Nội dung toàn văn Official Dispatch No. 1357 TCT/DNNN, on Determination of payable VAT

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 1357-TCT/DNNN |

Hanoi, May 9, 2005 |

To: Provincial/municipal Tax Departments

The General Department of Taxation has recently received reports from a number of enterprises (which declare and pay VAT by the credit method) on the fact that some tax offices have issued Decisions on recovery of VAT even where payable VAT amounts ( post-audit) are negative (i.e. output VAT amounts are smaller than input VAT amounts). More concretely as follows:

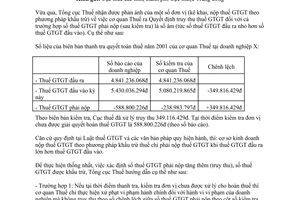

Figures in the written record of the 2001 tax settlement inspection by a tax office at enterprise X are as follows:

|

|

Figures reported by the enterprise |

Figures inspected by the tax office |

Difference |

|

- Output VAT |

VND 4,841,236,068 |

VND 4,841,236,068 |

|

|

- Input VAT in this period |

VND 5,430,036,294 |

VND 5,080,219,865 |

VND - 349,816,429 |

|

- Payable VAT |

VND - 588,800,226 |

VND – 238,983,797 |

VND + 349,816,429 |

According to the inspection record, the tax office has retrospectively collected VND 349,116,429. At the time of inspection, the enterprise had not yet been refunded the VAT amount of VND 588,800,226 (according to the report).

Pursuant to the provisions of the VAT Law and current legal provisions, business establishments paying VAT by the tax credit method shall have to pay VAT only when their output VAT amounts are larger than input VAT amounts.

For uniform implementation, the determination of additional payable VAT amounts (retrospectively collected amounts) and creditable VAT amounts is guided in detail by the General Department of Taxation as follows:

- Case 1: If at the time of inspection, enterprises have not been refunded tax, tax offices shall administratively sanction only violation acts of such enterprises but not retrospectively collect differences between payable VAT amounts according to the column of inspected figures (in the above example, the amount of VND 349,816,429 shall not be retrospectively collected). Inspected figures of payable VAT (VND -238,938,797) shall be carried forward to the subsequent period for further credit.

- Case 2: If at the time of inspection of tax settlement, enterprises have been refunded tax by tax offices, tax offices shall retrospectively collect wrongly declared VAT amounts. VAT amounts to be retrospectively collected must be equal to payable VAT amounts (in column of inspected figures) minus amounts in the column of reported figures (in the above example, the retrospectively collected amount shall be VND 349,816,429).

- Case 3: Assuming that the payable VAT amount after inspection by a tax office is a positive figure: VND 100,000,000, while the figure reported by the enterprise is a negative figure: VND –588,800,226, the VAT amount to be retrospectively collected shall be the figure inspected by the tax office: VND 100,000,000. At the same time, the tax office shall sanction the violation according to current regulations.

The General Department of Taxation provides the foregoing guidance to provincial/municipal Departments of Taxation for knowledge and implementation.

|

|

FOR THE GENERAL DIRECTOR OF

TAXATION |