Nội dung toàn văn Joint circular No. 63/2013/TTLT-BTC-BTNMT guiding Decree No. 25/2013/ND-CP environmental protection charge sewage

|

THE MINISTRY OF

FINANCE - THE MINISTRY OF NATURAL RESOURCES AND ENVIRONMENT |

SOCIALIST

REPUBLIC OF VIETNAM |

|

Hanoi, May 15, 2013 |

JOINT CIRCULAR

GUIDING IMPLEMENTATION OF THE GOVERNMENT’S DECREE NO. 25/2013/ND-CP DATED MARCH 29, 2013, ON ENVIRONMENTAL PROTECTION CHARGE FOR SEWAGE

Pursuant to the Ordinance No. 38/2001/PL-UBTVQH10 dated August 28, 2001, on Charges and Fees;

Pursuant to the Government’s Decree No. 57/2002/ND-CP dated June 03, 2002, detailing implementation of Ordinance on Charges and Fees;

Pursuant to the Government s Decree No. 24/2006/ND-CP dated March 06, 2006, amending and supplementing the Government’s Decree No. 5 7/2002/ND-CP dated June 03, 2002, detailing implementation of the Ordinance on Charges and Fees;

Pursuant to the Government's Decree No. 25/2013/ND-CP dated March 29, 2013, on the environmental protection charge for sewage;

Pursuant to the Government’s Decree No. 118/2008/ND-CP dated November 27, 2008, defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

Pursuant to the Government’s Decree No. 21/2013/ND-CP dated March 04, 2013, defining the functions, tasks, powers and organizational structure of the Ministry of Natural Resources and Environment;

At the proposal of the director of the Tax Policy Department and the general director of the Vietnam Environment Agency,

The Minister of Finance and the Minister of Natural Resources and Environment promulgate the Joint Circular guiding environmental protection charge for sewage as follows:

Article 1. Chargeable sewage

Sewage liable to environmental protection charge for sewage is sewage discharged into the environment, including industrial sewage and daily-life sewage.

1. Industrial sewage is sewage discharged into the environment from:

a) Establishments producing and processing agricultural, forestry and fishery products;

b) Establishments producing and processing food, alcohol, beer, beverage and tobacco;

c) Concentrated establishments rearing and slaughtering livestock and poultry;

d) Aquaculture establishments;

dd) Handicraft and cottage-industry production establishments in craft villages;

e) Establishments tanning and recycling leather;

g) Establishments mining and processing minerals;

h) Establishments of textile, dyeing and garment;

i) Establishments producing paper, pulp, plastics and rubber;

k) Establishments producing fertilizer, chemical, pharmaceuticals, plant protection drugs, building materials, stationery and household utensils:

l) Mechanical, metallurgical and metal working establishments, factories manufacturing machinery and spare parts;

m) Factories manufacturing electrical and electronic components and equipment;

n) Establishments preliminarily processing scrap, providers of services for dismantling old ships or cleaning ships;

o) Clean water plants;

p) Concentrated sewage treatment systems in industrial parks, urban centers (except cases exempted from the environmental protection charge as prescribed by law);

g) Other industrial production establishments.

2. Daily-life sewage is sewage discharged into the environment from:

a) Households;

b) State agencies;

c) People’s armed forces units (except the production and processing establishments of armed forces units);

d) Executive offices, branches and offices of organizations and individuals, not attaching with production and processing locations;

dd/ Establishments repairing or washing cars and motorbikes;

e) Hospitals, clinics; restaurants, hotels; training and research institutions; other business and service establishments;

g) Other organizations, individuals and entities discharging sewage not specified at Clause 1 of this Article.

Article 2. Non-chargeable objects

Sewage not liable to environmental protection charge applicable to sewage includes:

1. Water discharged from hydropower plants, water circulating in production and processing establishments without being discharged into the environment.

2. Sea water discharged after being used for salt making.

3. Daily-life sewage discharged by households in geographic areas currently enjoying regulation on price offsetting by State to keep water prices suitable to the socio-economic life.

4. Daily-life sewage discharged by households in areas without clean water supply systems.

5. Daily-life sewage discharged by households in communes of rural regions, including:

a) Communes in border, mountainous, highland, deep-lying and remote areas (under the Government’s regulations on border, mountainous, deep-lying and remote communes) and islands;

b) Communes not belonging to the special, grade-I, grade-II, grade-III, grade-IV and grade-IV urban centers defined in the Government’s Decree No. 42/2009/ND-CP dated May 07, 2009, on urban classification.

