Circular No. 68/2010/TT-BTC guiding the registration đã được thay thế bởi Circular No. 124/2011/TT-BTC, guiding registration fee và được áp dụng kể từ ngày 15/10/2011.

Nội dung toàn văn Circular No. 68/2010/TT-BTC guiding the registration

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 68/20107TT-BTC |

Hanoi, April 26, 2010 |

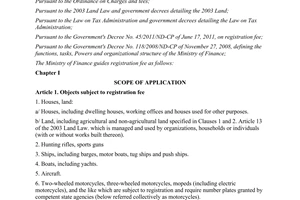

CIRCULAR

GUIDING THE REGISTRATION FEE

Pursuant to the Law on Tax Administration

and guiding documents;

Pursuant to the 2003 Land law and guiding documents;

Pursuant to the Government's Decree No. 176/1999/NDCP of December 21, 1999, on

registration fee;

Pursuant to the Government's Decree No. 80/ 2008/ND-CP of July 29, 2008,

amending and supplementing a number of articles of the Government's Decree No.

176/1999/ND-CP of December 21, 1999, and the Government's Decree No.

47/2003/ND-CP of May 12, 2003, on registration fee;

Pursuant to the Prime Minister's Decision No. 245/2003/QD-TTg of November 18.

2003, permitting the owing of house and residential land registration fee by

households and individuals in communes covered by Program 135 and ethnic

minority households and individuals in the Central Highlands;

Pursuant to the Government's Decree No. 118/2008/ND-CP of November 27, 2008,

defining the functions, tasks, powers and organizational structure of the

Ministry of Finance;

The Ministry of Finance guides the implementation of regulations on

registration fee as follows;

Chapter I

SCOPE OF APPLICATION

Article 1. Registration fee-liable objects

1. Houses and land:

a/ Houses, including houses, working offices, workshops, warehouses, shops, stores and other architectural works.

b/ Land, including agricultural and non-agricultural land of all categories specified in Clauses I and 2. Article 13 of the 2003 Land Law under management and use rights of organizations, households or individuals (regardless of whether or not works have been built on such land).

2. Means of transport, including road motor vehicles, motor means of waterway transport, means for fishing and transporting aquatic-products, specifically:

a/ Ships, including barges, speed-boats, tug boats, push boats, ship hulls or ship engine components.

b/ Motor boats.

c/ Automobiles, including all road motor vehicles with 4 or more wheels which are subject to registration with state management agencies under the Law on Road Traffic and guiding documents: substitute automobile frames or complete engine components, except machinery and equipment other than means of transport, such as road-rollers, cranes, shovels, bulldozers, machinery used for agricultural or forestry purposes (plows, harrows, scarifiers, weeding machines, rice plucking machines, tractors, etc.) and other machinery and equipment other than means of transport.

d/ Motorcycles, including two- and three-wheeled motorcycles, mopeds and the like which are subject to registration with state management agencies under the Law on Road Traffic and guiding documents: motorcycle frames or complete engine components.

Hulls and frames (collectively referred to as frames) and complete engine components subject to registration fee as specified at Point a, c and d of this Clause are substitute frames or engine components with frame or engine numbers different from those of assets for which competent state agencies have issued ownership or use right certificates but which are subject to re-registration with state management agencies under regulations. Cases of repairing frames or engines or replacing only engine blocks without changing frame or engine numbers or owners or users are not subject to registration fee.

3. Hunting rifles and sports guns.

Article 2. Registration fee payers

Vietnamese and foreign organizations and individuals, including foreign-invested enterprises operating under or not under the Law on Foreign Investment in Vietnam (now the Investment Law), that have assets liable to registration fee as specified in Article 1 of this Circular shall pay registration fee before registering ownership or use rights of their assets with competent state agencies (except cases exempt from registration fee specified in Article 3 of this Circular).

When it is otherwise provided for by a treaty which Vietnam has signed, acceded to or agreed upon, the provisions of such treaty shall be complied with.

Article 3. Cases of registration fee exemption

Organizations and individuals that have assets specified below are not required to pay registration fee:

1. Houses and land which are working offices of Vietnam-based foreign diplomatic missions and consulates and houses of heads of these missions and consulates.

Working offices of foreign diplomatic representations or consulates are buildings or their parts and their attached land which arc used for official purposes of diplomatic missions (including houses and their attached land of heads of the missions) or consulates as provided at Point b. Clause 1 and Point b. Clause 2. Article 4 of the 1993 Ordinance on Privileges and Immunities for Vietnam-based Diplomatic Missions. Consulates and Representative Offices of International Organizations.

2. Means of transport, hunting rifles and sports guns of the following foreign organizations and individuals:

a/ Diplomatic missions, consulates, representative offices of international organizations within the United Nations system.

b/ Diplomats, consuls, administrative and technical personnel of foreign diplomatic representations and consulates, members of international organizations within the United Nations system and their family members who are not Vietnamese citizens or do not permanently reside in Vietnam and are granted diplomatic or official identity cards by the Vietnamese Ministry of Foreign Affairs or local foreign affairs agencies authorized by the Ministry of Foreign Affairs.

c/ Other foreign organizations and individuals (representative offices of inter-governmental organizations outside the United Nations system, representative offices of non-governmental organizations, delegations of international organizations, members of these offices, and other organizations and individuals) other than those defined at Points a and b of this Clause, that are exempt from or not liable to registration fee (or exempt from or not liable to taxes, charges and fees of all kinds) under treaties which Vietnam has signed, acceded to or agreed upon.

In case treaties which Vietnam has signed, acceded to or agreed upon provide for non-collection of or exemption from charges and fees (in general) or registration fee (in particular) applicable also to Vietnamese partners, units directly implementing projects (or project management units) being Vietnamese partners will also be exempt from or not be liable to registration fee when registering ownership or use rights for assets under signed programs or projects.

In the case specified at Point c of this Clause, a registration fee declarant shall provide to the tax office an agreement signed between the Vietnamese Government and a foreign government (a copy signed with full name and stamped by the head of the project-implementing agency).

d/ For special programs or projects under which and other cases for which the Vietnamese Government has issued separate documents providing for exemption from or non-collection of registration fee for foreign organizations or individuals, such documents shall be complied with and registration fee payers are not required to provide copies of relevant agreements signed between the Vietnamese Government and foreign governments.

3. Land allocated by the State to organizations and individuals for use for the following purposes:

a/ Public purposes as provided for by the land law (except the cases specified in Clauses 3 and 4, Article 4 of this Circular).

b/ Mineral exploration and exploitation or scientific research licensed by competent slate agencies.

c/ Agricultural or forestry production, aquaculture or salt making.

d/ Construction of houses for sale, for which organizations and individuals licensed to conduct housing business have paid land use levies under law (unless they build houses not for sale but for dwelling, inn or hotel business, lease or other business activities). Land allocated by the State to economic organizations for building infrastructure for transfer or lease, regardless of whether such land is inside or outside industrial parks or export-processing zones.

A declarant of registration fee for land specified in this Clause must possess a competent state agency's land allocation decision (a copy notarized or certified by a competent authority) or obtain the commune-level People's Committee's certification of the allocation of land for agricultural or forestry production, aquaculture or salt making (for households and individuals defined at Point c of this Clause).

4. Agricultural land for which land use rights are transferred among households and individuals under the "land plot swap for Held consolidation" policy provided in Article 102 of Decree No. 181/ 2004/ND-CP.

5. Land leased from the State or organizations or individuals having lawful land use rights.

6. Land used for community purposes by religious or belief institutions recognized or licensed to operate by the State, including:

a/ Land involving pagodas, churches, sanctuaries, abbeys, schools, working offices or other facilities used by religious institutions;

b/Land involving communal houses, temples, shrines or small pagodas (except land used for building worshipping houses, worshiping halls, etc.. of family lines, households or individuals):

c/ Land used for building cemeteries or graveyards.

7. Houses, land and assets exclusively used for defense and security purposes.

8. Houses and land which are slate assets of slate agencies, public non-business units, political organizations, socio-political organizations, socio-politico-professional organizations, social organizations and socio-professional organizations under current laws.

9.Houses and land (including those purchased with compensation or support money) compensated when the State recovers houses and land of organizations or individuals that have paid registration fee (or those not liable to or exempt from registration fee under law).

10. Households' or individuals' houses which are built under the policy to develop separate houses under Point b. Clause 2. Article 50 of the Government's Decree No. 90/2000//ND-CP of September 6. 2006. detailing and guiding the implementation of the Housing Law.

11. Assets of organizations and individuals that already have ownership or use right certificate, upon re-registration of their ownership or use rights.

When dividing assets with ownership or use right certificates issued to households (co-owners or co-users of assets in asset ownership or use right certificates) to household members, asset recipients are not required to pay registration fee.

An asset ownership or use right certificate in the name of only one household member will not be regarded as that under common ownership or use of the household. However, to suit Vietnam's practical conditions, if the asset owner transfers his/her asset to his/her spouse, parent (including adoptive parent and parent-in-law) or child (including adopted child, daughter-in-law or son-in-law), the asset recipient is not required to pay registration fee.

12. Organizations' or individuals' assets for which registration fees have been paid (except cases not liable to or exempt from registration fee under a competent authority's policy or decision) and which are then transferred to other organizations or individuals for ownership or use right registration, are not subject to registration fee in the following cases:

a/ Organizations or individuals contribute their assets as capital to joint ventures or

partnerships with the legal entity status (state enterprises, foreign-invested enterprises, limited liability companies, joint-stock companies, etc.) which have registered their ownership or use rights of such assets, or which, upon dissolution. have divided their assets to member organizations and individuals for ownership or use right registration.

b/ Cooperative members contribute their assets as capital to their cooperatives, or cooperative members receive assets divided to them after they leave the cooperatives.

c/ Corporations, companies, enterprises or cooperatives transfer their assets to their member units (excluding individuals) or transfer assets among their member units in the form of mutual

ceasing of capital, or administrative and non business agencies or units transfer assets within the same state-funded agency or unit under decisions of competent authorities.

Assets transferred between corporations, companies or enterprises and their independent cost-accounting member units or transferred among independent cost-accounting member units not in the form of mutual ceasing of capital but in the form of sale and purchase, assignment, exchange or transfer between an agency or unit funded with state budget and another (for the administrative and non-business sector) are liable to registration fee.

d/Assets are divided or contributed as a result of division, splitting-up. consolidation, merger or renaming of organizations under decisions of competent authorities (unless renaming is made simultaneously with the change of asset owners, such as replacement of old founding members with new ones: transformation of limited liability companies with two or more members or joint-stock companies into one-member limited liability companies).

13. Assets which are moved to localities in which they are used without changing their owners or users.

In this case, asset owners shall produce to local tax offices with which asset ownership or use rights are registered asset ownership or use right registration papers (certificates of registration of means of waterway transport, motorcycle registration papers or automobile registration papers) enclosed with asset dossiers returned by registration management agencies of localities from which assets are moved which indicate their names and addresses of registration (in localities from which assets arc moved).

14. Houses of gratitude, houses of great solidarity and houses built for similar humanitarian purposes under policies and decisions issued by administrations of district or higher level, including land attached to these houses with its ownership or use rights registered in the beneficiaries' names.

In this case, a registration fee declaration dossier must comprise a paper on the transfer of house or land ownership or use rights between the donor and recipient (a copy notarized or certified by the commune-level People's Committee).

15. Special-use vehicles, including:

a/ Fire engines:

b/ Ambulances:

c/ Garbage (including other waste matters in sanitary and environmental treatment) trucks, road cleaners and sweepers:

d/ Vehicles used exclusively for war invalids, diseased soldiers and people with disabilities, with their ownership right registered in the names of these war invalids, diseased soldiers or people with disabilities.

Special-use vehicles mentioned in this Clause (15) are vehicles fitted with special-use equipment in complete sets, such as special-use water or chemical tanks and spray hoses (for fire engines and road cleaners), stretchers and sirens (for ambulances), garbage press containers or cranes, lifting devices, garbage collectors (for garbage trucks), motor three-wheelers (for vehicles used exclusively for war invalids, diseased soldiers or people with disabilities).

Registration fee shall be imposed in case these special-use vehicles have been transformed into other vehicles such as cargo or passenger transportation vehicles, cars or motor two-wheelers of all kinds, regardless of their users and use purposes.

16. Ship hulls and ship engine components, car frames and car engine components, motorcycle frames and motorcycle engine components, once used as substitute parts, must be re-registered within their warranty period. In this case, a registration fee declaration dossier comprises:

- A copy of the asset warranty paper.

- Bill for ex-warehousing the substitute asset, enclosed with a paper on the recovery of the old asset, issued by the seller to the buyer.

17. Goods permitted for trading, owned by organizations or individuals that make business registration without making ownership or use right registration with competent state agencies.

Article 4. Exemption from registration fee

Under Clause 1. Article 1 of Decree No. 80/ 2008/ND-CP exemption from registration fee is specified below:

1. Registration fee is exempted for houses and residential land of poor households; houses and residential land of ethnic minority people in communes, wards and townships in difficulty-hit areas. Specifically:

a/ Poor households are households which, at the time of registration fee declaration and payment (including registration fee declarants and payers who are their members), have poor household certificates issued by competent authorities or are certified as poor by commune-level People's Committees of localities where they reside according to the poverty line set by a Prime Minister decision and guiding documents.

b/ Houses and residential land of ethnic minority subject to registration fee declaration include houses and residential land of a household in which husband or wife is or both are ethnic minority persons and houses and residential land of ethnic minority individuals.

Difficulty-hit areas shall be identified under the Prime Minister's Decision No. 30/2007/QD-TTg of March 5. 2007. promulgating the list of administrative units in difficulty-hit areas, and amending and supplementing documents (if any).

In this case, a registration fee declarant shall enclose a land/house origin dossier with the certification of the commune-level People's Committee with which household membership registration is made or a copy of the household membership book evidencing that the husband or wife is or both are ethnic minority persons; or a paper evidencing that the house ownership or residential land use right-registering individual is an ethnic minority person.

2. Registration fee is exempted for non-motor inland waterway vessels (including fishing ships) with a gross tonnage of up to 15 tons, or motor vessels with the main engine's total capacity of up to 15 horsepower or with a seating capacity of up to 12 people as defined in the La won Inland Waterway Traffic and guiding documents (including substitute hulls and engine components fitted to these vessels).

3. Houses and land under lawful management and use rights of non-public establishments which register house ownership or land use rights for social, population, family or child protection and care purposes under the Government's Decree No. 53/2006/ND-CP of May 25. 2006. on policies to promote the development of nonpublic service providers. In case enterprises operating under the Law on Enterprises use houses or land for the above purposes, or nonpublic establishments register house ownership or land use rights but actually do not use such houses or land for the purposes eligible for incentives, they shall pay registration fee under regulations.

4. Houses and land eligible for incentives under the Government's Decree No. 69/2008/ ND-CP of May 30. 2008. on policies to encourage socialization of educational, job training, healthcare, cultural, sport and environmental activities.

Establishments that have been exempted from registration fee and have registered house ownership or land use rights but actually do not use such houses or land for the purposes eligible for incentives under regulations shall pay the exempted registration fee.

5. Registration fee exemption procedures comply with Section 1. Part F of the Finance Ministry's Circular No. 6()/2(X)7/TT-BTC of June 14. 2007. guiding a number of articles of I he Law on Tax Administration and the Government's Decree No. 85/2007/ND-CP of May 25. 2007. detailing a number of articles of the Law on Tax Administration.

Through examining the dossier, if seeing that the case is eligible for registration fee exemption, the tax office shall certify the "case of registration fee exemption under regulations" in the registration fee declaration form (the section reserved for the tax office) or in the notice of payment of house and land registration fee (for assets being houses and residential land).

Article 5. Owing of registration fee

1. Subjects allowed to owe registration fee:

If a household or an individual, upon receipt of a house ownership or residential land use right certificate, cannot pay a registration fee under regulations or can only pay part of the fee. it/he/ she may be allowed to owe the registration fee amount not yet paid into the state budget in the following cases:

a/ Houses and residential land of households or individuals (except cases eligible for registration fee exemption defined in Article 4 of this Circular) covered by the Program on socio-economic development in extreme difficulty-hit communes in mountainous, deep-lying and remote areas under the Prime Minister's Decision No. 135/1998/QD-TTg of July 31. 1998 (below referred to as Program 135) and specified in other decisions of the Prime Minister approving the list of extreme difficulty-hit communes covered by the program on socioeconomic development in extreme difficulty-hit communes, mountainous areas inhabited by ethnic minority people and border, deep-lying and remote areas and documents amending supplementing or guiding the implementation (if any).

b/ Other cases in which registration fee may be owed under the Government's regulations.

2. Houses or individuals stated

in Clause 1 of this Section are not allowed to owe registration

fee in the following cases:

a/ They use houses or residential land for other purposes such as for production, business or service activities (used as inns, hotels, shops, department stores, warehouses, working offices or companies' head offices), unless business establishments are closely associated with houses or residential land.

b/ They arc eligible to owe registration fee under Clause 1 of this Article but have paid registration fee. In this case they will not be refunded the paid registration fee amount so as to switch to owe such fee.

3. Procedures for owing registration fee:

a/ A household or an individual eligible to owe registration fee for houses or residential land specified in Clause 1 of this Article shall submit a dossier (comprising documents evidencing its/ his/her eligibility to owe registration fee under Clause 1 of this Article) to a competent state agency defined in Article 122 of Decree No. 181/ 2004/ND-CP.

b/ The agency competent to grant house ownership or residential land use right certificates shall inspect the dossier and. if ascertaining that the applicant is eligible to owe registration fee for houses or residential land under Clause 1 of this Article, write in the house ownership or residential land use rights certificate the phrase "Registration fee owed" before handing it to the house owner or land user.

4. For houses or residential land of a household or an individual for which the granted house ownership or land use right certificate is written with the phrase "Registration fee owed", the household or individual shall, before transferring or exchanging its/his/her houses or land, pay the owed registration fee amount calculated according to the registration fee calculation price applicable at the time of registration fee declaration.

The agency competent to grant house ownership or residential land use right certificates shall, when receiving a dossier of application for carrying out procedures for the transfer or exchange of house ownership or land use rights submitted by a household or individual that still owes registration fee. transfer such dossier, together with a "sheet on cadastral information for performance of financial obligations" to the tax office for registration fee calculation and issuance of a registration fee payment notice before carrying out procedures for the transfer or exchange under Joint Circular No. 30/2005/ TTLT/BTC-BTNMT of April 18. 2005. or under the one-stop shop mechanism applied in the locality.

Chapter II

REGISTRATION FEE CALCULATION BASES

Article 6. Asset value used for registration fee calculation

The asset value used for registration fee calculation is the actual transfer price of that asset on the domestic market at the time of registration fee calculation. The asset value used for registration fee calculation in some specific cases shall be determined as follows:

1. The value of land for registration fee calculation:

The land value used for registration fee calculation is the actual transfer price of land use rights declared by the taxpayer, which is determined as follows:

|

Land value used for registration fee calculation |

= |

Area of land liable to registration fee |

x |

Price of a square meter of land (m2) |

1.1. The area of land liable to registration fee is the total area of the land plot under the lawful use rights of an organization or individual, which is identified by a land use rights registry and indicated in the "sheet on cadastral information for performance of financial obligations" provided to the tax office.

1.2. If the taxpayer declares a price different from the actual transfer price, the land price will be determined based on the price of a square meter of land set by the People's Committee of the province or centrally run city (below referred to as provincial-level People's Committee) according to the method of determining land prices and the price frame of land of different categories prescribed by the Government. Land prices used for registration fee calculation in some specific cases are prescribed as follows:

a/ For land attached with a state-owned house which is sold to the current tenant under the Government's Decree No. 61/CP of July 5. 1994, the registration fee calculation price is the actual sale price written in the house and land sale invoice (issued by the Ministry of Finance) under a decision of the provincial-level People's Committee.

b/ For land allocated by the State through bidding or auction (below collectively referred to as auction), the registration fee calculation price is the actual auction-winning price written in the invoice or the actual auction-winning price indicated in the record on auction result or the decision approving the auction result issued by a competent state agency.

c/ For land allocated by the State in forms other than auction, registration fee will be calculated according to the land price set by the provincial-level People's Committee and applied at the time of registration.

d/ For land transferred from organizations or individuals (business or non-business), the registration fee calculation price is the actual transfer price indicated in the invoice, transfer contract, sale and purchase paper or registration fee declaration. If the actual transfer price written in these papers is lower than the land price set by the provincial-level People's Committee and applied at the time of registration, registration fee will be calculated according to the land price set by the provincial-level People's Committee.

c/ For cases in which a land user was granted a land use right certificate, then permitted by a competent agency to use the land for another purpose and at the time of registration fee declaration, if the land price set by the provincial-level People's Committee for the new purpose is higher than that prescribed for the purpose written in the land use right certificate (with a positive (+) difference), the land user shall pay registration fee calculated on such positive disparity amount; if the land price set for the new purpose is lower than that prescribed for the former purpose (with a negative (-) difference), the land user will neither be liable to registration fee nor refunded the paid registration fee amount.

For cases in which a land user was granted a land use right certificate but not liable to registration fee. then permitted by a competent agency to use land for another purpose which, however, is liable to registration fee. the registration fee calculation price will be the land price prescribed for the new purpose by the provincial-level People's Committee at the time of registration fee calculation.

f/ For land allocated by competent state agencies for resettlement purposes of which the price approved by a competent state agency has been balanced between the amount of compensation for land recovery and the land price in the resettlement quarter, the registration fee calculation price is the approved land price.

2. The value of houses for registration fee calculation:

The house value of for registration fee calculation (below referred to as the value of registration houses) is the actual transfer value of a house on the market at the time of registration fee calculation.

For cases in which the actual transfer value cannot be determined or it is declared lower than the market price, the house price used for registration fee calculation set by the provincial-level People's Committee at the time of registration will be applied as follows:

|

House value for registration fee calculation |

= |

Area of the house liable to registration fee |

x |

Price of one square meter(m2) of the house |

x |

Percentage(%)of the residual quality of the house liable to registration fee |

2.1. The area of the house liable to registration fee is the total floor area (inclusive of the area of support facilities) under the lawful ownership of an organization or individual.

2.2. The price of a square meter of the house is the actual price for the construction of one (1) square floor meter of a house of a certain grade or class set by the provincial-level People's Committee and applied at the time of registration.

2.3. The percentage (%) of the residual quality of the house liable to registration fee is specified as follows:

a/ First-time declaration for registration fee payment for houses already used for under 5 years: 100%; When making first-lime registration fee declaration for a house already used for 5 years or more, the percentage (%) of the residual quality of the house will comply with its corresponding use period as guided at Point b of this Clause

b/ Declaration from the second time on:

|

Use period |

Villas (%) |

Grade-I houses (%) |

Grade-II houses (%) |

Grade-Ill houses (%) |

Grade-IV houses (%) |

|

- Under 5 years |

95 |

90 |

90 |

80 |

80 |

|

- Between 5 and 10 years |

85 |

80 |

80 |

65 |

65 |

|

- Between over 10 and 20 years |

70 |

60 |

55 |

35 |

35 |

|

- Between over 20 and 50 years |

50 |

40 |

35 |

25 |

25 |

|

- Over 50 years |

30 |

25 |

25 |

20 |

20 |

The use period of a house will be counted from the time (year) when the construction of the house is completed and the house is handed over (or put into use) to the year of registration house declaration and payment. If the dossier does not contain sufficient grounds to determine the year of construction, the year of house purchase or receipt will apply.

2.4. Some specific cases of application of the value of houses liable to registration fee:

a/ The registration fee calculation price of a house under state ownership sold to the current tenant under the Government's Decree No. 61/ CP of July 5. 1994. is the actual sale price written in the house sale invoice as decided by the provincial-level People's Committee.

b/The registration fee calculation price of a house bought from an organization or individual (business or non-business), except houses under state ownership sold to current tenants under Decree No. 61/CP. is the actual purchase price written in the invoice (lawful invoice provided by the Ministry of Finance) or the actual purchase price written in the house sale/purchase or transfer contract, which, however, must not be lower than the house price set by the provincial-. level People's Committee at the lime of. registration fee calculation.

c/ The registration fee calculation price of a resettlement house whose price approved by a competent state agency has been balanced between the amount of compensation for house recovery and the price of houses in the resettlement quarter, is the approved price of the house

3. The value of ships, boats, cars, motorcycles, hunting rifles or sporting guns liable to registration lee (below collectively referred to as the value of registration assets) is the actual transfer value of assets on the domestic market at the time of registration fee calculation. The registration fee calculation price in some cases is specified as follows:

3.1. For assets bought directly from establishments licensed to produce or assemble these assets in the country (below collectively referred to as production establishments), it is the actual payment price (the sale price inclusive of value-added tax and excise tax. if any) written in the lawful sale invoice.

If an organization or individual buys an asset from a sale agent which directly signs an agency contract with a production establishment and sells the asset at the price set by the production establishment, it/he/she will be also regarded as having bought the asset directly from the production establishment.

The production establishment shall notify in writing the local tax office of the sale price of each kind of goods liable to registration fee in each period.

The tax office shall check the sale price written on the sale invoice issued by the agent to the customer against the price indicated in the price quotation of the production establishment, if they are consistent, the tax office shall calculate registration fee using the contractual price.

If the sale price written in the sale invoice issued by the sale agent to the customer is lower than the sale price quoted by the production establishment, registration fee will be calculated using the price provided in the table of minimum prices for registration fee calculation prescribed by the provincial-level People's Committee.

3.2. For an asset paid in installments, the registration fee calculation price is the price paid in lump sum. inclusive of value-added tax and excise tax (if any) on the asset (exclusive of installment payment interests).

3.3. For an asset through auction in accordance with the law on bidding and auction (including confiscated goods and liquidated goods), the registration fee calculation price is the actual auction-winning price written in the sale invoice.

3.4. For means of transport fitted with special-use equipment as integral parts, such as vehicles exclusively used for carrying frozen goods which are fitted with a freezing system, vehicles exclusively used for detecting waves which are fitted with a radar system, etc.. the registration lee calculation price is the total value of the means of transport, including the fitted special-use equipment.

3.5. For an asset of which the actual transfer value cannot be determined or the declared value is lower than the price set by the provincial-level People's Committee, the table of registration fee calculation prices set by the provincial-level People's Committee at the time of registration fee calculation shall apply.

If the provincial-level People's Committee has not yet set the registration fee calculation price for such asset, the market price of assets of an equivalent kind or the import price (the import duty calculation price determined by the customs office) at the border gate (CIF) plus i + ) import duty, excise tax (if any) and value-added tax imposed on assets of an equivalent kind (regardless of whether these assets are liable to or exempt from such taxes) shall apply.

3.6. For registration fee-liable assets that are used ones, the registration fee calculation price is the value of the brand-new asset multiplied by (x) the percentage (%) of the residual quality of the registration fee-liable asset. Specifically as follows:

a/ The value of the brand-new asset will be determined according to the table of registration fee calculation prices set by the provincial-level People's Committee.

b/ The percentage (%) of the residual quality of the registration fee-liable asset is specified as follows:

*First-time declaration for registration fee payment in Vietnam:

- Brand-new assets: 100%.

- Used assets imported into Vietnam: 85%.

* Registration fee declaration from the second time on in Vietnam (for making declaration to competent state agency for assets for which registration fee has been previously declared and paid in Vietnam):

- Having a use period of under 1 year: 85%

- Having a use period of between 1 and 3 years: 70%.

- Having a use period of between over 3 and 6 years: 50%.

- Having a use period of between over 6 and 10 years: 30%.

- Having a use period of over 10 years: 20%.

The use period of an asset shall be determined as follows:

- For an asset manufactured in Vietnam, its use period shall be counted from the time (year) of manufacture to the year of registration fee declaration:

- For a brand-new asset imported into Vietnam, its use period shall be counted from the time (year) of importation to the year of registration fee declaration. In case in which the time of importation cannot be identified, the time (year) of manufacture shall apply.

-For cases of making registration fee declaration in Vietnam from the second time for used assets imported into Vietnam, the use period will be counted from the time (year) of manufacture to the year of registration fee declaration and the asset value used for determining the registration fee calculation price is the price of brand-new assets of an equivalent kind set by the provincial-level People's Committee.

For example: An asset was manufactured in 2007. and registered for the lirst time in Vietnam in 2007 (brand-new). In 2009. it was transferred to another individual who registered for its use for the second time. In this case, the use period is 3 years (2007. 2008 and 2009).

For cases in which the time (year) of manufacture cannot be identified, the use period shall be counted from the time (year) of importation and the asset value used for determining the registration fee calculation price is the price of used assets (85%) of an equivalent kind.

4. Basing themselves on the principles of determination of registration fee calculation prices prescribed in Article 5 of Decree No. 170/ 1999/ND-CP and the guidance in this Circular, provincial-level People's Committees shall determine and issue tables of registration fee calculation prices of houses, land, ships, boats, cars, motorcycles, hunting rifles and sports guns for application in their respective localities in each period.

In the course of registration fee collection and management, if tax offices detect cases in which the prescribed registration fee calculation prices do not match market prices or upon receiving dossiers for registration fee payment for assets which have appeared in local markets but not yet included in tables of registration fee calculation prices, they shall promptly send their opinions thereon to the provincial-level People's Committees or authorized agencies for modification and supplementation of the price tables.

Within 15 days after promulgating tables of registration fee calculation prices, the promulgating agencies shall send them to the Ministry of Finance (the General Department of Taxation) for monitoring.

Article 7. Registration fee rates

Registration fee rates are prescribed as percentages of the asset value used for registration fee calculation, specifically as follows:

Houses and land: 0.5% (zero point five per cent).

Waterway motor vessels, vessels engaged in fishing activities or marine product transportation (including their hulls, chassis and complete marine engine components): 1% (one percent); particularly for offshore fishing ships (including their hulls, chassis and complete components of spare engines): 0.5% (zero point five per cent).

Offshore fishing ships are those fitted with a main engine of 90 horsepower or more and certified by a fishing ship registry as being qualified for offshore fishing. Registration fee declarants for offshore fishing ships shall produce to tax offices:

- The technical inspection record issued by a fishing ship registry.

- Papers showing the lawful origin of the ship, clearly stating its engine number and main engine capacity.

3. Hunting rifles and sports guns: 2% (two per cent)

4. The registration fee rates for motorcycles (including their chassis and complete components) are specified as follows:

a/ For motorcycles of organizations and individuals for which registration fee is declared and paid in centrally run cities, provincial cities and towns where the provincial-level Peoples Committees are headquartered:

- First-time registration fee declaration and payment: If the asset owner has declared and paid registration fee in another locality and then transferred the motorcycle to an organization or individual that makes registration fee declaration and payment in a locality stated in this Clause, the registration fee is 5% (five per cent i.

- Registration fee declaration and payment from the second time on (for motorcycles for which registration fee has been declared and paid by their owners in the localities stated in this Clause and now subject to registration fee declaration and payment): the registration fee rate is 1% (one per cent).

Centrally run cities and provincial cities and towns where provincial-level People's Committees are headquartered shall be determined by administrative boundary at the time of registration fee declaration, covering ail urban and rural districts of these cities. Provincial cities and towns where provincial-level People's Committees are headquartered cover all wards and communes of these cities and towns.

b/ Registration fee rates for motorcycles of organizations and individuals for which registration fee is declared and paid in localities other than those stated at Point a of this Clause are specified as follows:

- First-time registration fee declaration and payment: the registration fee rate is 2% (two per cent).

- Registration fee declaration and payment from the second time on (for motorcycles for which registration fee has been declared and paid once by their owners in Vietnam, subsequent times of registration fee declaration and payment will be considered the second time on): the registration fee rate is 1% (one percent).

When making registration fee declaration and payment for a motorcycle from the second time on. the asset owner shall produce to the tax office the motorcycle registration certificate or molorcycle registration dossier returned by the police office which has issued the registration certificate. The locality of the previous registration fee declaration and payment shall be identified according to the "place of permanent residence", "place of registration of permanent residence" or "address" shown in the motorcycle registration certificate or the motorcycle registration declaration or motorcycle transferor movement declaration in the motorcycle registration dossier and determined by administrative boundary at the lime of registration fee declaration.

Specific examples on the determination of registration fee rates for cases of registration fee declaration and payment from the second time on (in which locality A means a province, centrally run city, provincial city or town where the provincial-level People's Committee is headquartered and locality B means another locality):

+ Case I: For a motorcycle for which registration fee has been declared and paid in locality A. if the subsequent time of registration fee declaration and payment is made in locality A, the registration fee rate is 1%.

+ Case 2: For a motorcycle for which registration fee has been declared and paid in locality A. if the subsequent time of registration fee declaration and payment is made in locality B, registration fee will be paid at the rate of {%.

+ Case 3: For a motorcycle for which registration fee has been declared and paid in locality B. if the subsequent time of registration fee declaration and payment is made in locality

A. the registration fee rate is 5%.

+ Case 4: For a motorcycle for which registration fee has been declared and paid in locality B, if the subsequent time of registration fee declaration and payment is made in locality B, the registration fee rate is 1%.

+ Case 5: For a motorcycle for which registration fee has been declared and paid for the first time in locality A or locality B. if the subsequent times of registration fee declaration and payment are made in locality B and then locality A. the registration fee rate is 5%.

+ Case 6: For a motorcycle for which registration fee has been declared and paid for the first time in locality A or locality B. if the subsequent two times of registration fee declaration and payment are made in locality A. the registration fee rate is 1%.

+ Case 7: For a motorcycle for which registration fee has been declared and paid for the first time in locality A or locality B, if the subsequent time of registration fee declaration and payment is made in locality A or B and the following time in locality B. the registration fee rate is 1 %.

5. Registration fee rates for automobiles (including their chassis and complete engine components) are specified as follows:

5.1. For passenger cars of under 10 seats (including the driver), the registration fee rate is between 10% (ten percent)and 15% (fifteen per cent). Of which:

a/ The number of seats will be determined according to manufacturers" designs.

b/Passenger cars of under 10 seats, including the driver (below referred to as under-10 seat cars) exclude lambrettas and cars designed for both passenger and cargo transportation.

c/ Basing themselves on regulations on registration fee rates applicable to under-10 seat cars in Clause 2. Article 1 of Decree No. 80/2008/ ND-CP and the guidance in this Clause, provincial-level People's Committees of provinces and centrally run cities shall assign functional agencies to determine registration fee rates applicable to under-10 seat cars suitable to their local conditions for submission lo provincial-level People's Councils for decision.

5.2. For other automobiles (including trailers and semi-trailers) which arc not under-10 seat cars defined at Point 5.1 of this Clause and special-use vehicles exempted from registration fee under Clauses 7 and 15. Article 3 of this Circular, the registration fee rate is 2% (two per cent).

Article 8. Determination of registration fee amounts payable into the state budget

1. The registration fee amount for an asset will be determined based on the value of the registration fee-liable asset and the registration fee rate specified Articles 6 and 7 of this Circular:

|

Registration fee amount |

= |

Registration fee calculation value of the asset |

x |

Registration fee rate ('%) |

2. The registration fee amount payable into the state budget for an asset does not exceed five hundred (500) million dong per registration (except passenger cars of under 10 seats (including the driver) and cases mentioned in Clause 3 of this Article), specifically:

- If the registration fee amount calculated under the guidance in Clause 1 of this Article is VND five hundred (500) million or under, the registration fee amount to be paid into the state budget will be the amount actually arisen.

- If the registration fee amount calculated under the guidance in Clause 1 of this Section is

higher than VND five hundred (500) million, the registration fee amount to be paid into the slate budget will be VND live hundred (500) million.

3. Registration fee for all production and business workshops (including land attached thereto) of an organization or individual located in the same land/house plot under its/his/her lawful ownership or use rights will be calculated in aggregate. The maximum registration fee amount to be paid by such organization or individual for all workshops in its/his/her land plot will be VND five hundred (500) million, regardless of whether such organization or individual registers its/his/her ownership or use rights once or in many times.

For example: Company A has 3 workshops in a land plot of 100.000 in2; the total value of these workshops (including land) is VND 210 billion and the value of each workshop is VND 70 billion. In this case, the registration fee amount shall be calculated as follows:

- If Company A declares and pays registration fee in lump sum. the registration fee amount will be determined as = VND 210 billion x 0.5% = VND 1.05 billion and Company A shall only have to pay a registration fee amount of VND 500 million only.

- If Company A declares and pays registration fee thrice (one time for each workshop), the payable registration fee amount for the first time will be VND 350 million (VND 70 billion x 0.5%); the payable fee amount for the second time will be VND 150 million (instead of VND 350 million); for the next time of registration fee declaration for the last workshop. Company A will not be required to pay any registration fee (as it has fully paid the registration fee amount as prescribed).

Chapter III

REGISTRATION FEE DECLARATION AND ACCOUNTING

Article 9. Responsibilities of owners of assets liable to registration fee

1. Organizations and individuals having assets liable to registration fee (regardless of whether they are subject to pay registration fee) shall make registration fee declaration as follows:

a/ Upon receiving an asset (through purchase, transfer, exchange, donation, inheritance, etc.). the asset owner (or a person authorized by the asset owner) shall make registration fee declaration according to form No. 01/LPTB or No. 02/LPTB. issued together with the Finance Ministry's Circular No. 00/2007 AT-BTC of June 14.2007. guiding a number of articles of the Law on Tax Administration and the Government's Decree No. 85/2007/ND-CT of May 25. 2007. detailing a number of articles of the Law on Tax Administration. Declarants shall take responsibility for the accuracy of their declarations.

b/ The registration fee declaration will be made in two copies for each asset and enclosed with relevant papers (below collectively referred to as registration fee declaration dossier) and submitted to a dossier-receiving agency prescribed in Section IX. Part B of Circular No. 60/2007/TT-BTC.

c/ In order to comply with the time limit for registration of vehicle transfer and move prescribed in Section II. Part B of the Public Security Ministry's Circular No. 06/2009/TT-BCA(C11) of March 11. 2009. providing for the issuance and withdrawal of registration certificates and number plates for road motor vehicles, apply uniformly regulations to assets of all kinds and suit the practical situation, the time limit for making registration fee declaration with lax offices is thirty (30) days from the date the two parties make a paper on the transfer of the asset or the date of certification of the "lawful asset dossier" by a competent stale agency. For assets of which the ownership or use rights were transferred before the effective date of Decree No. 176/1999/ND-CP if registration fee has not been declared yet. the time limit for registration fee declaration will be counted from the effective date of Decree No. 176/1999/ND-CP

2. Asset owners (or persons authorized by asset owners) shall provide complete registration fee declaration dossiers to slate agencies under Point 1.2. Section IX. Part B of the Finance Ministry's Circular No. 00/2007 /TT- BTC of June 14. 2007. and the guidance in this Circular.

For cases in which an asset owner authorizes another persons to declare and pay registration fee. the authorization must be carried out under law and the authorized person shall produce:

-The paper of authorization to pay registration fee on behalf of the asset owner, clearly stating the name, address and identity card number of the authorized person (for individuals): or the letter of introduction issued by the authorizing organization (for organizations): and the identity card of the authorized person.

- In case an organization providing tax procedure services performs a service contract on registration fee declaration for the asset owner, the tax agent shall comply with regulations on responsibilities of tax agents in the course of carrying out tax procedures (sign and stamp on declaration dossiers and write the number of its practice certificate).

3. Organizations and individuals having assets liable to registration fee shall fully and timely pay registration fee into the state budget (except those eligible for registration fee exemption or reduction) according to law.

4. Registration fee will be paid in Vietnam dong according to the corresponding chapter, category, clause, item and sub-item of the State Budget Index.

The paper on money remittance into the state budget or the registration fee collection receipt enclosed with the registration fee notice which is handed by a tax office to an asset owner will serve as documents evidencing the asset owner's fulfillment of its/his/her obligation to pay registration fee for registering his/her asset ownership or use rights with competent state agencies.

5. For an asset which was sold, purchased or had their ownership or use rights transferred before the effective date of the Government's Decree No. 176/1999/ND-CP (January 1.2000), but the current lawful owner or user has not yet paid registration fee. registration fee must be paid in lump sum under the Government's Decree No. 176/1999/ND-CP and the guidance in this Circular (without having to pay registration fee on behalf of former owners or pay any fine, for cases in which the asset has been transferred for several times prior to January 1. 2000).

If an asset liable to registration fee has been transferred after the effective date of the Government's Decree No. 176/1999/ND-CP (January 1. 2000). registration fee must be declared and paid upon each transfer (except cases specified in Clause 17. Article 3 of this Circular). If the asset transferor has not yet paid registration fee. the asset transferee shall pay registration fee for the transferor according to law.

Article 10. Registration fee accounting

1. Organizations and individuals (individuals engaged in production, business or service activities) that pay registration fee may account the registration fee amount actually paid into the state budget (except fines) as an increase in their fixed assets.

2. Registration fee (including related fines, if any) constitutes a state budget revenue. Registration fee-collecting tax offices shall open accounting books to regularly update information on the collection and remittance of registration fee (including related fines, if any) into the state budget with regard to all fee notices already sent to asset owners (or land use right registries, for land and house registration fee notices). Such information includes serial number and dale of issuance of the notice: name of asset owner: kind of asset: payable fee amount (as indicated in the notice): serial number and date of the receipt (credit note issued by state treasury, money remittance document or receipt): paid fee amount (as indicated in the payment document): and owed fee amount (if any).

Chapter IV

TASKS. RESPONSIBILITIES AND POWERS OF TAX OFFICES AND RELATED AGENCIES

Article 11. Tasks and powers of tax offices

1. Provincial-level Tax Department-, shall guide the use of registration fee declaration forms issued together with the Finance Ministry's Circular No. 60/2007/TT-BTC of June 14. 2007. such as declaration form, place of receipt of declaration forms (via the Internet or directly at lax offices) and place of submission of declaration forms. For cases in which registration fee declaration forms for ships, boats, automobiles, motorcycles, hunting rifles or sports guns are needed for free distribution to taxpayers, provincial-level Tax Departments shall print and supply these declaration forms to district-level Tax Departments for free distribution to registration fee declarants.

2. To publicly post up the following regulations at the places of receipt of registration fee declaration dossiers:

a/ Requirements on registration fee declaration dossiers and procedures for registration fee declaration for each kind of assets (papers which asset owners are required to provide, the number and type (original, copy or notarized/certified copy) of each paper).

b/ Instructions on how to fill in registration fee declaration forms.

c/ The registration fee rate applicable to each type of asset.

d/ The currently valid table of registration fee calculation prices of assets, issued by the provincial-level People's Committee.

e/ A (brief) diagram showing the process of registration fee collection, from the receipt of dossiers lo the return of dossier-handling results and remittance of money into the slate budget. f/ Other relevant regulations (if any).

3. To guide organizations and individuals to make registration fee declaration under regulations.

4. To receive and inspect registration fee declaration dossiers under regulations. For cases in which dossiers are improper, to return them to asset owners for supplementation so as to ensure their completeness and validity under regulations.

Upon receiving a registration fee declaration dossier, the dossier recipient shall record it the dossier register according to a set form (No. 04-05/GNHS~or 04a-05/GNHS issued together with this Circular - not printed herein), writing down the ordinal number (based on the date of receipt), the name and address of the asset owner and the name of the registration fee-liable asset. The dossier submitter (or the dossier deliverer of a land use right registry) shall sign for certification.

5. To calculate registration fee amounts and issue registration fee notices according to a set form. Each registration fee notice will be madein 2 copies as follows:

a/ For houses and land, within three (03) working days after receiving a complete dossier for performance of financial obligations which is transferred from a land use right registry, the tax office shall determine and write all necessary information in the registration fee notice and send one (1) copy thereof lo the land use right registry for hand-over to the house or land owner (or his/ her authorized person), and keep one (I) copy.

b/ For ships, boats, automobiles, motorcycles, hunting rifles or sports guns, right on the date of receipt of the registration fee declaration dossier, the tax office shall determine and write all necessary information in the registration fee notice and hand one (I) copy of such notice to the asset owner (or his/her authorized person) and keep one (1) copy.

c/ In localities where registration fee is not collected via stale treasuries, tax offices shall directly collect registration fee and remit the collected amounts into state treasuries under current regulations.

6. To open accounting books to update information on each registration fee declarant according to form No. 05/SKT-LPTB issued together with this Circular (not printed herein). Such information includes: the payable registration fee amount (as indicated in the fee notice), the collected registration fee amount (according to the payment voucher) and case of non-collection of (exemption from) registration fee (specifying the non-collection).

Monthly (no later than the 5lhday). to complete the checking of registration fee notices against money payment documents (money payment papers or registration fee receipts) and documents on money remittance into state treasuries (for cases in which tax offices directly collect fee) in order to determine the registration fee amounts to be collected, already collected and already remitted into the slate budget in the preceding month and lake measures to handle cases of late payment, overpayment (underpayment) or other violations.

7. To settle complaints and denunciations about registration fee according to their competence under the Law on Tax Administration and guiding documents or transfer (heir dossiers to competent state agencies for handling under law.

8. To handle administrative violations of regulations on registration fee declaration and payment committed by organizations or individuals under the Law on Tax Administration and guiding documents.

9. To report on the collection and remittance of registration fee as well as problems arising in the course of registration fee management and collection in their respective localities under the guidance of the Ministry of Finance and the General Department of Taxation.

10. To archive and preserve books, documents and dossiers related to assets for which registration fee has been paid according to the following regulations:

a/ Registration fee collection documents (receipts, money remittance papers) will be bound in hooks by year (or by serial number recorded in registration fee collection and remittance accounting books) and by kind of asset (houses and land, ships, boats, etc.).

b/ Registration fee declaration dossiers for each type of assets, such as registration fee declarations and copies of papers evidencing the origin of assets, copies of documents certifying the eligibility for exemption from or non-collection of registration fee supplied by asset owners and registration fee notices, will be filed and numbered according to the ordinal numbers written in the registration fee collection and remittance accounting books of each year.

c/ Time limits for dossier preservation and archive:

- Accounting books of house and land registration fee collection and remittance and house and land registration fee collection documents (receipts, money payment papers) will be archived permanently.

- Accounting books of registration fee collection and remittance and registration fee collection documents for other assets (excluding houses and land) will be archived for at least ten (10) years.

- Registration fee declaration dossiers of each type of assets stated at Point b of this Clause will be archived for at least five (5) years.

Article 12. Responsibilities and powers of concerned agencies

1. State agencies receiving dossiers of application for certificates of the rights to own or use assets (house, land. ship, boats, automobiles, motorcycles, hunting rifles or sports guns), apart from coordinating with tax offices in receiving and forwarding dossiers of land users for the performance of financial obligations, shall:

a/ Inspect the observance of the law on registration fee by organizations and individuals that register asset ownership or use rights. If detecting an organization or individual who is liable to pay registration fee but has not yet paid registration fee into the state budget (having no money remittance paper or registration fee receipt), to refrain from issuing an ownership or a use right certificate for this asset (except for cases eligible for exemption from registration fee or entitled to owe registration fee according to regulations).

b/ If detecting an organization or individual that falsely declares or evades registration fee. to coordinate with tax agencies in retrospectively collecting the outstanding registration fee amount and imposing sanctions according to law.

2. Registration fee-collecting agencies:

On the basis of registration fee notices issued by tax offices, registration fee-collecting agencies shall:

a/Fully collect registration fee amounts stated in notices and account them according to the corresponding chapter, category, clause, item and sub-item of the State Budget Index.

In localities where state treasuries still fail to arrange places for registration fee collection, tax offices shall directly collect registration fee and shall make a list of collected fee amounts everyday or within five (5) days after fee collection and fully remit the collected fee amounts into the state budget under regulations.

b/ If detecting an organization or individual that pays registration fee after a time limit of 30 days from the date of receiving a fee notice from the tax office, calculate and collect a late payment fine for remittance into the stale budget under regulations.

Collecting agencies shall remit the collected amounts of late payment fines into the state budget and account them according to the corresponding chapter, category, clause and item oi' the state budget index.

Chapter V

IMPLEMENTATION PROVISIONS

Article 13. Effect

This Circular takes effect 45 days from the date of its signing and applies to registration fee declaration dossiers submitted to tax offices or transferable one-stop shop agencies since its effective date. This Circular replaces the Finance Ministry's Circular No. 95/2005/TT-BTC of October 26. 2(X)5. guiding the implementation of legal provisions on registration fee: Circular No. 02/2007/TT-BTC of January 8. 2007. amending and supplementing Circular No. 95/2005/TT-BTC of October 26. 2005. guiding the implementation of legal provisions on registration fee; Circular No. 79/2008/TT-BTC of September 15. 2008. guiding the implementation of the Government's Decree No. 80/2008/ND-CP of July 29. 2008. amending and supplementing a number of articles of the Government's Decree No. 176/1999/ND-CP of December 21. 1999; and Decree No. 47/ 2003/ND-CP of May 12.2003. on registration fee; and other regulations on registration fee which are contrary to this Circular.

Article 14. Organization of implementation

1. For cases in which land or residential land use rights certificates have been granted by competent state agencies but nor or only part of registration fee has yet been paid, registration fee shall be paid under Article 1 of Decree No. 80/2008/ND-CP specifically:

a/ For cases in which a registration fee payer fails to pay registration fee or has paid only part of registration fee within 30 days after receiving a fee notice:

- For cases of failing to pay registration fee: If the fee payer is eligible for registration fee exemption under the guidance in Clause 1. Article 4 of this Circular, it/he/she will not be required to pay registration fee: if the fee payer is liable to pay registration fee. it/he/she will pay registration fee under the guidance in Clause I. Article 7 of this Circular.

- For cases of having paid only of registration fee before the effective date of Decree No. 80/ 2008/ND-CP: The fee payer will be refunded the paid registration fee amount, if it/he/she is eligible for exemption from registration fee, or and be refunded the overpaid fee amount, if the paid fee amount is higher than the payable fee amount calculated under Decree No. 80/2008/ND-CP: if the paid fee amount is lower than the payable fee amount calculated under Decree No. 80/2008/ND-CP the fee payer shall pay the outstanding fee amount.

b/ For cases in which a registration fee payer fails to pay registration fee or has paid only pari of registration fee but the time limit of 30 days from the date of receiving a fee notice has expired:

For cases of failing to pay registration fee: If the fee payer is eligible for registration fee exemption under the guidance in Clause 1. Article 4 of this Circular, it/he/she will neither be required to pay registration fee nor fined for late payment: if the fee payer is liable to pay the fee. it/he/she shall pay it under the guidance in Clause 1. Article 7 of this Circular and be fined for late payment according to current regulations.

For cases of having paid only part of registration fee before the effective date of Decree No. 80/2008/ND-CP: The fee payer will be refunded the paid fee amount and not be fined for late payment, if it/he/she is eligible for registration fee exemption: if the paid fee amount is higher than the payable fee amount calculated under Decree No. 80/2008/ND-CP the overpaid fee amount shall be refunded but the fee payer shall be fined for late payment according to current regulations; if the paid fee amount is lower than the payable fee amount calculated under Decree No. 80/2008/ND-CP the fee payer shall pay the deficit fee amount and be fined foliate payment according to regulations.

c/ Procedures for adjusting registration fee and issuing adjusted registration fee notices for cases in which registration fee must be paid under this Clause comply with Clause I. Section IX. Part IJ of the Finance Ministry's Circular No. 60/2007/ TT-BTC of June 14. 2007. guiding a number of articles of the Law on Tax Administration and the Governments Decree No. 85/2007/ND-CP of May 25. 2007. detailing a number of articles of the Law on Tax Administration.

d/ The period of time and registration fee amounts used for calculating fines for late payment of registration fee under this Clause comply with registration fee notices which were issued under regulations applied before the effective date of Decree No. 80/2008/ND-CP.

e/ Procedures for refunding registration fee specified this Circular comply with the provisions in Part G of the Finance Ministry's Circular No. 00/2007 AT-BTC of June 14. 2007. guiding a number of articles of the Law on 'lax Administration and the Government's Decree No. 85/2007/ND-CP of May 25. 2007. detailing a number of articles of the Law on Tax Administration.

2. The General Department of Taxation, state treasuries, stale agencies competent to issue asset ownership and use right certificates, and organizations and individuals that have assets liable to registration fee shall implement the Government's Decree No. 176/1999/ND-CP the Prime Ministers Decision No. 245/2005/QD-TTg Decree No. 80/2008/ND-CP of July 29, 2008. and this Circular.

Any problems arising in the course of implementation should be promptly reported to the Ministry of Finance for study and additional guidance.-

|

|

FOR THE MINISTER

OF FINANCE |