Nội dung toàn văn Decision No. 47/2007/QD-NHNN of December 25, 2007, on the levels of fee charged on credit information service

|

THE

STATE BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 47/2007/QD-NHNN |

Hanoi, December 25, 2007 |

DECISION

ON THE LEVELS OF FEE CHARGED ON CREDIT INFORMATION SERVICE

THE GOVERNOR OF THE STATE BANK

- Pursuant to the Law on the State Bank of Vietnam in 1997; the Law on

the amendment, supplement of several articles of the Law on the State Bank of

Vietnam in 2003;

- Pursuant to the Law on the Credit Institutions in 1997; the Law on the

amendment, supplement of several articles of the Law on the Credit Institutions

in 2004;

- Pursuant to the Decree No. 52/2003/ND-CP dated 19 May 2003 of the Government

providing for the functions, assignments, authorities and organizational

structure of the State Bank of Vietnam;

- Upon the proposal of the Director of the Finance-Accounting Department and

the Director of the Credit Information Center,

DECIDES:

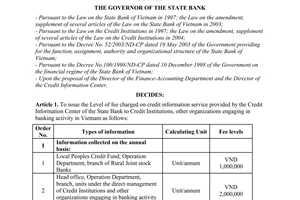

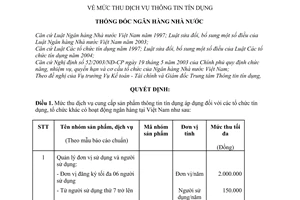

Article 1. Levels of fee charged on the supply of credit information products applicable to Credit Institutions, other organizations engaging in banking activity in Vietnam are provided for as follows:

|

Order No. |

Name

of product, service group |

Code of product group |

Calculating Unit |

Maximum

fee level |

|

1 |

Managing using unit and user: |

|

|

|

|

|

- Unit that registers 6 users at the maximum |

|

Unit/annum |

2,000,000 |

|

|

- From the 7th user and more |

|

User/annum |

150,000 |

|

2 |

Report on information of credit relationship |

R1x |

Copy |

60,000 |

|

3 |

Report on information of security asset |

R2x |

Copy |

60,000 |

|

4 |

Report on informtion of corporate finance |

R3x |

Copy/fiscal year |

90,000 |

|

5 |

Report on information of credit relationship, finance and security asset |

R4x |

Copy |

200,000 |

|

6 |

Periodical credit newsletter |

R5x |

Copy |

25,000 |

Using unit provided for in this Article shall be head office, transaction center, branch, subsidiary unit of credit institutions, other organiztions engaging in banking activity which are granted banking code in accordance with the Decision No. 23/2007/QD-NHNN dated 5 June 2007 of the Governor of the State Bank on the issuance of the Regulation on the system of banking codes used in banking activity and operations.

User provided for in this Article shall be any person the using unit registers with Credit Information Center as an user to exploit and use credit information products.

Based on the maxiumum fee level stipulated hereinabove, Director of the Credit Information Center shall provide for specific fee level of each product from time to time.

Article 2. Director of the Credit Information Center shall be entitled to decide reduction of fee for using credit information products as stipulated in Article 1 of this Decision in respect of using units which well comply with the Regulation on credit information activity, exploit and use many credit information products. The conditins and level of reduction of fee for using credit information products shall be provided for by the Director of the Credit Information Center, provided that such level of reduction does not exceed 15% of total fees of actually exploiting and using products of the using unit by month.

Article 3. Fee levels of other credit information products, services shall be set up by Director of the Credit Information Center, ensuring the principle of fully covering expenses, accumulating income and corresponding with the ability of using service of customers, including

1. Consolidated report on customers information (S1x)

2. Special report on enterprise (S2x)

3. Unexpected information report (S3x)

4. Searching information by time (S4x)

5. Product of credit rating and analysis (S5x)

6. Product of credit scoring (S6x)

All products stated in this Article shall be supplied based on the contract to credit institutions, other organizations engaging in banking activity and other organizations, individuals having demand.

Article 4. This Decision shall be effective since 01 February 2008 and replace the Decision No.1669/2005/QD-NHNN dated 18 November 2005 of the Governor of the State Bank on the issuance of the level of fee charged on credit information service.

Article 5. Director of the Administrative Department, the Director of the Finance-Accounting Department, the Director of the Credit Information Center , Heads of units of the State Bank, Managers of the State Bank branches in provinces, cities under the Central Governments management, General Directors (Directors) of Credit Institutions, concerned organizations and individuals shall be responsible for the implementation of this Decision.

|

|

FOR

THE GOVERNOR OF THE STATE BANK OF VIETNAM |