Guidance 258/HD-TLDD on trade union dues đã được thay thế bởi Decision 1908/QD-TLD 2016 management trade union budget assets collection distribution rewards và được áp dụng kể từ ngày 01/01/2017.

Nội dung toàn văn Guidance 258/HD-TLDD on trade union dues

|

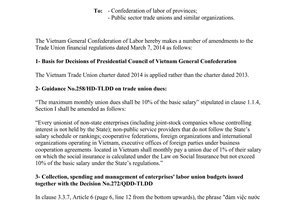

VIETNAM GENERAL

CONFEDERATION OF LABOR |

THE SOCIALIST

REPUBLIC OF VIETNAM |

|

No: 258/HD-TLDD |

Hanoi, March 07, 2014 |

GUIDANCE

ON TRADE UNION DUES

Pursuant to the Law on Trade Union dated 2012 and Regulation of Vietnam Trade Union 2013;

Vietnam General Confederation of Labor hereby provides guidance on the payment of trade union dues as follows:

I - Payers, amount of union dues, salary as basis for union due calculation and management of trade union dues.

1- Payers, amount of union dues, salary as basis for union dues

1.1- Every unionist of State regulatory authorities, affiliates of the People’s armed forces; political organizations; socio-political organizations; socio-professional organizations; social organizations; social-political-professional organizations and public services providers that follow the State salary’s schedule and ranking shall monthly pay a union due of 1% of the salary on which the social insurance premium is calculated under the Law on Social Insurances (hereinafter referred to as “social insurance salary base”).

The social insurance salary base includes the position allowances, salary by employment contract, and seniority allowances. If the social insurance salary base increases or decreases, the salary on which the union due is calculated also goes up or down, respectively, under the Law on Social Insurance.

1.2- Unionists of State-owned enterprises’ unions (including trade unions of joint-stock companies whose controlling interest is held by the State) shall monthly pay a union due of 1% of their net salary (after deduction of premiums of the social insurance, medical insurance, unemployment insurance and personal income tax) but the maximum due shall not exceed 10% of basic salary under the State’s regulations.

Every unionists working for non-state enterprises ( including joint-stock companies whose controlling interest is not held by the State); non-public service providers that do not follow the State’s salary schedule or rankings; cooperative federations, foreign organizations and international organizations operating in Vietnam, executive offices of foreign parties under business cooperation agreements located in Vietnam shall monthly pay a union due of 1% of their social insurance salary base under the Law on Social Insurance.

1.4- The union due paid by the unionist of an enterprise whose salary as the basis for union due calculation is hardly determined or those having difficulty in their business shall be imposed under regulations of laws but shall be at least 1% of the basic salary.

1.5- Every unionist working overseas shall pay a union due of 1% of their salary under regulations of the State.

1.6- Unionist receiving allowances from the social insurance for at least one month shall be exempted from union dues during the period of allowance and so do unemployment unionists.

2- Method of payment

The union due shall be monthly paid to the trade union committee or division or enterprise trade union or it shall deducted from monthly salary after it is agreed by unionists.

3- Management of union dues

The trade union due shall be promptly and fully recorded in accounting books and financial statement of the enterprise trade union. The union due shall be allocated, used and managed under regulations of Vietnam General Confederation of Labor.

II- Implementation organizations

Confederation of Labor of provinces, public sector trade unions and similar organizations, and supervisory trade unions shall inspect and instruct trade unions of enterprises to collect and manage union dues under regulation of the Vietnam General Confederation of Labor.

2-Executive boards of enterprises’ trade unions shall inspect, expedite and instruct their trade union members, trade union committees or division to collect, finalize and manage the union dues under regulations of the Vietnam General Confederation of Labor and internal regulations of enterprises’ trade unions.

III. Implementation.

This guidance enters into force from the date of its signature. This guidance shall apply from January 01, 2014 and replace the guidance No.1803/HD-TLDD dated November 29, 2013 by the Vietnam General Confederation of Labor.

|

|

PP.

PRESIDENTIAL COUNCIL |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed