Nội dung toàn văn Circular No. 85/2009/TT-BTC of April 28th, 2009, providing guidelines for implementation of Decision 58/2009/QD-TTg of the Prime Minister of the Government dated 16 April 2009 supplementing tax solutions for implementing the policy on stimulating investment and sales in order to alleviate the economic downturn and relieve hardships for enterprises.

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 85/2009/TT-BTC |

Hanoi, April 28th, 2009 |

CIRCULAR

PROVIDING GUIDELINES FOR IMPLEMENTATION OF DECISION 58/2009/QD-TTg OF THE PRIME MINISTER OF THE GOVERNMENT DATED 16 APRIL 2009 SUPPLEMENTING TAX SOLUTIONS FOR IMPLEMENTING THE POLICY ON STIMULATING INVESTMENT AND SALES IN ORDER TO ALLEVIATE THE ECONOMIC DOWNTURN AND RELIEVE HARDSHIPS FOR ENTERPRISES

Pursuant to the Law

on Value Added Tax and its guiding documents; Pursuant to the Law on Corporate

Income Tax and its guiding documents;

Pursuant to the Ordinance on Charges and Fees and its guiding documents;

Pursuant to the Law on Tax Management and its guiding documents;

Pursuant to Resolution 21/2008/QH12 of the National Assembly Legislature XII on

estimate of the State

Budget in 2009;

Pursuant to Decree 118/2008/ND-CP of the Government dated 27 November 2008 on

functions, duties, powers and organizational structure of the Ministry of

Finance;

Pursuant to Decision 58/2009/QD-TTg of the Prime Minister of the Government dated

16 April 2009 supplementing tax solutions for implementing the policy on stimulating

investment and sales in order to alleviate the economic downturn and relieve

hardships for enterprises ["Decision 58"];

The

Ministry of Finance hereby provides guidelines for implementation of Decision

58:

Article 1. Fifty per cent reduction of the value added tax rate

1. The following guidelines shall apply to goods and services entitled to 50% reduction of the value added tax (VAT) rate as from 1 May 2009 up to the end of 31 December 2009 stipulated in clause 1 of article 1 of Decision 58:

(a) Fibre, cloth, garments and leather footwear of all types comprising:

- Fibre of all types including linters of all types;

- Cloth of all types;

- Products of the garment industry;

- Leather of all types;

- Shoes of all types.

(b) Paper of all types (except for newsprint) including paper pulp, all types of paper products except for books stipulated in point (o) of article 8.2 of the Law on Value Added Tax and paper products which are subject to special sales tax.

(c) Cement.

(d) All types of bricks and tiles including asbestos cement boards.

(dd) Two and three wheel motor vehicles with cylinder capacity above 125cm3.

2. The 50% reduction of the VAT rate applicable to goods stipulated in clause 1 of this article shall also apply to sub-standard products and [product] scraps obtained during the production of such products.

3. The list of goods entitled to 50% reduction of the VAT rate as stated in clause 1 of this article is detailed in the List of Goods of the Preferential Import Tariff List issued with this Circular (hereinafter referred to as List of Goods).

Goods entitled to a 50% reduction of the VAT rate are marked "x" in the column "Goods entitled to reduction" on the List of Goods.

The 50% reduction of the VAT rate applicable to goods on the additional list shall apply uniformly to the commercial business, processing, production or import stage.

4. When preparing an invoice for sale of goods and services eligible for the VAT reduction, in the line reserved for the VAT rate, the following should be recorded: "10% by 50%", the amount of VAT; and the total amount which the purchaser must pay.

Where an enterprise uses self-printed invoices, 5% should be recorded in the line for the VAT rate; and in the line for goods and services, in addition to the name of the goods or services provided, the following line should also be recorded: goods eligible for 50% reduction of the VAT rate.

Example:

Company A sells 100 tons of cement to Company B pursuant to a contract signed between the parties, with a price of 1,300,000 VND per ton excluding VAT. Cement is eligible for the 50% reduction of VAT rate. Accordingly, Company A must record the following when it prepares its VAT invoice for delivery of cement to Company B during the period 1 May 2009 up to end of 31 December 2009:

In the column for goods and services, record "cement".

The price to be recorded shall be 1,300,000 dong X 100 tons = 130,000,000 dong. VAT rate: "10% by 50%".

VAT amount: 6,500,000 dong.

Total price to be paid: 136,500,000 dong.

Based on this VAT invoice, Company A shall declare output VAT, and Company B shall declare creditable input VAT at the amount of tax recorded in the invoice at 6,500,000 dong.

When declaring VAT, in the list of invoices and source documents for purchased goods or services (Form No. 1-1-GTGT issued with Circular 60/2007/TT-BTC) the taxpayer shall declare [VAT] in the line for goods and services subject to 5% tax rate (the following must be clearly recorded in the column "Note" of the list: "50% reduction has been made").

5. Entities entitled to apply 50% reduction of the VAT rate shall include family households and individuals engaged in production and business of goods eligible for 50% reduction of the VAT rate as stipulated in this article.

Any family household or individual who pays VAT on the basis of a fixed level of turnover or produces and trades various kinds of goods or services including those which are eligible and those which are ineligible for 50% reduction of the VAT rate shall be required to make a separate declaration of turnover of each kind of goods entitled to the VAT reduction (in item 3 of the sample form declaration No. 1-THKH issued with Circular 60/2007/TT-BTC on turnover of goods and services subject to VAT), the following must be clearly recorded: turnover of goods eligible for 50% reduction of the VAT rate. Where the family household or individual conducting business is unable to determine separate turnover of each kind of goods stipulated in this article, such goods shall be ineligible for 50% reduction of the VAT rate.

