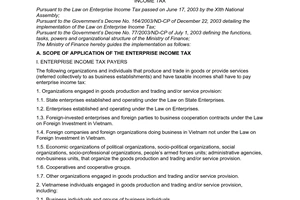

Nội dung toàn văn Official Dispatch No. 1728/TCT-PCCS, on Accounting loan interest payments as rea

|

MINISTRY

OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No.

1728/TCT-PCCS |

Hanoi, May 16, 2006 |

To: Provincial/municipal Tax Departments

The General Department of Taxation has received official letters of a number of tax departments and enterprises inquiring about inclusion of loan interest payments in reasonable expenses. The General Department of Taxation hereby gives the following opinions:

Point 7, Section III, Part B of the Finance Ministry’s Circular No. 128/2003/TT-BTC of December 22, 2003, guiding business income tax, defines reasonable expenses to be deducted for calculating taxable incomes as “Payments of interests on loans borrowed for production, goods trading and services from banks, credit institutions or economic organizations at the actual rates as agreed upon in borrowing contracts; payments of loan interests to other subjects at the actual rates at the time of signing of borrowing contracts, which must not exceed 1.2 times the lending interest at the same time applied by commercial banks having transactions with the business establishment.

The business establishment’s payments of interests on loans borrowed for legal capital and charter capital contributions shall not be accounted as reasonable expenses for determining taxable incomes.”

Under the above guidance:

- A business establishment getting loans from banks, credit institutions or economic organizations to serve its production and business activities but not for the purpose of capital increase shall be allowed to account its payments of interests on such loans as reasonable expenses for determining taxable incomes.

- A business establishment borrowing capital from the company’s founders or shareholders who meanwhile have not yet made full legal capital and charter capital contributions shall not be allowed to account its payments of interests on loans corresponding to the registered capital contributions as reasonable expenses for determining taxable incomes. The business establishment may only account payments of interests on loan amounts in excess of the registered capital contributions of the company’s founders or shareholders as reasonable expenses.

The General Department of Taxation informs provincial/municipal Tax Departments thereof for compliance.

|

|

FOR

THE GENERAL DIRECTOR |