Law No. 43-L/CTN of October 28th, 1995, on amendments and supplements to a number of articles of the Law on Special Consumption Tax. đã được thay thế bởi Law No. 05/1998/QH10 of May 20, 1998, on Special Consumption Tax. và được áp dụng kể từ ngày 01/01/1999.

Nội dung toàn văn Law No. 43-L/CTN of October 28th, 1995, on amendments and supplements to a number of articles of the Law on Special Consumption Tax.

|

THE

NATIONAL ASSEMBLY |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No: No number |

Hanoi , October 28th, 1995 |

LAW

ON AMENDMENTS AND SUPPLEMENTS TO A NUMBER OF ARTICLES OF THE LAW ON SPECIAL CONSUMPTION TAX

Pursuant to Articles 80 and

84 of the 1992 Constitution of the Socialist Republic of Vietnam;

This Law provides for the amendments and supplements to a number of articles of

the Law on Special Consumption Tax passed on June 30, 1990 by the VIIIth

National Assembly at its 7th Session, and the Law on Amendments and Supplements

to a Number of Articles of the Law on Special Consumption Tax passed on July 5,

1993 by the IXth Legislature of the National Assembly at its 3rd Session.

Article 1.-

To amend and supplement a number of articles of the Law on Special Consumption Tax as follows:

1- Article 1 is amended, supplemented into the following:

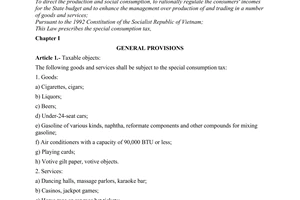

"Article 1.-

Organizations and individuals of all economic sectors (hereafter referred to as establishments) producing and importing goods defined in Article 9 of this Law are subject to special consumption tax stipulated by this Law."

2- Article 2 is amended and supplemented into the following:

"Article 2.-

1- Each item of goods subject to special consumption tax shall have to pay special consumption tax only once. In case items covered by special consumption tax are produced from materials for which the special consumption tax was already paid, the special consumption tax already paid for the materials shall be deducted when calculating the special consumption tax for their production.

a) Establishments producing items of goods subject to special consumption tax shall have to pay only the special consumption tax but not the turnover tax when these goods items are put on sale.

b) Establishments which import goods subject to the special consumption tax shall have to pay the special consumption tax when the goods are imported, and to pay turnover tax when the goods are put on sale.

2- Goods subject to the special consumption tax shall not have to pay special consumption tax if they are for export."

3- Article 3 is amended and supplemented into the following:

"Article 3.- Establishments which produce or import goods subject to special consumption tax are obligated to declare and fully pay tax in accordance with the provisions of the Law on Special Consumption Tax."

4- Article 6 is amended and supplemented into the following:

“Article 6.- The basis for calculating tax on goods subject to special consumption tax shall be the quantity of goods, the taxable unit prices, and the applicable tax rates."

5- Article 7 is amended and supplemented into the following:

“Article 7.- Prices for calculating the special consumption tax:

1- For the goods produced, the taxable prices shall be their sale prices at the production places, as fixed by the establishments which produce them, not including the special consumption tax.

2- For the imported goods, the taxable prices shall be their prices for calculating the import duty, plus (+) the import duty."

6- Article 9 is amended and supplemented into the following:

"Article 9.- Items of goods subject to special consumption tax and the tax rates specified in the following tax index:

|

Ordinals |

Items of goods |

Tax rates (%) |

|

1 |

Smoking stuff: |

|

|

|

a) Filter cigarettes produced mainly from imported materials |

70 |

|

|

b) Filter cigarettes produced mainly from local materials |

52 |

|

|

c) Cigarettes without filters, cigars |

32 |

|

|

d) Imported cigarettes, cigars |

70 |

|

2 |

Alcohol |

|

|

|

a) Tonic whisky |

15 |

|

|

b) Others (including ethyl alcohol) |

|

|

|

- Over 40% alcohol |

90 |

|

|

- 30 - 40% alcohol |

75 |

|

|

- Under 30% alcohol, including fruit wines |

25 |

|

3 |

Beer of all kinds |

90 |

|

|

Canned beer |

75 |

|

4 |

Fireworks, flares... (excluding firecrackers) |

100 |

|

5 |

Imported automobiles (including those in SKD form) |

|

|

|

- with 5 seats or less |

100 |

|

|

- with 6 - 15 seats |

60 |

|

|

- with 16 - 24 seats |

30 |

|

6 |

Assorted gasoline, naphtha, reformate component, and other components for mixing petrol |

15 |

In case of necessity, the Standing Committee of the National Assembly may decide to change or add a number of goods items and tax rates specified in the special consumption tax index, and shall have to submit them to the National Assembly for ratification at its next session."

7- First sentence of Article 10 is amended and supplemented into the following:

"Establishments which produce and import goods subject to special consumption tax have the responsibilities:"

8- Article 11 is amended and supplemented into the following:

"Article 11.- Establishments which produce or import goods subject to special consumption tax are obligated to submit their declaration of special consumption tax; to fully pay the special consumption tax after deducting the tax already paid in the month and the amount of special consumption tax paid earlier (if any) in accordance with the tax notice.

Monthly, establishments which produce goods subject to special consumption tax shall have to submit their declarations of special consumption tax for the previous month to the tax agency within the first 5 days of the following month."

9- Article 14 is amended and supplemented into the following:

"Article 14.- Domestically produced goods shall be declared by the production establishments when they are put on sale or delivered to the subcontractors.

Imported goods shall be declared by the importers together with their declaration of import duty at the time of registration of the declaration of imports."

10- Article 15 is amended and supplemented into the following:

"Article 15.- Payment of special consumption tax is provided for as follows:

1- For domestically produced goods, special consumption tax shall be paid right after the goods are put on sale or delivered to the subcontractors. In case the sale money is not collected yet, the time limit for paying tax may be extended, but no later than 15 days, from the date of making sale invoices or delivering goods to the subcontractors.

For small establishments and establishments which are subject to quota-based consumption rate, the special consumption tax shall be paid periodically on the 10th, 20th and last day of each month.

2- For imported goods, special consumption tax shall be paid within the time limit for paying import duty, but no later than 30 days, from the date of receiving tax notice from the tax agency about the amount to be paid.

Special consumption tax on non-commercial imports must be paid upon their importation into Vietnam."

Article 2.- This Law takes effect as from January 1st, 1996.

Article 3.- The Government shall amend and supplement the documents with detailed provisions for the implementation of the Law on Special Consumption Tax in accordance with this Law.

This Law was passed on October 28, 1995 by the IXth National Assembly of the Socialist Republic of Vietnam at its 8th Session.

|

|

CHAIRMAN

OF THE NATIONAL ASSEMBLY |