Nội dung toàn văn Decision No. 79/2002/QD-BTC of June 13, 2002, announcing the list of legal documents promulgated by the Ministry of Finance, which cease to be effective, are annulled or superseded by others

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No: 79/2002/QD-BTC |

Hanoi, June 13, 2002 |

DECISION

ANNOUNCING THE LIST OF LEGAL DOCUMENTS PROMULGATED BY THE MINISTRY OF FINANCE, WHICH CEASE TO BE EFFECTIVE, ARE ANNULLED OR SUPERSEDED BY OTHERS

THE MINISTER OF FINANCE

Pursuant to the Law on

Promulgation of Legal Documents of November 12, 1996;

Pursuant to the Government’s

Decree No.101/CP of September 23, 1997 detailing the implementation of a number

of articles of the Law on Promulgation of Legal Documents;

Pursuant to the Government’s

Decree No.178-CP of October 28, 1994 on the tasks, powers and organizational

structure of the Ministry of Finance;

At the proposal of the director of the Department of Financial Policies,

DECIDES:

Article 1.- To announce the list of 51 legal documents promulgated by the Ministry of Finance up to December 31, 2001, which cease to be effective (enclosed herewith).

Article 2.- This Decision takes effect 15 days after its signing.

Article 3.- The ministries, the ministerial-level agencies, the agencies attached to the Government, the People’s Committees of the provinces and centrally-run cities and the units under and attached to the Ministry of Finance shall have to implement this Decision.

|

MINISTER OF FINANCE |

LIST OF LEGAL DOCUMENTS PROMULGATED BY THE

MINISTRY OF FINANCE UP TO DECEMBER 31, 2001, WHICH CEASE TO BE EFFECTIVE, ARE

ANNULLED OR SUPERSEDED BY OTHERS

(Promulgated together with the Finance Minister’s Decision No.79/2002/QD-BTC of June 13, 2002)

|

Ordinal number |

Forms of document |

Code numbers of documents |

Dates of promulgation |

Extracted contents |

Extent of invalidation |

|

I. TAXATION |

|||||

|

1 |

Circular |

90/TC/TCT |

November 10, 1993 |

Guiding a number of points on tax policies toward joint-venture banks and branches of foreign banks in Vietnam |

Whole |

|

2 |

Circular |

104/TC/GTBD |

December 22, 1993 |

Guiding the collection of radio frequency charges |

Whole |

|

3 |

Circular |

62/TC/TCDN |

July 31, 1995 |

Amending and supplementing the regime of collecting of radio frequency charges |

Whole |

|

4 |

Circular |

39/TC/TCT |

June 26, 1997 |

Guiding the implementation of Decree No.05/1997/ND-CP detailing the implementation of the Ordinance on Income Tax on High Income Earners |

Whole |

|

5 |

Circular |

March 21, 1998 |

Guiding the import tax exemption for organizations and individuals conducting petroleum activities under the Petroleum Law |

Whole |

|

|

6 |

Circular |

May 13, 1998 |

Guiding the tax provisions on investment forms under the Law on Foreign Investment in Vietnam |

Whole |

|

|

7 |

Circular |

July 14, 1998 |

Guiding the implementation of Decree No.30/1998/ND-CP detailing the implementation of the Enterprise Income Tax Law |

Whole |

|

|

8 |

Circular |

July 16, 1999 |

Guiding the tax provisions on investment forms under the Law on Foreign Investment in Vietnam |

Whole |

|

|

9 |

Circular |

February 23, 2000 |

Guiding the supplements and amendments to a number of points in Circular No.39/TC/TCT of June 26, 1997 |

Whole |

|

|

10 |

Circular |

41/2001/TT-BTC |

December 6, 2001 |

Additionally guiding the exemption from and reduction of agricultural land use tax in 2001 |

Whole |

|

11 |

Circular |

February 7, 2001 |

Vietnam's 2001 List of commodities and their tax rates in implementation of ASEAN's CEPT Agreement |

Whole |

|

|

12 |

Circular |

95/2001/TT-BTC |

November 23, 2001 |

Additionally guiding Circular No.41/2001/TT-BTC on exemption from and reduction of agricultural land use tax in 2001 |

Whole |

|

II. MANAGEMENT OF PUBLIC ASSETS |

|||||

|

13 |

Circular |

70/TT-BTC |

July 10, 1997 |

Guiding the payment of land rent, capital contribution to joint ventures with land use right value by domestic organizations according to Decree No.85/ND-CP of December 17, 1996 |

Whole |

|

III. ENTERPRISE FINANCIAL MANAGEMENT |

|||||

|

14 |

Circular |

64/TC/TCDN |

September 15, 1997 |

Guiding the regime of deduction for setting up and use of reserves against inventory price decrease, bad debts, securities price fall |

Whole |

|

15 |

Circular |

33/TC/TCT |

June 13, 1997 |

The regime of collection and use of budgetary capital |

Whole |

|

IV. ADMINISTRATIVE AND NON-BUSINESS FINANCE |

|||||

|

16 |

Circular |

25/TC/HCSN |

May 21, 1996 |

Provisionally prescribing the collection and use of fees for training of land-road motorized vehicle drivers |

Whole |

|

17 |

Decision |

950/TC/HCSN |

October 17, 1996 |

Promulgating the Regulation on distribution and use of interests on loans provided by the National Employment Assistance Fund |

Whole |

|

18 |

Decision |

811/TC/HCSN |

June 26, 1998 |

Promulgating the Regulation on distribution and use of interests on loans provided by the National Employment Assistance Fund |

Whole |

|

19 |

Circular |

150/1998/TT-BTC |

November 19, 1998 |

Guiding the management and use of funds for training and fostering cadres and State employees |

Whole |

|

20 |

Circular |

48/1999/TT-BTC |

June 5, 1999 |

Guiding the use of fines for administrative violations in the field of traffic order and safety |

Whole |

|

21 |

Circular |

70/1999/TT-BTC |

June 10, 1999 |

Guiding the amendments and supplements to Circular No.24/1999/TT-BTC of March 4, 1999 guiding the financial management in implementing the regime of rewards for outstanding achievements in the performance of socio-economic and national defense tasks |

Whole |

|

V. STATE TREASURY |

|||||

|

22 |

Decision |

490/TCQD/KBNN |

July 9, 1997 |

Promulgating the regime of treasure management in the State Treasury system |

Whole |

|

VI. ACCOUNTING AND AUDITING REGIMES |

|||||

|

23 |

Decision |

827/1998/QD-BTC |

April 7, 1998 |

Promulgating the commune budget accounting regime |

Whole |

|

24 |

Decision |

39/2001/QD-BTC |

February 5, 2001 |

Amending and supplementing the commune budget accounting regime promulgated together with Decision No.827/1998/QD-BTC of April 7, 1998 |

Whole |

|

VII. STATE BUDGET |

|||||

|

25 |

Circular |

01/1999/TT-BTC |

April 1, 1999 |

Guiding the commune budget revenue and expenditure management |

Whole |

|

26 |

Circular |

12/2000/TT-BTC |

February 2, 2000 |

Guiding the mechanism of giving rewards for VAT over-collection in 1999 |

Whole |

|

27 |

Circular |

March 30, 2000 |

Guiding the refund of revenues already remitted into the State budget |

Whole |

|

|

28 |

Circular |

July 19, 2000 |

Guiding the elaboration of 2001 State budget estimates |

Whole |

|

|

29 |

Decision |

74/2000/QD-BTC |

December 25, 2000 |

On the assignment of 2001 budget revenue-expenditure estimates |

Whole |

|

30 |

Decision |

207/2000/QD-BTC |

December 25, 2000 |

On the assignment of 2001 budget revenue-expenditure estimates |

Whole |

|

31 |

Circular |

09/2001/TT-BTC |

January 18, 2001 |

Guiding the implementation of a number of points on policies and measures for administering the 2001 State budget estimates |

Whole |

|

32 |

Circular |

58/2001/TT-BTC |

July 11, 2001 |

Additionally guiding the State budget index system |

Whole |

|

33 |

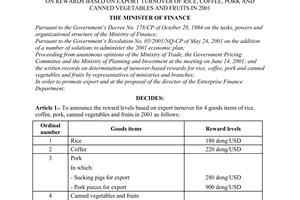

Decision |

September 6, 2001 |

Providing for rewards on export values of rice, coffee, pork, canned vegetables and fruits in 2001 |

Whole |

|

|

VIII. DEVELOPMENT INVESTMENT |

|||||

|

34 |

Circular |

March 13, 1999 |

Guiding the management and allocation of State budget capital for the project on planting of 5 million hectares of forest under Decision No.661/QD-TTg of July 29, 1998 |

Whole |

|

|

35 |

Circular |

October 1, 2000 |

Guiding the management and use of advertisement revenues for investment in development of Vietnam Television Station |

Whole |

|

|

IX. ORGANIZATION, PERSONNEL AND TRAINING |

|||||

|

36 |

Decision |

514/TC/QD/TCCB |

November 25, 1991 |

Prescribing the decentralization of management of cadres and public employees |

Whole |

|

37 |

Decision |

675/TC/QD/TCCB |

June 6, 1995 |

Prescribing the decentralization of management of cadres and public employees |

Whole |

|

38 |

Decision |

998/TC/QD/TCCB |

November 9, 1994 |

Regulation on organization and operation of the Financial Science Institute |

Whole |

|

39 |

Decision |

413/TC/QD/TCCB |

May 20, 1995 |

Regulation on organization and operation of the Center for Fostering of Finance Officials |

Whole |

|

X. AID RECEPTION |

|||||

|

40 |

Circular |

22/TT-BTC |

February 26, 1999 |

Guiding the State financial management regime applicable to non-refundable aids |

Whole |

|

XI. FINANCE-BANKING |

|||||

|

41 |

Circular |

45/TT-BTC |

May 30, 1994 |

Prescribing the financial management regime applicable to insurance enterprises |

Whole |

|

42 |

Circular |

76/TC/TCNH |

October 25, 1995 |

Prescribing the insurance commission regime |

Whole |

|

43 |

Circular |

59/TC/TCNH |

September 27, 1996 |

Guiding the interest subsidies for loans for policy households and poor households in Mekong River delta to elevate their housing bases or build piled houses |

Whole |

|

44 |

Circular |

December 13, 1999 |

Prescribing the life insurance commission regime |

Whole |

|

|

45 |

Circular |

September 6, 1998 |

Prescribing reinsurance business activities |

Whole |

|

|

46 |

Circular |

April 3, 1998 |

Guiding the procedures for granting certificates of satisfaction of criteria and conditions for insurance business |

Whole |

|

|

47 |

Circular |

April 3, 1998 |

Guiding the insurance exploitation and insurance premium management |

Whole |

|

|

48 |

Circular |

April 3, 1998 |

Prescribing operations of insurance agents and collaborators |

Whole |

|

|

49 |

Circular |

02/TT-BTC |

April 1, 1996 |

Guiding the supplements and amendments to the insurance commission regime |

Whole |

|

50 |

Decision |

581a/TC/TCNH |

January 7, 1996 |

Promulgating the provisional Regulation on general provisions of insurance policies |

Whole |

|

51 |

Decision |

927/TC/TCNH |

August 18, 1995 |

Readjusting the application scope of insurance rules, provisions and premium rate bracket |

Whole |

|

MINISTER OF FINANCE |