Decision No. 327/QD-NH5 of October 04, 1997 ratifying the statute on the organization and operation of the industrial and Commercial Bank of Vietnam đã được thay thế bởi Decision No.1325/QD-NHNN of November 28, 2002 approving the charter on organization and operation of the industrial and commercial Bank of Vietnam và được áp dụng kể từ ngày 28/11/2002.

Nội dung toàn văn Decision No. 327/QD-NH5 of October 04, 1997 ratifying the statute on the organization and operation of the industrial and Commercial Bank of Vietnam

|

THE STATE BANK |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 327/QD-NH5 |

Hanoi, October 04, 1997 |

DECISION

RATIFYING THE STATUTE ON THE ORGANIZATION AND OPERATION OF THE INDUSTRIAL AND COMMERCIAL BANK OF VIETNAM

THE GOVERNOR OF THE STATE BANK

Pursuant to the Law on State Enterprises of

April 20, 1995;

Pursuant to the Ordinance on the State Bank of Vietnam, Ordinance on Banks,

Credit Cooperatives and Financial Companies promulgated together with Order No.37/LCT-HDNN8

and Order No.38/LCT-HDNN8 of May 24, 1990 of the President of the State

Council;

Pursuant to Decree No.15-CP of March 2, 1993 of the Government on the tasks,

powers and State management responsibilities of the ministries and the

ministerial-level agencies;

Pursuant to Document No.3329/DMDN of July 11, 1996 of the Government

authorizing the Governor of the State Bank to sign the decision on the

re-establishment of the Industrial and Commercial Bank of Vietnam;

Pursuant to Document No.3575/DMDN of July 18, 1997 of the Government

authorizing the Governor of the State Bank to temporarily ratify the Statute on

the Organization and Operation of the State-Owned Banks;

At the proposals of the Chairman of the Managing Board of the Industrial and

Commercial Bank of Vietnam and the Director of the Financial Regulations

Department of the State Bank of Vietnam,

DECIDES

Article 1.- To ratify the Statute on the Organization and Operation of the Industrial and Commercial Bank of Vietnam, which includes 11 chapters and 58 articles, issued together with this Decision.

Article 2.- This Decision takes effect 15 days after its signing and shall replace Decision No.251/QD-NH5 of November 11, 1992 of the Governor of the State Bank allowing the application of the Statute of the Industrial and Commercial Bank of Vietnam.

Article 3.- The Chairman of the Managing Board and the General Director of the Industrial and Commercial Bank of Vietnam, the Director of the Financial Regulations Department, the Director of the Office, the Chief Inspector, the heads of the attached units of the Central State Bank, the Directors of branches of the State Bank in the provinces and cities directly under the Central Government shall have to implement this Decision.

|

|

ACTING GOVERNOR OF THE

STATE BANK |

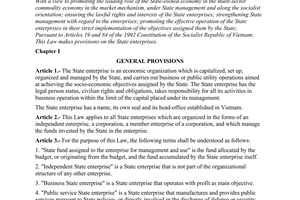

STATUTE

ON THE ORGANIZATION AND OPERATION OF THE INDUSTRIAL AND COMMERCIAL BANK OF VIETNAM

(Ratified under Decision No.327-QD/NH5 of October 4, 1997 of the Governor of the State Bank)

Chapter I

GENERAL PROVISIONS

Article 1.- The Industrial and Commercial Bank of Vietnam (hereafter referred to as the Industrial and Commercial Bank for short) is a State enterprise of special category comprising member units which are closely inter-related in their activities for economic, financial, technological, information, training, research and marketing interests; the Industrial and Commercial Bank undertakes monetary and credit businesses and provides financial, monetary and banking services for customers at home and abroad.

The Industrial and Commercial Bank was established under Decree No.402-CT of November 13, 1990 of the Chairman of the Council of Ministers (now the Prime Minister) and was re-established under Decision No.285/QD-NH5 of September 21, 1996 of the Governor of the State Bank, as authorized by the Prime Minister, after the State corporation model stipulated in Decision No.90-TTg of March 7, 1994, aim to enhance the accumulation, concentration, specialization and business cooperation to fulfill the tasks assigned by the State and raise business capability and efficiency of the member units and the entire Bank, thus meeting the demand of the national economy.

Article 2.- The Industrial and Commercial Bank has:

1. The legal person status under Vietnamese law

2. Its international transaction name as the Industrial and Commercial Bank of Vietnam, or called VIETINCOMBANK or written as ICBV for short

Its head office located in Hanoi city.

3. Its own organizational and operational statute, managerial and executive apparatus;

4. Its own capital and assets:

a/ The statutory capital, as determined by the Government, is 1,100,000,000,000 VND (one thousand and one hundred billion Vietnam Dong)

b/ The Bank shall take responsibility for its debts within the limit of its capital and assets under the State ownership and its management.

5. Its own seal and bank accounts opened at the State Bank, domestic and foreign banks.

6. Its balance sheets and various centralized funds as prescribed by law.

Article 3.- The duration of operation of the Industrial and Commercial Bank is 99 years, from the date the Governor of the State Bank signs the decision on its re-establishment after the State corporation model.

Article 4.- The Industrial and Commercial Bank shall be managed by the Managing Board and run by the General Director.

Article 5.- The Industrial and Commercial Bank shall be subject to the State management by the State Bank, the ministries, the ministerial-level agencies, the agencies attached to the Government and the People's Committees of the provinces and cities directly under the Central Government according to their prescribed functions; and at the same time to the management by these agencies in their capacity as the agencies exercising the owner's rights in accordance with the Law on State Enterprises and other provisions of law.

Article 6.- The organization of the Communist Party of Vietnam in the Industrial and Commercial Bank shall operate in accordance with the Constitution and laws of the State of the Socialist Republic of Vietnam and the regulations of the Communist Party of Vietnam.

The Trade Union organization and other socio-political organizations in the Industrial and Commercial Bank shall operate in accordance with the Constitution, laws and their respective statutes.

Chapter II

RIGHTS AND OBLIGATIONS OF THE INDUSTRIAL AND COMMERCIAL BANK

SECTION 1.- RIGHTS OF THE INDUSTRIAL AND COMMERCIAL BANK

Article 7.- The Industrial and Commercial Bank shall have the rights to:

1. Manage and use capital, land and other resources assigned to it by the State; the mobilized capital, entrusted financial aid as well as loans as prescribed by law in order to achieve the objectives and accomplish the assigned or entrusted tasks.

2. Re-assign the resources that the Industrial and Commercial Bank has received from the State to its member units for management and use, redistribute, when necessary, the resources already assigned to the member units in conformity with the overall development plan of the Industrial and Commercial Bank.

3. Transfer, replace, lease, pledge or mortgage assets under its ownership, except for important assets and equipment which, as stipulated by the Government, require permission from a competent State agency on the principle of preserving and developing the capital. With regard to the land under the management and use of the Industrial and Commercial Bank, the land legislation shall apply.

Article 8.- The Industrial and Commercial Bank shall have the right to organize the following professional operations in accordance with the provisions of law:

1. Capital mobilization:

a/ Receiving savings deposits, demand and time deposits and payment deposits in Vietnam Dong or foreign currencies from all Vietnamese and foreign organizations and individuals;

b/ Issuing different kinds of certificate of deposits, promissory notes, debentures and bonds of the Bank and applying other forms of capital mobilization.

2. Receiving financial aid and entrusted investment capital from the Government, the State Bank, international and national organizations and individuals for economic, social and cultural development programs.

3. Borrowing capital from the State Bank and other financial and credit institutions inside and outside the country, and from other foreign organizations and individuals.

4. Lending:

a/ Providing economic organizations with short-, medium- or long-term loans in Vietnam Dong and foreign currencies; providing individuals and households of all economic sectors with short-, medium- or long-term loans in Vietnam Dong;

b/ Discounting commercial bills, time bills, bonds and other papers of monetary value.

5. Providing financial leasing services (including the import and re-export of the leased equipment).

6. Making L/C payments, providing credit guaranty and re-guaranty, bid guaranty and other guaranty and re-guaranty services for enterprises and financial and credit institutions inside and outside the country.

7. Conducting monetary and credit business transaction and providing external banking services.

8. Investing in forms of capital contribution, joint venture, stock purchase, property purchase and other forms in enterprises and other financial-credit institutions.

9. Conducting transactions related to the pledge of movable assets.

10. Trading in gold and silver, precious metals and gems (including the import-export thereof).

11. Providing payment services for customers.

12. Trading in securities and acting as broker or agent to issue securities to customers.

13. Keeping, preserving and managing securities, papers of monetary value and other valuable properties for customers.

14. Providing consultancy services regarding monetary matters, banking agency, insurance services, management of capital and investment development projects upon the request of customers

15. Investing in repairing, renovating and upgrading the pledged and/or mortgaged assets that have been made to the State ownership and put under the management by the Industrial and Commercial Bank for use or commercial purpose; investing by itself or entering into joint venture for investing in the construction of material and technical bases in direct service of business activities and being allowed to lease the temporarily unused part of the material and technical bases.

16. Engaged in other business lines and trades if so approved by a competent State agency.

17. Performing other transactions entrusted by the State and the State Bank.

Article 9.- The Industrial and Commercial Bank shall have the right to organize its management and business as follows:

1. Organizing the managerial apparatus and business activities in accordance with law, the objectives and tasks assigned by the State and the State Bank.

2. Renewing technology, facilities and equipment.

3. Opening transaction offices, branches and representative offices inside and outside the country in accordance with the provisions of law.

4. Performing business transactions mentioned in Article 8 of this Statute; expanding the business scale on the basis of its capability and the market demand.

5. Selecting markets and uniformly assigning such markets to its member units.

6. Providing detailed guidance for the implementation of the State policies, regimes and regulations on banking activities in accordance with law. Issuing documents on the regulations, rules and other professional technical and managerial measures necessary for its business activities.

7. Within the framework of the regulations of the State Bank, the Industrial and Commercial Bank is entitled to:

a/ Set specific interest rates for different kinds of deposits and loans;

b/ Determine the maximum loan that may be amount lent to a customer;

c/ Determine the rates of commission, fees, rewards and fines applicable in its business and service activities;

d/ Determine the exchange rates for the trading in foreign currencies

8. Initiating lawsuits regarding economic and civil disputes and proposing the institution of criminal cases related to its activities.

9. Requesting customers who wish to borrow capital to produce documents and dossiers and supply the information on their production, business and financial situation so that the Bank can consider and make loans as well as inspect the use of such loans.

10. Refusing to enter into credit relations and other business and service relations with customers if the Bank sees that such relations are contrary to law or bring about no economic efficiency or it is impossible to recover capital.

11. Developing and applying labor norms and wage unit price in conformity with the norms and unit prices prescribed by the State.

12. Directly recruiting, employing, arranging and training laborers and dividing the responsibility for the recruitment, employment, arrangement and training of laborers; selecting forms of wage payment and rewards and exercising other rights of the employer in accordance with the provisions of the Labor Code and other provisions of law; deciding the levels of wages and rewards for laborers on the basis of the wage unit price, service charges and efficiency of operations of the Industrial and Commercial Bank.

13. Participating in domestic and international associations appropriate to its business line.

14. Directly signing economic and civil contracts, contracts for scientific and technical cooperation and training of banking personnel for purposes of doing business with organizations and individuals inside and outside the country. Inviting and receiving domestic and foreign business partners of the Industrial and Commercial Bank; deciding to send abroad its personnel (including those of its member units) for business, study, visit or survey tours; the sending of the Chairman of the Managing Board or the General Director abroad for such purposes must be permitted by the Governor of the State Bank. The sending abroad of other members of the Managing Board, the Control Commission and assistants to the Managing Board shall be decided by the Chairman of the Managing Board. And the sending abroad of the Deputy General Directors and other officials in the assisting apparatus and internal inspection body of the Industrial and Commercial Bank shall be decided by the General Director.

Article 10.- The Industrial and Commercial Bank shall have the financial management rights to:

1. Enjoy financial autonomy, take the initiative in business activities, take self-responsibility for its business results, preserve and develop its capital to ensure the growth of the Bank's business activities in accordance with law.

2. Use its capital, land and funds to meet business demands in a timely manner on the principle of capital preservation, efficiency and compliance with the State Bank's regulations on ensuring safety in monetary and credit business activities and relevant provisions of law.

3. Borrow capital from the State Bank in accordance with the regulations issued by the Governor of the State Bank and mobilize by itself capital for business activities without altering the form of State ownership over the Industrial and Commercial Bank; issue bonds, debentures and promissory notes of the Bank in accordance with law; mortgage the land use right associated with assets under its management to credit institutions to borrow capital for business activities in accordance with the provisions of law.

4. Establish, manage and use the centralized funds in accordance with the provisions of law.

5. Use the remaining profits in accordance with law.

6. Be entitled to the regimes of capital subsidies and business profit subsidies or other State's preferential treatment regimes when performing the tasks assigned by the Government.

7. Be entitled to investment or re-investment privileges as prescribed by the State.

Article 11.- The Industrial and Commercial Bank shall have the right to refuse and denounce requests of any organization or individual regarding the provision of resources not prescribed by law, except for voluntary contributions for humanitarian and public utility purposes.

SECTION 2.- OBLIGATIONS OF THE INDUSTRIAL AND COMMERCIAL BANK

Article 12.-

1. The Industrial and Commercial Bank shall have the obligation to receive and effectively use, preserve and develop the capital, land and other resources allocated by the State to achieve the business objectives and fulfill the tasks assigned by the State.

2. The Industrial and Commercial Bank shall have the obligation to fulfill its commitments regarding:

a/ The repayment of deposits to depositors;

b/ The debts to be recovered or paid as stated in the balance sheet of assets of the Industrial and Commercial Bank at the time of its establishment after the State corporation model;

c/ The repayment of international credits it has borrowed from the Government or the State Bank and used for its business activities or for the State-assigned objectives and tasks;

d/ The repayment of credits directly borrowed by the Bank or by its member units or customers under the Bank's guaranty under guaranty contracts if such units or customers are not capable of paying the due debts.

Article 13.- The Industrial and Commercial Bank shall have the following obligations in managing its business activities:

1. To register its business and conduct business according to the registered business line; take responsibility to the State for the results of its activities and before law for its commitments to customers; keep secret data and the status of operation of its customers, except in case of a request from the competent State agency as prescribed by law.

2. To draw up the development strategy, five-year and annual plans according to the tasks assigned by the State and the market demand.

3. To sign and organize the performance of economic and civil contracts with its partners.

4. To contribute to meeting the demands of the monetary market and play the leading role in monetary business activities, ensure the major objectives in the implementation of the monetary stabilization policy of the State as assigned by the Governor of the State Bank.

5. To renovate and modernize technology and mode of management; use revenues from the transfer of properties for re-investment and renovation of its equipment and technology.

