Nội dung toàn văn Decision No. 96/2009/QD-TTg on amendment of a number of articles of Decisions

|

PRIME MINISTER OF THE GOVERNMENT |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 96/2009/QD-TTg |

Ha Noi, July 22, 2009 |

DECISION

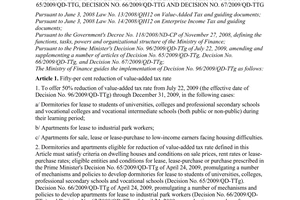

ON AMENDMENT OF A NUMBER OF ARTICLES OF DECISIONS 65-2009-QD-TTg, 66-2009-QD-TTg AND 67-2009-QD-TTg OF THE PRIME MINISTER OF THE GOVERNMENT DATED 24 APRIL 2009

Pursuant to the Law on

Organization of the Government dated 25 December 2001;

Pursuant to Resolution 21-2008-QH12 of the National Assembly dated 8 November

2008 on estimated State budget for the year 2009;

Having considered the proposal of the Minister of Finance,

DECIDES:

Article 1.

Article 3.1 of Decision 65-2009-QD-TTg of the Prime Minister of the Government dated 24 April 2009 issuing a number of mechanisms and policies on development of residential housing for lease by students of universities, colleges, and professional or vocational establishments shall be amended as follows:

"1. To grant fifty (50) per cent reduction of the VAT rate from the effective date of this Decision to 31 December 2009 in respect of activities of investment in or commercial operation1 of residential housing for lease by students of universities, colleges, vocational colleges, and professional or vocational establishments.

To exempt income earned from activities of investment in or commercial operation of residential housing for lease by students of universities, colleges, vocational colleges, and professional or vocational establishments from corporate income tax payable for the year of 2009".

Article 2.

Articles 5.2(b) and (c) of Decision 66-2009-QD-TTg of the Prime Minister of the Government dated 24 April 2009 issuing a number of mechanisms and policies on development of residential housing for lease by workers working in industrial zones shall be amended as follows:

"(b) To grant fifty (50) per cent reduction of the VAT rate from the effective date of this Decision to 31 December 2009 in respect of activities of investment in or commercial operation of residential housing for lease by workers working in industrial zones.

(c) To exempt income earned from activities of investment in or commercial operation of residential housing for lease by workers working in industrial zones from corporate income tax payable for the year of 2009".

Article 3.

Articles 5.2(b) and (c) of Decision 67-2009-QD-TTg of the Prime Minister of the Government dated 24 April 2009 issuing a number of mechanisms and policies on development of residential housing for lease by low-income earners in urban zones shall be amended as follows:

"(b) To grant fifty (50) per cent reduction of the VAT rate from the effective date of this Decision to 31 December 2009 in respect of activities of investment in or commercial operation of residential housing for sale, lease or lease and purchase by low-income earners who encounter difficulty in residential housing.

(c) To exempt income earned from investment in or commercial operation of residential housing for sale, lease or lease and purchase by low-income earners who encounter difficulty in residential housing, from corporate income tax payable for the year of 2009".

Article 4. Effectiveness

This Decision shall be of full force and effect as of the date of signing.

Article 5. Organization of implementation

1. The Ministry of Finance shall provide guidelines for implementation of this Decision.

2. Ministers, heads of ministerial equivalent bodies and Government bodies and chairmen of people's committees of provinces and cities under central authority shall be responsible for the implementation of this Decision.

|

|

PRIME

MINISTER |