Nội dung toàn văn Official Dispatch No. 13231/BTC-TCT, on personal income tax payable by foreigner

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 13231/BTC-TCT |

Hanoi, September 18, 2009 |

To: Provincial – level Tax Departments

Regarding the personal income tax (PIT) obligation of foreign staff members of Vietnam-based representative offices and project offices of foreign non-governmental organizations, the Ministry of Finance issued Official Letter No. 10109/BTC-TCT of July 16, 2009, reporting it to the Prime Minister. Based on the Prime Minister’s directing opinions stated in the Government Office’s Official Letter No. 4994/VPCP-KTTH of July 23, 2009, on PIT payable by foreigners working in Vietnam-based offices of foreign non-governmental organizations, the Ministry of Finance provides the following guidance:

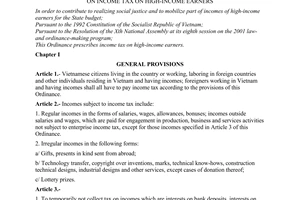

1. For the period prior to December 31, 2008: Foreigners working in Vietnam-based representative offices and project offices of foreign non-governmental organizations were exempt from PIT under the Ordinance on Income Tax on High-Income Earners.

2. From January 1, 2009, onward: For foreigners working in Vietnam-based representative offices and project offices of foreign non-governmental organizations enjoy PIT exemption on the basis of the Government’s commitments in international agreements with foreign non-governmental organizations on the following conditions:

- Their wages or allowances are paid from foreign sources and not covered by capital sources for implementation of projects in Vietnam.

- They are foreign nationals (including also those holding both foreign citizenship and Vietnamese citizenship).

- PIT exemption is given for a specified duration on the basis of agreements on PIT exemption durations concluded between the Vietnamese Government or the Working Committee for Foreign Non-Governmental Organizations (when authorized by the Vietnamese Government) and Vietnam-based foreign non-governmental organizations.

In case agreements concluded between the Working Committee for Foreign Non-Governmental Organizations (authorized by the Vietnamese Government) and foreign non-governmental organizations before January 1, 2009, which are still effective, provide PIT exemption for foreign staff members of these organizations, these agreements continue applying.

3. Dossiers and procedures for PIT exemption:

Vietnam-based representative offices of foreign non-governmental organizations shall submit lists of their foreign staff members who are eligible for PIT exemption, made according to the form provided in the Appendix to this Official Letter and agreements concluded between the Vietnamese Government or the Working Committee for Foreign Non-Governmental Organizations (when authorized by the Vietnamese Government) and Vietnam-based foreign non-governmental organizations to the Tax Departments of provinces or cities where they are located before November 30, 2009. Offices that terminate their operations before November 30, 2009, shall submit lists of their staff members eligible for PIT exemption to tax offices not later than the date of termination of operation.

Offices that commence operation after November 30, 2009, or employ new staff members or terminate labor contracts with existing staff members, shall submit lists of their staff members eligible for PIT exemption to tax offices not later than the last day of the month in which they commence operation or change their staff.

Vietnam-based chief representatives of foreign non-governmental organizations are responsible for the accuracy of lists of their staff members eligible for PIT exemption submitted to tax offices.

Provincial-level Tax Departments are requested to guide Vietnam-based representative offices of foreign non-governmental organizations in complying with the above guidance and urge these offices to submit lists of their staff members within the prescribed time limit. They should also report any problems arising in the course of implementation to the Ministry of Finance (the General Department of Taxation) for timely settlement.

|

|

FOR THE MINISTER OF FINANCE |