6. Water used to cool equipment and machinery without direct contact with pollutants and discharged separately from other sewage sources.

4. Overflow natural rainwater.

Article 3. The charge payers

1. Payers of environmental protection charge for sewage are households, units, organizations and individuals having sewage defined in Article 1 of this Circular.

2. If organizations and individuals that discharge sewage into water drainage systems have paid drainage charge, units managing, operating the drainage system shall be payers of environmental protection charge for sewage discharged by these organizations and individuals into the environment.

3. Production and processing establishments defined at Clause 1, Article 1 of this Circular which use water source from clean water suppliers must pay environmental protection charge for industrial sewage, but not environmental protection charge for daily-life sewage.

Article 4. Charge level

1. Environmental protection charge for daily-life sewage

The environmental protection charge for daily-life sewage is calculated as a percentage (%) of the sale price of 1 m3 (one cubic meter) of clean water but not exceed 10% (ten percent) of sale price of clean water exclusive of value-added tax.

For daily-life sewage discharged by organizations and households that exploit water by themselves (except households defined at Clauses 3, 4 and 5, Article 2 of this Circular), the charge level is determined according to each water user, based on the average water volume used by one person in the commune, ward or township where water is exploited and the average sale price of 1 m3 (one cubic meter) of clean water in such commune, ward or township.

Based on provision on the environmental protection charge rate for daily-life sewage at Clause 1, Article 5 of the Government’s Decree No. 25/2013/ND-CP dated March 29, 2013, on environmental protection charge for sewage, and socio-economic conditions, living conditions and incomes of people in localities, the provincial/municipal People’s Committees shall elaborate the environmental protection charge level for daily-life sewage applicable to each specific area and group of objects in their localities, in order to submit them to the People’s Councils at the same level for decision.

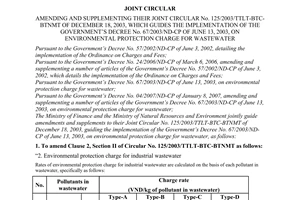

2. The environmental protection charge for industrial sewage

a) The environmental protection charge for industrial sewage discharged by production and processing establishments outside the list of production and processing sectors and industries discharging sewage containing heavy metals promulgated by the Ministry of Natural Resources and Environment (hereinafter referred to as the list), shall be calculated under the formula:

F = f + C, in which:

- F is the payable charge;

- f is a fixed charge of 1,500,000 VND/year.

- C is a variable charge and calculated on total volume of sewage; the concentration of 02 (two) pollutants being chemical oxygen demand (COD) and total suspended solids (TSS). The charge level applicable to each pollutant follows the detailed table below:

|

No. |

Chargeable pollutant |

Charge level (VND/kg) |

|

1 |

COD |

1,000 |

|

2 |

TSS |

1,200 |

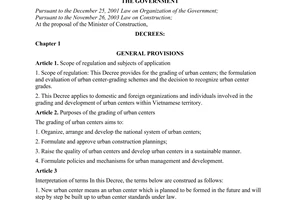

b) The environmental protection charge for sewage discharged by production and processing establishments on the list is calculated under the formula:

F = (f x K) + C, in which:

- F, f and C are defined as Point a of this Clause;

- K is the charging coefficient based on the sewage volume discharged by the production and processing establishments on the list and determined as follows:

|

No. |

Sewage volume (m3/day) |

Coefficient K |

|

1 |

Less than 30 m3 |

2 |

|

2 |

Between 30 m3 and 100 m3 |

6 |

|

3 |

Between move than 100 m3 and 150 m3 |

9 |

|

4 |

Between more than 150 m3 and 200 m3 |

12 |

|

5 |

Between more than 200 m3 and 250 m3 |

15 |

|

6 |

Between more than 250 m3 and 300 m3 |

18 |

|

7 |

More than 300 m3 |

21 |

c) If production and processing establishments on the list have treated heavy metals in their sewage up to the national technical regulation on quality of surface water to be suitable with use purpose of the receipt source, they shall be applied the coefficient K equal to 1.

d) Production and processing establishments with an annual average chargeable sewage volume less than 30 m3/day are not required to apply the variable charge (C=0).

