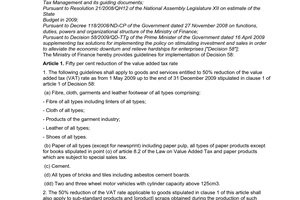

Nội dung toàn văn Decision No. 58/2009/QD-TTg April 16, 2009, adding a number of tax-related measures to implement the policy to stimulate investment and consumption, stop economic decline and remove difficulties for enterprises

|

THE PRIME

MINISTER |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 58/2009/QD-TTg |

Hanoi, April 16, 2009 |

DECISION

ADDING A NUMBER OF TAX-RELATED MEASURES TO IMPLEMENT THE POLICY TO STIMULATE INVESTMENT AND CONSUMPTION, STOP ECONOMIC DECLINE AND REMOVE DIFFICULTIES FOR ENTERPRISES

THE PRIME MINISTER

Pursuant to the December 25,

2001 Law on Organization of the Government;

Pursuant to the National Assembly's Resolution No. 21/2008/QH12 of November 8,

2008, on the 2009 state budget estimations;

Pursuant to the Ordinance on Charges and Fees;

At the proposal of the Minister of Finance,

DECIDES:

Article 1. To add a number of tax-related measures to implement the policy to stimulate investment and consumption, stop economic decline and remove difficulties for enterprises as follows:

1. To give 50% value-added tax reduction from May 1, 2009, through December 31, 2009, for the following goods and services:

a/ Fibers, fabrics and garments and footwear products of all kinds;

b/ Paper and paper products of all kinds, except for books prescribed at Point n, Clause 2, Article 8 of the Law on Value-Added Tax, and newsprint;

c/ Cement;

d/ Bricks and tiles of all kinds;

e/ Two wheeled and three-wheeled motorcycles of a cylinder capacity of over 125 cm3.

2. To extend the value-added tax payment time limit to 180 days for imported machines, equipment, spare parts and special-use means of transport in the technology lines which cannot be manufactured at home and need to be imported to create fixed assets of enterprises, applicable to all customs declarations of imports registered with customs offices from May 1, 2009, through December 31, 2009.

Machines, equipment, spare parts and special-use means of transport prescribed in this Clause are determined on the basis of differentiating them from the List of machines, equipment, special-use means of transport, construction materials, supplies and spare parts which can be manufactured at home, issued by the Ministry of Planning and Investment.

3. To give 30% reduction of payable enterprise income tax for the fourth quarter of 2008 for incomes from fiber production, weaving, dyeing, garment and footwear production.

4. To give 50% reduction of registration fee for passenger cars of under 10 seats (including the driver) from May 1, 2009, through December 31, 2009.

Article 2. This Decision takes effect on the date of its signing. The Ministry of Finance shall guide the implementation of this Decision.

Article 3. Ministers, heads of ministerial-level agencies, heads of government-attached agencies and presidents of provincial-level People's Committees shall implement this Decision.-

|

|

PRIME MINISTER |