Nội dung toàn văn Decision No. 24/2013/QD-TTg amending and supplementing clause 1 article 1 of the

|

THE PRIME MINISTER |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 24/2013/QD-TTg |

Hanoi, May 03, 2013 |

DECISION

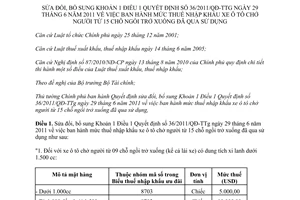

AMENDING AND SUPPLEMENTING CLAUSE 1 ARTICLE 1 OF THE DECISION NO. 36/2011/QD-TTG OF JUNE 29, 2011 ON ISSUING IMPORT TAX RATE FOR USED CARS FROM 15 SEATS OR LESS

Pursuant to the Law on Government Organization dated December 25, 2001;

Pursuant to the Law on Export and Import Tax dated June 14, 2005;

Pursuant to the Government’s Decree No. 87/2010/ND-CP dated August 13, 2010 detailing a number of articles of the Law on Import Duty and Export Duty;

At the proposal of the Minister of Finance;

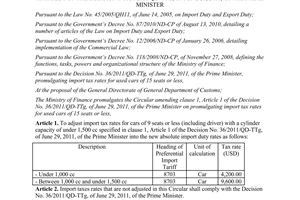

The Prime Minister promulgates the Decision amending and supplementing clause 1 article 1 of the Decision No. 36/2011/QD-TTg of June 29, 2011 on issuing import tax rate for used cars from 15 seats or less,

Article 1. To amend and supplement Clause 1 Article 1 of the Decision No. 36/2011/QD-TTg of June 29, 2011 on issuing import tax rate for used cars from 15 seats or less as follows:

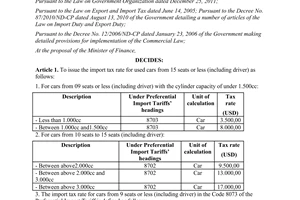

“1. For cars from 09 seats or less (including driver) with the cylinder capacity of under 1,500cc:

|

Description

|

Under headings in Preferential Import Tariffs |

Unit of calculation |

Tax level (USD) |

|

- Less than 1,000cc |

8703 |

Car |

5,000.00 |

|

- Between 1,000cc and 1,500cc |

8703 |

Car |

10,000.00 |

Article 2. Implementation provisions

1. This Decision takes effect on June 20, 2013.

2. Ministers, heads of ministerial-level agencies, heads of Government-attached agencies, the provincial/municipal People’s Committees, relevant agencies and units shall have to implement this Decision.

|

|

THE PRIME

MINISTER |

------------------------------------------------------------------------------------------------------

This translation is translated by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments