Nội dung toàn văn Official Dispatch No. 3734 TCT/DTNN on accounting the 13th month salaries

|

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 3734 TCT/DTNN |

Hanoi, November 15, 2004 |

OFFICIAL LETTER

ON ACCOUNTING THE 13TH MONTH SALARIES AS EXPENSES

To: Provincial/municipal Tax Departments

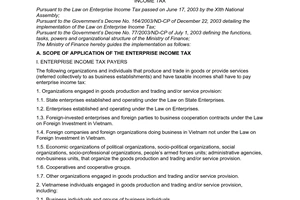

The General Department of Taxation has recently received official letters from many enterprises, inquiring about guidance on the accounting of the 13th month salary as reasonable expenses. Concerning this issue, the General Department of Taxation gives the following opinions:

According to the provisions of Point 3.1b, Clause 3, Section III, Part B of the Ministry of Finance’s Circular No. 128/2003/TT-BTC of December 22, 2003, guiding the implementation of the Government’s Decree No. 164/2003/ND-CP of December 22, 2003, detailing the implementation of the Law on Business Income Tax (BIT), salaries actually paid to laborers (including the 13th salaries and additional salaries) shall be accounted as reasonable expenses in determining the BIT-liable incomes, provided that such salaries are specified (salary levels and payment conditions) in labor contracts or collective labor agreements, approved by the Managing Boards and calculated in a reasonable manner (associated with and relevant to business results of enterprises). This provision shall be applicable to all non-state enterprises.

Annually, enterprises have to register with tax agencies the total payable salary fund in the year and criteria and methods for setting up such salary fund, together with BIT declarations.

Except above-said salaries allowed to be accounted as deductible expenses, when determining taxable incomes, enterprises must not account bonuses for laborers as reasonable expenses. Enterprises use after-tax profits to pay bonuses

Provincial/municipal Tax Departments are requested to guide enterprises and implement the aforesaid guidance in a uniform manner. Any problems arising in the course of implementation should be specifically reported to the General Department of Taxation for timely guidance.

|

|

FOR THE GENERAL DIRECTOR OF

TAXATION |