6. To fulfill its obligations toward laborers as prescribed by the Labor Code, ensuring the laborers' participation in the management of the Bank.

7. To abide by the State's regulations on the protection of natural resources, environment, national defense and security.

8. To apply the reporting, statistical and accounting regimes and the regimes of periodical and extraordinary reports as required by the State; make extraordinary reports at the request of the owner's representative; be accountable for the authenticity of these reports.

9. To submit to the inspection of the owner's representative; abide by the inspection regulations of the State Bank, the financial agencies and the competent State agencies as prescribed by law.

Article 14.- The Industrial and Commercial Bank has the obligations to:

1. Strictly observe the regimes and regulations on the management of capital, properties, funds, the accounting, cost-and-profit accounting and auditing regimes as well as other regulations of the State; take responsibility for the authenticity of the Bank's financial activities.

2. Make public the annual financial statements and relevant information so as to properly and objectively evaluate its activities in accordance with the regulations of the Ministry of Finance and the State Bank.

3. Make tax and other payments to the State budget as prescribed by law. Properties transferred by the Industrial and Commercial Bank among its member units in the form of capital increase or decrease shall not be subject to registration fee; the internal transfer services among the member units to meet the demands of capital supply and business shall not be subject to turnover tax.

Chapter III

THE MANAGING BOARD AND THE CONTROL COMMISSION

Article 15. -

1. The Managing Board of the Industrial and Commercial Bank shall perform the function of managing the activities of the Bank and shall take responsibility for the Bank's development according to the tasks assigned by the State.

2. The Managing Board shall have the powers and tasks of:

a/ Receiving capital (including debts regarded as capital), land and other resources allocated by the State to the Industrial and Commercial Bank;

Considering and approving the plan proposed by the General Director regarding the allocation of capital and other resources to the member units as well as the plan on the transfer of capital and other resources among the member units; inspecting and supervising the implementation of such plans;

b/ Inspecting and supervising all the Bank's activities, including the use, preservation and development of the assigned capital and resources, the implementation of resolutions and decisions of the Managing Board and the provisions of law and the fulfillment of obligations toward the State;

c/ Adopting the General Director's proposal before submitting it to the Governor of the State Bank for approval regarding the strategy, overall planning, long-term development plans and five-year plans of the Industrial and Commercial bank; deciding the objectives and annual plans of the Bank and report them to the Governor of the State Bank so that the latter assigns them to the Bank's member units;

d/ Approving the orientations and plan submitted by the General Director on the capital mobilization and use as well as the criteria for ensuring capital security within the Industrial and Commercial Bank

e/ Organizing the evaluation of the investment plan, new investment projects and cooperation investment projects with foreign parties which involve the capital under the management of the Industrial and Commercial Bank and submitting them to the competent agency for approval;

f/ Submitting to the Governor of the State Bank for approval or deciding, as empowered by the Governor of the State Bank, joint venture projects and stock purchase as stipulated by the Government and the State Bank; deciding other economic contracts of great value;

g/ Approving and supervising the application of interest rates, commission rates, service charges, rewards and fines set for customers for each period of the Bank's business operation, as well as the economic-technical norms and criteria and wage unit prices applicable within the Bank at the proposal of the General Director on the basis of the general regulations of the banking branch and the State;

h/ Elaborating and submitting to the Governor of the State Bank for ratification the Statute on the Organization and Operation of the Industrial and Commercial Bank and the amendments and supplements thereto;

i/ Ratifying the organizational and operational statutes and regulations of the Bank's member units and the amendments and supplements thereto at the request of the General Director. Deciding the opening of the Bank's transaction offices, branches and representative offices in the country and abroad in accordance with the provisions of law. Approving the plan on the organization of the Bank's business management apparatus which is submitted by the General Director. Proposing the establishment, splitting, merger or dissolution of the Bank's member units as prescribed by law;

j/ Adopting draft documents guiding in detail the implementation of policies, regimes and regulations of the State and the State Bank regarding the banking activities as well as draft statutes, regulations, technical professional and managerial measures in the Bank's business activities before the General Director sign them for issuance;

k/ Elaborating and issuing the regulation on the Managing Board's operation; the regulation on the Control Commission's organization and operation; and approving the working regime of the internal inspection bureau of the Industrial and Commercial Bank;

l/ Approving the criteria and plan for the training of directors and deputy directors of the member units and heads of various sections at the head office of the Industrial and Commercial Bank, regulations regarding financial matters, labor, training, recruitment, wages, rewards and disciplines to be applied in the Industrial and Commercial Bank;

m/ Submitting to the Governor of the State Bank:

+ The appointment, dismissal, commendation, discipline or replacement of members of the Managing Board as stipulated by the Government;

+ The approval of the Head of the Control Commission;

+ The appointment, dismissal, commendation or discipline of Deputy General Directors and the chief accountant of the Industrial and Commercial Bank;

n/ Deciding the appointment, dismissal, commendation or discipline of other members of the Control Commission;

Deciding the appointment, dismissal, commendation or discipline of the directors of the member units, the head of the internal inspection bureau as well as the officials directly managing the Bank's contributed capital at other enterprises at the request of the General Director;

o/ Deciding the banks' total payroll for its managerial, executive and business apparatus and adjusting it, when necessary, at the request of the General Director.

p/ Approving the plan proposed by the General Director regarding the establishment and use of the Bank's centralized funds in accordance with current regulations;

q/ Adopting the plans on the increase of the statutory capital, guaranty of loans and liquidation of assets of the member units before they are decided by the General Director; submitting the liquidation of important properties and equipment which fall outside the scope of its competence to the Governor of the State Bank and the Ministry of Finance for decision; adopting the annual capital mobilization plans (in any form) of independent cost-and-profit accounting member units before they are decided by the General Director in accordance with the provisions of law;

r/ Adopting the quarterly, biannual and annual reports on the Bank's activities, the general financial statements (including the balance sheet) and the annual statements of final accounts of the Industrial and Commercial Bank and its member units submitted by the General Director; requesting the General Director to make public the annual financial statements as prescribed by law

s/ Adopting issues regarding legal proceedings and disputes related to the Bank at the request of the General Director. Requesting the State Bank to submit to the Government for approval the proposal to place the Industrial and Commercial Bank in the state of being preserved;

t/ Issuing the regulations on the protection of business secrets, internal economic information and protection of State secrets as prescribed by law, which shall be submitted by the General Director for uniform application in the whole Industrial and Commercial Bank;

u/ Deciding policies and principles on scientific and technical cooperation and training of the Industrial and Commercial Bank's personnel inside and outside the country;

v/ Presenting explanations on its conclusions and being entitled to make complaints regarding the settlement decisions of the Inspectorate of the State Bank concerning the inspection and supervision of the Industrial and Commercial Bank;

w/ Approving and deciding other issues submitted by the General Director, according to its competence.

Article 16.-

1. The Managing Board shall be composed of 5 or 7 members appointed or dismissed by the Governor of the State Bank. The criteria for the membership of the Managing Board are specified in Article 32 of the Law on State Enterprises.

2. The Managing Board shall comprise some full-time members including the Chairman, a member who is concurrently the General Director, a member who is concurrently the head of the Control Commission, and a number of part-time members who are experienced experts in the banking, financial, business administration and legal areas.

3. The Chairman of the Managing Board shall not concurrently be the General Director of the Industrial and Commercial Bank.

4. A term of office of a Managing Board member shall be five years. A Managing Board member may be re-appointed. He/she shall be dismissed or replaced in case of :

a/ Violating law or the Statute of the Industrial and Commercial Bank;

b/ Being incapable of fulfilling the assigned work and at the request of at least two thirds of the incumbent Managing Board members;

c/ Asking for resignation for plausible reasons;

d/ Being transferred or appointed to another working post

5. The Chairman of the Managing Board shall take responsibility for organizing the performance of the tasks and exercising powers of the Managing Board as defined in Clause 2, Article 15 of this Statute.

Article 17.- Working regime of the Managing Board:

1. The Managing Board shall work according to the collective regime and meet once a month to consider and decide issues that fall under its competence and responsibilities. In case of necessity, at the request of the Chairman of the Managing Board, the Head of the Control Commission or the General Director or more than 50% of the Managing Board members, the Managing Board may convene extraordinary meetings to deal with urgent issues of the Industrial and Commercial Bank.

2. The Chairman of the Managing Board shall convene and chair all the Managing Board's meetings; in case he/she is absent for plausible reasons, he/she shall authorize another member of the Managing Board to convene and chair the meetings.

3. A meeting of the Managing Board shall be considered valid only when it is attended by at least two thirds of its members. All documents of a meeting of the Managing Board must be distributed 5 days in advance to the members of the Managing Board and the invited participants. The contents and conclusions of the meeting of the Managing Board shall be recorded in a minutes which must be signed by all participating members of the Managing Board. The resolutions and decisions of the Managing Board shall take effect when they are voted for by more than 50 % of the total number of the Managing Board members. Members of the Managing Board shall have the right to reserve their opinions. Such reservation shall be made in writing with the signature of the opinion reserver and shall be filed together with the relevant resolution and/or decision of the meeting.

4. When the Managing Board meets to consider issues related to the development strategy, overall planning, five-year and annual plans, large investment projects, joint venture projects with foreign parties, annual financial statements and issuance of the system of economic and technical norms and standards, etc., of the Industrial and Commercial Bank, it shall have to invite competent representatives of the concerned ministries and branches to the meeting; if there is an important content related to the local administration, it shall have to invite representatives of the provincial People's Committee; if there is a content related to the interests and obligations of the employees in the Bank, it shall have to invite representatives of the Trade Union organization of the banking branch. The invited representatives shall have the right to speak their opinions but shall not participate in voting; if discovering that a resolution or decision of the Managing Board is harmful to common interests, they shall be entitled to send a written petition thereon to the Managing Board and at the same time report to the heads of the agencies that they represent for consideration and settlement according to their competence. In case of necessity, the heads of such agencies shall report to the Prime Minister.

5. Resolutions and decisions of the Managing Board shall be binding on the whole Industrial and Commercial Bank. In case where the General Director's opinion differs from the resolutions and/or decisions of the Managing Board, the General Director shall be entitled to reserve such opinion and request a competent State agency to handle it; pending a decision of the competent State agency, the General Director shall still have to abide by the resolutions and/or decisions of the Managing Board.

At the request of the Managing Board, the General Director of the Industrial and Commercial Bank and the Directors of the member units shall have to provide fully and promptly necessary information related to all activities of the Bank. In case of necessity, the Managing Board may examine all accounting records, transaction documents and mails of the Bank and member units, which, however, must not affect the Bank's business activities.

The members of the Managing Board shall have to keep secret all information supplied to them.

6. Costs for the operation of the Managing Board and the Control Commission, including wages and allowances for their members and assisting experts shall be accounted into the managerial expenses of the Industrial and Commercial Bank. The General Director shall ensure all necessary working conditions and facilities for the Managing Board and the Control Commission.

Article 18.- Assisting apparatus of the Managing Board:

1. The Managing Board shall use the executive apparatus and seal of the Industrial and Commercial Bank for the performance of its tasks.

2. The Managing Board shall be assisted by a secretariat composed of not more than 5 experts working on a full-time basis. It shall decide the selection, replacement, commendation and discipline of the assisting experts.

3. The Managing Board shall set up the Control Commission to assist it in inspecting and supervising the General Director, the assisting apparatus and the member units of the Industrial and Commercial Bank in their executive and financial activities as well as in their observance of the Statute of the Industrial and Commercial Bank, resolutions and decisions of its Managing Board, the observance of the State laws.

Article 19.-Interests and responsibilities of Managing Board members:

1. The full-time members shall receive basic wages according the wage scale set for State employees and according to the wage distribution regime applied to State enterprises as stipulated by the Government. They shall also be entitled to monetary rewards corresponding to the business results of the Industrial and Commercial Bank. The part-time members shall be entitled to responsibility allowances and monetary rewards according to the regulations of the Government.

2. Managing Board members must not:

a/ Place themselves in a position that restricts their honesty, public-mindedness and impartiality or causes conflicts between the Bank's interests and personal interests.

b/ Abuse their powers to seek personal profits or misappropriate business opportunities of the Bank, thus damaging its interests.

c/ Take actions beyond the competence of the Managing Board stipulated in this Statute.

3. A member who is the Chairman of the Managing Board or the General Director of the Industrial and Commercial Bank shall not be allowed to use his/her title to set up private enterprises, limited liability companies (including joint venture enterprises) or stock companies, to hold managerial or executive posts in the above-said enterprises; or to set up economic contractual relations with the private enterprises, limited liability and stock companies where their spouses, parents or children hold managerial or executive posts.

4. The spouses, parents, children and siblings of the Chairman of the Managing Board or the General Director of the Industrial and Commercial Bank must not be concurrently the chief accountant or cashier at the Bank or member units.

5. Managing Board members shall take joint responsibility to the Governor of the State Bank and before law for the resolutions and decisions of the Managing Board; if they fail to fulfill the assigned tasks, violate the Statute of the Industrial and Commercial Bank, make wrong decisions or decisions ultra vires or abuse their powers, causing damage to the Bank and the State, they shall bear responsibility therefor and make material compensation for such damage caused by themselves in accordance with the provisions of law.

Article 20.- The Control Commission:

1. The Control Commission shall be composed of 5 members including its head being a member of the Managing Board who is assigned by the Managing Board, while four other members are appointed, dismissed, commended or disciplined by the Managing Board, including one accountant, one member recommended by the Congress of the Delegates of Workers and Employees of the Industrial and Commercial Bank, one member recommended by the Governor of the State Bank and one member recommended by the General Director of the General Department for Management of State Capital and Properties at Enterprises. The headship of the Control Commission, as assigned by the Managing Board, shall be valid only when it is approved by the Governor of the State Bank.

2. Control Commission members must not be spouses, parents, children or siblings of the General Director, the Deputy General Directors or the chief accountant of the Industrial and Commercial Bank and must not concurrently hold any other posts in the executive apparatus of the Bank or any post at other credit organizations.

3. A Control Commission member must have the following qualifications;

a/ Being an experienced expert in banking, accounting, auditing, economic and/or financial area, knowledgeable about legal matters;

b/ Having been working in one of the above-said areas for at least 5 years;

c/ Having no criminal records of economic offenses;

d/ Being a virtuous, honest and independent person in his/her work.

4. A term of office of a Control Commission member is 5 years. A Control Commission member may be re-appointed or replaced during his/her term if he/she fails to fulfill the assigned tasks.

5. Control Commission members shall enjoy wages and monetary rewards as decided by the Managing Board in accordance with the State regulations.

6. The Control Commission shall operate according to the Regulation on its Organization and Operation issued by the Managing Board.

