Nội dung toàn văn Circular No. 45/2009/TT-BTC guiding value-added tax, royalties and business inco

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 45/2009/TT-BTC |

Hanoi, March 11, 2009 |

CIRCULAR

GUIDING VALUE-ADDED TAX, ROYALTIES AND BUSINESS INCOME TAX FOR HYDROPOWER GENERATION ESTABLISHMENTS

Pursuant to November 29, 2006

Law No. 78/2006/QH11 on Tax Administration; and the Government’s Decree No.

85/2007/ND-CP of May 25, 2007, detailing the implementation of a number of

articles of the Law on Tax Administration;

Pursuant to June 3, 2008 Law No. 13/2008/QH12 on Value-Added Tax; and the

Government’s Decree No. 123/2008/ND-CP of December 8, 2008, detailing and

guiding the implementation of a number of articles of the Law on Value-Added

Tax;

Pursuant to June 3, 2008 Law No. 14/2008/QH12 on Business Income Tax; and the

Government’s Decree No. 124/2008/ND-CP of December 11, 2008, detailing the

implementation of a number of articles of the Law on Business Income Tax;

Pursuant to the April 16, 1998 Ordinance on Royalties (amended), the Ordinance

Amending and Supplementing Article 6 of the Ordinance on Royalties; and the

Government’s Decree No. 05/2009/ND-CP of January 19, 2009, detailing the

implementation of the Ordinance on Royalties and the Ordinance Amending and

Supplementing Article 6 of the Ordinance on Royalties;

Pursuant to the Government’s Decree No. 118/2008/ND-CP of November 27, 2008,

defining the functions, tasks, powers and organizational structure of the

Ministry of Finance;

The Ministry of Finance guides the declaration and payment of value-added tax,

royalties, and business income tax for hydropower generation establishments as

follows:

Article 1. Scope of application

This Circular guides value-added tax (VAT), royalties, and business income tax (BIT) for hydropower generation establishments, including companies engaged in hydropower generation under or not under the Electricity of Vietnam (EVN).

Article 2. On VAT

1. Determination of payable VAT amounts

1.1. Hydropower generation establishments shall determine their payable VAT amounts by the credit method provided in the VAT Law and guiding documents.

1.2. Dependent-accounting hydropower companies of EVN shall determine their payable VAT amounts for their power generation operation as follows:

|

Payable VAT amount for power generation operation |

= |

Output VAT amount |

- |

Creditable input VAT amount |

The output VAT amount is determined by the following formula:

|

Output VAT amount |

= |

Power output |

x |

Taxed price |

x |

VAT rate (10%) |

In which:

- Power output is that delivered and received according to electricity meters as certified by the hydropower company and the power transmission company or the power trading company.

- Taxed price is fixed at 60% of the average commodity power selling price applied in the previous year and exclusive of VAT. In case the average commodity power selling price applied in the previous year is not yet identified, the temporary price announced by EVN will be used but must not be lower than the average commodity power selling price of the year preceding the previous year. When the average commodity power selling price applied in the previous year is identified, the difference shall be declared for adjustment in the declaration period of the month when the official price is identified.

The average commodity power selling price of a year shall be determined no later than March 31 of the subsequent year.

For example: If the average commodity power selling price of 2008 was VND 866/kWh and exclusive of VAT, the taxed price of 2009 (under the above guidance) will be VND 519.6 (= VND 866 x 60%).

The input VAT amount for power generation operation shall be credited based on value-added invoices of purchased goods and services of the hydropower company.

2. Tax declaration and payment

2.1. Hydropower generation establishments defined at Point 1.1, Clause 1 of this Article shall make VAT declaration in localities where they are headquartered and pay VAT to treasuries in localities where their hydropower plants (including turbines, spillways and major physical facilities) are located. In case a hydropower plant (including turbine, spillway and major physical facilities) is located in two neighboring provinces, the VAT amount payable by this establishment shall be equally divided to the two provinces.

A hydropower generation establishment shall submit its VAT declaration dossier to the tax office of the locality where it has registered tax declaration and send a copy of its VAT return to the tax office of the neighboring localities which shares the hydropower plant for monitoring.

2.2. For dependent accounting hydropower companies of EVN: These companies shall make VAT declaration in localities where they are headquartered according to the VAT return form applicable to dependent-accounting establishments of EVN promulgated together with this Circular (not printed herein) and concurrently send copies of their VAT returns to tax offices of localities sharing a hydropower plant (if any) and pay VAT to treasuries of these localities. In case a hydropower plant (including turbine, spillway and principal physical facilities) is located in two neighboring provinces, the VAT amount payable by the dependent-accounting hydropower company of EVN shall be equally divided to the two provinces.

VAT amounts paid by dependent-accounting hydropower companies of EVN (based on payment documents) shall be regarded as EVN’s input VAT amounts which EVN may declare for credit under regulations.

2.3. Procedures for sending documents

Hydropower generation establishments shall pay VAT into the state budget under regulations. In case a hydropower generation establishment is a company having a hydropower plant (including turbines, spillway and principal physical facilities) located in two or more provinces, it shall pay VAT to the state treasury of the locality where it has registered tax declaration (or the locality where it is headquartered) and concurrently pay VAT to the treasury(ies) of the locality(ies) entitled to VAT revenues. Tax payment documents shall be made separately for each state treasury and must clearly indicate state budget revenue accounts of the localities which share the hydropower plant or are entitled to VAT revenues.

2.4. VAT declaration and payment in some specific cases:

2.4.1. The Hoa Binh Hydropower Company (a dependent-accounting unit of EVN) which has its head office and the Hoa Binh Hydropower Plant in the same locality, Hoa Binh province, shall make VAT declaration and payment in Hoa Binh province.

2.4.2. The Tri An Hydropower Company (a dependent-accounting unit of EVN) which has its head office and has Tri An Hydropower Plant in the same locality, Dong Nai province, shall make VAT declaration and payment in Dong Nai province.

2.4.3. The Yaly Hydropower Company (a dependent-accounting unit of EVN) which has its head office in Gia Lai province and three hydropower plants: Yaly hydropower plant, Sesan 3 hydropower plant and Pleikrong hydropower plant.

The Yaly Hydropower Company shall make VAT declaration in Gia Lai province with its VAT amount divided as follows:

+ The VAT amount of the Yaly hydropower plant and Sesan 3 hydropower plant shall be equally paid by the Yaly Hydropower Company to Gia Lai and Kon Tum provinces (50% for each province).

+ The whole VAT amount of the Pleikrong hydropower plant shall be paid by the Yaly Hydropower Company to Kon Tum province.

2.4.4. The Dai Ninh Hydropower Company (a dependent-accounting unit of EVN) which has its head office in Lam Dong province and the Dai Ninh hydropower plant in Binh Thuan province and the hydropower spillway in Lam Dong province shall make VAT declaration in Lam Dong province. The VAT amount of the Dai Ninh hydropower plant shall be equally paid to Binh Thuan and Lam Dong provinces (50% for each province).

2.4.5. The Sesan 3A Power Development Investment Joint-Stock Company, a unit outside EVN, which has head office in Gia Lai province and the Sesan 3A hydropower plant in both Gia Lai and Kon Tum provinces, shall make VAT declaration in Gia Lai province and pay VAT amounts of the Sesan 3A hydropower plant equally to Gia Lai and Kon Tum provinces (50% for each province).

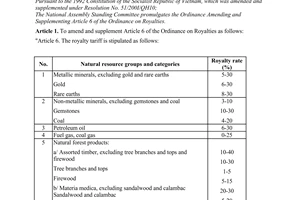

Article 3. On royalties

1. Hydropower generation establishments shall make royalties declaration and pay royalties for natural water used for hydropower generation based on the power output loaded on transmission lines in the declaration period, royalties calculation prices and rates.

Royalties amount payable in a tax period is determined as follows:

|

Royalties amount payable in the period |

= |

Power output loaded on transmission lines in the declaration period |

x |

Royalties calculation price |

x |

Royalties rate |

In which:

- Power output loaded on transmission lines in the declaration period means a power output delivered and received according to electricity meters as certified by the hydropower company and the power transmission company or the power trading company.

- Royalties calculation price for natural water used for hydropower generation means the average commodity power selling price.

The average commodity power selling price used for royalties calculation for hydropower generation establishments shall be announced by the Ministry of Finance in January every year.

- Royalties rate for natural water used for hydropower generation is 2% under the Government’s Decree No. 05/2009/ND-CP of January 19, 2009.

2. Royalties declaration and payment

2.1. Hydropower generation establishments shall make royalties declaration and pay royalties in localities where they have registered for royalties declaration and payment according to the royalties return form set for hydropower generation establishments provided in this Circular.

In case the royalties amount of a hydropower generation establishment is divided to different localities, this hydropower generation establishment shall submit a royalties declaration dossier to the tax office of the locality where it has registered for royalties declaration (or where it is headquartered) and make and send copies of this dossier to tax offices of localities which are entitled to the royalties revenue.

2.2. Procedures for sending of royalties payment documents between state treasuries and tax offices comply with the guidance of Point 2.3, Article 2 of this Circular.

3. The royalties declaration and payment in some specific cases:

3.1. The Hoa Binh Hydropower Company (a dependent accounting unit of EVN): The royalties amount paid by the Hoa Binh Hydropower Company shall be divided equally to Hoa Binh and Son La provinces (50% for each province).

3.2. The Tri An Hydropower Company (a dependent-accounting unit of EVN) shall make royalties declaration and payment in Dong Nai province.

3.3. The Yaly Hydropower Company (a dependent-accounting unit of EVN) shall pay royalties for its hydropower plants as follows:

- The royalties amount of the Yaly hydropower plant shall be paid to Kon Tum province (70%) and Gia Lai province (30%).

- The royalties amount of the Sesan 3 hydropower plant shall be paid equally to Gia Lai and Kon Tum provinces (50% for each province).

+ The whole royalties amount of the Pleikrong hydropower plant shall be paid to Kon Tum province.

3.4. The Dai Ninh Hydropower Company (a dependent-accounting unit of EVN) shall pay the royalties amount of the Dai Ninh hydropower plant in Lam Dong province.

3.5. The Sesan 3A Power Development Investment Joint-Stock Company, a unit outside EVN, which is headquartered in Gia Lai province, shall pay the royalties amount equally to Gia Lai and Kon Tum provinces (50% for each province).

3.6. The Da Nhim – Ham Thuan – Da Mi Hydropower Company, which has its head office in Lam Dong province and 2 hydropower plants:

- The Ham Thuan – Da Mi hydropower plant: the royalties amount for this plant shall be paid equally by the Da Nhim – Ham Thuan – Da Mi Hydropower Company to Lam Dong and Binh Thuan provinces (50% for each province).

- The Da Nhim hydropower plant: The Da Nhim – Ham Thuan – Da Mi Hydropower Company shall declare and pay 100% of the royalties amount to Lam Dong province.

Article 4. On business income tax (BIT)

1. Principles for BIT determination

Independent-accounting hydropower companies shall pay BIT in localities where they are headquartered. Independent-accounting hydropower companies which have dependent-accounting hydropower generation establishments operating in provinces or centrally run cities other than localities where they are headquartered; dependent-accounting hydropower generation establishments of parent companies within EVN (including dependent-accounting hydropower companies and dependent hydropower plants) which are headquartered in provinces or centrally run cities other than the locality where EVN is headquartered shall calculate and pay their BIT amounts in localities where they are headquartered and where their dependent-accounting hydropower generation establishments are located.

2. BIT determination and procedures for BIT declaration and payment

2.1. BIT amounts to be calculated and paid in provinces or centrally run cities where dependent-accounting hydropower units are located are BIT amounts payable in the period multiplied by (x) the ratio of expenditures of dependent-accounting hydropower generation establishments to total expenditures of the enterprises.

Independent-accounting hydropower companies and parent companies within EVN shall determine by themselves the ratio of expenditures of their dependent-accounting hydropower generation establishments to those of their head offices based on BIT finalization figures in 2008 and this ratio shall be used stably from 2009 on. In case operating units establish new dependent-accounting hydropower generation establishments in localities or reduce existing ones, they shall re-determine by themselves the expenditure ratio for each specific case and use it for subsequent tax declaration periods.

2.2. Independent-accounting hydropower companies and parent companies within EVN shall make BIT declaration for income tax amounts arising in their head offices and dependent-accounting units according to BIT forms set for enterprises having dependent accounting hydropower units. Based on BIT amounts calculated and paid on a quarterly basis and the expenditure ratio of dependent-accounting units, independent-accounting hydropower companies and parent companies within EVN shall determine BIT amounts to be temporarily paid for each quarter by their head offices and dependent-accounting units.

3. Procedures for transfer of documents between the treasury and tax offices

Independent-accounting hydropower companies and parent companies within EVN shall pay BIT arising in localities where they are headquartered to state treasuries at the same level with tax offices where they have registered for tax declaration and concurrently pay BIT amounts on behalf of their dependent hydropower generation establishments in localities. Tax payment documents shall be made separately for each state treasury, clearly indicating the state budget revenue account of the locality where the hydropower plant is located or which is entitled to the revenue.

4. Tax finalization

Independent-accounting hydropower companies and parent companies within EVN shall make BIT declaration and finalization in localities where they are headquartered. Their BIT amounts remaining to be paid are equal to payable BIT amounts already finalized minus BIT amounts already temporarily paid in localities where they are headquartered and where their dependent units are located. BIT amounts remaining to be paid (surplus or deficit) shall be finalized and paid or refunded in localities where these companies are headquartered.

In case a difference (surplus or deficit) arises in the course of BIT inspection and finalization, BIT amounts (surplus or deficit) shall be paid in localities where companies are headquartered and are not required to be allocated to localities where their dependent-accounting generation establishments are located.

Article 5. Organization of implementation

1. This Circular takes effect 45 days from the date of its signing and applies to the VAT, BIT and royalties declaration as follows:

- For VAT and royalties: This Circular applies from the tax declaration period of January 2009. In case hydropower generation establishments have made VAT and royalties declaration for the tax declaration period of January 2009 not in compliance with this Circular’s guidance, these establishments shall make adjusted declarations in compliance with this Circular’s guidance and will not be fined for late payment.

- For BIT: This Circular applies from the BIT declaration period of the first quarter of 2009.

2. Any difficulties or problems arising in the course of implementation should be promptly reported to the Ministry of Finance for timely settlement.-

|

|

FOR

THE MINISTER OF FINANCE |