPORTING CI:

REPORT ON RESULT OF LENDING, DISCOUNT OF VALUABLE PAPERS FOR SECURITIES

INVESTMENT AND TRADING

MONTH.... YEAR 20...

Unit: billion dong

|

Norms |

Figures |

Increase/decrease over previous month (%) |

|

I. Loan revenue |

||

|

II. Outstanding loan |

||

|

1. Classified by loan term |

||

|

- Short term |

||

|

- Medium term |

||

|

- Long term |

||

|

2. Classified by demand for loan capital |

||

|

- Lending, discount of valuable papers for securities company |

||

|

- Providing loan mortgaged by securities and/or secured by other asset to customers using loan capital for buying securities |

||

|

- Providing loan by making advance to customers who have sold securities and use loan capital for buying securities |

||

|

- Providing loan to customers to supplement the deficit upon matching securities buying orders; |

||

|

- Providing loan to laborers for buying shares issued in the first time upon transforming state owned company into joint stock company |

||

|

- Providing loan for making capital contribution to, buying shares from joint stock company, buying fund certificate of investment fund |

||

|

- Performing the discount of valuable papers so as customers can use discounted amount to buy securities |

||

|

- Loans and discounts of valuable papers in other forms which customers use those amounts to buy securities |

||

|

III. The ratio of outstanding bad debt from loan, discount of valuable papers for securities investment and trading |

||

|

IV. Ratio of outstanding securities loan over charter capital |

|

............, date.................... |

|

|

DRAWER |

GENERAL DIRECTOR |

Guidance on the table drawing:

1. Subject of application: commercial banks, foreign bank branches, joint venture banks, finance companies, central People’s Credit Fund;

2. Ratio of bad debt = outstanding bad debt from loan, discount of valuable papers for securities investment and trading / total outstanding loan, discount of valuable papers for securities investment and trading;

3. Report recipient: Monetary Policy Department (email: [email protected]; [email protected])

4. Please clearly state full name, contact telephone number of person in charge of answering the report’s contents if requested by the State Bank.

5. Any query that may occur during the implementation, please contact the following telephone number: 04-8246955