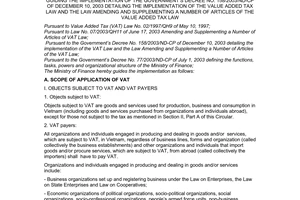

Nội dung toàn văn Official Dispatch No. 9338/BTC-TCHQ of July 25, 2005, Regarding value added tax on goods items under heading No. 8448

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 9338/BTC-TCHQ |

Hanoi, July 25, 2005 |

To: - Provincial/municipal Customs Departments

The General Department of Customs has received reports from several provincial/municipal Customs Departments on problems related to value added tax (VAT) rates of goods items under Heading No. 8448 arising in their implementation of Point 8 of the Finance Ministry's Circular No. 62/2004/TT-BTC of June 24, 2004, and the Table of VAT rates according to the Preferential Import Tariffs promulgated together with Circular No. 62/2004/TT-BTC;

After reaching agreement with the Tax Policy Department of the Finance Ministry, the General Department of Customs hereby provides the following guidance to units for uniform implementation:

- The calculation of VAT on goods items in Chapters 84 thru 90 shall comply with the provisions of Point 8 of the Finance Ministry's Circular No. 62/2004/TT-BTC of June 24, 2004: "for goods being machinery or equipment parts or accessories under Headings or Subheadings in Chapters 84 thru 90 (except for parts and accessories of automatic data-processing machines specified at Point 2.35, Section II, Part B of Circular No. 120/2003/TT-BTC) which are subject to the tax rate of 5%, this tax rate shall apply only to parts and accessories made of metal. Non-metal parts and accessories under these Headings or Subheadings shall be subject to the VAT rate of 10%."

- The "Particularly" section under Heading No. 8448 of the Table of VAT rates according to the Preferential Import Tariffs promulgated together with the Finance Ministry's Circular No. 62/2004/TT-BTC shall not apply.

- For cases where VAT notices have been issued and VAT has been collected according to the "Particularly" section under Heading No. 8448, VAT shall not be re-calculated. For cases where VAT notices have been issued but VAT has not yet been collected, VAT shall be re-calculated for enterprises.

The General Department of Customs hereby notifies the above-said guidance to provincial/municipal Customs Departments for knowledge and implementation.

|

|

Dang Thi Binh An |