Nội dung toàn văn Decision No. 106/2008/QD-BTC of November 17, 2008, on collection, management and use of fees for registration of franchising activities.

|

THE MINISTRY OF FINANCE ----------- |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 106/2008/QD-BTC |

Hanoi, November 17, 2008 |

DECISION

ON COLLECTION, MANAGEMENT AND USE OF FEES FOR REGISTRATION OF FRANCHISING ACTIVITIES

THE MINISTER OF FINANCE

Pursuant to Decree 35/2006/ND-CP of the Government dated 31 March 2006 making detailed provisions for implementation of the Commercial

Law with respect to franchising

activities;

Pursuant to Decree 57/2002/ND-CP

of the Government dated 3 June 2002 implementing the Ordinance on Fees and

Charges;

Pursuant to Decree 24/2006/ND-CP

of the Government dated 6 March 2006 amending

Decree 57 above; Pursuant to Decree 77/2003/ND-CP

of the Government dated 1 July 2003 on functions, duties, powers and

organizational structure of the

Ministry of Finance;

On receipt of the opinion of the Ministry of Industry and

Trade in Official Letter 7514/BCT-KH dated 25 August 2008;

Having considered

the proposal of the Director

of the Department for Monetary Policy,

DECIDES:

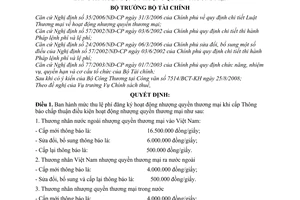

Article 1

To promulgate the amount of fees payable for registration of franchising activities when a Notice of satisfaction of conditions for conducting franchising activities is issued1, as follows:

1. A foreign business entity granting a franchise in Vietnam:

- Issuance of new notice, sixteen million five hundred thousand (16,500,000) dong.

- Amendment or addition to the notice, six (6) million dong.

- Re-issuance of the notice, five hundred thousand (500,000) dong.

2. A Vietnamese business entity granting a franchise overseas:

- Issuance of new notice, four million (4,000,000) dong.

- Amendment, addition or re-issuance of the notice, five hundred thousand (500,000) dong.

3. A business entity granting a franchise within Vietnam:

- Issuance of new notice, four million (4,000,000) dong.

- Amendment, addition or re-issuance of the notice, five hundred thousand (500,000) dong.

Article 2

Fee-payers as stipulated in article 1 of this Decision means both Vietnamese and foreign business entities to whom the State authority (Ministry of Industry and Trade and its subsidiary entities) issues Notices of satisfaction of conditions for conducting franchising activities in accordance with law.

Article 3

Fees for registration of franchising activities shall be revenue of the State budget and shall be managed and used as follows

1. The authority collecting the fees stipulated in clauses 1 and 2 of article 1 shall retain all (100%) of such fees to cover the costs of issuing Notices and collection of fees in accordance with the stipulated regime.

2.The authority collecting the fees stipulated in clause 3 of article 1 shall pay all (100%) of such fees into the State Budget in accordance with the stipulated regime.

Article 4

This Decision shall be of full force and effect fifteen (15) days after the date on which it is published in the Official Gazette.

Article 5

Other matters relating to the collection, payment, management, use, receipt, and public notification of fees payable for registration of franchising activities and which are not regulated in this Decision shall be implemented in accordance with the following Circulars of the Ministry of Finance:

- Circular 63/2002/TT-BTC dated 24 July 2002 guiding fees and charges;

- Circular 45/2006/TT-BTC dated 25 May 2006 amending Circular 63 above;

- Circular 60/2007/TT-BTC dated 14 June 2007 guiding implementation of the Law on Tax Management.

Article 6

Fee-payers paying fees for registration of franchising activities and other bodies concerned shall be responsible for implementation of this Decision.

|

|

FOR

THE MINISTER OF FINANCE |