Nội dung toàn văn Official Dispatch No. 1460/TCT-DTNN, On grant of tax identification numbers

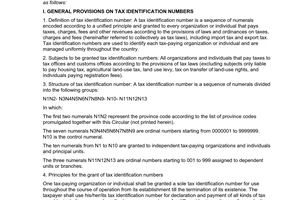

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 1460/TCT-DTNN |

Hanoi, April 17, 2007 |

To: The Tax Department of Quang Ngai province

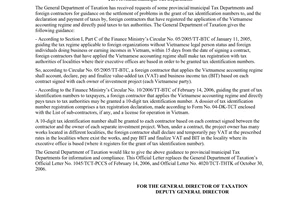

In response to Official Letter No. 594/CT-QLKK-KTT of March 27, 2007, of the Tax Department of Quang Ngai province concerning the grant of tax identification numbers to foreign contractors, the General Department of Taxation gives the following guidance:

Pursuant to the Ministry of Finance’s Circular No. 05/2005/TT-BTC of January 11, 2005, and Circular No. 10/2006/TT-BTC of February 14, 2006, and by the General Department of Taxation’s Official Letter No. 4926/TCT-DTNN of December 26, 2006 (sent to provincial/municipal Tax Departments):

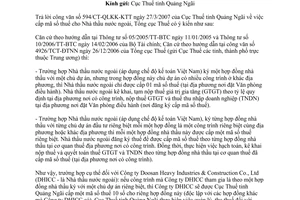

- In case a foreign contractor (that applies the Vietnamese accounting system) enters into a contract with a project owner that has, as stated in the contract, many affiliated companies in different localities, the foreign contractor will be granted only one tax identification number (in the locality where its executive office is located). The foreign contractor shall assess and temporarily pay value-added tax (VAT) at the prescribed rate in localities where contracted works are constructed and pay VAT and business income tax (BIT) in the locality where its executive office is located (where it registers for grant of tax identification number).

- In case a foreign contractor (that applies the Vietnamese accounting system) enters into different contracts with different investment project owners, each representing a separate company located or not located in the same locality with others, a separate tax identification number will be granted for each contract. The foreign contractor shall make tax registration for grant of tax identification number for each contract at tax offices of localities where contracted works are constructed, and also conduct the accounting, and VAT and BIT assessment, payment and finalization for each contract with these tax offices (in localities where works are constructed).

In the case of Doosan Heavy Industries and Construction Co., Ltd (DHICC – a foreign contractor): If the work constructed by DHICC is under a contract signed with a separate project owner, DHICC will be granted by the Tax Department of Quang Ngai province a 10-digit tax identification number for that contract (independent from other contracts of DHICC). The Tax Department of Quang Ngai province shall manage and collect taxes from DHICC arising from its performance of this contract with the granted tax identification number according to regulations. DHICC shall conduct separate cost-accounting and make VAT and BIT declaration, payment and finalization for the work with the Tax Department of Quang Ngai province.

The General Department of Taxation would like to give the above guidance to the Tax Department of Quang Ngai province for information and guidance to local enterprises.

|

|

FOR THE GENERAL DIRECTOR OF

TAXATION |