Nội dung toàn văn Decision no. 81/2005/QD-BTC of November 18, 2005 on the implementation of the commitments in the Viet Nam - US agreement on textile and garment trading

|

THE

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 81/2005/QD-BTC |

Hanoi , November 18, 2005 |

DECISION

ON THE IMPLEMENTATION OF THE COMMITMENTS IN THE VIETNAM-US AGREEMENT ON TEXTILE AND GARMENT TRADING

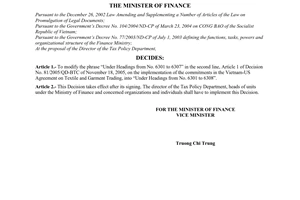

THE MINISTER OF FINANCE

Pursuant to the December 26,

1991 Law on Export Tax and Import Tax, and the July 5, 1993 Law and May 20,

1998 Law No. 04/1998/QH10 Amending and Supplementing the Law on Export Tax and

Import Tax;

Pursuant to the Vietnam-US Agreement on Textile and Garment Trading for the

2003-2005 period;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, on the

tasks, powers and organizational structure of the Ministry of Finance;

At the proposal of the director of the Tax Policy Department and the director

of the International Cooperation Department,

DECIDES:

Article 1.- The import tax rate of 12% (twelve percent) shall apply to goods items under Headings 6301 thru 6307 in the Finance Minister’s Decision No. 19/2004/QD-BTC of February 16, 2004, promulgating the list of import goods and their tax rates for implementation of the import tax reduction schedule under the Vietnam-US Agreement on Textile and Garment Trading for the 2003-2005 period.

Article 2.- The provisions of Article 1 shall apply to textiles and garments that have certificates of origin of the European Union (EU) or certificates of origin of Australia.

Article 3.- For goods items enjoying the import tax rate specified in Article 1 above, if such rate is higher than the preferential (MFN) import tax rate specified in the current Preferential Import Tariffs, the MFN rate shall apply.

Article 4.- This Decision takes effect and applies to import goods declarations registered with customs offices 15 days after its publication in “CONG BAO.” Ministers, heads of ministerial-level agencies, heads of Government-attached agencies, and presidents of provincial/municipal People’s Committees shall join in directing the implementation of this Decision.

|

|

FOR THE MINISTER OF

FINANCE |