Article 21.- Tasks, powers and responsibilities of the Control Commission:

1. To perform the tasks assigned by the Managing Board regarding the inspection and supervision of the General Director and the assisting apparatus in executive activities and member units of the Industrial and Commercial Bank in their financial activities, observance of laws, the Bank's Statute and resolutions, decisions of the Managing Board.

2. To submit quarterly and annual reports and irregular reports on specific cases to the Managing Board regarding its inspection and supervision results; detect in time and immediately report to the Managing Board activities showing indications of law breaking within the Industrial and Commercial Bank.

3. To participate and express opinions in meetings of the Managing Board.

4. Not to disclose inspection and supervision results without permission of the Managing Board; take responsibility to the Managing Board and before law for intentionally ignoring or covering up violations of law.

Chapter IV

THE GENERAL DIRECTOR AND THE ASSISTING APPARATUS

Article 22.-

1. The General Director of the Industrial and Commercial Bank shall be appointed, dismissed, commended or disciplined by the Governor of the State Bank at the proposal of the Managing Board. He/she shall be the Bank's representative of law and shall take responsibility to the Managing Board, the Governor of the State Bank and before law for running the Bank's activities. He/she shall have the highest executive power in the Industrial and Commercial Bank.

2. The General Director shall be assisted by a number of Deputy General Directors who shall run one or a number of fields of activities of the Bank under the assignment of the General Director and take responsibility to the General Director and before law for their assigned tasks.

3. The chief accountant of the Industrial and Commercial Bank shall assist the General Director in directing and organizing the performance of the accounting and statistical work and shall have powers and tasks as prescribed by law.

4. The Office and specialized and professional sections at departments at the head office of the Industrial and Commercial bank shall have the function of advising and assisting the Managing Board and the General Director in the managerial and executive work.

5. The internal inspection apparatus shall assist the General Director in inspecting business activities of the Industrial and Commercial Bank and member units in accordance with the provisions of law and internal regulations of the Bank.

Article 23.- The General Director shall have the following tasks and powers:

1. Together with the Chairman of the Managing Board to sign the receipt of capital, land and other resources allocated by the State to the Bank for management and use in conformity with the objectives and tasks assigned by the State. To allocate the State-assigned capital and resources to the member units according to the plan already approved by the Managing Board. To propose to the Managing Board the plan on the necessary adjustment of capital and other resources when re-assigning such resources to the member units and make adjustments thereto when the tasks of the member units are changed in the form of capital increase or decrease.

2. To effectively use, preserve and develop capital according to the plan already approved by the Managing Board. To elaborate the plan for capital mobilization and submit it to the Managing Board for approval and organization of ifs implementation.

3. To draw up the development strategy, long-term and annual plans, programs of action, new and in-depth investment plans and projects, investment cooperation projects involving foreign partners, joint venture schemes and schemes for coordinating business activities among the member units, plans for the construction of technical and material base, the training and re-training of the Bank's personnel as well as measures for performance of economic contracts of great value and submit them to the Managing Board for consideration and decision or for further submission to the State Bank and competent State agencies for decision. To organize the implementation of the approved plans, programs, projects and measures.

4. To run business activities of the Industrial and Commercial Bank; to take responsibility for the results of its business activities; to fulfill tasks and major objectives related to the materialization of the State policies on monetary stabilization as assigned by the Governor of the State Bank to the Industrial and Commercial Bank; to take responsibility to the Managing Board, the Governor of the State Bank and before law for the fulfillment of the above objectives and tasks in compliance with the State regulations

5. To set and submit to the Managing Board for approval different interest rates, commission rates, fees, rewards and fines related to the Bank's business activities and services in each period of time applicable to its customers, as well as the economic-technical norms, standards, wage unit price and service charges in conformity with the general regulations of the banking branch and the State. To organize and inspect the implementation of these norms, criteria and unit price in the whole Industrial and Commercial Bank.

6. To elaborate and submit to the Managing Board for passage draft documents guiding in detail the implementation of the State policies, regimes and rules regarding banking activities, draft rules and regulations, professional, technical and managerial norms in business activities of the Bank so that they are signed for issuance.

7. To request the Managing Board to submit to the Governor of the State Bank for decision the appointment, dismissal, commendation or discipline of the Deputy General Directors and the chief accountant of the Industrial and Commercial Bank.

To propose the Managing Board for decision the appointment, dismissal, commendation or discipline of Directors of the member units, the head of the internal inspection bureau and the officials directly managing the contributed capital of the Industrial and Commercial Bank at other enterprises.

8. To appoint, dismiss, transfer, commend or discipline deputy directors and the chief accountants of the member units, directors of the units attached to the member units and other equivalent posts at the proposal of the directors of the member units.

To appoint, dismiss, commend or discipline the heads and deputy heads of the specialized sections and departments, the head and deputy head(s) of the Bank's Office, the chief inspector and inspectors of the Industrial and Commercial Bank and the chief representatives of the Bank's overseas representative offices.

9. To draw up and submit to the Managing Board for approval the total payroll of the managerial and business apparatus of the Industrial and Commercial Bank, including adjustments plans in cases where the organization and the managerial and business payroll of the Bank and member units undergo any change; to establish and personally direct the assisting apparatus, inspect the execution of decisions on the managerial and business payroll by the member units; submit to the Managing Board for approval the organizational and operational statutes and regulations of the member units elaborated by their Directors; to decide the plans on the establishment, re-organization and dissolution of the units attached to the member units submitted by the Directors of the member units.

10. To work out and submit to the Managing Board for approval the regulations on the functions, tasks and working regime of the internal inspection apparatus of the Bank.

11. To draw up and submit to the Managing Board for approval other documents which the Managing Board is competent to decide as stated in Clause 2, Article 15 of this Statute.

12. To organize and run the activities of the Industrial and Commercial Bank according to the resolutions and decisions of the Managing Board; to submit to the Managing Board for approval the reports on the results of business activities of the Industrial and Commercial Bank, including: the quarterly, biannual and annual reports, general financial statements (including the balance sheet) and annual statements of final accounts of the Industrial and Commercial Bank and its member units.

13. To send reports to the Managing Board, the State Bank and competent agencies on the results of business activities of the whole Industrial and Commercial Bank, including quarterly, biannual and annual reports, general financial statements (including the property balance sheet and annual statements of final accounts of the whole Industrial and Commercial bank).

The general financial statements must reflect clearly and separately the centralized cost-and profit accounting of the Bank and the cost-and-profit accounting of the independent cost-and-profit accounting member units. These statements must be certified by an auditing agency approved by the competent State agency in accordance with current regulations.

14. To sign, within the ambit of his/her responsibility, documents, contracts and letters of certification of the Industrial and Commercial Bank and take responsibility to the Managing Board and before law for his/her decisions.

15. To represent the Industrial and Commercial Bank in international relations, legal proceedings, disputes, dissolution and bankruptcy.

16. To fulfill the Bank's tax payment obligation and inspect the payment of taxes and other remittances by its member units as prescribed by law. To draw up the plan for distribution of the Bank's after-tax-profit then submit it to the Managing Board for approval in accordance with the State regulations.

17. To provide all documents requested by the Managing Board and the Control Commission. To prepare documents for the Managing Board meetings.

18. To submit to the inspection and supervision by the Managing Board, the Control Commission, the State Bank and competent State agencies over the performance of his/her executive duties.

19. To be entitled to apply measures beyond his/her competence in emergency cases (such as natural disasters, enemy sabotage, fires, incidents), and take responsibility for such decisions; then have to report them immediately to the Managing Board, the State Bank and the competent State agencies for further settlement.

Article 24.- The internal inspection apparatus

1. The internal inspection apparatus is composed of the head and deputy heads of the internal inspection bureau, the chief inspector and inspectors. The head of the internal inspection bureau shall run the internal inspection apparatus. The inspectors working at the head office of the Industrial and Commercial Bank shall be under the control of the head of the internal inspection bureau; the inspectors working at the member units shall be under the control of the chief inspector. The regulations on the organization and operation of the internal inspection apparatus shall be submitted by the General Director to the Managing Board for ratification.

2. The head and deputy heads of the internal inspection bureau, the chief inspector and inspectors must be possessed of all qualifications defined in Items 2 and 3, Article 18 of this Statute.

3. The head of the internal inspection bureau shall be appointed or dismissed by the Managing Board at the proposal of the General Director. The deputy heads of the internal inspection bureau, the chief inspector and inspectors shall be appointed or dismissed by the General Director.

4. The internal inspection apparatus shall have the following tasks

a/ To inspect the managerial and executive work of the Industrial and Commercial Bank and its member units in accordance with the provisions of law and the Bank's Statute;

b/ To conduct inspection for the purpose of ensuring the procedure for carrying out professional business activities prescribed by the legislation on banking activities and the internal regulations of the Industrial and Commercial Bank;

c/ To supervise the strict observance of the regulations of the State Bank on ensuring safety for monetary and credit business activities of the Industrial and Commercial Bank and its member units;

d/ To assess the extent of safety assurance in banking business activities and propose measures to enhance the safety assurance capability in business activities of the Bank and its member units;

e/ To perform the internal auditing function of the Industrial and Commercial Bank;

f/ To report to the General Director and the head of the Control Commission the inspection and auditing results, make its recommendations on the operation situation of the Industrial and Commercial Bank;

g/ To consider and settle, within the scope of its functions and powers, or submit to the General Director for settlement the complaints related to business activities of the Industrial and Commercial Bank;

h/ Not to disclose the inspection and auditing results without the permission of the General Director or the head of the Control Commission; to take responsibility to the General Director and the Managing Board for the inspection and auditing results;

i/ Within the scope of his/her prescribed functions, the head of the internal inspection bureau shall be entitled to attend meetings convened by the General Director of the Industrial and Commercial Bank.

Chapter V

THE COLLECTIVE OF LABORERS IN THE INDUSTRIAL AND COMMERCIAL BANK

Article 25.- The Congress of the Delegates of Workers and Employees of the Industrial and Commercial Bank is the direct form of the laborers' participating the management of the Bank. The Congress of the Delegates of Workers and Employees shall have the following rights:

1. To participate in the discussion and elaboration of the collective labor agreement before it is negotiated and signed by the representative of the labor collective and the General Director;

2. To discuss and adopt the regulations on the utilization of the funds directly related to the interests of the laborers in the Industrial and Commercial Bank;

3. To discuss and contribute comments on the overall planning and plans, to evaluate the efficiency of business management, to propose measures for labor protection and improvement of the working conditions, the material and spiritual life, the environmental hygiene and the training and re-training of laborers of the Industrial and Commercial Bank;

4. To recommend candidates to the Managing Board and the Control Commission.

Article 26.- The Congress of Delegates of Workers and Employees is organized and operates under the guidance of the Vietnam General Confederation of Labor.

Chapter VI

MEMBER UNITS OF THE INDUSTRIAL AND COMMERCIAL BANK

Article 27.-

1. The Industrial and Commercial Bank has its member units which are independent cost-and-profit accounting State enterprises, dependent cost-and-profit accounting units or non-business units. The list of the member units is provided for in the Appendix attached to this Statute.

2. The member units of the Industrial and Commercial Bank have their own seals, are allowed to open their accounts at different banks in conformity with their cost-and-profit accounting modes.

3. Member units which are independent cost-and-profit accounting enterprises shall have their own organizational and operational statute; dependent cost-and-profit accounting units and non-business units shall have their own organizational and operational regulations. Such statutes and regulations must be ratified by the Managing Board and in accordance with law and the Statute of the Industrial and Commercial Bank;

Article 28.- Member units which are independent cost-and-profit accounting enterprises:

1. Independent cost-and-profit accounting State enterprises which are member units of the Industrial and Commercial Bank have the right to business and financial autonomy, are bound in interests and duties to the Bank as provided for in this Statute.

2. The Managing Board and the General Director of the Industrial and Commercial Bank shall have the following rights toward the member units which are independent cost-and-profit accounting enterprises:

a/ To authorize the directors of the member enterprises of the Industrial and Commercial Bank to manage and run the operations of the enterprises in conformity with their statutes already ratified by the Managing Board. The directors of the member units which are independent cost-and-profit accounting enterprise shall take responsibility to the Managing Board, the General Director of the Industrial and Commercial Bank and before law for the operations their enterprises;

b/ To appoint, dismiss, commend or discipline the directors, deputy directors and chief accountants;

c/ To ratify the plans, to inspect the implementation of the plans and financial settlements; define the deduction level for setting up the reward and welfare funds at the enterprises according to the regulations of the Ministry of Finance and the financial regulations of the Industrial and Commercial Bank;

d/ To deduct part of the basic depreciation fund and the after-tax profits according to the regulations of the Ministry of Finance and the current provisions of law to set up centralized funds of the Industrial and Commercial Bank which shall be used for the purpose of re-investment and implementation of the investment projects at the member units;

e/ To approve the schemes and plans for expanded investment and in-depth investment, for cooperation and joint venture, supplement or retrieval of part of the capital or for the assignment of stocks which are managed by the Bank but possessed by its member enterprises;

f/ To regulate financial sources, including foreign currencies, among different member units so as to achieve the most effective use of capital in the Industrial and Commercial Bank on the principle of ensuring that the total properties of an enterprise, having part of its capital withdrawn must not be lower than the total debts plus the allocated State budget capital and other capital sources deemed to belong to the enterprise already adjusted in proportion to the tasks or size of such enterprise;

g/ To approve the forms of wage payment, the wage unit price and measures for ensuring the life and working conditions for the workers and employees of the enterprises;

h/ To decide the expansion or shrinkage of business scope of the member enterprise according to the general development strategy of the Industrial and Commercial Bank;

i/ To ratify the organizational and operational statutes of the enterprises, including the assignment of power to their Directors concerning the organization of the managerial apparatus of the enterprises; the recruitment, commendation, promotion and discipline of workers and employees; the limit of credit (borrowings and lendings); the purchase and sale of their fixed assets or stocks of stock companies, and entering into joint ventures in accordance with the provisions of the Law on State Enterprises and the regulations of the State Bank on ensuring safety for monetary and credit activities; the purchase and sale of copyrights, patents, inventions, technology transfer, to participate in economic associations; and other issues related to the autonomy of a State enterprise as a member of the Industrial and Commercial Bank as prescribed in the Law on State Enterprises;

j/ To inspect the operations of the member enterprises and request them to report on the financial situation and business results.

Article 29.- The member units of the Industrial and Commercial Bank which are independent cost-and-profit accounting enterprises shall be entitled to take initiative in conducting their business activities and be liable for their debts and commitments within the limit of the amount of capital and assets owned by the State but managed and used by themselves. Specifically:

1. In the development investment strategy:

a/ Each enterprise is assigned to organize the implementation of development investment projects according to the plan of the Industrial and Commercial Bank. The enterprise shall be allocated capital and resources by the Bank for such implementation.

b/ Each enterprise may invest on its own in constructions and development projects other than the projects directly managed by the Industrial and Commercial Bank. In this case, the enterprise shall have to mobilize fund by itself (in accordance with the provisions of law) and shall take financial responsibility.

2. In business activities, each enterprise shall draw up and organize the implementation of its own plans on the basis of:

a/ Ensuring that their objectives, criteria and major economic-technical norms (including the unit price and prices) comply with the overall plan of the Industrial and Commercial Bank.

b/ The plan for business expansion based on making optimum use of all resources owned or mobilized by the enterprise according to the market demands.

3. In financial activities and economic cost-and-profit accounting:

a/ Each enterprise shall receive capital and other resources from the State allocated by the Industrial and Commercial Bank. It shall have to preserve and develop such capital and resources;

b/ Each enterprise may mobilize capital and other credit sources in accordance with the provisions of law for the implementation of its own business and development investment plans;

c/ Each enterprise may set up and use such funds as development investment fund, financial reserve fund, severance allowance reserve fund, reward fund, welfare fund and other funds in accordance with the regulations of the Ministry of Finance and current provisions of law. It shall be obliged to make deductions and contribute them to the centralized funds of the Industrial and Commercial Bank and be entitled to use such centralized funds as prescribed in the Statute and financial regulations of the Bank and by decisions of the Managing Board;

d/ Each enterprise shall have to pay taxes and fulfill other financial obligations as prescribed by law;

e/ The enterprise may be authorized by the Industrial and Commercial Bank to perform contracts with domestic and foreign customers in the name of the Bank.

4. In the domain of organization, personnel and labor:

a/ Each enterprise is entitled to request the General Director of the Industrial and Commercial Bank to consider and decide the establishment, re-organization or dissolution of its attached units and the organization of its managerial apparatus in accordance with the Bank's Statute and its own statute;

b/ Within the framework of the official payroll permitted by the Industrial and Commercial Bank, each enterprise is entitled to recruit, employ or lay off workers and employees in its managerial and business apparatus. The appointment to or dismissal from the managerial posts in the enterprise and its attached units as well as the arrangement and application of the wage system must comply with the assignment of power of the Industrial and Commercial Bank;

c/ Each enterprise shall have to care for the human resource development as well as to ensure the materialization of the development strategy and the performance of business tasks of the enterprise, care for the improvement of the working and living conditions of the laborers as prescribed in the Labor Code and the Law on Trade Union.

Article 30.- Member units which are dependent cost-and-profit accounting units:

1. Dependent cost-and-profit accounting member units include transaction offices and branches attached to the Industrial and Commercial Bank, which are located in the areas necessary for the Bank's business activities.

2. They act as representatives authorized by the Industrial and Commercial Bank and have the right to business autonomy as assigned by the Bank, are bound in obligations and interests to the Bank which shall take final responsibility for financial obligations derived from the commitments of such units.

3. They are entitled to sign economic contracts and take initiative in conducting business, organizational and personnel activities as assigned or authorized by the Bank.

4. They have their attached units, including branches attached to the dependent cost-and-profit accounting member units, transaction offices, shops and savings-funds located in the areas appropriate for the Bank's activities. Such units are allowed to have their own seals in service of the authorized business activities.

5. The organization of the business apparatus, the functions, tasks, powers and obligations of the dependent cost-and-profit accounting units and their attached units shall be specified in the organizational and operational regulations of the dependent cost-and-profit accounting units ratified by the Managing Board.

Article 31.- Member units which are non-business units:

The non-business member units have their own organizational and operational regulations ratified by the Managing Board, apply the regime of covering expenditures with revenues, are entitled to create their own sources of revenues from the provision of services, performance of contracts on scientific research and training for Vietnamese and foreign units and are entitled to enjoy the reward fund and the welfare fund according to the prescribed regime. In case the funds are lower than the average level of the Industrial and Commercial Bank, they may receive support from the reward and welfare funds of the Bank.

Chapter VII

MANAGEMENT OF THE CONTRIBUTED CAPITAL OF THE INDUSTRIAL AND COMMERCIAL BANK AND ITS MEMBER ENTERPRISES AT OTHER ENTERPRISES

SECTION 1.- MANAGEMENT OF THE CAPITAL CONTRIBUTED BY THE INDUSTRIAL AND COMMERCIAL BANK TO OTHER ENTERPRISES

Article 32.- With regard to the capital contributed by the Industrial and Commercial Bank to other enterprises, the Managing Board of the Bank shall have the following rights and obligations:

1. To adopt the plans for capital contribution, joint venture or stock purchase, worked out by the General Director to be submitted to the competent State agency for decision.

2. To decide the appointment, dismissal, commendation or discipline, at the proposal of the General Director, of the persons directly managing the capital contributed by the Industrial and Commercial Bank to enterprises.

3. To supervise and inspect the use of capital contributed by the Bank to other enterprises, take responsibility for the efficient utilization, preservation and development of the contributed capital and the collection of profits therefrom.

Article 33.- Rights and obligations of the persons directly managing the capital contributed by the Industrial and Commercial Bank to other enterprises:

1. To hold managerial or executive posts at the enterprises with capital contributed by the Bank in accordance with their Statutes

2. To monitor and supervise the operations of these enterprises.

3. To observe the reporting regime as prescribed and take responsibility to the Managing Board of the Industrial and Commercial Bank for the efficiency of the utilization of the capital contributed by the Bank to such enterprises.

SECTION 2.- MANAGEMENT OF THE CONTRIBUTED CAPITAL OF INDEPENDENT COST-AND-PROFIT ACCOUNTING MEMBER ENTERPRISES AT OTHER ENTERPRISES

Article 34.- Independent cost-and-profit accounting member enterprises may contribute capital to other enterprises as assigned by the Industrial and Commercial Bank. In the management of the capital contributed by a member enterprise to other enterprises, the Director of such enterprise shall have the following rights and obligations:

1. To work out the plans on capital contribution, joint venture or stock purchase and submit them to the General Director who then request the Managing Board of the Bank to submit them to the Governor of the State Bank for decision.

2. To appoint, dismiss, commend or discipline the persons directly managing the capital contributed by the enterprise to other enterprises.

3. To supervise, inspect the use of the capital contributed by the enterprise, take responsibility for the efficient utilization, preservation and development of the contributed capital, and collect profits from the capital contributed by the enterprise to other enterprises.

Article 35.- Rights and obligations of the persons directly managing the capital contributed by member enterprises to other enterprises:

1. To hold managerial or executive posts at the enterprises with capital contributed by their enterprises in accordance to their statutes.

2. To monitor and supervise the business activities of the enterprises with capital contributed by their enterprises.

3. To observe the reporting regime defined by the Director; and take responsibility to the Managing Board, the General Director of the Industrial and Commercial Bank and the directors of the member enterprises for the efficiency of the utilization of the capital contributed by their enterprise to the enterprises where they are assigned to manage and control the contributed capital.

SECTION 3.- JOINT VENTURE UNITS

Article 36.- The joint venture units which the Industrial and Commercial Bank or its member enterprises take part in, shall be managed, run and operate under the Law on Foreign Investment, the banking legislation and relevant laws of Vietnam. The Industrial and Commercial Bank or its member enterprises shall exercise all rights, fulfill obligations and responsibilities towards these joint ventures regarding financial activities as prescribed by law and according to the signed contracts.

Chapter VIII

FINANCE OF THE INDUSTRIAL AND COMMERCIAL BANK

Article 37.- The Industrial and Commercial Bank is an independent cost-and-profit accounting unit that applies the general cost-and-profit accounting and enjoys financial autonomy in business activities in accordance with the Law on State Enterprises, the banking legislation, other provisions of law and the Statute of the Industrial and Commercial Bank.

Article 38.-

1. The statutory capital of the Industrial and Commercial Bank is composed of:

a/ The capital assigned by the State at the time of the establishment of the Bank;

b/ Additional capital (if any) allocated by the State to the Bank;

c/ "The supplementary reserve fund for the statutory capital", which is deducted as prescribed by law;

d/ Other capital sources as prescribed by law.

2. The Industrial and Commercial Bank is not allowed to use its statutory capital for purposes in contravention of the provisions of law.

3. In case of an increase or decrease of its statutory capital, the Industrial and Commercial Bank must promptly adjust the property balance sheet accordingly and announce the adjusted statutory capital.

Article 39.- The mobilized capital of the Industrial and Commercial Bank

1. The Industrial and Commercial Bank shall use and have to repay as scheduled the capital, both principal and interest, mobilized from its customers.

2. The mobilized capital of the Industrial and Commercial Bank shall include various kinds of capital mobilized in the forms mentioned in Clause 1, Article 8 of this Statute.

3. The mobilized capital shall be used only for activities prescribed by law.

4. The Industrial and Commercial Bank shall have to abide by the prescribed mobilization limits and the rates for ensuring safety in monetary and credit business activities as prescribed by law.

Article 40.- Capital borrowed by the Industrial and Commercial Bank

With regard to its borrowed capital (from the State Bank, foreign banks, credit organizations, foreign organizations and individuals), the Industrial and Commercial Bank shall have to use it for the right purposes and with economic efficiency, thus bringing about profits and ensuring the repayment of both principal and interests.

Article 41- Capital received by the Industrial and Commercial Bank (financial support capital, development investment capital and entrusted investment capital) shall be lent to the State programs and projects on centralized capital construction or used for support of investment in the development of specific-purpose programs and projects.

Article 42.- Other kinds of capital of the Industrial and Commercial Bank that are generated during the process of its professional activities shall be used in accordance with the provisions of law.

Article 43.-

1. The Industrial and Commercial Bank may set up and use the centralized funds to ensure high efficiency for the development process of the whole Bank.

2. The making of deductions for setting up and use of the centralized funds of the Industrial and Commercial Bank shall comply with the provisions of the Bank's Statute and financial regulations as well as relevant provisions of law. These funds include:

a/ The development investment fund;

b/ The fund for scientific research and full-time training;

c/ The financial reserve fund;

d/ The severance allowance reserve fund;

e/ The reward and welfare funds;

f/ Other funds (as prescribed by law).

Article 44.- Financial autonomy of the Industrial and Commercial Bank:

1. The Industrial and Commercial Bank operates on the principle of financial autonomy, self-balancing of its revenues and expenditures and is responsible for preserving and developing business capital sources, including capital contributed to other enterprises.

2. The Industrial and Commercial Bank shall be liable for paying the debts recorded in its property balance sheet and fulfilling other financial commitments, if any.

3. The Industrial and Commercial Bank shall inspect and supervise financial activities within the whole Bank.

4. The Industrial and Commercial Bank shall conduct the cost-and-profit accounting and accountancy according to the system of accounting accounts defined by the State Bank after consulting the Ministry of Finance.

5. The Industrial and Commercial Bank shall have to work out, submit and register its financial plans and dispatch its financial statements and property balance sheet in accordance with current provisions of law.

6. The Industrial and Commercial Bank shall have to pay taxes and other remittances in accordance with the provisions of law and its financial regulations, except for the taxes already paid by its member units. It is entitled to use the profits after fulfilling its tax obligations toward the State as currently prescribed by law.

7. The profits earned by the Industrial and Commercial Bank shall be determined and used according to the current financial regime.

8. The profits earned by the Industrial and Commercial Bank or its member units from the capital contributed to other enterprises shall be exempt from profit tax provided that these enterprises have paid the profit tax before apportioning dividends to the capital contributors.

9. The financial operations of the member units and the relations in financial operations between the Industrial and Commercial Bank and its member units shall comply with the Bank's Statute and financial regulations.

10. The material responsibility of the Industrial and Commercial Bank in its business and civil relations is limited to the total amount of capital owned by the State and managed by the Bank at the time of the latest announcement.

11. The Industrial and Commercial Bank shall have to strictly comply with the Ordinance on Accounting and Statistics, the current accounting regime and financial reporting regime applicable to State enterprises.

12. The financial and business activities of the Industrial and Commercial Bank shall be inspected and supervised by the State Bank and other competent State agencies as prescribed by law.

13. Handling of business losses:

a/ The Industrial and Commercial Bank may apply necessary measures as prescribed by law to offset risks occurring in its business activities;

b/ In cases where the Industrial and Commercial Bank suffers from prolonged losses and is in the danger of bankruptcy, the State Bank may propose the Government to place the Industrial and Commercial Bank in the state of preservation and apply measures to restore the normal situation.

Chapter IX

RELATIONSHIP BETWEEN THE INDUSTRIAL AND COMMERCIAL BANK AND THE STATE AGENCIES, LOCAL AUTHORITIES, CREDIT ORGANIZATIONS AND CUSTOMERS

Article 45.- The relationship with the Government

1. Abiding by law and strictly implementing the Government's regulations related to the organization and operation of the Industrial and Commercial Bank.

2. Carrying out the plan and development strategy of the Industrial and Commercial Bank within the framework of the State's master plan and strategy for the branch and territorial development.

3. Abiding by the regulations on the establishment, splitting, merger and dissolution; the policies on organization and personnel, the financial, credit, tax and profit collection regimes; and the accounting and statistical regimes of the State.

4. Submitting to the control and inspection of the observance of laws, policies and regimes of the State at the Industrial and Commercial Bank.

5. Observing the State auditing regime.

6. Being entitled to propose and recommend solutions, mechanisms and policies regarding the State management over the Industrial and Commercial Bank.

7. Being entitled to manage and use capital, properties, land and other resources allocated by the State to perform its business tasks and having to preserve and develop these resources.

8. Being entitled to allowances, capital subsidies and other regimes as stipulated by the Government.

Article 46.- The relationship with the Ministry of Finance:

1. Submitting to the State management by the Ministry of Finance in terms of :

a/ Observance of the regulations on finance, accounting, taxes, organization of the cost-and-profit accounting apparatus and accountancy;

b/ Performance of tasks related to the entrusted capital and services for the State budget.

2. Submitting to the management by the Ministry of Finance in its capacity as the agency assigned by the Government to perform a number of an owner's functions in the following domains:

a/ Determination of capital and other resources allocated by the State to the Industrial and Commercial Bank for management and use;

b/ Supervision of the effective utilization, preservation and development of capital and other resources allocated to the Bank in the operating process which are reflected in the annual final account statements;

c/ Examination and inspection of the contents of the annual financial report and the final account statements of the Industrial and Commercial Bank;

d/ Approval of the Financial Regulation of the Industrial and Commercial Bank before it is issued by the Managing Board.

3. Submitting to the Ministry of Finance's control and inspection of financial and other matters that come under the competence of the Ministry of Finance .

4. Being entitled to propose financial and credit solutions, mechanisms and policies and other contents related to the Industrial and Commercial Bank, seeking the Ministry of Finance's approval before organizing the transfer of high-value assets, the fulfillment of financial obligations, the distribution of after-tax profit, the liquidation of the Bank's assets and important equipment in accordance with the regulations of the Government and the additional allocations of budget capital to the Industrial and Commercial Bank.