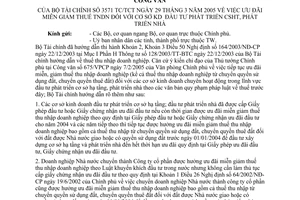

Nội dung toàn văn Official Dispatch No. 3571/TC/TCT of March 29, 2005, on business income tax exemption or reduction for business establishments engaged in infrastructure and house development investment

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 3571/TC/TCT |

Hanoi, March 29, 2005 |

To: - Ministries,

ministerial-level agencies, government-attached agencies

- Provincial/municipal People’s Committees

The Ministry of Finance has guided the implementation of Clause 2 and Clause 3, Article 50 of Decree No. 164/2003/ND-CP of December 12, 2003, in Section I, Part H of its Circular No. 128/2003/TT-BTC of December 22, 2003, providing guidance on business income tax (BIT). Pursuant to the Prime Minister’s directing opinions in the Government Office’s Official Letter No. 675/VPCP of February 7, 2005, on the continued grant of preferences regarding BIT exemption and reduction (including BIT on incomes earned from the transfer of land-use rights or land-lease rights) for business establishments engaged in infrastructure and house development investment according to previous legal documents on taxes. The Ministry of Finance hereby provides the following additional guidance:

1. For business establishments engaged in infrastructure or house development investment that have been granted investment licenses or investment preference certificates, if their investment licenses or investment preference certificates are still valid for BIT exemption or reduction for 2004 and subsequent years, they shall continue enjoying BIT exemption or reduction, including BIT on incomes earned from the transfer of the rights to use or lease land allotted by the State or land which they have the rights to use before January 1, 2004, for investment in infrastructure construction and house development, until the expiration of the preferential period stated in their investment licenses or investment preference certificates.

2. State enterprises transformed into joint-stock companies that enjoy BIT exemption or reduction under the Law on Domestic Investment Promotion without having to carry out procedures of application for investment preference certificates according to the provisions of Clause 1, Article 26 of the Government’s Decree No. 64/2002/ND-CP of June 19, 2002, on the transformation of state enterprises into joint stock companies, shall also enjoy BIT exemption or reduction for incomes earned from the transfer of the rights or use or lease land allotted by the State or land which they have the rights to use before January 1, 2004 for investment in infrastructure construction and house development.

3. For business establishments which are allotted land by the State or have the land-use rights from January 1, 2004 for investment in infrastructure construction or house development, if they are eligible for BIT exemption or reduction, they shall not be considered for BIT exemption or reduction for incomes earned from the transfer of land-use rights or land-lease rights according to the provisions of Article 15 of the Government’s Decree No. 164/2003/ND-CP of December 22, 2003.

The Ministry of Finance hereby notifies the aforesaid guidance to ministries and provincial/municipal People’s Committees for directing their units in the implementation.

|

|

Truong Chi Trung |