Nội dung toàn văn Official Dispatch No. 3913/TCT-TNCN, on the determination of exempted personal

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 3913/TCT-TNCN |

Hanoi, September 21, 2007 |

OFFICIAL LETTER

ON THE DETERMINATION OF EXEMPTED PERSONAL INCOME TAX AMOUNTS

To: Provincial/municipal Tax Departments

The General Department of Taxation has received official letters from localities adressing problems in guiding the methods of determining personal income tax (PIT) amounts of individuals who have both income exempt from PIT and income subject to PIT. In order to ensure consistency in the determination of payable PIT amounts, the General Department of Taxation provides the following guidance:

According to Chapter II of the Government’s Decree No. 147/2004/ND-CP of July 23, 2007, detailing the implementation of the Ordinance on Income Tax on High-Income Earners:

Individuals who earn in a year both income subject to PIT and income exempt from PIT shall declare all income earned in the year, including income exempt from PIT. The payable PIT amount is determined as follows:

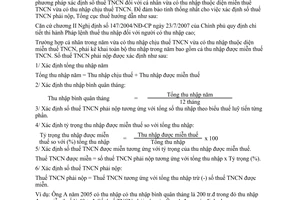

1. Determining the total yearly income

The total yearly income = Taxable income + Income exempt from tax

2. Determining the average monthly income:

|

The average monthly income |

= |

The

total yearly income |

3. Determining the payable PIT amount corresponding to the total income according to the marginal progressive tax rates table.

4. Determining the proportion of income exempt from tax to the total income:

|

The proportion of income exempt from tax to the total income (%) |

= |

Income

exempt from tax |

x |

100 |

5. Determining the exempted PIT amount corresponding to the proportion of income exempt from tax.

The exempted PIT amount = The payable PIT amount corresponding to the total income x proportion (%).

6. Determining the payable PIT amount:

The payable PIT amount = The PIT amount corresponding to the total income minus (-) the exempted PIT amount.

For example: The average monthly income in 2005 of Mr. A is VND 200 million, of which income exempt from tax is VND 40 million. The payable PIT amount of Mr. A is determined as follows:

The tax amount payable according to the marginal progressive tax rates table and corresponding to the total income of VND 200 million is VND 64.2 million.

|

The proportion of income exempt from tax to the total income (%) |

= |

VND

40 million |

x |

100 |

= |

20% |

The exempted PIT amount = VND 64.2 million x 20% = VND 12.84 million

The payable PIT amount = VND 64.2 million - VND 12.84 million = VND 51.36 million.

The General Department of Taxation gives this notice to Tax Departments for instruction on compliance.

|

|

FOR

THE GENERAL DIRECTOR OF TAXATION |