Article 2. Extension of time-limit for payment of VAT levied on imported goods

1. The time-limit for VAT payment shall be extended for up to 180 days applicable to consignments of imported goods being machinery, equipment, replacement accessories and specialized means of transportation forming part of a technological line of a type not yet able to be produced domestically, and must be imported to form fixed assets for enterprises.

The extended period for tax payment shall be continuously calculated from the date of registration of the customs declaration, including public holidays as stipulated by law and weekends, and shall apply to declarations of imported goods registered with the customs office from 1 May 2009 up to the end of 31 December 2009. If the last day of the period for tax payment is a holiday as stipulated by law, then such last day shall be extended until the next day after the holiday.

2. Machinery, equipment, replacement accessories and specialized means of transportation stipulated in clause 1 of this article must not fall on the list issued by the Ministry of Planning and Investment of machinery, equipment, specialized means of transportation, building materials, supplies and spare parts able to be produced domestically.

In cases where a production or business establishment imports a complete production line of machinery and equipment eligible for the extension of time-limit for VAT payment in accordance with the guidelines in clause 1 of this article, but in the complete production line there is machinery or equipment which is able to be produced domestically, then the entire complete production line of machinery and equipment shall be eligible for the extension of time-limit for VAT payment.

Importers must present the following file to the customs office in order to determine that goods are eligible for the extension of time-limit for VAT payment at the import stage:

- Contract for importation;

Where import is through an authorized agent, there must also be the contract authorizing the importation.

Where the establishment is the successful tenderer for supply of goods to entity/entities to be used for the purposes referred to in this article, there must also be a notice of successful tenderer and contract of sale to enterprise/s in accordance with the tendering results.

Where a finance leasing company imports for financial leasing, there must also be the finance lease contract.

- Certification of the director of the enterprise that the goods are imported to form fixed assets.

3. In a case where the time-limit for payment of tax levied on goods stipulated in clause 1 of this article has been extended and the use purpose (for example, for disposal or liquidation) of such goods is changed during the extended period, VAT must be declared and paid at the import stage eligible for extension to the customs office at which the customs declaration was registered. The date of calculation of VAT shall be the date of change of use purpose.

4. Any enterprise importing goods stipulated in clause 1 of this article may choose to pay VAT in one installment with respect to the amount of VAT on imported goods eligible for the extension of time- limit for tax payment or may pay tax by installments but the date of payment of the last instalment must not be after the extended period.

Enterprises shall not, within 180 days from the date of registration of the customs declaration, be fined for delay in paying the amount of VAT to be paid by instalments.

Article 3. Reduction of corporate income tax

1. An enterprise shall be entitled to a 30% reduction of the corporate income tax (CIT) amount payable for the fourth quarter of year 2008 with respect to its income from activities of production and processing of fibre, weaving, dyeing, sewing and production of leather and shoes (hereinafter collectively referred to as activities entitled to tax reduction).

The activities entitled to tax reduction shall provide a basis for determining tax reduction pursuant to provisions of applicable laws on classification of national economic sectors.

2. Method of determining amount of CIT to be reduced

The amount of CIT to be reduced for the fourth quarter of year 2008 shall equal 30% of the CIT payable on income from the activities entitled to tax reduction arising in the quarter. The amount of CIT applicable to income from the activities entitled to tax reduction in the fourth quarter of year 2008 shall provide a basis for determining the amount of tax to be reduced and an enterprise shall be entitled to choose one of the following methods to determine the amount of CIT to be reduced:

- Such amount may be determined in accordance with the results of business accounting by the enterprise;

- Such amount may be determined as the total amount of CIT payable in year 2008 for income from the activities entitled to tax reduction, divided by four.

If the enterprise does not maintain separate accounting of income from the activities entitled to CIT reduction, the amount of CIT eligible for the reduction shall be determined as a percentage, namely revenue from the activities entitled to tax reduction over total revenue from all business activities of the enterprise.

With respect to an enterprise engaged in production of shoes and also in production of sandals, income from the activities entitled to tax reduction shall include income from production of sandals.

In the case of an enterprise currently entitled to CIT incentives in accordance with the law on corporate income tax, then the figure to be reduced by 30% shall be the remaining CIT figure after deducting the amount of preferential CIT pursuant to the law on CIT.

The fourth quarter of year 2008 stipulated in this article shall be deemed to comprise October, November, and December of year 2008.

3. Order and procedures for implementation

The 30% reduction of CIT for the fourth quarter of year 2008 applicable to income from the activities entitled to tax reduction shall comply with the guidelines in Section II of Circular 03-2009-TT-BTC of the Ministry of Finance dated 13 January 2009.

An enterprise which has declared and paid CIT into the State Budget for year 2008 and has finalized its tax, shall prepare a file for additional and amended declarations in accordance with Circular 60/2007/TT-BTC dated 14 June 2007 in order to reduce by 30% the CIT amount payable for the fourth quarter of year 2008, and the CIT amount for the fourth quarter of year 2008 eligible for the reduction shall be deducted from the amount of tax payable for the next tax period or shall be refunded in accordance with regulations.

4. The reduction of CIT pursuant to the guidelines in this Circular shall apply to enterprises which have implemented the accounting regime on invoices and source documents and have registered to pay tax in accordance with their declarations.

Article 4. Reduction of registration fees

1. A 50% reduction of the registration fee applicable to passenger vehicles with less than 10 seats (including the driver's seat) shall apply to files for declaration of registration fees paid to the tax office as from 1 May 2009 up to the end of 31 December 2009, irrespective of whether it is the first registration or a subsequent registration.

2. Vehicles entitled to the 50% reduction of the registration fee stipulated in this article shall not include three wheel motors and vehicles designed to carry both passengers and cargo.

3. Declaration of registration fees

In item 2 of Part B "Registration fee payable (in dong)" of the declaration of registration fees (Form 2- LPTB issued with Circular 60/2007/TT-BTC of the Ministry of Finance dated 14 June 2007), the following must be added: "Equal to the value of the asset (applicable to passenger vehicles with less than 10 seats including the driver's seat) used to calculate the registration fee multiplied by the registration fee rate (%) and 50%".

Article 5. Organization of implementation and effectiveness

1. This Circular shall be of full force and effect as from 1 May 2009 up to the end of 31 December 2009.

2. Any difficulties or problems arising during implementation should be promptly reported to the Ministry of Finance for prompt resolution.

|

|

FOR

THE MINISTER OF FINANCE |

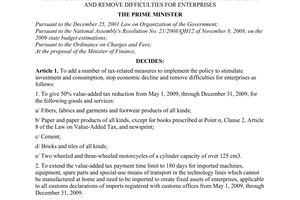

VALUE ADDED TAX RATES IN ACCORDANCE WITH THE

LIST OF GOODS1

(Issued with Circular 85/2009/TT-BTC of the Ministry of Finance dated 28

April 2009)

|

Code |

Description |

Tax Rate (%) |

Goods entitled to reduction |

|||

|

2523 |

|

|

|

Portland cement, aluminous cement, slag cement, super sulphate cement and similar hydraulic cements, whether or not coloured or in the form of clinkers. |

|

|

|

3816 |

|

|

|

Refractory cements, mortars, concretes and similar compositions, other than products of heading 38.01. |

|

|

|

|

|

|

|

|

|

|

|

41.04 |

|

|

|

Tanned or crust hides and skins of bovine (including buffalo) or equine animals, without hair on, whether or not split, but not further prepared. |

|

|

|

|

|

|

|

|

|

|

|

41.05 |

|

|

|

Tanned or crust skins of sheep or lambs, without wool on, whether or not split, but not further prepared. |

|

|

|

|

|

|

|

|

|

|

|

41.06 |

|

|

|

Tanned or crust hides and skins of other animals, without wool or hair on, whether or not split, but not further prepared. |

|

|

|

|

|

|

|

|

|

|

|

41.07 |

|

|

|

Leather further prepared after tanning or crusting, including parchment-dressed leather, of bovine (including buffalo) or equine animals, without hair on, whether or not split, other than leather of heading 41.14. |

|

|

|

|

|

|

|

|

|

|

|

4112 |

00 |

00 |

00 |

Leather further prepared after tanning or crusting, including parchment-dressed leather, of sheep or lamb, without wool on, whether or not split, other than leather of heading 41.14. |

10 |

x |

|

|

|

|

|

|

|

|

|

41.13 |

|

|

|

Leather further prepared after tanning or crusting, including parchment-dressed leather, of other animals, without wool or hair on, whether or not split, other than leather of heading 41.14. |

|

|

|

|

|

|

|

|

|

|

|

41.14 |

|

|

|

Chamois (including combination chamois) leather; patent leather and patent laminated leather; metallised leather. |

|

|

|

|

|

|

|

|

|

|

|

41.15 |

|

|

|

Composition leather with a basis of leather or leather fibre, in slabs, sheets or strip, whether or not in rolls; parings and other waste of leather or of composition leather, not suitable for the manufacture of leather articles; leather dust, powder and flour. |

|

|

|

42.03 |

|

|

|

Articles of apparel and clothing accessories, of leather or of composition leather. |

|

|

|

42.05 |

|

|

|

Other articles of leather or of composition leather. |

|

|

|

43.02 |

|

|

|

Tanned or dressed fur skins (including heads, tails, paws and other pieces or cuttings), unassembled, or assembled (without the addition of other materials) other than those of heading 43.03. |

|

|

|

43.03 |

|

|

|

Articles of apparel, clothing accessories and other articles of fur skin. |

|

|

|

43.04 |

|

|

|

Artificial fur and articles thereof. |

|

|

|

4701 |

00 |

00 |

00 |

Mechanical wood pulp. |

10 |

x |

|

4702 |

00 |

00 |

00 |

Chemical wood pulp, dissolving grades. |

10 |

x |

|

47.03 |

|

|

|

Chemical wood pulp, soda or sulphate, ther than dissolving grades. |

|

|

|

|

|

|

|

|

|

|

|

47.04 |

|

|

|

Chemical wood pulp, sulphite, other than dissolving grades. |

|

|

|

|

|

|

|

|

|

|

|

4705 |

00 |

00 |

00 |

Wood pulp obtained by a combination of mechanical and chemical pulping processes. |

10 |

x |

|

|

|

|

|

|

|

|

|

47.06 |

|

|

|

Pulps of fibres derived from recovered (waste and scrap) paper or paperboard or of other fibrous cellulose material. |

|

|

|

|

|

|

|

|

|

|

|

47.07 |

|

|

|

Recovered (waste and scrap) paper or paperboard. |

|

|

|

48.02 |

|

|

|

Uncoated paper and paperboard, of a kind used for writing, printing or other graphic purposes, and non perforated punch-cards and punch tape paper, in rolls or rectangular (including square) sheets, of any size, other than paper of |

|

|

|

|

|

|

|

heading 48.01 or 48.03; paper and paperboard. |

|

|

|

|

|

|

|

|

|

|

|

48.03 |

|

|

|

Toilet or facial tissue stock, towel or napkin stock and similar paper of a kind used for household or sanitary purposes, cellulose wadding and webs of cellulose fibres, whether or not creped, crinkled, embossed, perforated, surface-coloured, surface-decorated or printed, in rolls or sheets. |

|

|

|

|

|

|

|

|

|

|

|

48.04 |

|

|

|

Uncoated kraft paper and paperboard, in rolls or sheets, other than that of heading 48.02 or 48.03. |

|

|

|

|

|

|

|

|

|

|

|

48.05 |

|

|

|

Other uncoated paper and paperboard, in rolls or sheets, not further worked or processed than as specified in Note 3 to this Chapter. |

|

|

|

|

|

|

|

|

|

|

|

48.06 |

|

|

|

Vegetable parchment, greaseproof papers, tracing papers and glassine and other glazed transparent or translucent papers, in rolls or sheets. |

|

|

|

|

|

|

|

|

|

|

|

4807 |

00 |

00 |

00 |

Composite paper and paperboard (made by sticking flat layers of paper or paperboard together with an adhesive), not surface-coated or impregnated, whether or not internally reinforced, in rolls or sheets. |

10 |

x |

|

|

|

|

|

|

|

|

|

48.08 |

|

|

|

Paper and paperboard, corrugated (with or without glued flat surface sheets), creped, crinkled, embossed or perforated, in rolls or sheets, other than paper of the kind described in heading 48.03. |

|

|

|

|

|

|

|

|

|

|

|

48.09 |

|

|

|

Carbon paper, self-copy paper and other copying or transfer papers (including coated or impregnated paper for duplicator stencils or offset plates), whether or not printed, in rolls or sheets. |

|

|

|

|

|

|

|

|

|

|

|

48.10 |

|

|

|

Paper and paperboard, coated on one or both sides with kaolin (China clay) or other inorganic substances, with or without a binder, and with no other coating, whether or not |

|

|

|

|

|

|

|

Surface- coloured, surface-decorated or printed, in rolls or rectangular (including square) sheets, of any size. |

|

|

|

|

|

|

|

|

|

|

|

48.11 |

|

|

|

Paper, paperboard, cellulose wadding and webs of cellulose fibres, coated, impregnated, covered, surface-coloured, surface-decorated or printed, in rolls or rectangular (including square) sheets, of any size, other than goods of the kind described in heading 48.03, 48.09 or 48.10. |

|

|

|

|

|

|

|

|

|

|

|

4812 |

00 |

00 |

00 |

Filter blocks, slabs and plates, of paper pulp. |

10 |

x |

|

|

|

|

|

|

|

|

|

48.13 |

|

|

|

Cigarette paper, whether or not cut to size or in the form of booklets or tubes. |

|

|

|

|

|

|

|

|

|

|

|

48.14 |

|

|

|

Wallpaper and similar wall coverings;window transparencies of paper. |

|

|

|

|

|

|

|

|

|

|

|

48.16 |

|

|

|

Carbon paper, self-copy paper and other copying or transfer papers (other than those of heading 48.09), duplicator stencils and offset plates, of paper, whether or not put up in boxes. |

|

|

|

|

|

|

|

|

|

|

|

48.17 |

|

|

|

Envelopes, letter cards, plain postcards and correspondence cards, of paper or paperboard; boxes, pouches, wallets and writing compendiums, of paper or paperboard, containing an assortment of paper stationery. |

|

|

|

|

|

|

|

|

|

|

|

48.18 |

|

|

|

Toilet paper and similar paper, cellulose wadding or webs of cellulose fibres, of a kind used for household or sanitary purposes, in rolls of a width not exceeding 36 cm, or cut to size or shape; handkerchiefs, cleansing tissues, towels, tablecloths, serviettes, napkins for babies, tampons, bed sheets and similar household, sanitary or hospital articles, articles of apparel and clothing accessories, of paper pulp, paper, cellulose wadding or webs of cellulose fibres. |

|

|

|

|

|

|

|

|

|

|

|

48.19 |

|

|

|

Cartons, boxes, cases, bags and other packing containers, of paper, paperboard, cellulose wadding or webs of cellulose fibres; box files, letter trays, and similar articles, of paper or paperboard of a kind used in offices, shops or the like. |

|

|

|

|

|

|

|

|

|

|

|

48.20 |

|

|

|

Registers, account books, note books, order books, receipt books, letter pads, memorandum pads, diaries and similar articles, exercise books, blotting-pads, binders (loose-leaf or other), folders, file covers, manifold business forms, interleaved carbon sets and other articles of stationery, of paper or paperboard; albums for samples or for collections and book covers, of paper or paperboard. |

|

|

|

|

|

|

|

|

|

|

|

48.21 |

|

|

|

Paper or paperboard labels of all kinds, whether or not printed. |

|

|

|

|

|

|

|

|

|

|

|

48.22 |

|

|

|

Bobbins, spools, cops and similar supports of paper pulp, paper or paperboard (whether or not perforated or hardened). |

|

|

|

|

|

|

|

|

|

|

|

48.23 |

|

|

|

Other paper, paperboard, cellulose wadding and webs of cellulose fibres, cut to size or shape; other articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibres. |

|

|

|

49.06 |

|

|

|

Plans and drawings for architectural, engineering, industrial, commercial, topographical or similar purposes, being originals drawn by hand; hand-written texts; photographic reproductions on sensitised paper and carbon copies of the foregoing. |

|

|

|

5004 |

00 |

00 |

00 |

Silk yarn (other than yarn spun from silk waste) not put up for retail sale. |

10 |

x |

|

5005 |

00 |

00 |

00 |

Yarn spun from silk waste, not put up for retail sale. |

10 |

x |

|

5006 |

00 |

00 |

00 |

Silk yarn and yarn spun from silk waste, put up for retail sale; silk-worm gut. |

10 |

x |

|

50.07 |

|

|

|

Woven fabrics of silk or of silk waste. |

|

|

|

51.06 |

|

|

|

Yarn of carded wool, not put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

51.07 |

|

|

|

Yarn of combed wool, not put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

51.08 |

|

|

|

Yarn of fine animal hair (carded or combed), not put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

51.09 |

|

|

|

Yarn of wool or of fine animal hair, put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

5110 |

00 |

00 |

00 |

Yarn of coarse animal hair or of horsehair (including gimped horsehair yarn), whether or not put up for retail sale. |

10 |

x |

|

|

|

|

|

|

|

|

|

51.11 |

|

|

|

Woven fabrics of carded wool or of carded fine animal hair. |

|

|

|

|

|

|

|

|

|

|

|

51.12 |

|

|

|

Woven fabrics of combed wool or of combed fine animal hair. |

|

|

|

|

|

|

|

|

|

|

|

5113 |

00 |

00 |

00 |

Woven fabrics of coarse animal hair or of horsehair. |

10 |

x |

|

52.05 |

|

|

|

Cotton yarn (other than sewing thread), containing 85% or more by weight of cotton, not put up for retail sale. |

|

|

|

52.06 |

|

|

|

Cotton yarn (other than sewing thread), containing less than 85% by weight of cotton, not put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

52.07 |

|

|

|

Cotton yarn (other than sewing thread) put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

52.08 |

|

|

|

Woven fabrics of cotton, containing 85% or more by weight of cotton, weighing not more than 200 g/m2. |

|

|

|

|

|

|

|

|

|

|

|

52.09 |

|

|

|

Woven fabrics of cotton, containing 85% or more by weight of cotton, weighing more than 200 g/m2. |

|

|

|

|

|

|

|

|

|

|

|

52.10 |

|

|

|

Woven fabrics of cotton, containing less than 85% by weight of cotton, mixed mainly or solely with man-made fibres, weighing not more than 200 g/m2. |

|

|

|

|

|

|

|

|

|

|

|

52.11 |

|

|

|

Woven fabrics of cotton, containing less than 85% by weight of cotton, mixed mainly or solely with man-made fibres, weighing more than 200 g/m2. |

|

|

|

|

|

|

|

|

|

|

|

52.12 |

|

|

|

Other woven fabrics of cotton. |

|

|

|

53.01 |

|

|

|

Flax, raw or processed but not spun; flax tow and waste (including yarn waste and garneted stock). |

|

|

|

|

|

|

|

|

|

|

|

53.08 |

|

|

|

Yarn of other vegetable textile fibres; paper yarn. |

|

|

|

|

|

|

|

|

|

|

|

53.09 |

|

|

|

Woven fabrics of flax. |

|

|

|

|

|

|

|

|

|

|

|

53.10 |

|

|

|

Woven fabrics of jute or of other textile bast fibres of heading 53.03. |

|

|

|

|

|

|

|

|

|

|

|

5311 |

00 |

00 |

00 |

Woven fabrics of other vegetable textile fibres; woven fabrics of paper yarn. |

10 |

x |

|

54.02 |

|

|

|

Synthetic filament yarn (other than sewing thread), not put up for retail sale, including synthetic monofilament of less than 67 decitex. |

|

|

|

|

|

|

|

|

|

|

|

54.03 |

|

|

|

Artificial filament yarn (other than sewing thread), not put up for retail sale, including artificial monofilament of less than 67 decitex. |

|

|

|

|

|

|

|

|

|

|

|

54.04 |

|

|

|

Synthetic monofilament of 67 decitex or more and of which no cross-sectional dimension exceeds 1 mm; strip and the like (for example, artificial straw) of synthetic textile materials of an apparent width not exceeding 5 mm. |

|

|

|

|

|

|

|

|

|

|

|

5405 |

00 |

00 |

00 |

Artificial monofilament of 67 decitex or more and of which no cross-sectional dimension exceeds 1 mm; strip and the like (for example, artificial straw) of artificial textile materials of an apparent width not exceeding 5 mm. |

10 |

x |

|

|

|

|

|

|

|

|

|

5406 |

00 |

00 |

00 |

Man-made filament yarn (other than sewing thread), put up for retail sale. |

10 |

x |

|

|

|

|

|

|

|

|

|

54.07 |

|

|

|

Woven fabrics of synthetic filament yarn, including woven fabrics obtained from materials of heading 54.04. |

|

|

|

54.08 |

|

|

|

Woven fabrics of artificial filament yarn, including woven fabrics obtained from materials of heading 54.05. |

|

|

|

55.01 |

|

|

|

Synthetic filament tow. |

|

|

|

5502 |

00 |

00 |

00 |

Artificial filament tow. |

10 |

x |

|

55.03 |

|

|

|

Synthetic staple fibres, not carded, combed or otherwise processed for spinning. |

|

|

|

55.04 |

|

|

|

Artificial staple fibres, not carded, combed or otherwise processed for spinning. |

|

|

|

55.05 |

|

|

|

Waste (including noils, yarn waste and garneted stock) of man-made fibres. |

|

|

|

55.06 |

|

|

|

Synthetic staple fibres, carded, combed or otherwise processed for spinning. |

|

|

|

5507 |

00 |

00 |

00 |

Artificial staple fibres, carded, combed or otherwise processed for spinning. |

10 |

x |

|

55.09 |

|

|

|

Yarn (other than sewing thread) of synthetic staple fibres, not put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

55.10 |

|

|

|

Yarn (other than sewing thread) of artificial staple fibres, not put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

55.11 |

|

|

|

Yarn (other than sewing thread) of man- made staple fibres, put up for retail sale. |

|

|

|

|

|

|

|

|

|

|

|

55.12 |

|

|

|

Woven fabrics of synthetic staple fibres, containing 85% or more by weight of synthetic staple fibres. |

|

|

|

|

|

|

|

|

|

|

|

55.13 |

|

|

|

Woven fabrics of synthetic staple fibres, containing less than 85% by weight of such fibres, mixed mainly or solely with cotton, of a weight not exceeding 170 g/m2. |

|

|

|

55.14 |

|

|

|

Woven fabrics of synthetic staple fibres, containing less than 85% by weight of such fibres, mixed mainly or solely with cotton, of a weight exceeding 170 g/m2. |

|

|

|

|

|

|

|

|

|

|

|

55.15 |

|

|

|

Other woven fabrics of synthetic staple fibres. |

|

|

|

55.16 |

|

|

|

Woven fabrics of artificial staple fibres. |

|

|

|

56.04 |

|

|

|

Rubber thread and cord, textile covered; textile yarn, and strip and the like of heading 54.04 or 54.05, impregnated, coated, covered or sheathed with rubber or plastics. |

|

|

|

5605 |

00 |

00 |

00 |

Metallised yarn, whether or not gimped, being textile yarn, or strip or the like of heading 54.04 or 54.05, combined with metal in the form of thread, strip or powder or covered with metal. |

10 |

x |

|

|

|

|

|

|

|

|

|

5606 |

00 |

00 |

00 |

Gimped yarn, and strip and the like of heading 54.04 or 54.05, gimped (other than those of heading 56.05 and gimped horsehair yarn); chenille yarn (including flock chenille yarn); loop wale-yarn. |

10 |

x |

|

56.07 |

|

|

|

Twine, cordage, ropes and cables, whether or not plaited or braided and whether or not impregnated, coated, covered or sheathed with rubber or plastics. |

|

|

|

58.01 |

|

|

|

Woven pile fabrics and chenille fabrics, other than fabrics of heading 58.02 or 58.06. |

|

|

|

58.02 |

|

|

|

Terry towelling and similar woven terry fabrics, other than narrow fabrics of heading 58.06; tufted textile fabrics, other than products of heading 57.03. |

|

|

|

58.03 |

|

|

|

Gauze, other than narrow fabrics of heading 58.06. |

|

|

|

58.04 |

|

|

|

Tulles and other net fabrics, not including woven, knitted or crocheted fabrics; lace in the piece, in strips or in motifs, other than fabrics of headings 60.02 to 60.06. |

|

|

|

58.06 |

|

|

|

Narrow woven fabrics, other than goods of heading 58.07; narrow fabrics consisting of warp without weft assembled by means of an adhesive (bolducs). |

|

|

|

5809 |

00 |

00 |

00 |

Woven fabrics of metal thread and woven fabrics of metallised yarn of heading 56.05, of a kind used in apparel, as furnishing fabrics or for similar purposes, not elsewhere specified or included. |

10 |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

Chapter 59 Impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use |

|

|

|

|

|

|

|

|

|

|

|

59.01 |

|

|

|

Textile fabrics coated with gum or amylaceous substances, of a kind used for the outer covers of books or the like; tracing cloth; prepared painting canvas; buckram and similar stiffened textile fabrics of a kind used for hat foundations. |

|

|

|

|

|

|

|

|

|

|

|

59.02 |

|

|

|

Tyre cord fabric of high tenacity yarn of nylon or other polyamides, polyesters or viscose rayon. |

|

|

|

|

|

|

|

|

|

|

|

59.03 |

|

|

|

Textile fabrics impregnated, coated, covered or laminated with plastics, other than those of heading 59.02. |

|

|

|

|

|

|

|

|

|

|

|

59.04 |

|

|

|

Linoleum, whether or not cut to shape; floor coverings consisting of a coating or covering applied on a textile backing, whether or not cut to shape. |

|

|

|

|

|

|

|

|

|

|

|

5905 |

00 |

00 |

00 |

Textile wall coverings. |

10 |

x |

|

|

|

|

|

|

|

|

|

59.06 |

|

|

|

Rubberised textile fabrics, other than those of heading 59.02. |

|

|

|

|

|

|

|

|

|

|

|

59.07 |

|

|

|

Textile fabrics otherwise impregnated, coated or covered; painted canvas being theatrical scenery, studio back-cloths or the like. |

|

|

|

|

|

|

|

|

|

|

|

59.11 |

|

|

|

Textile products and articles, for technical uses, specified in Note 7 to this Chapter. |

|

|

|

60.01 |

|

|

|

Pile fabrics, including “long pile” fabrics and terry fabrics, knitted or crocheted. |

|

|

|

60.04 |

|

|

|

Knitted or crocheted fabrics of a width exceeding 30 cm, containing by weight 5% or more of elastomeric yarn or rubber thread, other than those of heading 60.01. |

|

|

|

|

|

|

|

|

|

|

|

60.05 |

|

|

|

Warp knit fabrics (including those made on galloon knitting machines), other than those of headings 60.01 to 60.04. |

|

|

|

60.06 |

|

|

|

Other knitted or crocheted fabrics. |

|

|

|

61.01 |

|

|

|

Men’s or boys’ overcoats, car-coats, capes, cloaks, anoraks (including ski- jackets), wind-cheaters, wind-jackets |

|

|

|

|

|

|

|

And similar articles, knitted or crocheted, other than those of heading 61.03. |

|

|

|

|

|

|

|

|

|

|

|

61.02 |

|

|

|

Women’s or girls’ overcoats, car-coats, capes, cloaks, anoraks (including ski- jackets), wind-cheaters, wind-jackets and similar articles, knitted or crocheted, other than those of heading 61.04. |

|

|

|

|

|

|

|

|

|

|

|

61.03 |

|

|

|

Men’s or boys’ suits, ensembles, jackets, blazers, trousers, bib and brace overalls, breeches and shorts (other than swimwear), knitted or crocheted. |

|

|

|

61.04 |

|

|

|

Women’s or girls’ suits, ensembles, jackets, blazers, dresses, skirts, trousers, bib and brace overalls, breeches and shorts (other than swimwear), knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.05 |

|

|

|

Men’s or boys’ shirts, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.06 |

|

|

|

Women’s or girls’ blouses, shirts and shirt-blouses, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.07 |

|

|

|

Men’s or boys’ underpants, briefs, nightshirts, pyjamas, bathrobes, dressing gowns and similar articles, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.08 |

|

|

|

Women’s or girls’ slips, petticoats, briefs, panties, nightdresses, pyjamas, négligés, bathrobes, dressing gowns and similar articles, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.09 |

|

|

|

T-shirts, singlets and other vests, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.10 |

|

|

|

Jerseys, pullovers, cardigans, waistcoats and similar articles, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.11 |

|

|

|

Babies’ garments and clothing accessories, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.12 |

|

|

|

Track suits, ski suits and swimwear, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.13 |

|

|

|

Garments, made up of knitted or crocheted fabrics of heading 59.03, 59.06 or 59.07. |

|

|

|

|

|

|

|

|

|

|

|

61.14 |

|

|

|

Other garments, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.15 |

|

|

|

Panty hose, tights, stockings, socks and other hosiery, including graduated compression hosiery (for example, stockings for varicose veins) and footwear without applied soles, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.16 |

|

|

|

Gloves, mittens and mitts, knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

61.17 |

|

|

|

Other made up clothing accessories, knitted or crocheted; knitted or crocheted parts of garments or of clothing accessories. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chapter 62 Articles of apparel and clothing accessories, not knitted or crocheted |

|

|

|

|

|

|

|

|

|

|

|

62.01 |

|

|

|

Men’s or boys’ overcoats, car-coats, capes, cloaks, anoraks (including ski- jackets), wind-cheaters, wind-jackets and similar articles, other than those of heading 62.03. |

|

|

|

|

|

|

|

|

|

|

|

62.02 |

|

|

|

Women’s or girls’ overcoats, car-coats, capes, cloaks, anoraks (including ski- jackets), wind-cheaters, wind-jackets and similar articles, other than those of heading 62.04. |

|

|

|

|

|

|

|

|

|

|

|

62.03 |

|

|

|

Men’s or boys’ suits, ensembles, jackets, blazers, trousers, bib and brace overalls, breeches and shorts (other than swimwear). |

|

|

|

|

|

|

|

|

|

|

|

62.04 |

|

|

|

Women’s or girls’ suits, ensembles, jackets, blazers, dresses, skirts, divided skirts, trousers, bib and brace overalls, |

|

|

|

|

|

|

|

Breeches and shorts (other than swimwear). |

|

|

|

|

|

|

|

|

|

|

|

62.05 |

|

|

|

Men’s or boys’ shirts. |

|

|

|

|

|

|

|

|

|

|

|

62.06 |

|

|

|

Women’s or girls’ blouses, shirts and shirt-blouses. |

|

|

|

|

|

|

|

|

|

|

|

62.07 |

|

|

|

Men’s or boys’ singlets and other vests, underpants, briefs, nightshirts, pyjamas, bathrobes, dressing gowns and similar articles. |

|

|

|

|

|

|

|

|

|

|

|

62.08 |

|

|

|

Women’s or girls’ singlets and other vests, slips, petticoats, briefs, panties, nightdresses, pyjamas, négligés, bathrobes, dressing gowns and similar articles. |

|

|

|

|

|

|

|

|

|

|

|

62.09 |

|

|

|

Babies’ garments and clothing accessories. |

|

|

|

|

|

|

|

|

|

|

|

62.10 |

|

|

|

Garments, made up of fabrics of heading 56.02, 56.03, 59.03, 59.06 or 59.07. |

|

|

|

|

|

|

|

|

|

|

|

62.11 |

|

|

|

Track suits, ski suits and swimwear; other garments. |

|

|

|

|

|

|

|

|

|

|

|

62.12 |

|

|

|

Brassières, girdles, corsets, braces, suspenders, garters and similar articles and parts thereof, whether or not knitted or crocheted. |

|

|

|

|

|

|

|

|

|

|

|

62.13 |

|

|

|

Handkerchiefs. |

|

|

|

|

|

|

|

|

|

|

|

62.14 |

|

|

|

Shawls, scarves, mufflers, mantillas, veils and the like. |

|

|

|

|

|

|

|

|

|

|

|

62.15 |

|

|

|

Ties, bow ties and cravats. |

|

|

|

|

|

|

|

|

|

|

|

62.16 |

|

|

|

Gloves, mittens and mitts. |

|

|

|

|

|

|

|

Chapter 63 Other made up textile articles; sets; worn clothing and worn textile articles; rags |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUB-CHAPTER I |

|

|

|

|

|

|

|

OTHER MADE UP TEXTILE ARTICLES |

|

|

|

|

|

|

|

|

|

|

|

63.01 |

|

|

|

Blankets and travelling rugs. |

|

|

|

|

|

|

|

|

|

|

|

63.02 |

|

|

|

Bed linen, table linen, toilet linen and kitchen linen. |

|

|

|

|

|

|

|

|

|

|

|

63.03 |

|

|

|

Curtains (including drapes) and interior blinds; curtain or bed valances. |

|

|

|

|

|

|

|

|

|

|

|

63.04 |

|

|

|

Other furnishing articles, excluding those of heading 94.04. |

|

|

|

|

|

|

|

|

|

|

|

63.05 |

|

|

|

Sacks and bags, of a kind used for the packing of goods. |

|

|

|

63.06 |

|

|

|

Tarpaulins, awnings and sunblind's; tents; sails for boats, sailboards or land craft; camping goods. |

|

|

|

|

|

|

|

|

|

|

|

63.07 |

|

|

|

Other made up articles, including dress patterns. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUB-CHAPTER II |

|

|

|

|

|

|

|

SETS |

|

|

|

|

|

|

|

|

|

|

|

6308 |

00 |

00 |

00 |

Sets consisting of woven fabric and yarn, whether or not with accessories, for making up into rugs, tapestries, embroidered table cloths or serviettes, or similar textile articles, put up in packing for retail sale. |

10 |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

SUB-CHAPTER III |

|

|

|

|

|

|

|

WORN CLOTHING AND WORN TEXTILE ARTICLES; RAGS |

|

|

|

|

|

|

|

|

|

|

|

6309 |

00 |

00 |

00 |

Worn clothing and other worn articles. |

10 |

x |

|

|

|

|

|

|

|

|

|

63.10 |

|

|

|

Used or new rags, scrap twine, cordage, rope and cables and worn out articles of twine, cordage, rope or cables, of textile materials. |

|

|

|

|

|

|

|

|

|

|

|

64.01 |

|

|

|

Waterproof footwear with outer soles and uppers of rubber or of plastics, the uppers of which are neither fixed to the sole nor assembled by stitching, riveting, nailing, screwing, plugging or similar processes. |

|

|

|

|

|

|

|

|

|

|

|

64.02 |

|

|

|

Other footwear with outer soles and uppers of rubber or plastics. |

|

|

|

64.03 |

|

|

|

Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather. |

|

|

|

|

|

|

|

|

|

|

|

64.04 |

|

|

|

Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of textile materials. |

|

|

|

64.05 |

|

|

|

Other footwear. |

|

|

|

|

|

|

|

|

|

|

|

64.06 |

|

|

|

Parts of footwear (including uppers whether or not attached to soles other than outer soles); removable in-soles, heel cushions and similar articles; gaiters, leggings and similar articles, and parts thereof. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chapter 65 Headgear and parts thereof |

|

|

|

|

|

|

|

|

|

|

|

6501 |

00 |

00 |

00 |

Hat-forms, hat bodies and hoods of felt, neither blocked to shape nor with made brims; plateau and manchons (including slit manchons), of felt. |

10 |

x |

|

|

|

|

|

|

|

|

|

6504 |

00 |

00 |

00 |

Hats and other headgear, plaited or made by assembling strips of any material, whether or not lined or trimmed. |

10 |

- |

|

|

|

|

|

|

|

|

|

65.05 |

|

|

|

Hats and other headgear, knitted or crocheted, or made up from lace, felt or other textile fabric, in the piece (but not in strips), whether or not lined or trimmed; hair-nets of any material, whether or not lined or trimmed. |

|

|

|

|

|

|

|

|

|

|

|

65.06 |

|

|

|

Other headgear, whether or not lined or trimmed. |

|

|

|

|

|

|

|

|

|

|

|

6808 |

00 |

00 |

00 |

Panels, boards, tiles, blocks and similar articles of vegetable fibre, of straw or of shavings, chips, particles, sawdust or other waste, of wood, agglomerated with cement, plaster or other mineral binders. |

10 |

- |

|

|

|

|

|

|

|

|

|

68.09 |

|

|

|

Articles of plaster or of compositions based on plaster. |

|

|

|

68.10 |

|

|

|

Articles of cement, of concrete or of artificial stone, whether or not reinforced. |

|

|

|

|

|

|

|

|

|

|

|

68.11 |

|

|

|

Articles of asbestos-cement, of cellulose fibre-cement or the like. |

|

|

|

|

|

|

|

|

|

|

|

68.12 |

|

|

|

Fabricated asbestos fibres; mixtures with a basis of asbestos or with a basis of asbestos and magnesium carbonate; articles of such mixtures or of asbestos (for example, thread, woven fabric, clothing, headgear, footwear, gaskets), whether or not reinforced, other than goods of heading 68.11 or 68.13. |

|

|

|

|

|

|

|

|

|

|

|

68.15 |

|

|

|

Articles of stone or of other mineral substances (including carbon fibres, articles of carbon fibres and articles of peat), not elsewhere specified or included. |

|

|

|

|

|

|

|

|

|

|

|

6901 |

00 |

00 |

00 |

Bricks, blocks, tiles and other ceramic goods of siliceous fossil meals (for example, kieselguhr, tripolite or diatomite) or of similar siliceous earths. |

10 |

- |

|

|

|

|

|

|

|

|

|

69.02 |

|

|

|

Refractory bricks, blocks, tiles and refractory ceramic constructional goods, other than those of siliceous fossil meals or similar siliceous earths. |

|

|

|

|

|

|

|

|

|

|

|

69.04 |

|

|

|

Ceramic building bricks, flooring blocks, support or filler tiles and the like. |

|

|

|

|

|

|

|

|

|

|

|

69.05 |

|

|

|

Roofing tiles, chimney-pots, cowls, chimney liners, architectural ornaments and other ceramic constructional goods. |

|

|

|

|

|

|

|

|

|

|

|

69.07 |

|

|

|

Unglazed ceramic flags and paving, hearth or wall tiles; unglazed ceramic mosaic cubes and the like, whether or not on a backing. |

|

|

|

69.08 |

|

|

|

Glazed ceramic flags and paving, hearth or wall tiles; glazed ceramic mosaic cubes and the like, whether or not on a backing. |

|

|

|

|

|

|

|

|

|

|

|

7016 |

|

|

|

Paving blocks, slabs, bricks, squares, tiles and other articles of pressed or moulded glass, whether or not wired, of a kind used for building; glass cubes and other glass small wares, whether or not on a backing, for mosaics or similar decorative purposes; leaded lights and the like; multicellular or foam glass in blocks, panels, plates, shells or similar forms. |

|

|

|

|

|

|

|

|

|

|

|

87.11 |

|

|

|

Motorcycles (including mopeds) and cycles fitted with an auxiliary motor, with or without side-cars; side-cars. |

|

|