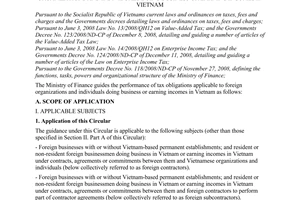

Nội dung toàn văn Official Dispatch No. 1947/TCT-CS of June 08, 2011, on tax policy for foreign co

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No: 1947/TCT-CS |

Hanoi, June 08, 2011 |

To: Departments of Tax of central provinces and cities

General Department of Tax received some Documents from some questions on the calculation of Value Added Tax (VAT) and enterprise income tax of foreign contractors. The General Department has opinions on this problem as following:

1. Legal Documents:

Pursuant to the regulations at Part C of the Circular No. 134/2008/TT-BTC dated December 31, 2008 of the Ministry of Finance guiding the performance of tax obligations applicable to foreign organizations and individuals doing business or earning incomes in Vietnam, Vietnam party signs contract with foreign contractors to supply goods and services at the effect time of Circular No. 134/2008/TT-BTC the determination of VAT and enterprise income tax for the foreign contractor as well as the contract implementation are under the Circular No. 134/2008/TT-BTC.

2. Way of payments on the Circular No. 134/2008/TT-BTC as following:

At the Point 2.1.1, Section III, Part B of the Circular No. 134/2008/TT-BTC regulating turnover for VAT calculation:

a/ Turnover for VAT calculation is the total turnover received by a foreign contractor or subcontractor from the provision of services or services accompanying VAT-liable goods inclusive of payable taxes, including expenses (if any) paid by a Vietnamese party for the foreign contractor or subcontractor.

b/ Determination of turnover for VAT calculation in some specific cases:

b1/ When, under a contractor or subcontractor contract, the turnover received by a foreign contractor or subcontractor is exclusive of payable VAT, the turnover for VAT calculation shall be converted into VAT-inclusive turnover and determined according to the following formula:

|

Turnover for VAT calculation |

= |

VAT-exclusive turnover |

|

1 - The percentage of added value to turnover x VAT rate |

At the Point 3.1, Section III, Part B of the Circular No. 134/2008/TT-BTC regulating turnover for enterprise income tax (EIT) calculation:

a/ Turnover for EIT calculation

Turnover for EIT calculation is the total turnover exclusive of VAT and inclusive of payable taxes (if any) received by a foreign contractor or subcontractor. Turnover for EIT calculation also includes expenses (if any) paid by a Vietnamese party for a foreign contractor or subcontractor.

b/ Determination of turnover for EIT calculation in some specific cases:

b1/ When, under a contractor or subcontractor contract, the turnover received by a foreign contractor or subcontractor is exclusive of payable EIT, turnover for EIT calculation shall be determined according to the following formula:

|

Turnover for EIT calculation |

= |

EIT-exclusive turnover |

|

1 - EIT rate based on turnover for EIT calculation |

Pursuant to the above regulations, in the case that Vietnamese party signs the contract with foreign contractors when the contract value does not include EIT and VAT, Vietnamese party has to define turnover for VAT calculation and EIT calculation due to above regulation when declaring, crediting and paying tax for foreign contractor, including:

Defining turnover for EIT calculation according to the regulation at the Point 3.1, Section II, Part B of the Circular No. 1.4/2008/TT-BTC and then defining turnover for VAT calculation (included EIT) according to the regulation at the Point 2.1.1, Section III, Part B of the Circular No. 134/2008/TT-BTC.

The General Department of Tax responds to Departments of Tax of provinces and cities for guiding the implementation among units.

|

|

FOR

THE GENERAL DIRECTOR |