Nội dung toàn văn Circular No. 19/2014/TT-BTC cars motorcyles of persons entitled to privileges and immunities in Vietnam

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No.: 19/2014/TT-BTC |

Hanoi, February 11, 2014 |

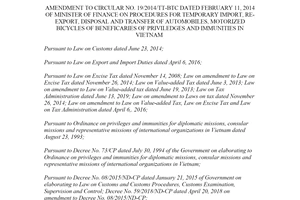

CIRCULAR

REGULATING THE PROCEDURES FOR TEMPORARY IMPORT FOR RE-EXPORT, DESTRUCTION AND TRANSFER FOR CARS AND MOTORCYCLES OF PERSONS ENTITLED TO PRIVILEGES AND IMMUNITIES IN VIETNAM

Pursuant to the Customs Law No. 29/2001/QH10 dated June 29, 2001 and the Law amending and supplementing a number of the Customs Law No. 42/2005/QH11 dated June 14, 2005;

Pursuant to the Law on Export and Import tax No. 45/2005/QH11 dated June 14, 2005;

Pursuant to the Law on Tax Administration No. 78/2006/QH10 dated November 29, 2006; the Law amending and supplementing a number of Articles of the Law on Tax Administration 21/2012/QH13 dated November 20, 2012;

Pursuant to the Law on Value Added Tax No.13/2008/QH12 dated June 3, 2008; the Law amending and supplementing a number of Articles of the Law on Value Added Tax No. 31/2013/QH13 dated June 19, 2013;

Pursuant to the Law on Special Consumption Tax No. 27/2008/QH12 dated November 14, 2008;

Pursuant to the Ordinance on the privileges and immunities for diplomatic missions, consular offices and representative offices of international organizations in Vietnam dated August 23, 1993;

Pursuant to Decree No.73-CP of July 30, 1994 of the Government detailing the implementation of the Ordinance on the privileges and immunities for diplomatic missions, consular offices and representative offices of international organizations in Vietnam;

Pursuant to Decree No. 154/2005/ND-CP dated December 15, 2005 of the Government detailing a number of articles of the Customs Law regarding customs procedures, inspection and supervision;

Pursuant to Decree No. 26/2009/ND-CP dated March 16, 2009 of the Government detailing the implementation of some articles of the Law on Special Consumption Tax and Decree No. 113/2011/ND-CP dated December 08, 2011 of the Government amending and supplementing a number of articles of Decree No. 26/2009/ND-CP dated March 16, 2009 of the Government detailing the implementation of some articles of the Law on Special Consumption Tax;

Pursuant to Decree No. 87/2010/ND-CP dated August 13, 2010 of the Government detailing the implementation of some articles of the Law on Export and Import Tax;

Pursuant to Decision No. 53/2013/QD-TTg dated September 13, 2013 of the Prime Minister on temporary import for re-export, destruction and transfer for cars and motorcycles of the persons entitled to privileges and immunities in Vietnam

Pursuant to Decree No. 187/2013/ND-CP dated November 20, 2013 of the Government detailing the implementation of the Commercial Law regarding international goods sale and purchase and activities of agent, sale and purchase, outsourcing and transit of goods with foreign countries;

Pursuant to Decree No. 209/2013/ND-CP dated December 18, 2013 detailing and guiding the implementation of a number of Articles of Law on Value Added Tax;

Pursuant to Decree No. 215/2013/ND-CP dated December 23, 2013 of the Government defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

At the proposal of the General Director of the General Department of Customs,

The Minister of Finance issues the Circular regulating the procedures for temporary import for re-export, destruction and transfer for cars and motorcycles of the persons entitled to privileges and immunities in Vietnam;

Chapter 1.

GENERAL REGULATION

Article 1. Scope of application

This Circular regulates the procedures for temporary import for re-export, destruction, transfer and donation (hereafter referred to as transfer) for cars and motorcycles (hereafter referred to as motorcycles) of the persons entitled to privileges and immunities in Vietnam;

Article 2. Subjects of application

1. Vietnam-based diplomatic missions, consular offices and representative offices of international organizations are entitled to the privileges and immunities under international treaties that Vietnam has signed or acceded to under the provisions in Article 8, Article 9, Article 10 of Decree No.73-CP dated July 30, 1994 of the Government.

2. Diplomatic officials of diplomatic missions, consular officials of consular offices and officials of representative offices of Vietnam-based international organizations are entitled to the privileges and immunities under the international treaties that Vietnam has signed or acceded to.

3. Administrative and technical employees of diplomatic missions and consular offices are entitled to the privileges and immunities on the principle of reciprocity between Vietnam and sending countries; employees of representative offices of Vietnam-based international organizations are entitled to the privileges and immunities under the international treaties that Vietnam has signed or acceded to.

4. Vietnamese organizations and individuals receiving the transfer of cars temporarily imported from the persons specified in Clause 1, 2 and 3 mentioned above (hereafter referred to as car buyers);

5. Customs authorities;

Article 3. A number of regulations on conditions for temporary import for re-export, transfer and destruction of vehicles

1. The persons specified in Clause 1, 2 and 3 Article 2 of this Circular are entitled to tax-free temporary import of cars and motorcycles by type, amount or conditions specified in Clause 1, Article 3 and Clause 1, Clause 2, Article 4 of Decision No. 53/2013/QD-TTg.

2. The persons specified in Clause 1, 2 and 3, Article 2 of this Circular are entitled to temporary import of in-use cars are movable assets specified in Clause 4 and 5, Article 4 of Decision No. 53/2013/QD-TTg.

3. The persons specified in Clause 1, Article 2 of this Circular are only entitled to tax-free import of cars and motorcycles exceeding quota limits specified in Clause 2, Article 3 of Decision 53/2013/QD-TTg when the Ministry of Foreign Affairs agrees in writing.

4. Tax-free temporary import of cars and motorcycles for additional quota:

a) The persons specified in Clause 1, Article 2 of this Circular are only entitled to temporary import of cars and motorcycles for additional quota if they meet the conditions specified at Point a, Clause 3, Article 4 of Decision No. 53/2013/QD-TTg.

b) The persons specified in Clause 2 and 3, Article 2 of this Circular are only entitled to temporary import of cars and motorcycles for additional quota if they meet the conditions specified at Point b, Clause 3, Article 4 of Decision No. 53/2013/QD-TTg.

5. The persons specified in Clause 1, 2 and 3, Article 2 of this Circular are entitled to re-export, transfer or destruction when they meet the conditions specified in Article 7, 8 and 9 of Decision No. 53/2013/QD-TTg.

6. Before going through the procedures for re-export, transfer or destruction of cars and motorcycles, the persons specified in Clause 1, 2 and 3, Article 2 of this Circular must complete the procedures for revocation of certificate of registration and number plate;

The persons specified in Clause 2 and 3 of this Circular must go through the procedures for revocation of certificate of registration and number plate, re-export, transfer or destruction of cars and motorcycles within thirty (30) days before the end of the working time in Vietnam based on the identification card issued by the Ministry of Foreign Affairs.

In case of failure of re-export, transfer or destruction of cars and motorcycles, the above persons must authorize their units to perform the procedures for re-export, transfer or destruction of vehicles, the power-of-attorney with the units’ certification of having deleted the register of car circulation and committed to preserve the integrity of vehicles at the units and completed the procedures for re-export, transfer or destruction of vehicles as prescribed within 06 months after these persons have ended their terms of office;

The persons specified in Clause 1, 2 and 3, Article 2 of this Circular must not assign the in-use cars temporarily imported under the provisions in Clause 2, Article 9 of Decision No. 53/2013/QD-TTg.

The persons who buy the vehicles from the persons specified in Clause 1, 2 and 3, Article 2 of this Circular must perform the declaration and pay the prescribed taxes and fees within the time stipulated by the law on taxes and fees

Chapter 2.

SPECIFIC REGULATION

Article 4. Dossier and procedures for issue of temporary import paper of cars and motorcycles

1. Dossier to request the issue of temporary import paper of cars and motorcycles includes:

a) Written request for temporary import of vehicles: 01 original;

b) Identification card issued by the Ministry of Foreign Affairs (for persons specified in Clause 2 and 3, Article 2 of this Circular): 01 copy and introducing the original for comparison;

c) Bill of lading or other shipping documents of equivalent value: 01 original and 01 copy of the carrier (except for cars and motorcycles temporarily imported through roadway).

d) The circulation registration or registration of circulation cancellation for cars issued by the competent authorities of the transferring country: 01 Vietnamese translation certified from the original, an original for verification and comparison (in case of temporary import of in-use cars as movable assets);

dd) Certification from the units where these person are working in Vietnam (for the persons specified in Clause 2 and 3, Article 2 of this Circular) on the moving of assets or transfer of working place from foreign countries to Vietnam: 01 original;

e) Introducing the tax-free car and motorcycle quota Book issued by the Ministry of Foreign Affairs for the customs authorities to verify and compare;

g) The written consent to temporary import of cars and motorcycles of excessive quota from the Ministry of Foreign Affairs (in case of temporary import exceeding the quota standard): 01 original;

2. Procedures for issue of temporary import paper of cars and motorcycles from the customs authorities;

a) Responsibilities of the persons specified in Clause 1, 2 and 3, Article 2 of this Circular;

a.1) Fully preparing dossier under the provisions in Clause 1 of this Article;

a.2) Submitting dossier for issue of temporary import paper of cars and motorcycles specified in Clause 1 of this Article to the Customs Department of province and city where their head offices are located (for the persons specified in Clause 1, Article 2 of this Circular) or where the persons’s offices are located (for the personsspecified in Clause 2 and 3, Article 2 of this Circular);

b) Responsibility of the Customs Department of province and city where the dossier for issuing temporary import paper of cars and motorcycles:

b.1) Receiving dossiers, checking their completeness and validity, verify and compare the quota standard of cars and motorcycles in the tax-free car and motorcycle quota Book. If the dossiers are valid, issue the receiving slip for response to the persons requesting the issue of temporary import paper of cars and motorcycles and shall issue the permit within 05 working days after the receipt of dossiers;

If the dossiers are not complete as prescribed, guide the persons submitting dossier for issue of temporary import paper of vehicles to complete them as prescribed;

b.2) Each car or motorcycle temporarily imported shall be issued with 01 set of import permit including 03 copies (Form No. 01: G/2014/TNK OTO/XEMAY-NG issued together with this Circular), the temporary import paper must specify the name, address and title of temporary importer of vehicles, brand, model, year of manufacture, country of manufacture, paint color, chassis number, engine number, engine capacity, condition, (brand new, used) and the time limit for temporary import for re-export of vehicles (brand new, used) and the time limit for temporary import for re-export of vehicles over the time of working in Vietnam specified on the identification number issued by the Ministry of Foreign Affairs (for the persons specified in Clause 2 and 3, Article 2 of this Circular). The temporary import paper of vehicles is valid within 30 days from the issue date;

b.3) After issuing the temporary import paper, the customs authorities issuing the permit shall record the contents of issue in the tax-free car and motorcycle quota Book (the box for cars and motorcycles temporarily imported ) issued by the Ministry of Foreign Affairs, affix seal for certification and hand it over to the person requesting the issue together with 02 copies of temporary import paper (with 01 bill of lading with the seal of issuing customs authorities) in order to submit it to the border gate customs for temporary import procedures;

b.4) Updating information on the information management system of the General Department of Customs for cars and motorcycles temporarily imported of the persons entitled to diplomatic immunity in Vietnam;

Article 5. Dossier and procedures for temporary import of cars and vehicles

1. Dossier for temporary import of cars and motorcycles

a) Temporary import paper of cars and motorcycles: 02 originals;

b) Bill of lading: 01 original (with the seal of Customs Department of province and city issuing the temporary import paper of cars and motorcycles);

c) The customs non-commercial declaration of export / import (HQ/2011-PMD): 02 originals;

d) Registration for inspection of technical safety and quality and environmental protection of imported motored vehicles (for cars): 01 original;

dd) Registration for inspection of quality of imported motorcycles: 01 original;

2. Procedures for temporary import of cars and motorcycles;

a) Place of procedures:

a1) The procedures for temporary import of cars shall be done at the border gate Customs Sub-Department (to which the cars are transported from foreign countries). As for the case of temporary import of cars through roadway border gate, the procedures for temporary import of cars shall be done at the international border gate;

a2) Procedures for temporary import of motorcycles shall be done at the Customs Sub-Department as prescribed by law;

b) Procedures for temporary import of motorcycles shall be done under current regulations for goods imported for non-commercial purposes;

c) The Customs Sub-Department only allows the customs clearance when there is certificate of technical safety and quality and environmental protection for imported motored vehicles (for cars) and certificate of technical safety and quality and environmental protection for motocycles of quality inspection authorities;

d) Upon the end of customs clearance for cars and motocycles, the leader of Customs Sub-Department shall certify:

d.1) The content “cars and motorcycles temporarily imported” in the right corner of customs declarations of non-commercial exports / imports (HQ/2011-PMD);

d.2) The results of procedures for temporary import of cars and motorcycles in 02 permits of temporary import of vehicles;

Returning the temporary importer 01 temporary import paper of vehicles and 01 customs declaration HQ/2011-PMD (copy kept by declarant) to perform the procedures for registration of vehicle circulation and 01 copy from the original (copy kept by declarant) with signature and seal of the customs Sub-Department of temporary import border gate and seal for “re-export or transfer as prescribed by law” to perform the procedures for re-export or transfer as prescribed; copying and sending the temporary import permit and declaration with certification of customs Sub-Department of import border gate to the customs Department of province and city issuing the temporary import paper for monitoring, management and transmission of information data of declaration of temporary import of vehicles to the General Department for concentrated management of information; no issue of declaration of origin for cars and motorcycles temporarily imported;

Article 6. Dossier and procedures for re-export of cars and motorcycles

1. Dossier for re-export of cars and motorcycles

a) Written request for re-export of vehicles: 01 original with certification of the unit where the person is working in Vietnam;

b) Documents of the Ministry of Foreign Affairs (Department of State Protocol Department or Service of Foreign Affairs of locality where the consular offices are located) on the re-export of vehicles: 01 original.

c) Customs declaration of import of vehicles (copy kept by declarant) with the seal used for “re-export or transfer as prescribed by law”: 01 copy with certification of the customs Sub-Department of temporary import border gate;

d) Revocation of registration, plate number of cars and motorcycles issued by police authorities: 01 original;

dd) Certification record of the competent authorities on cars and motorcycles’ accident, natural disasters or objective reasons concerning the technical problems leading to failure of use: 01 original (for cases specified in Clause 3, Article 7 of Decision No. 53/2013/QD-TTg).

2. Procedures for re-export of cars and motocycles:

a) Procedures for re-export of cars and motocycles:

b) Based on the dossier specified in Clause 1 of this Article, the customs Sub-Department of border gate shall perform the procedures for re-export under current regulations for exported goods of non-commercial purposes. In case of any doubt about the declaration of temporary import specified at Point in finished products of cough, antipyretic and analgesic drug, Clause 1 of this Article, the border gate customs Sub-Department performing the temporary import of vehicles shall be requested to provide information on declaration of temporary import. Within 05 days after the customs Sub-Department of re-export border gate requests in writing, the customs Sub-Department of border gate performing procedures for temporary import of vehicles shall provide information for the customs Sub-Department of vehicle re-export border gate;

c) Upon the end of re-export procedures, the customs Sub-Department of border gate performing the procedures for export of cars and vehicles shall inform in writing, copy and send the declaration of vehicles re-export completed with customs procedures to the Customs Department of province and city issuing the temporary import paper of vehicles to perform the liquidity of temporary import paper of vehicles as prescribed;

Article 7. Dossier, procedures and tax policies for transfer of cars

1. The procedures for issuing the permit of transfer and transfer procedures shall be done at the customs Department of province and city issuing the temporary import paper of vehicles;

2. Dossier for issue of transfer

a) For units’ vehicles

Written request for vehicle transfer: 01 original;

b) For individuals’ vehicles

b.1) Written request for vehicle transfer: 01 original with the certification of unit where the person are working in Vietnam or the unit’s written request for transfer (in case where the persons specified in Clause 2 and 3, Article 2 of this Circular authorize their units to perform the procedures for vehicle transfer);

b.2) Identification card issued by the Ministry of Foreign Affairs (for the persons specified in Clause 2 and 3, Article 2 of this Circular): 01 copy with certification of the persons’ units and introducing the original for comparison;

b.3) Documents of the Ministry of Foreign Affairs (Department of State Protocol Department or Service of Foreign Affairs of locality where the consular offices are located) on the vehicle transfer: 01 original.

b.4) Power of attorney for the persons’ units to perform the procedures for vehicle transfer: 01 original;

c) Revocation of registration, number plate of cars issued by the police authorities: 01 original;

d) Customs declaration of temporary import of vehicles (copy kept by declarant) with the seal used for “re-export or transfer as prescribed by law”: 01 copy with certification of the customs Sub-Department of temporary import border gate;

e) The customs declarations of non-commercial exports / imports (HQ/2011-PMD): 02 originals;

3. Procedures for issue of transfer

a) Responsibilities of persons specified in Clause 1, 2 and 3, Article 2 of this Circular;

a.1) Fully preparing dossiers under the provisions in Clause 2 of this Article;

a.2) Submitting dossier for issue of permit of vehicle transfer specified in Clause 2 of this Article to the Customs Department of province and city issuing the temporary import paper of vehicles;

b) Responsibilities of Customs Department of province and city receiving dossier for the issue of permit of vehicle transfer:

b.1) Receiving dossiers, checking their completeness and validity, verify and compare with the conditions for transfer specified in Article 9 of Decision No. 53/2013/QD-TTg If the dossiers are valid, issue the receiving slip for response to the persons requesting the issue of permit of transfer and shall issue the permit of transfer within 05 working days after the receipt of dossiers;

If the dossiers are not complete as prescribed, guide the persons submitting dossier for issue of permit of transfer to complete them as prescribed;

In case of doubt about the declaration of temporary import specified at Point d, Clause 2 of this Article, request the border gate customs Sub-Department of performing the procedures for temporary import of vehicles to provide information on declaration of temporary import. Within 05 days after the customs Sub-Department of re-export border gate has requested in writing, the customs Sub-Department of border gate performing the procedures for temporary import of vehicles are responsible for providing information for the customs Sub-Department of vehicle re-export border gate;

b.2) Each imported car shall be issued with 01 set of permit of transfer including 03 copies (Form No.02: G/2014/CN- OTO – NG issued together with this Circular). The permit of transfer must specify: name and address of unit (for unit’s car), full name and address (for individual’s car) of assignor and assignee; date of of temporary import paper, declaration of temporary import, car brand, country of manufacture, paint color, chassis number, engine number and engine capacity;

b.3) After issuing the permit of vehicle transfer, hand over 02 copies to the persons requesting the transfer so that the persons specified in Clause 1, 2 and 3 may keep 01 copy and hand over 01 copy to the assignee for transfer procedures;

b.4) Updating information on the management software system of the General Department of Customs for cars and motorcycles temporarily imported of the persons entitled to diplomatic immunity in Vietnam;

4. Transfer procedures

a) The persons specified in Clause 1, 2 and 3, Article 2 of this Circular shall fill in 02 customs declaration of non-commercial imports/exports (HQ/2011-PMD).

b) Responsibilities of Customs Department of province and city issuing the permit of car transfer:

b1) Based on the permit of car transfer and customs declaration specified at Point….Clause 3, Point a, Clause 4 of this Article and comparison with actual car for performing the transfer procedures (including tax calculation and collection under the provisions of Clause 5 of this Article, except the case where the persons who buy, receive, give, donate, offer are the persons specified in Clause 1, 2 and 3 of Article 2 of this Circular). Within 10 days after the receipt of dossier for requesting the issue of permit of vehicle transfer, the Customs Department of province and city shall complete the transfer procedures as prescribed;

b2) Return 01 declaration HQ/2011-PMD (copy kept by declarant) and tax receipt to the persons who go through the transfer procedures or the authorized persons as prescribed by law for car circulation registration procedures or collect the copy of certificate of payment to the state budget in cash or cheque through the state treasury (with its certification) or the payment order through bank from the persons going through the transfer procedures or the authorized persons as prescribed by law;

b3) Performing the liquidity of temporary import paper of vehicles as prescribed;

5. Tax policy for assigned vehicles:

The grounds for calculation of import tax are the taxable value, tax rate and exchange rate at the time of transfer, particularly:

a) Time of transfer: In compliance with provisions at Point c, Clause 4, Article 9 of Decision No. 53/2013/QD-TTg.

b) Taxable value: In compliance with provisions in Clause 1, Article 20 of Circular No. 205/2010/TT-BTC dated December 15, 2010 of the Ministry of Finance guiding the Decree No. 40/2007/ND-CP dated March 16, 2007 of the Government regulating the determination of customs value for the imports and exports;

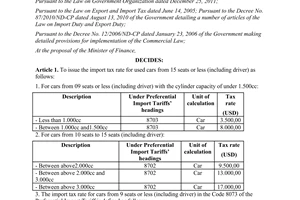

c) Tax rate:

c1) For cars of 15 seats or more (including driver): the import tax rate for used cars shall be applied under the provisions in Decision No. 36/2011/QD-TTg dated June 29, 2011 of the Prime Minister and Decision No. 24/2013/QD-TTg dated May 03, 2013 amending and supplementing Clause 1, Article 1 of Decision No. 36/2011/QD-TTg dated June 29, 2011 on issuing the import tax rate for used cars of 15 seats or less.

c2) For cars of 16 seats or more (including driver): the tax rate shall be applied for used cars of 16 seats or more in the preferential import tariff effective at the time of transfer;

Article 8. Destruction of cars and motorcycles

1. Before destroying the vehicles, the persons specified in Clause 1, 2 and 3 of this Circular must send a written notice to the Customs Department of province and city issuing the temporary import paper of cars and motorcycles. The written notice must specify the name and address of temporary importer of vehicles, the date of temporary import paper and the declaration of temporary import;

2. The procedures for destruction of vehicles shall comply with regulations of the Ministry of Natural Resources and Environment.

3. The Customs Department of province and city issuing the temporary import paper of cars and motorcycles shall base on the Record of destruction (the original) regulated by the Ministry of Natural Resources and Environment to compare with the information related to the vehicles (temporary import paper, declaration of temporary import and the conditions specified in Article 8 of Decision No. 53/2013/QD-TTg) to perform the liquidity of temporary import paper of cars and motorcycles as prescribed;

Chapter 3.

IMPLEMENTATION PROVISION

Article 9. Implementation organization

1. The General Department of Customs shall control and manage information related to the temporary import of cars and motorcycles of the persons who are entitled to the privileges and immunities in Vietnam on the principle of concentrated control and management of information;

The General Department of Customs shall assume the prime responsibility to develop the information management system for cars and motorcycles temporarily imported of the persons who are entitled to the privileges and immunities in Vietnam;

2. The Customs Department of province and city issuing the import permit of cars and motorcycles/ or performing the import procedures shall carry out the entry and transmission of data of cars and motorcycles temporarily imported, re-exported or destroyed under the guidance of the General Department of Customs;

3. The General Department of Customs shall receive the data sent by the Customs Department of province and city and carry out the concentrated control and manage the relevant information;

4. On the quarterly or irregular basis, The General Department of Customs shall coordinate with the State Protocol Department - Ministry of Foreign Affairs, Department of Roadway and Railway Police and the Ministry of Public Security to provide and exchange information related to the temporary import of cars and motorcycles of the persons who are entitled to the privileges and immunities in Vietnam and the cases where the cars and motorcycles exceed the time limit for temporary import without procedures for re-export, transfer or destruction of vehicles;

5. The General Director of General Department of Customs shall direct the Directors of Customs Departments of province and city to manage, monitor and implement the provisions in this Circular. Any problem arising during the implementation should be promptly reported to the Ministry of Finance (through the General Department of Customs for guidance and direction;

Article 10. Effect

1. This Circular takes effect on March, 28, 2014;

2. Annulling the provisions in Circular No. 02/2001/TT-TCHQ dated May 29, 2001 of the General Department of Customs on customs procedures and management of cars and motorcycles of the persons who are entitled to the diplomatic privileges and immunities;

3. During the implementation, if the relevant documents referred in this Circular are amended, supplemented or superseded, the provisions of new documents shall apply from their effective date.

|

|

FOR

THE MINISTER |

Form no. 01: G/2014/TNK - OTO/XM-NG

|

GENERAL

DEPARTMENT OF CUSTOMS -------- |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. ……/TNK - NG |

|

TEMPORARY IMPORT PAPER OF CARS/MOTORCYCLES

Pursuant to Circular no.19/2014/TT-BTC dated 11 February 2014 of Ministry of Finance providing the procedures for importing, re-exporting, destruction and transfer of cars and motorcycles of the person who are entitled to the right of privileges and immunity in Vietnam;

On considering the application of Unit/Mr./Mrs.: …….

CUSTOMS DEPARTMENT OF PROVINCE AND CITY ….

….

Confirms the unit/Mr./Mrs.:

Position: ……………..; diplomatic ID no.……………………….; Time-limit for temporary import: ……………………………………………..

Address: …………………………………………………………….

Tax-free car and motorcycle quota Book No.: ……... dated ………… issued by …..………………………………..;

Temporarily importing ………cars, ……….. motorcycles under the regulation of diplomatic privileges and immunities in Vietnam:

- Car brand: ………, Model: …….., year of manufacture: ………., country of manufacture: ……, paint color:....., chassis number: ………, engine number: ………..; cylinder capacity: …………, engine conditions: ……………

- Temporarily imported cars under bill of lading number……………. date ….…………, port of destination:

The import of the above-mentioned cars/ motorcycles is done under current regulations.

This permit is valid for 30 days from its signing date./.

|

|

……., ………. 20... DIRECTOR OF DEPARTMENT (signature, seal) |

CONFIRMATION

of border gate customs Sub-Department performing the import procedures:

Confirm:

Has …:

|

|

……., ………. 20...... HEAD OF SUB-DEPARTMENT (Signature and seal) |

Form no. 02: G/2014/CN - OTO - NG

|

GENERAL

DEPARTMENT OF CUSTOMS |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No.: ……/CN - NG |

|

PERMIT OF TRANSFER OF CARS/MOTORCYCLES

Based on the Circular No. 19 /2014/TT-BTC dated February 11, 1024 of the Ministry of Finance regukating the procedures for temporary import, re-export, destruction and assignement of car and motorcycles of the persons who are entitled to the privileges and immunities in Vietnam;

Based on the written request of unit/Mr.Mrs:….

CUSTOMS DEPARTMENT OF PROVINCE AND CITY….

Confirms the unit/Mr/Mrs…..

Position: ………………….; diplomatic ID card: …………………; Time limit for temporary import: ………………………………………….

Address: ……………………………………………………..

Tax-free car and motorcycle quota Boo No……………..date of issue…….

Transfer of…………. cars which are temporarily imported under the temporary import paper no.: …………….on date………………….…………………. at the border gate Customs Sub-Department: …………………………….. under the Customs Department of province and city ……………………………. to unit/Mr./Mrs.:…………………………………………………..; address:……………………………. …………………………………………………………

- Car brand: ………, Mode: …….., year of manufacture/: ………., country of manufacture: ……, paint color:....., chassis number: ………………., engine number: ……………….; cylinder capacity:…………………

The transfer of cars above mentioned is done under current regulations;

This permit is valid within 30 days from its signing date;

|

|

……..., date.... month….20….. DIRECTOR (Signature and seal) |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed