Circular No. 162/2011/TT-BTC on promulgation of the Vietnam’s special preferenti đã được thay thế bởi Circular No. 166/2014/TT-BTC promulgating Vietnam’s special preferential import tariff và được áp dụng kể từ ngày 01/01/2015.

Nội dung toàn văn Circular No. 162/2011/TT-BTC on promulgation of the Vietnam’s special preferenti

|

THE MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 162/2011/TT-BTC |

Hanoi, November 17, 2011 |

CIRCULAR

ON PROMULGATION OF THE VIETNAM’S SPECIAL PREFERENTIAL IMPORT TARIFF FOR REALIZATION OF THE ASEAN-CHINA FREE TRADE AREA IN THE PERIOD OF 2012-2014

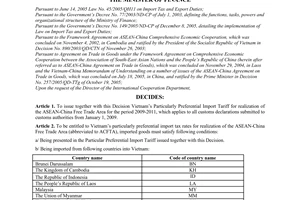

Pursuant to Law No. 45/2005/QH11, dated 14/6/2005, on Export Duty and Import Duty;

Pursuant to the Government’s Decree No. 118/2008/ND-CP dated 27/11/2008, defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

Pursuant to the Government’s Decree No. 87/2010/ND-CP dated 13/8/2010, detailing the implementation of Law No. 45/2005/QH11, dated 14/6/2005, on Export Duty and Import Duty;

Pursuant to the Framework Agreement on Comprehensive Economic Cooperation between the member countries of Association of Southeast Asian Nations (abbreviated to ASEAN) and the People’s Republic of China (hereinafter referred to as China), which was signed on November 04, 2002, in Cambodia and ratified by the President of the Socialist Republic of Vietnam in the Decision No. 890/2003/QD-CTN dated 26/11/2003;

Pursuant to the Agreement on Trade in Goods of the Framework Agreement on ASEAN-China Comprehensive Economic Cooperation (hereinafter abbreviated to as the ASEAN-China Agreement on Trade in Goods), which was signed on November 29, 2004, in Laos, and the Memorandum between Vietnam and China, on a number of issues in the ASEAN-China Agreement on Trade in Goods, which was signed on July 18, 2005, in China, and ratified by the Prime Minister of the Socialist Republic of Vietnam in the Decision No. 257/2005/QD-TTg dated 19/10/2005;

The Ministry of Finance promulgates the Circular on the Vietnam’s Special Preferential Import Tariff for realization of the ASEAN-China Free Trade Area as follows:

Article 1. To promulgate together with this Circular the Vietnam’s Special Preferential Import Tariff for realization of the ASEAN-China Free Trade Area in the period of 2012-2014 (the applicable duty rates are abbreviated to as ACFTA duty rates).

Of which:

+ Column “HS” and column “Goods description” are developed on the basis of the 2012 AHTN (ASEAN Harmonized Tariff Nomenclature) and classified at the 8-digit level.

+ Column “ACFTA duty rate (%)”: Duty rate applicable to each year, from January 01 to December 31 of the year, beginning from 2012 until the end of 2014.

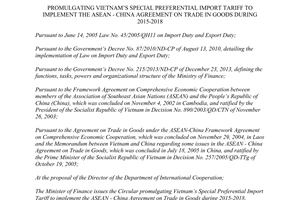

|

Country Name |

Country name code |

|

Brunei Darussalam |

BN |

|

The Kingdom of Cambodia |

KH |

|

The Republic of Indonesia |

ID |

|

The Lao People’s Democratic Republic |

LA |

|

Malaysia |

MY |

|

The Union of Myanmar |

MM |

|

The Republic of the Philippines |

PH |

|

The Republic of Singapore |

SG |

|

The Kingdom of Thailand |

TH |

|

The People’s Republic of China (China) |

CN |

|

The Socialist Republic of Vietnam (goods from non-tariff areas imported into the domestic market) |

VN |

+ Column “Countries are not entitled to preferential tax rates”: Commodities imported from countries shown country name code (specified at point (b) Article 2 of this Circular) shall not be applied the ACFTA duty rates as prescribed in this Circular.

Article 2. Import goods must fully satisfy the following conditions in order to be applied the ACFTA duty rates:

1) Being goods in the Special Preferential Import Tariff promulgated together with this Circular;

2) Being imported into Vietnam from the member countries of the ASEAN- China Free Trade Area, including:

3) Being transported directly from an export country defined in clause (2) of this Article, to Vietnam, according to regulations of the Ministry of Industry and Trade.

4) Satisfying the regulations on origin of goods in the ASEAN-China Agreement on Trade in Goods and having ASEAN-China certificates of origin (abbreviated to as C/O- Form E) according to regulations of the Ministry of Industry and Trade.

Article 3. This Circular takes effect on January 01, 2012; replaces the Decision No. 111/2008/QD-BTC dated 01/12/2008 of the Minister of Finance, on promulgating Vietnam’s particularly preferential import tariff for realization of the ASEAN-China Free Trade Area in the period of 2009-2011

|

|

FOR THE

MINISTER OF FINANCE |

------------------------------------------------------------------------------------------------------

This translation is translated by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments