Nội dung toàn văn Decision No. 36/2011/QD-TTg on issuing import tax rate for used cars from 15 sea

|

THE PRIME MINISTER |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 36/2011/QD-TTg |

Hanoi, June 29, 2011 |

DECISION

ON ISSUING IMPORT TAX RATE FOR USED CARS FROM 15 SEATS OR LESS

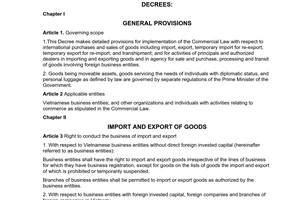

Pursuant to the Law on Government Organization dated December 25, 2011;

Pursuant to the Law on Export and Import Tax dated June 14, 2005; Pursuant to the Decree No. 87/2010/ND-CP dated August 13, 2010 of the Government detailing a number of articles of the Law on Import Duty and Export Duty;

Pursuant to the Decree No. 12/2006/ND-CP dated January 23, 2006 of the Government making detailed provisions for implementation of the Commercial Law;

At the proposal of the Minister of Finance,

DECIDES:

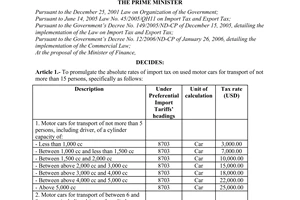

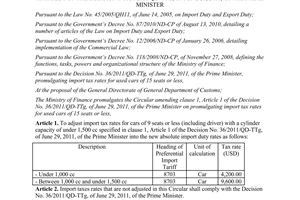

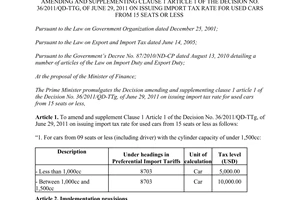

Article 1. To issue the import tax rate for used cars from 15 seats or less (including driver) as follows:

1. For cars from 09 seats or less (including driver) with the cylinder capacity of under 1.500cc:

|

Description |

Under Preferential Import Tariffs’ headings |

Unit of calculation |

Tax rate (USD) |

|

- Less than 1.000cc |

8703 |

Car |

3.500,00 |

|

- Between 1.000cc and1.500cc |

8703 |

Car |

8.000,00 |

2. For cars from 10 seats to 15 seats (including driver):

|

Description |

Under Preferential Import Tariffs’ headings |

Unit of calculation |

Tax rate (USD) |

|

- Between above2.000cc |

8702 |

Car |

9.500,00 |

|

- Between above 2.000cc and 3.000cc |

8702 |

Car |

13.000,00 |

|

- Between above 3.000cc |

8702 |

Car |

17.000,00 |

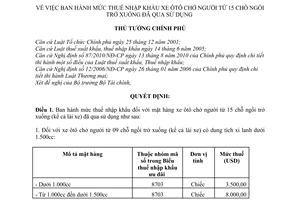

3. The import tax rate for cars from 9 seats or less (including driver) in the Code 8073 of the Preferential Import Tariff is defined as follows:

a) For cars with the cylinder capacity of from 1.500cc to under 2.500cc: Import tax rate = X + 5.000 USD

b) For cars with the cylinder capacity of from 2.500cc and over: Import tax rate = X + 15.000 USD

c) X listed in the sub-clause (a), (b) of this clause is defined as follows: X = Tax value of used cars multiplies (x) tax rate of the same car type’s tax flow in Chapter 87 of the Preferential Import Tariff taking effect at the time of customs declaration registration.

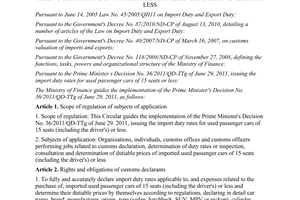

Article 2. Responsibilities of the Ministry of Finance:

1. To base itself on the practical situation in each specific period to issue Decision on increasing or reducing by 20% the tax rates regulated at Article 1 of this Decision, but not over the ceiling level in accordance with Vietnam’s commitment of joining the World Trade Organization (WTO) control and regulate the domestic consumption market, prevent the utilization for commercial frauds. To report thereon to the Prime Minister in case of the adjustment over 20%.

2. Pursuant to the Decree No. 40/2007/ND-CP dated March dated March 16, 2007 of the Government, providing for customs valuation of imported and exported goods guiding import dutiable value for cars prescribed at the clause 3, Article 3 of this Decision, in order to prevent the declaration of lower price than reality to avoid tax, ensure the compliance of public and transparent principal and not arise anymore administrative procedure.

Article 3. Implementation provision

1. This Decision takes effect on August 15, 2011 and replaces the Decision No. 69/2006/QD-TTg dated March 28, 2006 of the Prime Minister promulgating the absolute rates of import tax on used motor cars.

2. Ministers, heads of ministerial-level agencies, heads of Governmentattached agencies, and presidents of provincial/municipal People’s Committees shall have to implement this Decision.

|

|

THE PRIME MINISTER |