Article 5. Determination of the payable charges

1. For daily-life sewage

a) The payable environmental protection charge for daily-life sewage is determined as follows:

- In case where the charge level is stipulated according to a percentage of the sale price of clean water:

|

The payable environmental protection charge for daily-life sewage (VND) |

= |

Volume of clean water used by the charge payer |

x |

The sale price of clean water excluding VAT (VND/m3) |

x |

The rate of environmental protection charge for daily-life sewage pursuant to decisions of the provincial/municipal People's Council (%) |

In case the sale price of clean water includes VAT, the sale price of clean water excluding VAT is determined as follows:

|

The sale price of clean water excluding VAT |

= |

The sale price of clean water including VAT |

|

1 + VAT tax rate |

The current VAT tax rate of clean water is 5% (five percent).

- In case where the charge level is stipulated with a certain amount:

|

The payable environmental protection charge for daily-life sewage (VND) |

= |

Volume of clean water used by the charge payer (m3) |

x |

The environmental protection charge level for daily-life sewage pursuant to decisions of the provincial/municipal People's Council (VND/m3) |

b) Volume of used clean water is determined according to water meter of charge payer. If charge payers fail to have water meters, volume of the presumptive used clean water for each group of clean water users as prescribed by the provincial/municipal People’s Committees shall be applied in order to conform to each group of clean water users.

For those that exploit water by themselves, volume of the used clean water is determined based on number of persons stated in household registration books (for households) or timekeeping records, payrolls or labor contracts (for entities not being production and processing organizations) and the average volume of clean water used per capita in the commune, ward or township.

For business and service establishments that exploit water by themselves for use, volume of the used clean water is determined based on scope of business and service activities as declared by the establishments and appraised by the communal People’s Committees.

2. For the industrial sewage

a) For production and processing establishments outside the list:

- Case of having an annual average chargeable sewage volume less than 30 m3/day, they shall only pay the fixed charge f = 1,500,000 VND /year;

- Case of having an annual average chargeable sewage volume of 30 m3/day or more, apart from paying a fixed charge f = 1,500,000 VND/year, they shall pay a variable charge (Cq) calculated according to the following formula:

|

Cq VND |

= |

Total volume of sewage discharged into environment (m3) |

x |

Concentration of COD in sewage (mg/l) |

x |

Charge level applicable to COD (VND/kg) |

+ |

Concentration of TSS in sewage (mg/l) |

x |

Charge level applicable to TSS (VND/kg) |

x |

10-3 |

In which:

+ Total volume of sewage discharged into environment is volume of sewage actually discharged by establishment in the quarter;

+ Concentrations of COD and TSS in sewage are determined according to the actual analysis results;

+ The charge levels applicable to COD and TSS are specified at Point a, Clause 2, Article 4 of this Circular.

b) Production and processing establishments on the list:

- If the annual average chargeable sewage volume is less than 30 m3/day, the payable charge equals the fixed charge multiplied by coefficient K of 2, which is 3,000,000 VND /year;

- If the annual average chargeable sewage volume is 30 m3/day or more, the quarterly payable charge is calculated according to the following formula:

Fq = (f x K)/4 + Cq, in which:

+ Fq is the quarterly payable charge (VND);

+ f = 1,500,000 VND;

+ K is specified at Point b, Clause 2, Article 4 of this Circular and determined based on the daily average sewage volume in the payable quarter;

+ Cq is calculated according to the formula specified at Point a of this Clause.

c) Determination of volume of sewage discharged into environment:

- For establishments which have sewage meters, volume of sewage discharged into environment is determined based on indexes read on meter;

- For establishments which have no sewage meters, volume of sewage discharged into environment is determined based on the actual measurement results of state management agencies of environment, or calculated to equal to 80% of volume of water used by them.

Article 6. Declaration, appraisal and payment of charge

1. The environmental protection charge for daily-life sewage

a) Monthly, the clean water suppliers shall collect environmental protection charge for sewage from organizations and individuals liable to environmental protection charge for daily-life sewage together with charge for clean water use. Organizations and individuals being payers of the environmental protection charge for daily-life sewage shall pay full environmental protection charge for sewage to the clean water suppliers at the same time point of paying charge for clean water use under monthly sale invoices.

b) The communal People’s Committees shall determine and collect charge from organizations, individuals, households and the business and service establishments that exploit water by themselves for use and are payers of environmental protection charge for daily-life sewage in their localities.

c) The clean water suppliers and the communal People’s Committees shall open an account for “temporary collection of environmental protection charge for daily-life sewage” at the local state treasuries. Depending on whether such amount is small or large, they shall remit the collected charge amount into such account on a daily or weekly basis. Monthly, not later than the 20th of the next month, they shall remit the environmental protection charge amount for daily-life sewage on the account of temporary collection into the state budget after subtracting the amount allowed to be retained at their units in accordance with regulations.

Monthly, the clean water suppliers and the communal People’s Committees shall calculate the collected amount of environmental protection charge for daily-life sewage, make charge declarations according to Form No. 01 enclosed with this Circular, and send them to the local tax administration agency.

The clean water suppliers and the communal People’s Committees shall open accounting books to monitor separately the collected amounts of environmental protection charge for daily-life sewage. The collected amounts of environmental protection charge for daily-life sewage shall not be accounted in turnover of the clean water suppliers.

d) State treasuries shall account amounts of environmental protection charge for daily-life sewage remitted by the clean water suppliers and the communal People’s Committees in the respective chapter, category and clause according to current regulations on state budget index.

dd) Annually, within 60 days, from January 01 of the next year, the clean water suppliers and the communal People’s Committees shall finalize the collected and remitted amounts of environmental protection charge for daily-life sewage in their localities with local taxation agencies in accordance with regulations.

2. The environmental protection charge for industrial sewage

a) Payers of environmental protection charge for industrial sewage have obligations:

- To declare the payable charges to the provincial Departments of Natural Resources and Environment where sewage is discharged into environment according to Form No. 02 enclosed with this Circular, ensure the accuracy of declarations and facilitate for the provincial Departments of Natural Resources and Environment to appraise the charge amounts of establishments, conduct periodical or irregular inspections of sewage sources:

+ For production and processing establishments on the list that have an average chargeable sewage volume of 30 m3/day or more in the year, they shall declare the quarterly payable charges as prescribed at Point b, Clause 2, Article 5 of this Circular within the first five (5) days of the first month of the next quarter;

+ For production and processing establishments outside the list that have an average chargeable sewage volume of 30 m3/day or more in the year, they shall declare the quarterly payable variable charges within the first five (5) days of the first month of the next quarter and the fixed charge payable once for the whole year at the same time point of declaring and paying the variable charge for the first quarter.

- To pay sufficiently and timely the payable charges into the account of “the temporarily collected environmental protection charge for industrial sewage” according to notices of the provincial Departments of Natural Resources and Environment within 10 (ten) days after receiving notices about the payable charges from the provincial Departments of Natural Resources and Environment.

For production and processing establishments that have an average chargeable sewage volume of less than 30 m3/day in the year, they shall pay charges as prescribed at Points a and b, Clause 2, Article 5 of this Circular once for the whole year according to the notices of the provincial Departments of Natural Resources and Environments, deadline of charge payment is not later than March 31.

- To finalize the annual payable charges with the provincial Departments of Natural Resources and Environment within 45 (forty-five) days from January 01 of the next year.

b) The provincial Departments of Natural Resources and Environment and the district-level Divisions of Natural Resources and Environment (as being decentralized) shall:

- Coordinate with relevant agencies in reviewing and adjusting classification of entities liable to pay the fixed charge or variable charge, charge payers on the list and outside the list as prescribed at Clause 2, Article 4 of this Circular, and notify such to the environmental protection charge payers for industrial sewage not later than March 10 every year.

- Appraise declarations of environmental protection charge for industrial sewage Basis for appraisal are figures declared by charge payers; measurement results of state management agencies of environment or results of the latest examination or inspection not exceeding 12 months up to the time of charge declaration and payment.

Not later than the last day of the first month of the next quarter, they shall issue notices of the payable environmental protection charges for industrial sewage to charge payers according to Form No. 03 enclosed with this Circular.

- Open accounting books to separately monitor the environmental protection charges for industrial sewage of the local charge payers, monitor, manage and use part of the charge amounts as prescribed at Clause 2, Article 7 of this Circular.

- Quarterly, not later than the last day of the second month of the next quarter, the provincial Departments of Natural Resources and Environment shall sum up the collected environmental protection charges for industrial sewage and send them to the provincial Departments of Taxation, and periodically compare them with state treasuries where transactions are performed.

- Annually, within 60 (sixty) days, from January 01 of the next year, finalize with tax agencies at the same level the collected and remitted amounts of environmental protection charge for industrial sewage in the last year in their localities in accordance with regulations.

- Open accounts for “temporary collection of environmental protection charges for industrial sewage” at state treasuries in their localities.

- Periodically (not later than the 15th of the second quarter of the next quarter), they shall coordinate with the state treasuries (where the accounts for temporary collection are opened) in remitting 80% of the collected charge amounts into the state budget and the remitting 20% of the remaining charge amounts into the deposit accounts of the provincial Departments of Natural Resources and Environment (or the district Divisions of Natural Resources and Environment Divisions as being decentralized) for management and use in accordance with regulations.

c) For production and service establishments directly managed by the Ministry of Public Security or the Ministry of National Defense, in case of reason for security and national secret, the Ministry of Public Security or the Ministry of National Defense shall appraise declarations of environmental protection charge and notify the provincial Departments of Natural Resources and Environment where such establishments are operating according to Form No. 04 enclosed with this Circular.

Article 7. Management and use of charge

Environmental protection charge for sewage is revenue of state budget which must be managed and used as follows:

1. For daily-life sewage

a) The clean water suppliers and the communal People’s Committees may respectively deduct at most 10% (ten percent) and 15% (fifteen percent) of total collected amount of environmental protection charge for daily-life sewage to cover expenditures for charge collection. The provincial People’s Councils shall decide the specific deduction level.

The clean water suppliers and the communal People’s Committees must use the amount of environmental protection charge for daily-life sewage deducted according to the above provisions for proper purposes and with lawful documents as prescribed. If such amount is not yet used up at the end of year, the remaining amount shall be forwarded to the next year for expenditures in accordance with regulations.

b) The remaining amount (after deducting the amount allowed to be deducted by the clean water suppliers or the communal People’s Committees) shall be remitted into local budgets and use as guided at Clause 3 of this Article.

2. For the industrial sewage

a) The provincial Departments of Natural Resources and Environment or the district Divisions of Natural Resources and Environment (as being decentralized) may deduct 20% (twenty percent) of the total collected amount of environmental protection charge for industrial sewage to cover expenditures for charge collection (investigation, making of statistics, review, classification, updating and management of charge payers), expenditures for measurement, assessment, taking samples and analyzing of sewage samples to serve the appraisal of charge declarations, charge management and periodical or irregular inspections of industrial sewage.

The provincial Departments of Natural Resources and Environment or the district Divisions of Natural Resources and Environment (as being authorized) must use the deducted amount of environmental protection charge for daily-life sewage according to the above provisions for proper purposes and with lawful documents in accordance with regulations. If such amount is not yet used up at the end of year, the remaining amount shall be forwarded to the next year for expenditure in accordance with regulations.

b) The remaining charge (80% of the total collected amount of environmental protection charge for industrial sewage) shall be remitted into local budgets and used as guide at Clause 3 of this Article.

3. Management and use of the environmental protection charge amount remitted into state budget

After deducting the retained amount as prescribed at Clauses 1 and 2 of this Article, the units collecting charges shall remit all remaining charges into local budgets for spending on environmental protection work; adding operational capital for environmental protection funds of localities to serve the prevention, mitigation and control of environmental pollution caused by sewage; and organizing the application and implementation of technological and technical solutions and plans for sewage treatment.

4. The collection, remittance, management, use, documents of charge collection, and disclosure of regulations on environmental protection charge for sewage that are not mentioned in this Circular shall comply with guidance in the Circular No. 63/2002/TT-BTC dated July 24, 2002 of the Ministry of Finance, guiding implementation of legislation on charges and fees, Circular No. 45/2006/TT-BTC dated May 25, 2006, amending and supplementing Circular No. 63/2002/TT-BTC dated July 24, 2002, Circular No. 28/2011/TT-BTC dated February 28, 2011, of the Ministry of Finance, guiding implementation of a number of articles of the Law on Tax Administration, and guiding the Government’s Decree No. 85/2007/ND-CP dated May 25, 2007, and Decree No. 106/2010/ ND-CP dated October 18, 2010, and Circular No. 153/2010/TT-BTC dated September 28, 2010, of the Ministry of Finance, guiding the printing, issuance and use of goods sale and service provision invoices, and amending and supplementing documents (if any).

Article 8. Duties and obligations of local agencies

1. Tax agencies shall

Examine, urge and finalize the collection, remittance, management and use of environmental protection charge for sewage by the clean water suppliers, the communal People’s Committees and local agencies of natural resources and environment.

2. The provincial Departments of Natural Resources and Environment shall:

a) Guide the charge payers for industrial sewage to declare and pay the charge as prescribed at Point a, Clause 2, Article 6 of this Circular;

b) Based on the requirement of charge collection of each locality and the managerial capability of the district-level natural resources and environment agencies, the provincial Departments of Natural Resources and Environment may report to the provincial People’s Committees to decentralize the collection of environmental protection charge for industrial sewage in the localities to the district-level Divisions of Natural Resources and Environment;

c) Conduct periodical or irregular inspections of the declaration and payment of environmental protection charge for industrial sewage;

d) Sum up the annual figures on environmental protection charge for sewage in localities according to form No. 05 enclosed with this Circular and send them to the Ministry of Natural Resources and Environment before May 31 of the next year.

3. The provincial Departments of Finance shall

Assume the prime responsibility for, and coordinate with the provincial Departments of Natural Resources and Environment and Taxation Departments in, advising the provincial People’s Committees in submitting to the provincial People’s Councils for providing for environmental protection charge for sewage under their competence.

4. The clean water suppliers shall:

a) Coordinate with the provincial Departments of Natural Resources and Environment and relevant units in organizing the charge collection;

b) Sum up the annual figures on environmental protection charge for daily-life sewage in localities and notify the provincial Departments of Natural Resources and Environment according to form No. 06 enclosed with this Circular before March 31 of the next year.

5. The district Divisions of Natural Resources and Environment as being decentralized shall:

a) Coordinate with the provincial Departments of Natural Resources and Environment and relevant units in organizing the charge collection;

b) Sum up the annual figures on environmental protection charge for industrial sewage according to form No. 07 enclosed with this Circular and send them to the provincial Departments of Natural Resources and Environment by March 31 of the next year.

6. The communal People’s Committees shall

Guide the declaration and payment of environmental protection charge for daily-life sewage by charge payers that exploit water by themselves for use as prescribed at Point b, Clause 1, Article 6 of this Circular.

Article 9. Implementation organization

1. This Circular takes effect on July 01, 2013, and replaces the Joint Circular No. 125/2003/TTLT-BTC-BTNMT dated December 18, 2003, of the Ministry of Finance and the Ministry of Natural Resources and Environment, guiding implementation of the Government’s Decree No. 67/2003/ND-CP on environmental protection charge for sewage, the Joint Circular No. 106/2007/TTLT-BTC-BTNMT dated September 06, 2007, amending and supplementing the Joint Circular No. 125/2003/TTLT-BTC-BTNMT and the Joint Circular No. 107/2010/TTLT-BTC-BTNMT dated July 26, 2010, amending and supplementing the Joint Circular No. 125/2003/TTLT-BTC-BTNMT and the Joint Circular No. 106/2007/TTLT-BTC-BTNMT.

2. From the effective date of this Circular:

- For daily-life sewage: In case where the provincial People’s Councils have not yet issued the charge level according to percentage of the sale price of clean water, or the average per-capita charge level applicable to households and organizations that exploit water by themselves for use as prescribed at Clause 1, Article 4 of this Circular and the rate of the collected charge amount to be deducted and retained at agencies collecting charge as prescribed at Clause 1, Article 7 of this Circular, the previously- issued charge level and deduction rate will continue to be applied.

- For industrial sewage: the provincial Departments of Natural Resources and Environment shall assume the prime responsibility for, and coordinate with relevant agencies in, classifying charge payers on the list and outside the list; and issue notices to send them to charge payers, which will serve as a ground for the production and processing establishments to declare and pay charge (deadline for sending such notices is September 30, 2013).

3. In 2013, establishments liable to pay the fixed charge as prescribed at Clause 2, Article 4 of this Circular shall pay half of the fixed charge (except those prescribed at Point b, Clause 2, Article 5 of this Circular).

4. Enterprises which are newly established, dissolved, suspended operation or go bankrupt in the year shall declare and pay the fixed charge and variable charge on a quarterly basis on the basis of number of quarters of practical operation in the year due to dissolution, operation termination or bankruptcy, they shall not be adjusted.

In the course of implementation, any arising problems should be reported timely to the Ministry of Finance and the Ministry of Natural Resources and Environment for consideration, settlement or amendment and supplementation as appropriate.

|

FOR THE MINISTER

OF NATURAL RESOURCES AND ENVIRONMENT |

FOR THE

MINISTER OF FINANCE |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed