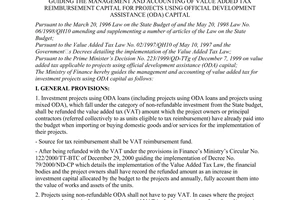

Nội dung toàn văn Decision No. 223/1999/QD-TTg of December 7, 1999, on the value added tax on projects using official development assistance (ODA) capital

|

THE PRIME MINISTER OF GOVERNMENT |

SOCIALIST REPUBLIC OF VIET NAM |

|

No: 223/1999/QD-TTg |

Hanoi, December 7, 1999 |

DECISION

ON THE VALUE ADDED TAX ON PROJECTS USING OFFICIAL DEVELOPMENT ASSISTANCE (ODA) CAPITAL

THE PRIME MINISTER

Pursuant to the Law on Organization of the

Government of September 30, 1992;

Pursuant to the Value Added Tax Law No. 02/1997/QH9 of May 10, 1997;

Pursuant to the National Assembly Standing Committee’s

Resolution No. 90/1999/NQ-UBTVQH10 of September 3, 1999 on amending and

supplementing a number of lists of goods and services not subject to the

value-added tax and the value added tax rates for a number of goods and

services;

At the proposal of the Minister of Finance,

DECIDES:

Article 1.- The projects using non-refundable ODA capital shall not have to pay the value-added tax. In cases where the project owners or the principal contractors have already paid the value-added tax in the buying prices of goods and/or services, they shall be refunded such tax amount by the State.

Article 2.- For projects using ODA loans, which fall under the category of non-refundable investment from the State budget, the project owners or the principal contractors shall be refunded the value-added tax amounts already paid when importing and purchasing domestic goods and/or services for the project implementation. The source for tax reimbursement shall be covered by the State’s value-added tax reimbursement fund. The reimbursed tax amounts shall be regarded as the capital allocated from the budget and the project owners shall have to record them as an increase in the project’s invested capital.

Article 3.- For projects using ODA capital under the re-lending mechanism from the budget (including projects using mixed ODA capital - non-refundable ODA and ODA loans - where the non-refundable ODA is provided under a separate agreement), the project owners must not use the source of ODA capital but the source of domestic capital for payment of value-added tax as prescribed by law.

Article 4.- This Decision takes effect from the date of its signing.

The project owners or the principal contractors who have already paid value-added tax calculated in the buying prices of goods and/or services for the project implementation before the effective date of this Decision, shall be also refunded the tax amounts as prescribed in this Decision.

Within three days from the date of receipt of the full and valid dossiers and vouchers, the tax agency shall have to complete the procedures for value-added tax reimbursement to the project owners or principal contractors, who are eligible for tax reimbursement as prescribed in Article 1 and Article 2 above.

Article 5.- The Minister of Finance shall have to guide the implementation of this Decision.

The ministers, the heads of the ministerial-level agencies, the heads of agencies attached to the Government and the presidents of the People’s Committees of the provinces and centrally-run cities shall have to implement this Decision.

|

FOR THE PRIME MINISTER |