Law No. 35-L/CTN of June 23, 1994, The Labor Code of The Socialist Republic of Vietnam. đã được thay thế bởi 2012 Labor code và được áp dụng kể từ ngày 01/05/2013.

Nội dung toàn văn Law No. 35-L/CTN of June 23, 1994, The Labor Code of The Socialist Republic of Vietnam.

|

THE

STANDING COMMITTEE OF NATIONAL ASSEMBLY |

OF VIET |

|

No: 35-L/CTN |

, June 23, 1994 |

THE NATIONAL ASSEMBLY OF THE OF

IX

LEGISLATURE, 5TH SESSION

(May 26 - June 23, 1994)

THE LABOR CODE OF THE OF

PREAMBLE

Labor is the most important activity of man. It creates the material wealth and spiritual values of society. High-productivity, high-quality and high-efficiency labor is the determinant factor of national development.

Labor legislation defines the rights and obligations of the employee and the employer, the labor standards and the principles for labor use and management, thus contributing to the promotion of production. Therefore, it plays an important role in social life and in the legal system of the country.

Inheriting and developing the labor legislation of our country since 1945, the Labor Code institutionalizes the renewal line of the Communist Party of Vietnam and concretizes the provisions of the 1992 Constitution of the Socialist Republic of Vietnam on labor and on the use and management of labor.

The Labor Code protects the right to work, the interests and other rights of the employee. At the same time it protects the legitimate rights and interests of the employer, thus creating conditions for the establishment of harmonious and stable labor relations, helping to develop the creativeness and talent of the intellectual and manual workers as well as of the labor managers, in order to achieve high productivity, quality and social progress in labor, production and service, efficient use and management of labor, thus contributing to the industrialization and modernization of the country in the cause of bringing prosperity to the people and strength to the nation and building a just and civilized society.

Chapter I

GENERAL PROVISIONS

Article 1.- The Labor Code regulates labor relations between the salaried employee and the employer, and the other social relations directly related to labor relations.

Article 2.- The Labor applies to all employees as well as all organizations and individuals employing labor according to labor contracts in all economic sectors and of all forms of ownership.

This Labor Code also applies to the apprentices, house workers and a number of other jobs defined in this Code.

Article 3.- Vietnamese citizens working in enterprises with foreign invested capital in Vietnam, at foreign or international offices and organizations based on Vietnamese territory and foreigners working for Vietnamese businesses, organizations or individuals on Vietnamese territory come within the jurisdiction of this Code as well as other prescriptions of Vietnamese law, unless otherwise stipulated in the international conventions which the Socialist Republic of Vietnam has signed or acceded to.

Article 4.- The labor regime for State employees and public servants, holders of elected, assigned or appointed posts, persons in the People's Armed Forces, the People's Security Service, persons of mass organizations and other political and social organizations, as well as members of the cooperatives shall be stipulated by other legal documents. However, some of the provisions of this Code may be applied to a number of these persons, depending on concrete cases.

Article 5.-

1- Everyone has the right to work, to choose freely a job or profession, to learn a trade and to improve his/her professional standard without discrimination of sex, nationality, social background, belief or religion.

2- Maltreatment of an employee and forcible labor, in any form, are forbidden.

3- The State encourages, creates conditions for or assists all activities which generate employment or self-employment, all activities in job teaching and learning to create employment as well as all activities in production and business which employ a large work-force.

Article 6.- An employee must have attained at least 15 years of age, have the capability to work and must work according to a labor contract.

An employer may be a business, an office, an organization or an individual (in the latter case he/she must be at least 18 years old). The employer hires, utilizes labor and pays for that labor.

Article 7.-

1- The employee is paid a salary based on his/her agreement with the employer, but this salary shall not be lower than the minimum salary prescribed by the Sate, if he/she meets previously agreed-upon requirements for productivity, quality and efficiency. The employee is covered by the regulations on labor protection, and must be assured conditions consistent with labor safety and sanitation requirements. The employee is entitled to statutory paid leaves, including annual leave, and to social insurance as prescribed by law. The State shall enforce special labor regimes and social policies aimed at protecting women's labor and certain types of specific labor.

2- The employee has the right to found, join and work for a trade union according to the Trade Union Law, in order to protect his/her legitimate rights and interests. The employee is entitled to the community welfare benefits and take part in the management of the business according to the rules of the business and the prescriptions of law.

3- The employee has the obligation to fulfill the labor contract and the collective labor accord, to observe labor discipline and labor regulations and to obey the lawful direction of the employer.

4- The employee has the right to strike as prescribed by law.

Article 8.-

1- The employer has the right to select and recruit labor, assign labor and control its disposition as required by the need of production and business. He/she has the right to issue bonuses or commendations and handle the violations of the labor discipline as prescribed by labor legislation.

2- The employer has the right to send his/her representative to negotiate and sign collective labor accords within the business or collective labor accord of the whole branch. The employer has the responsibility to cooperate and discuss with the trade union issues concerning labor relations and to improve the material and spiritual life of the employee.

3- The employer has the obligation to fulfill the labor contract, the collective labor accord and the other agreements with employees, to respect the honor and dignity of the employee, and to behave properly toward the employee.

Article 9.- The labor relations between the employee and the employer are established and effected through negotiations and agreement on the principles of voluntariness, equality, cooperation, mutual respect for each other's legitimate rights and interests and full implementation of the commitments.

The State encourages the agreements that assure employees more favorable conditions than prescribed in the labor legislation.

The employee and the employer have the right to ask the authorized office or organization to settle a labor dispute. The State encourages the settlement of labor disputes by reconciliation and arbitration.

Article 10.-

1- The State exercises unified management of the manpower resources, manages labor through legislation and adopts policies to develop and distribute man-power resources, diversify the forms of labor utilization and labor supply services.

2- The State guides the employee and the employer to build a harmonious and stable labor relationship so as to work in tandem for the development of the business.

Article 11.- The State encourages a democratic, just and civilized management of labor at the business. It encourages all measures, including deduction from the business's profits as bonuses, in order to make the employee pay greater attention to the operation of the business with a view to high efficiency in the management of labor and production of the business.

The State shall enact policies to help the employee buy shares to contribute capital to the development of the business.

Article 12.- The trade union joins the State office, the economic organizations and the social organizations in caring for and protecting the rights and interests of the employee, and in inspecting and supervising the implementation of the prescriptions of labor legislation.

Chapter II

EMPLOYMENT

Article 13.- All income-generating laboring activities which are not banned by law are recognized as employment.

The State, businesses and the whole society are all responsible to provide jobs and ensure that every person with labor capabilities has the chance to be employed.

Article 14.-

1 - The State shall set out the targets for job generation in its five-year and annual plans for socio-economic development, create necessary conditions, provide financial support, grant loans, tax exemption or reduction, and apply other incentive measures to enable employable persons to create employment for themselves as well as to enable organizations, units and individuals in all economic sectors to develop new and diversified occupations aimed at providing employment for as many individual employees as possible.

2- The State shall enact preferential employment policies to attract and use the labor force among the people of ethnic minorities.

3- The State shall enact incentive policies to create favorable conditions for organizations and individuals inside and outside the country, including Vietnamese settled abroad, to invest in developing production and business in order to increase the availability of jobs.

Article 15.-

1- The Government shall draw up national employment programs and projects on investment in socio-economic development and transfer of the population to undeveloped regions in close association with the employment program; establish the national employment fund from the State budget and other sources and expand the job-seeking service system. Annually, the Government shall submit to the National Assembly its proposed national employment program and fund for approval.

2- The People�s Committee in provinces and cities directly under the Central Government shall set up their own employment programs and funds and submit them to the People�s Council of the same level for approval.

3- The State agencies, economic organizations, people�s organizations and social organizations shall, within the scope of their responsibility and powers, have the task of joining in the implementation of the employment programs and funds.

Article 16.-

1- The employee has the right to work for any employer and at any place not forbidden by law. The job seeker has the right to contact directly a potential job procurer or register with a job-seeking service organization to find a job suited to his/her desire, capabilities, professional standard and health condition.

2- The employer is entitled to contact directly the job seeker or recruit labor through a job-seeking service organization. He/she has the right to increase or reduce the number of employees in conformity with the demand in production and business and within the prescriptions of law.

Article 17.-

1- In case the employee who has been working regularly in a business for one year or more loses his/her job due to the restructuring of the business or the change of technology, the employer has the responsibility to retrain him/her in order to employ him/her in a new job. If no new job can be created and the employee has to be laid off, his/her employer has to pay him/her a severance allowance at the rate of one month's salary for every year of service, but the amount shall not be less than the value of two months of his/her salary.

2- When the need arises for a massive lay-off by virtue of Item 1 of this Article, the employer must publicize the list of the would-be laid-off employees and then proceeding from the need of the business and the seniority of each employee at the business, his/her professional skill, family situation and other factors, shall lay them off one by one after discussing and agreeing with the Executive Committee of the local trade union in the business according to the procedure stipulated in Item 2 of Article 38 of this Code. The lay-off can become effective only after the local labor office has been notified about it.

3- The business must set up its reserve fund for severance allowances as prescribed by the Government in order to provide timely relief for the employees who lose their jobs at the business.

4- The Government shall adopt policies and measures to provide job training and retraining and guidance in production and business, grant low interest loans from the National Employment Fund and create other conditions for the employees to find new jobs or create jobs for themselves; and provide financial support for the localities and services where many people are under-employed or lose their employment due to business restructuring or to a change in technology.

Article 18.-

1- The job seeking service organization, established by virtue of law, has the task of providing consultation, introducing or supplying jobs or helping in the recruitment of labor, along with collecting and supplying information about the labor market. The sending of Vietnamese laborers to work abroad can be effected only when a permit to this effect has been issued by the competent State authority.

2- The job-seeking service organization is allowed to collect fees, is eligible for tax exemption or reduction by the State and is entitled to organize job training as stipulated in Chapter III of this Code.

3- The Ministry of Labor, War Invalids and Social Welfare shall exercise unified State management over the job-seeking service organizations throughout the country.

Article 19.- All acts enticement, false promise and mendacious advertisement aimed at misleading the laboring people or misusing the job-seeking service to commit law-breaking acts are prohibited.

Chapter III

APPRENTICESHIP

Article 20.-

1- Everyone has the right to choose freely a profession and a place for apprenticeship suited to the need of his/her employment.

2- All businesses, organizations and individuals who meet the conditions prescribed by law shall be allowed to open a job-training establishments.

The Government shall issue regulations on the opening of job-training establishments.

Article 21.-

1- A job-training establishment must be registered and operate according to the regulations on job training. It is entitled to collect tuition and must pay these taxes as prescribed by law.

2- A job-training establishment shall be eligible for tax exemption or reduction if it addresses requirements of the war disabled and ailing military personnel, the handicapped, or members of ethnic minorities; if it is located in a place which has a high rate of underemployment or unemployment; or if its teaches traditional crafts or provides job tutoring at work places or at home.

Article 22.- An apprentice admitted to a job training establishment must be at least 13 years old, except for a number of jobs defined by the Ministry of Labor, War Invalids and Social Welfare. He/she must respond to the health norms required by the job to be taught.

Article 23.-

1- The business has the responsibility to upgrade the professional skills of the employees and to retrain them before transferring them to other jobs in the business.

2- A business which accepts a person to learn or practice a trade in order to work later for it under the terms stipulated in the job learning or apprenticeship contract, shall not have to register that person. But it must also not collect tuition from him/her. The time for learning or practicing a trade shall be included in the person's seniority at the business. During the period of job learning or apprenticeship, if the learner or apprentice takes direct part in manufacturing products for the business, he/she shall be paid a salary to be agreed upon mutually by the two parties.

Article 24.-

1- An apprenticeship can be effected only through a written or verbal contract between the apprentice and the employer or the representative of the job training establishment. Where a written contract is used, a copy of the contract must be provided to both parties.

2- The job training contract must specify the goal of training, the place of training, the amount of tuition, the duration of training and the level of compensation where a violation of the contract occurs.

3- When a business accepts an apprentice with explicit intent to employ him/her later at the business, the job training contract must state the terms by which the apprentice shall work for the business and the mutual commitment to sign the labor contract after completion of his/her training. If after learning the trade, the apprentice does not accept to work for the business as committed, he/she must compensate the employer for the training expenditures.

4- No compensation shall be made if the job learning contract ends before term due to a force-majeure cause.

Article 25.- All businesses, organizations and individuals are strictly forbidden from abusing their job training licenses and from using job training to promote self interests, exploit the labor of the apprentice or induce and coerce him/her into unlawful activities.

Chapter IV

LABOR CONTRACT

Article 26.- The labor contract is the agreement between the employee and the employer which defines the payment, the working conditions and the rights and obligations of each party in their labor relations.

Article 27.-

1- The labor contract must be made in one of the following forms:

a/ A contract with indefinite duration;

b/ A contract valid from one to three years;

c/ A contract for a seasonal job or a specific job to be carried out in less than one year.

2- It is forbidden that a labor contract is signed for a seasonal job or a specific job with a duration of less than one year to perform tasks of a perpetual nature, i.e. jobs lasting more than one year, except when temporary replacement is necessary for a employee who is called for military duty or who takes maternity leave or who is temporarily absent for other reasons.

Article 28.- The labor contract must be made in writing in two copies, with each party keeping one copy. The commitment can be made orally if the job has a temporary character and its term does not exceed three months or it is the job of a housework.

When a verbal commitment is used, the two parties must automatically comply with the prescriptions of the labor legislation.

Article 29.-

1- The contents of the labor contract must include the following elements: a description of the duties to be performed the working time, the break time, the salary, the place of work, the duration of the contract, the conditions on labor safety and labor sanitation, along with the social insurance for the employee.

2- In the event that the labor contract or any part thereof provides for the rights and interests of the employee which are inconsistent with those prescribed in the labor legislation, in the collective labor accord or in the labor regulations in force at the business, or if the contract puts restrictions on other rights of the employee, those improper portions or the whole contract must be modified or revised.

3- When the contents, as described in Item 2 of this Article, are detected, the Labor Inspector shall guide the parties to make the necessary modifications or revisions. If either side refuses to make the recommended modifications or revisions, the Labor Inspector is authorized to force the revocation of the improper contents.

Article 30.-

1- The labor contract is directly made between the employee and the employer.

2- The labor contract may be signed between the employer and the legally assigned representative of a group of employees. In this case the contract is as valid as if it were signed with each employee.

3- The employee may sign one or more labor contracts, with one or more employers, but he/she must assure full compliance with each of the signed contracts.

4- The duties to be performed under the labor contract must be carried out by the contractor and shall not be assigned to another person without the consent of the employer.

Article 31.- In case of a merger or a division of the business, or assignment of ownership, managerial power or the right to use the property of the business, the succeeding employer has the responsibility to honor the labor contract with the employee until the two parties agree to amend or terminate the labor contract or to sign a new contract.

Article 32.- The employer and the employee shall agree on the probation, the term of probation and the rights and obligations of the two parties. The salary of the employee during the period of probation must be equal at least to 70% of the statutory salary of his/her job. The term of a probation must not exceed 60 days for a job requiring high technical skill and 30 days for other jobs.

During the period of probation, each party is entitled to cancel its agreement on probation without advance notice and without having to make compensation if the probation does not meet the requirements already agreed upon by both parties. If the probation meets the requirements, the employer must sign on the employee as a full-time worker pursuant to their agreement.

Article 33.- The labor contract shall take effect on the day of the signing or on a mutually agreed date.

In the process of implementing the labor contract, if a party wishes to change the contents of the labor contract, it must notify the other party at least three days in advance. The change of the contents of the labor contract may be effected by either modifying or supplementing the existing labor contract or by signing a new contract

Article 34.-

1- In the event of unexpected difficulty or due to the need in production and business, the employer is entitled to temporarily assign the employee to another job to which he/she is not accustomed but not for more than 60 days a year.

2- When the employer decides to assign the employee to another job to which he/she is not accustomed, the employer must notify him/her at least three days in advance. The employer must also specify the term of this temporary job which must suit the health and gender of the employee.

3- The employee assigned to another job as defined in Item 1 of this Article shall be paid the salary of the new job. If this salary is lower than that of his/her former job he/she is entitled to the former salary for the first 30 days on the new job. The salary of the new job must be equal to at least 70% of the old salary and not lower than the minimum salary prescribed by the State.

Article 35.-

1- The labor contract shall be temporarily suspended in the following circumstances:

a/ The employee is called for military duty or other citizen duties prescribed by law.

b/ The employee is taken into temporary custody or detention.

c/ Other circumstances as may be mutually agreed upon.

2- At the end of the temporary suspension of the labor contract under the circumstances defined in Points (a) and (c), Item 1, of this Article, the employer must reinstate the employee.

3- The reinstating of an employee under temporary custody or detention after the expiring of the temporary suspension of the labor contract shall be set by the Government.

Article 36.- The labor contract shall terminate upon the happening of the following events:

1- The term of the contract expires;

2- The job under contract has been finished;

3- The two parties agree to terminate the contract;

4- The employee is sentenced to imprisonment or is banned from doing the former job by ruling of the Court;

5- The employee dies or is declared missing by the Court.

Article 37.-

1- The employee working under a labor contract the terms of which range from one year to three years, or a labor contract to do a seasonal job or a specific job which lasts less than one year, is entitled to unilaterally terminate the contract before term in one of the following circumstances:

a/ The employee is not assigned the job or to the working place, or otherwise not assured the conditions of work already agreed in the contract;

b/ The employee is not paid fully or at the time stipulated in the contract;

c/ The employee is maltreated or subjected to forced labor;

d/ The employee or his/her family encounters such difficult circumstances that he/she cannot continue executing the contract;

e/ The employee is elected to a permanent post in a people's elected body or is appointed to an official post in the State apparatus;

f/ The employee is pregnant and must stop working by prescription of the doctor.

2- When the employee decides to unilaterally terminate the labor contract as stipulated at Item 1 of this Article, he/she must notify the employer:

a/ At least three days in advance of the circumstances described at Point (a), (b) and (c);

b/ At least thirty days in advance of the circumstances described in Points (d) and (e) with regard to a contract with terms ranging from one year to three years; at least three days in advance if it is a contract for a seasonal job or a specific job which lasts less than one year;

c/ In the circumstances described in Point (f), the time for advance notification is defined in Article 112 of this Code.

3- The employee working under a labor contract without a definite term is entitled to unilaterally terminate the labor contract but must notify the employer at least 45 days in advance.

Article 38.-

1. The employer is entitled to unilaterally terminate the labor contract in the following circumstances:

a/ The employee constantly fails to perform the duties set forth in the contract;

b/ The employee is subject to dismissal as provided for in Article 85 of this Code;

c/ The employee, working under a labor contract without a definite term, falls sick and has gone through 12 months of medical treatment, or the employee working under a contract with a definite term, has taken six consecutive months of sick leave or the employee, working under a contract of less than one year, has taken sick leave longer than half the term of the labor contract without any prospect of recovery in the near future. However, after recovery, resumption of the employee's labor contract shall be considered;

d/ Natural disasters, fire or any force-majeure causes of which the employer has sought all means to overcome the consequences without success and is accordingly forced to scale down production and reduce the labor force;

e/ The business, office or organization terminates its operation.

2- Before unilaterally terminating the labor contract under Points (a), (b) and (c) of Item 1 of this Article, the employer must discuss and reach agreement with the Executive Committee of the local Trade Union. In case of disagreement, the two sides must report to the competent office or organization. Only 30 days after notification to the labor office is employer entitled to take decision for which he/she shall be responsible. In case they do not agree with the decision of the employer, the Executive Committee of the local Trade Union and the employee are entitled to request settlement of the labor dispute according to the procedure prescribed by law.

3 - When the employer decides to unilaterally terminate the labor contract, except for cases defined at Point (b), Item 1 of this Article, the employer must notify the employee:

a/ At least 45 days prior to the termination of the labor contract without a definite term;

b/ At least 30 days prior to the termination of labor contracts with terms ranging from one year to three years;

c/ At least three days prior to the termination of labor contracts for seasonal jobs or specific jobs which last less than one year.

Article 39.- The employer is not allowed to terminate unilaterally the labor contract in the following circumstances:

1- The employee is under medical treatment by decision of the doctor as a result of sickness, a labor accident or an occupational disease, except for cases stipulated at Points (c) and (d) of Item 1, Article 38, of this Code;

2- The employee is on annual leave, or is taking a leave for personal affairs or any other leave with the consent of the employer;

3- The employee is a woman in circumstances defined in Item 3, Article 111, of this Code.

Article 40.- Each party may revoke its unilateral decision to terminate the labor contract before the advance notice expires. Upon the expiring of the advance notice, either party has the right to terminate the labor contract.

Article 41.-

1- In case the decision of the employer to terminate unilaterally the labor contract contravenes law, he/she must re-instate the employee and pay compensation commensurate with the salary of the employee during the days when he/she is denied the right to work. In case the employee does not want to return to work, he/she is entitled, besides the compensation commensurate with his/her salary during the days he/she is denied the right to work, to an allowance as stipulated at Item 1, Article 42, of this Code.

2- In case the employee terminates unilaterally the labor contract in contravention of law, he/she shall not receive any severance allowance.

3- In case the employee terminates unilaterally the labor contract, he/she shall repay the training expenses, if any, as prescribed by the Government.

4- In case of a unilateral termination of the labor contract, the party which violates the regulations on advance notice shall compensate the other party an amount of money equivalent to the salary of the employee during the days when no advance notice of the termination is received.

Article 42.-

1- Upon the termination of a labor contract with an employee who has worked regularly at the business, office or organization for more than one year, the employer has the responsibility to pay the employee a severance allowance representing one half month's salary for every year of service, plus wage subsidies (if any).

2- Upon the termination of the labor contract as defined in Points (a) and (b), Item 1, Article 85, of this Code, the employee shall not receive the severance allowance.

Article 43.- Within seven days after termination of the labor contract, the two parties have the responsibility to settle the accounts relating to the interests of each party. In special cases, this time-limit may be extended but not for more than 30 days.

In the event of bankruptcy of the business, the accounts related to the interests of the employee shall be settled according to the provisions of the Law on Bankruptcy.

The employer shall record the reason for the termination of the labor contract in the Labor Register and has the responsibility to return the Register to the employee. Apart from the provisions in the Labor Register, the employer is not allowed to add any other comment that may be a hindrance to the employee in seeking a new job.

Chapter V

COLLECTIVE LABOR ACCORD

Article 44.-

1- The collective labor accord (hereafter called collective accord) is a written agreement between the labor collective and the employer on the conditions for labor and use of labor; and the rights, interests and obligations of both parties in their employment relations.

The collective accord is negotiated and signed by the representative of the labor collective and the employer on the principles of voluntariness, equality and openness.

2- The contents of the collective accord must not contravene the provisions of labor legislation as well as other legislation.

The State encourages the signing of collective accords with terms more favorable to the employees than those prescribed by labor legislation.

Article 45.-

1- The representatives to the negotiations of a collective accord between the two parties shall be composed of the following:

a/ From the labor collective: the Executive Committee of the local Trade Union or the provisional trade union organization;

b/ From the employer: the Director of the business or his/her delegate duly empowered under the Statute on Organization of Businesses or a person mandated by the business Director.

The number of representatives to the negotiations, of a labor accord from each party shall be decided by mutual agreement, but the two sides must have equal numbers.

2- The representative who signs for the labor collective shall be the President of the Executive Committee of the local trade union or the person mandated by this committee. The representative who signs for the employer shall be the business Director or a person with the mandate of the business Director.

3- The signing of the collective accord can be effected only when more than 50% of the members in the labor collective in the business agree to its negotiated contents.

Article 46.-

1- Each party is entitled to file its own request for the signing of the collective accord as well as to propose its contents. Upon reception of the request, the recipient must agree to negotiate and shall discuss the time for beginning the negotiations which shall be no later than 20 days from the reception of the request.

2- The main contents of the collective accord shall contain commitments on the work and the guarantee of work; the time for work and the time for rest; the salaries, bonuses and wage subsidies; the labor standards, labor safety, labor sanitation and social insurance for the employees.

Article 47.-

1- This signed collective accord shall be made into four copies, of which:

a/ One copy is to be kept by the employer;

b/ One copy is to be kept by the Executive Committee of the local trade union;

c/ One copy is to be sent by the local trade union Executive Committee to its next higher level;

d/ One copy is to be sent by the employer to the provincial labor office for registration, no later 10 days from the date of signing.

The businesses which have their establishments in many provinces or cities directly under the Central Government shall have the collective accord signed at the labor office of the province where the business has its main office.

2- The collective accord shall take effect from the day of registration at the provincial labor office. Within fifteen days from the reception of the collective accord, the provincial labor office must announce the registration. If no announcement is made after the said time limit expires, the collective accord shall automatically take effect.

Article 48.-

1- The collective accord shall be considered partially invalid if one or more of the terms in the accord are not yet accepted by the provincial labor office; nevertheless, the other terms which have been registered are still valid for implementation.

2- The collective accord shall be considered completely invalid in one of the following circumstances:

a/ The entire content of the accord is contrary to law;

b/ The signatories do not have the proper competence;

c/ The negotiation and signing of the accord do not proceed according to the prescribed order; or

d/ The accord has not been registered at the provincial labor office.

3- The declaration to annul the collective accord which is considered invalid in the circumstances stipulated at Point a, Item 2, of this Article comes under the jurisdiction of the provincial labor office. With regard to the collective accord signed in circumstances described in Points (b), (c) and (d), Item 2, of this Article, if the terms of the signed accord are favorable to the employees, the provincial labor office shall guide the parties to revise it in due procedure. If no-revision is forthcoming, the provincial labor, office shall declare to annual the accord.

Article 49.-

1- Once the collective accord has taken effect, the employer must notify accordingly all employees at the business. Everyone at the business, including those who are hired after the signing of the collective accord, has the responsibility to implement it.

2- When the rights and interests of the employees, upon which agreement has been reached in the labor contract, are lower than those stipulated in the collective accord, the corresponding terms in the collective accord shall apply. All regulations on labor in the business must be changed according to the stipulations in the collective accord.

3- When one party deems that other party either fails to fulfill or violates the collective accord, that party is entitled to demand that the other party conform to the accord. The two parties must discuss a solution. If they cannot agree, each party is entitled to demand resolution of the labor dispute concerning collective labor, according to proceedings prescribed by law.

Article 50.- The collective accord is signed for terms ranging from one year to three years. For a business which signs a collective accord for the first time, the term may be less than one year.

Only three months after the accord takes effect, for accords with terms shorter than one year, and six months, for accords with terms ranging from one year to three years, shall each of the parties be entitled to propose amendments or additions to the accord. These amendments and additions shall be made in the same procedure for the signing of a collective accord.

Article 51.- Prior to the expiring of the collective accord, the two parties may negotiate to extend its term or sign a new accord. If the negotiations are continuing at the time the previous accord expires, that collective accord shall continue to be effective. If the negotiations yield no new collective accord, within three months of the expiring of the previous accord, that accord shall automatically cease to be effective.

Article 52.-

1- When a division of a business occurs, or an assignment of ownership, management power or the right to property utilization by a business is made, the succeeding employer has the responsibility to continue to abide by the collective accord until it expires or until a new collective accord is signed.

When businesses merge, the implementation of the collective accord shall be directed by the Government.

2- When a collective accord ceases to be effective because the business terminates its operation, the rights and interests of the employees shall be settled according to Article 66 of this Code.

Article 53.- The employer shall bear all expenses which incurred in the negotiations, signing, registration, amendment, addition and publication of the collective accord.

The representatives of the labor collective who are employees on the payroll of the business shall continue to receive their salaries while taking part in the negotiations and signing of the collective accord.

Article 54.- The provisions in this Chapter shall apply to the negotiations and signing of collective accords within any industry.

Chapter VI

SALARY

Article 55.- The salary of the employee shall be agreed upon by the two parties to the labor contract and is paid according to the labor productivity as well as the quality and effectiveness of the work. The salary of the employee must not be less than the minimum wage prescribed by the State.

Article 56.- The minimum wage is based on the cost of living and must enable the employee who handles even the simplest work in normal working conditions to recuperate and also to accumulate for expanded reproduction. This minimum wage shall be used as the basis for the calculation of salaries for other types of labor.

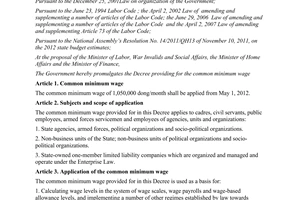

The Government shall decide and make public the common minimum wage, the minimum wages to be applied in different areas, the minimum wages in different industries for each period after consulting the Vietnam General Confederation of Labor and the representatives of the employers.

When a rise occurs in the cost-of-living index and causes a drop in the real wage of the employees, the Government shall adjust the minimum wage to ensure this real wage.

Article 57.- The Government shall make public the wage scales and wage groups as basis for determining social and health insurance and for calculating wages for overtime and night-shift duties, suspension of work, and annual and other leaves of the employees after consulting the Vietnam General Confederation of Labor and the representatives of the employers.

Article 58.-

1- The employer is entitled to choose one of the forms of salary payment which are time salary (hour, day, week, month), product salary or package salary. But he/she must maintain the chosen form over a given period of time and must notify the employee of this form of payment.

2- The employee shall receive his/her pay, whether by the hour, the day or the week, immediately after the hour, the day or the week of work, or shall receive a lump sum as agreed upon by the two parties but this lump sum must be paid to the employee at least once within every fifteen days of work.

3- The monthly salaried employee shall receive his/her salary once a month or once every half-month.

4- The employee who is paid by the product or by the package shall be paid as agreed upon by the two parties. If the work is spread over many months, he/she shall receive each months a provisional pay according to the volume of work he/she has done during each month.

Article 59.-

1- The employees shall receive his/her salary directly, fully, on time and at the place of his/her work.

In special cases when the pay is delayed for some reason, this delay must not exceed one month and the employer has to compensate the employee in an amount at least equal to the interest rate published by the State Bank at the time of the payment of the salary.

2- The salary is paid in cash. Any portion of the salary paid by check or money order, issued by the State, shall be agreed upon by the two parties bases on condition that the arrangement does not cause damage or inconvenience to the employee.

Article 60.-

1- The employee is entitled to know the reason for all deductions from his/her salary. Before deducting from the employee's salary, the employer must discuss it with the Executive Committee of the local Trade Union. No deduction shall exceed 30% of the employee's monthly wage.

2- The employer is not allowed to suspend the employee's salary as a form of discipline.

Article 61.-

1- Compensation for overtime labor shall be paid as follows:

a/ On weekdays, it must be equal at least to 150% of the hourly pay for a regular work day.

b/ On weekends or holidays, it must be equal at least to 200% of the hourly pay for a regular work day.

If the overtime hours are worked at night, the employee shall receive additional pay stipulated at Item 2 of this Article.

If the employee later takes time off in an amount equal to the time of his/her overtime work, the employer shall pay him/her only the difference between the amount earned from overtime and that earned during the regular workday.

2- The employee working at night, as stipulated in Article 70 of this Code, shall receive additional pay representing at least 30% of the amount earned during the regular work day.

Article 62.- During the time of work interruption, the employee shall be paid as follows:

1- If the interruption is caused by the employer, the employee shall receive his/her full salary;

2- If the interruption is caused by the employee, he/she shall not receive his/her pay; the other employees in the same unit who must stop working shall receive a pay as may be agreed upon by the two parties, which in no case may be lower than the minimum wage;

3- If the interruption is caused by a disruption of power or water supply, beyond the control of the employer or by any other force-majeure causes, the compensation shall be agreed upon by the two parties, which in no case may be lower than the minimum wage.

Article 63.- Allowances, bonuses, pay raises and other incentives may be agreed upon in the labor contract, the collective accord or stipulated in the regulation of the business.

Article 64.- The employer is responsible for deducting, from the business's annual profits, an amount to reward the employees who have worked for more than one year at the business, according to Government regulations and in conformity with the characteristics of each kind of business.

Article 65.-

1- When the work involves the use of a contractor or an intermediary of a similar role, the employer who is the chief owner of the contract must maintain a complete list of the names and addresses of such persons together with a list of the employees working under them. He/she must ensure that the contractor or the equivalent abide by the prescription of law regarding labor compensation, labor safety and labor sanitation.

2- If the contractor or the intermediary with a similar role does not pay fully, does not pay the employee or does not ensure the other rights and interests of the employee, the employer who is the chief owner of the contract has the responsibility to pay the employee and ensure his/her other rights and interests. In this case, the employer who is the chief owner of the contract is entitled to request the contractor or the intermediary with a similar role to pay compensation to the employee or ask the competent State agency to settle the dispute as prescribed by law.

Article 66.- When a merger or division of the business or assignment of ownership, managerial power or the right to use the business�s property occurs, the succeeding employer has the responsibility to pay the salary and assure other rights and interests of the employee. In the event of bankruptcy of the business, the employee shall have the superior right in the settlement of debts of the business, including salary, severance allowance, social insurance and other rights, interests, benefits of the employee written in the collective accord and labor contract already signed.

Article 67.-

1- When he/she or his/her family meets with difficulty, the employee is entitled to an advance payment of his/her salary on terms agreed upon by the two parties.

2- The employer shall advance payment of salary to the employee who must temporarily suspend his/her work to perform his/her civil obligations.

3- The advance payment of salary to the employee who is under temporary custody or detention shall be defined by the Government.

Chapter VII

WORK AND BREAK TIME

SECTION I.- WORK TIME

Article 68.-

1- The work day shall not exceed 8 hours nor 48 hours per week. The employer is entitled to schedule the working hours daily or weekly but must notify the employees in advance.

2- Work shifts shall be shortened by one or two hours for employees working in especially heavy, noxious or dangerous jobs, as prescribed in the list of such jobs published by the Ministry of labor, War Invalids and Social Welfare and the Ministry of Public Health.

Article 69.- The employer and the employee may agree on overtime hours, but the length of such overtime shall not exceed four hours per day nor 200 hours per year.

Article 70.- Night working hours are considered to be from 22:00 hours to 6:00 hours the following day, or from 21:00 hours to 5:00 hours the following day, depending on the climatic zones set by the Government.

SECTION II.- BREAK TIME

Article 71.-

1- The employee is entitled to at least a half an hour of rest inclusive of the work time if he/she works continuously for eight hours.

2- The employee on a night shift is entitled to at least 45 minutes of rest inclusive of the work time.

3- The employee working on a night-shift is entitled to at least 12 hours of rest before beginning another shift.

Article 72.-

1- During each week, the employee is entitled to at least one day of rest (24 straight hours).

2- The employer may arrange the weekly rest day on Sunday or any other fixed day in the week.

3- In special cases, where the rest day cannot be arranged weekly due to the work cycle, the employer must ensure that the employee can have an average of four days of rest at least in a month.

Article 73.- The employee is entitled to abstain from work and receive full pay on the following holidays:

- New Year's Day (solar calendar): one day;

- Lunar New Year Festival: four days (the last day of the lunar year and the first three days of the new lunar year);

- Victory Day: one day (April 30);

- International Labor Day: one day (May 1st);

- National Day: one day (September 2nd);

If one of the above-stated holidays coincides with a weekly non-working day, the employee is entitled to observe the holiday on the following day.

Article 74.-

1- The employee with 12 months' service, at a business or with an employer, is entitled to an annual leave with full pay under the following specifications:

a/ 12 days for a person working in normal conditions;

b/ 14 days for a person working in heavy, noxious or dangerous jobs, in places with harsh living conditions, or for persons under 18 years of age;

c/ 16 days for persons working in especially heavy, noxious and dangerous jobs, and for persons working in heavy, noxious and dangerous jobs in places with harsh living conditions.

2- The time for travel, not inclusive of the annual leave, shall be defined by the Government.

Article 75.- The number of days in an annual leave shall increase proportionally with the seniority of the employee at a business or with an employer, at the rate of one day for every five years.

Article 76.-

1- The employer is entitled to set the calendar for annual leaves after consulting the Executive Committee of the local Trade Union and must notify it in advance everyone in the business.

2- The employee may agree with the employer to divide his/her annual leave into many shorter periods. Those working in remote areas may elect to combine leave of two years into a single leave. If the employee wants to combine leave of three years, he/she must obtain the consent of the employer.

3- The employee, who due to work severance or for other reasons, has not taken his/her annual leave or has not used all the days in that annual leave, shall paid for the pays for which he/she is entitled to take as part of his/her fully paid leaves.

Article 77.-

1- The employee on annual leave shall receive an advance payment equal to, at minimum, the pay for the days during leave. The travel expenditures and the salary of the employer during the days he/she spends on traveling shall be agreed upon by the two parties.

2- The employee with less than 12 months of work shall enjoy a number of days of leave corresponding with the length of his/her employment. This leave may be paid in cash.

SECTION III.- LEAVE FOR PERSONAL MATTERS, UNPAID LEAVE

Article 78.- The employee is entitled to fully paid leave for personal matters in the following situations:

1- Marriage: three days;

2- Marriage of his/her son or daughter: one day;

3- Death of a parent (including parents of the husband or the wife), death of spouse, death of a son or a daughter: 3 days.

Article 79.- The employee may agree with the employer to take unpaid leaves.

SECTION IV.- WORK TIME, BREAK

TIME FOR PERSONS PERFORMING JOBS

OF A SPECIAL NATURE

Article 80.- The work and break time of persons working at sea, in mines and doing other jobs on a special nature shall be defined by the Government.

Article 81.- The work and rest periods of the employee employed under contracts of less than one day or less than one week or under package contracts, shall be agreed upon by the employee and the employer.

Chapter VIII

LABOR DISCIPLINE, MATERIAL LIABILITY

Article 82.-

1- Labor discipline is the set of norms regarding the time, technology and management of production and business. It is stipulated in the labor regulation.

The labor regulation must not contravene the labor legislation and other legislation. A business employing ten or more employees must have a written labor regulation.

2- Before publishing the labor regulation, the employer must consult the Executive Committee of the local Trade Union at the business.

3- The employer must register the labor regulation with the provincial labor office. The labor regulation shall take effect from the day of registration. Within ten days of receiving the labor regulation, the labor provincial labor office must issue a notice of registration. If no notification is received after this period, the labor regulation shall automatically take effect.

Article 83.-

1- A labor regulation must comprise the following essential points:

a/ The work and break times;

b/ Discipline in the business;

c/ Labor safety and labor sanitation at the work place;

d/ Protection of property and technology and trade secrets of the business;

e/ Acts which violate labor discipline, disciplinary measures and material liability.

2- The labor regulation must be notified to each employee and its main points must be posted up at the necessary places in the business.

Article 84.-

1- An employee who violates the labor discipline shall, depending on the seriousness of his/her fault, be subjected to one of the following disciplinary measures:

a/ Reprimand;

b/ Transfer to another job with a lower pay for a maximum of six months; or

c/ Dismissal.

2- It is forbidden to apply many disciplinary measures at the same time against an act of violation of the labor discipline.

Article 85.-

1- Dismissal, as a disciplinary measure, can be applied only in the following circumstances:

a/ The employee has committed an act of theft, embezzlement or disclosure of trade and technological secrets or another act which causes serious damage to property and other interests of the business.

b/ The employee, who has been disciplined and transferred to another job, commits a new offense while the term of the earlier disciplinary measure is still in effect.

c/ The employee is absent without authorization and without a plausible reason from work for seven days in a month or 20 days in a year.

2- After dismissing an employee, the employer must report the dismissal to the provincial labor office.

Article 86.- The time limit for handling a violation of the labor discipline is three months from the date of the violation and must not exceed six months even in special cases.

Article 87.-

1- When selecting on the disciplinary measure against the violator of the labor discipline, the employer must prove the offense of the employee.

2- The employee has the right to defend him/herself or ask for a defense by a solicitor, a people's defender or any other person.

3- When examining an alleged labor discipline violation, three must be the presence of the concerned employee and the participation of the representative of the Executive Committee of the local Trade Union at the business.

4- The proceedings of a disciplinary case regarding a violation of the labor discipline must be preserved in writing.

Article 88.-

1- A violator of the labor discipline shall be automatically reinstated, if he/she does not commit another violation within three months from the date of the previous reprimand and within six months from the date of the previous transfer to another job.

2- An employee who is disciplined by transfer to another job shall be considered for reduced sanction after having served half the term of the sanction and showing progress in mending his/her ways.

Article 89.- The employee who damages instruments or equipment or who otherwise causes damage to property of the business, must pay compensation as prescribed by law for that. If the damage is not serious and is due to inadvertence, the maximum compensation shall not exceed three months of his/her salary and shall be gradually subtracted from his/her salary, as stipulated in Article 60 of this Code.

Article 90.- The employee who causes a loss of tools, equipment or other property assigned by the business, or who causes a material consumption in excess of the allowed level shall, depending on each case, pay partial or full compensation at the market price. The employee shall make compensation according to the responsibility contract, if such a contract has been signed. He/she shall not have to make any compensation in case of force majeure.

Article 91.- The order of, and procedure for, the compensation of damages stipulated in Article 89 and 90 shall apply as set forth in Articles 86 and 87 of this Code.

Article 92.-

1- The employer is entitled to suspend temporarily the work of the employee if the employer finds that the suspected violation involves complex matters and that the continued presence of the concerned employee at work might impede the inquiry. This suspension can be conducted only after consultation with the Executive Committee of the local Trade Union.

2- The temporary suspension of an employee's work shall not exceed 15 days, and even in special cases, it shall not exceed three months. The employee is entitled to an advance payment representing 50% of his/her salary for the whole duration of the suspension before the suspension takes effect.

After the period of temporary suspension the employee must be reinstated.

3- If the employee is found to have violated the labor discipline and is sanctioned, he/she shall not have to return the advance payment.

4- If the employee is found not in violation of the labor discipline, the employer must pay the employee his/her full wages and subsidies for the period of the temporary suspension.

Article 93.- If the employee finds that the penalty imposed on him/her is not justified, that employee, who is sanctioned for violation of labor discipline, who is subjected to temporary suspension from work or who is made to pay compensation according to his/her material liability, is entitled to protest to the employer or the competent authority or request the settlement of the labor dispute as prescribed by law.

Article 94.- If the competent authority concludes that the decision of the employer to discipline the employee is unjustified, the employer must annul that decision, publicly apologize to him/her, rehabilitate his/her honor and restore all his/her material benefits.

Chapter IX

LABOR SAFETY, LABOR SANITATION

Article 95.-

1- The employer has the responsibility to fully provide the employees with equipment for labor safety and labor sanitation and to improve their working conditions. The employee must observe the regulation on labor safety, labor sanitation and the labor rules of the business. All organizations and individuals related to labor and production must observe legislation on labor safety, labor sanitation and environmental protection.

2- The Government shall set up the national program for labor protection, labor safety, labor sanitation and integrate it in the social-economic development plan and budget of the State; invest in scientific research and support the development of enterprises engaged in producing instruments for labor safety, labor sanitation and equipment for personal safety; and publish the standards, rules and measures for labor safety and labor sanitation.

3- The Vietnam General Confederation of Labor shall join the Government to establish the national program for labor protection, labor safety, labor sanitation and to expand programs of scientific research and legislation on labor protection, labor safety and labor sanitation.

Article 96.-

1- In new construction, or in the expansion and transformation, of establishments for production, utilization, maintenance, storage and stockpiling of machines, equipment, materials and substances, which require strict labor safety and labor sanitation, measures must be provided to ensure labor safety and labor sanitation at the work places of the employees and the environment as prescribed by law.

The list of machines, equipment, materials and substances requiring strict labor safety and labor sanitation shall be published by the Ministry of Labor, War Invalids and Social Welfare and the Ministry of Public Health.

2- The production, utilization, maintenance and transportation of machines, equipment, materials, energy, electricity, chemicals, fertilizers, herbicides, rat poisons as well as the change of technology and importation of new technology shall be done in conformity with the standards of labor safety and labor sanitation. The machinery, equipment, material and substances which require strict labor safety and sanitation must be declared, registered and licensed by the State Inspection Office on labor safety or labor sanitation.

Article 97.- The employer must ensure that the place of employment meet the standards on space, ventilation, lighting and the prescribed maximum limits on dust, steam, noxious gases, radiation, magnetism, heat, noise, vibration and other harmful factors. These factors must be controlled and measured regularly.

Article 98.-

1- The employer must provide regular control and maintenance of the machines, equipment, building structures and storage according to the standards of labor safety and sanitation.

2- The employer must equip those parts of machines and equipment at the business which are likely to provoke accidents with requisite safety features and guards. At the work place of the business, in places where machines and equipment are installed, and in areas where noxious and dangerous elements are present, arrangements must be made to provide protection against accident, including the posting of prominent instructing signals on labor safety and labor sanitation at visible places.

Article 99.-

1- When at a place of work, machinery or equipment, there is a danger of labor accident or occupational disease, the employer must take remedial measures immediately or must order immediate cessation of operations at the said place until the danger has been removed.

2- The employee has the right to refuse to work or to leave the working place when he/she detects that an imminent labor accident is seriously threatening his/her life or health, but he/she must immediately warn the person directly responsible for the danger. The employer must not force the employee to continue his/her work or return to the working place so long as the danger has not been removed.

Article 100.- A working place where dangerous and noxious elements exist and are likely to provoke labor accidents, must be equipped by the employer with technical and medical devices as well as appropriate labor protection equipment, to ensure prompt first aid when an accident occurs.

Article 101.- The employee performing dangerous or noxious jobs must be equipped adequately with personal protection means.

The employer must ensure the provision of means for personal protection, consistent with the standards of quality and design prescribed by law.

Article 102.- In hiring and deploying labor, the employer shall base his/her decision on the health criteria for each type of work. The employer must organize training and guidance for the employee on the regulations and measures for safety and sanitation, as well as the dangers of accident which need to be aware of in the work of each employee.

The employee must be given a health check at the time of hiring and periodical health checks according to the prescribed requirements, the cost of the health checks for the employee is borne by the employer.

Article 103.- The business has the responsibility to organize health care for the employees and must give prompt first aid and emergency aid to the employees when necessary.

Article 104.- The employee working at places where dangerous or noxious elements exit shall receive compensation in kind, enjoys preferential treatment in the setting of work and break time, as prescribed by law.

The employee working in exposure to noxious elements or bacteria must be provided by the employer with measures for detoxification and disinfection and personal hygiene after work.

Article 105.- A labor accident is an accident that causes injuries to any party or function of the body of the employee or death to the employee during the course of work associated with the execution of a job or a task.

The victim of a labor accident must be given prompt first aid and thorough treatment. The employer must take responsibility, as prescribed by law, for the occurrence of the labor accident.

Article 106.- An occupational disease is a disease caused by the harmful effects of the labor conditions on the employee. A list of the occupation diseases shall be published by the Ministry of Public Health and the Ministry of Labor, War Invalids and Social Welfare, after consultation with the Vietnam General Confederation of Labor and the representative of the employers.

The employee suffering from an occupational disease must be provided with thorough treatment and periodical medical checks and a specific medical record must be maintained for that employee.

Article 107.-

1- The employee incapacitated by either a labor accident or an occupational disease shall receive a general examination by the Labor Medical Examination Board to classify both his/her injury and the rate of his/her disability and shall undergo rehabilitation to restore his/her labor capabilities. If later the employee can continue to work, he/she shall be assigned a job suited to his/her health, according to the conclusion of the Labor Medical Examination Board.

2- The employer must bear all the medical costs, from the first aid and emergency care through completion of the treatment to the victim of labor accident or occupational disease. The employee is entitled to social insurance in case of labor accident or occupational disease. If the business has not joined any form of statutory social insurance, the employer must pay the employee a sum equal to that provided for in the Social Insurance Statute.

3- The employer has the responsibility to pay compensation in a amount equal to, at minimum, 30 months of the salary of the employee who suffers a reduction by 81% and more of his/her labor capacity, or an equivalent amount to the close relatives of an employee who dies as a result of a labor accident or an occupational disease not of his/her own fault. When the injury or death of an employee is the result of his/her own fault, the employee is the result of his/her own fault, the employee still receive an allowance equal to, at minimum, 12 months of his/her salary.

Article 108.- All labor accidents and cases of occupational disease must be declared, investigated, recorded in writing, statisticized and periodically reported as prescribed by law.

It is strictly forbidden to conceal or falsely declare or report labor accidents and occupational diseases.

Chapter X

SPECIFIC PROVISIONS ON WOMEN'S LABOR

Article 109.-

1- The State ensures the right to equality of women to men in all domains of employment and shall adopt policies encouraging employers to create conditions for female employees to have regular jobs. It should also widely apply to female employees the system of flexible work schedule, non-full work day, non-full work week, and take-home work.

2- The State shall adopt for female employees policies and measures to expand their employment step by step, improve their working conditions, upgrade their professional standard, care for their health, and promote their material and spiritual welfare with a view to helping the female employees effectively promote their professional capabilities and harmoniously combine work with family life.

Article 110.-

1- The State agencies have the responsibility to devise diversified and convenient forms of training for female employees to provide them with skills for jobs other than their incumbent ones, and to facilitate the use of female labor in a manner suitable to the physical characteristics of women as well as their maternal function.

2- The State shall adopt policies of preferential treatment and tax reduction to the businesses employing a predominantly female labor force.

Article 111.-

1- Gender discrimination against female employees and abuse of their honor and dignity by the employer are strictly forbidden.

The employer must observe the principle of gender equality in recruitment, utilization, pay raise and remuneration for work performed.

2- The employer must give priority to the woman who meets all the requirements for a job position that the business is seeking to fill and which can be filled by either a man or a woman.

3- The employer may not dismiss or unilaterally terminate a labor contract with a female employee for reasons of marriage, pregnancy, maternity leave or of caring for her child under 12 months of age, unless the business terminates its operation.

Article 112.- The pregnant female employee is entitled to unilaterally terminate her labor contract without having to pay compensation, stipulated in Article 41 of this Code, if she can produce a certification by a doctor that there will be harmful effects on the fetus if she continues working. In this case, the time limit during which the female employee has to notify her employer in advance about her job termination shall depend on the time prescribed as safe for her by the doctor.

Article 113.-

1- The employer is not allowed to use female labor for heavy or dangerous jobs or jobs which necessitate exposure to noxious substances of harmful effects on the reproductive and child-rearing function of women. The list of such substances is to be published by the Ministry of Labor, War Invalids and Social Welfare and the Ministry of Public Health.

Businesses employing female labor for the above mentioned jobs must adopt plans for retraining in order to transfer gradually such female employees to more appropriate jobs, must increase health protection, and must improve the working conditions or reduce the work time.

2- The employer may not use female employees of any age for permanent work in mines or jobs requiring constant immersion in water.

Article 114.-

1- The female employee is entitled to take leave before and after child birth, for four to six months, according to prescriptions by the Government and depending on the working conditions, the character of the job and whether it is a heavy or noxious job or a job in a remote region. If she gives birth to a twin or more children, the mother is entitled to another 30 days of leave for each additional child. The rights and interests of the female employees during maternity leave are defined in Article 141 and 144 of this Code.

2- Upon the end of the maternity leave, the female employee may take and additional unpaid leave, as may be agreed with the employer, if she so requests. The female employee may return to work before the end of her maternity leave, but no sooner than two months after the childbirth, if her doctor certifies in writing that her return to work will not harm her health. However, she must notify the employer in advance. In this case the female employee shall continue to receive the childbirth allowance besides the pay for her labor.

Article 115.-

1- The employer may not assign a female employee who is seven or more months pregnant or who is caring for her child of less than 12 months of age to overtime work, nighttime work or work involving significant travel.

2- From the seventh month of her pregnancy onward, the female employee performing heavy labor shall be assigned to a lighter job or shall have her work day reduced by one hour, while continuing to receive full pay.

3- The female employee is entitled to 30 minutes of rest per workday during her menstrual period. The female employee caring for her child of less than 12 months of age is entitled to 60 minutes off during work time while continuing to receive full pay.

Article 116.-

1- At locations where female employees work, there must be a place to change, a bathroom and a room for women's hygiene.

2- In places where a large female labor force is employed, the employer has the responsibility to help organize day-care centers for children, or cover part of the cost incurred to the female employees in sending their children to day-care centers.

Article 117.-

1- During her leave for pre-natal examination, for taking a family-planning measure, or on account of a miscarriage, tending a sick child under seven years of age or of adopting a new-born, the female employee shall still receive a social insurance allowance or shall be paid a sum equivalent to the social insurance allowance by the employer. The duration of the leave and the level of allowance stipulated in this item shall be defined by the Government. If the sick child is cared for by a person other than the mother, the mother shall still receive the social insurance allowance.

2- Upon completion of her statutory maternity leave and even the additional unpaid leave allowed to her, the female employee shall still be assured of her job when she returns to work.

Article 118.-

1- At businesses employing a large female labor force, the persons responsible at the managerial board must assign an individual to monitor female labor affairs. Before taking any decision related to the rights and interests of the female employees and their children, consultation must be made with the representative of the female employees.

2- Among the labor inspectors there must be an appropriate number of women inspectors.,

Chapter XI

SOME SPECIFIC REGULATIONS CONCERNING MINORS AND OTHER TYPES OF LABORERS

SECTION I.- MINOR LABORERS

Article 119.-

1- A minor laborer is one under 18 years of age. Where the employment of minors occurs, there must be a separate record of each minor's full name, date of birth, current jobs, the result of each periodical health check, which must be produced to the labor inspector on request.

2- It is strictly forbidden to misuse the labor of minors.

Article 120.- It is forbidden to employ children below 15 years of age, except for those professions and jobs to be defined by the Ministry of Labor, War Invalids and Social Welfare.

With regard to the occupations and jobs which are allowed to employ children under 15 years of age for work, job learning or apprenticeship, their admission and the utilization of their labor must be consented and monitored by their parents or tutors.

Article 121.- An employer is allowed to employ minors only for jobs suited to a minor's health in order to protect the development of their physical and intellectual conditions as well as their personality. The employer has the responsibility to care for the minor employee in the domain of labor, wages, health and education during employment.

It is forbidden to employ minors in heavy and dangerous jobs or jobs necessitating exposure to noxious substances prescribed in the list published by the Ministry of Labor, War Invalids and Social Welfare and the Ministry of Public Health.

Article 122.-

1- The work hours of a minor employee may not exceed seven hours per day nor 42 hours per week.

2- The employer may assign minor employees to overtime work or night time work only in a number of occupations and jobs defined by the Ministry of Labor, War Invalids and Social Welfare.

SECTION II.- ELDERLY LABORERS

Article 123.- An elderly employee is one over 60 years of age for men and over 55 years of age for women.

In the last year before retirement, the elderly employee is entitled to a reduction of one hour from his/her daily work time or to the system of non-full work day or non-full work week, according to prescriptions by the Government.

Article 124.-

1- If the need arises, the employer may agree with the elderly employee to extend the labor contract or to sign a new labor contract, as provided for in Chapter IV of this Code.

2- If, after retirement, the elderly employee works under a new labor contract, apart from the benefits he/she enjoys from the pension system, the elderly employee shall enjoy the benefits stipulated in the labor contract.

3- The employer has the responsibility to care for the health of the elderly employee and may not employ the elderly employee in heavy or dangerous jobs or jobs necessitating regular exposure to noxious substances which negatively impart the health of the elderly employee.

SECTION III.- DISABLED LABORERS

Article 125.-

1- The State protects the right of the disabled to work and encourages the employment of, and job creation for, the disabled. The State shall devote part of its annual budget to help the disabled recover their health, rehabilitate their work capacities or learn a trade. The State shall adopt policies of granting low-interest loans to the disabled so that they can procure jobs for themselves and stabilize their lives.

2- Institutions which admit the disabled for job training are entitled to a tax reduction, to low-interest loans and other preferential treatments in order t create conditions to enable the disabled to learn a trade.

3- The Government shall set a mandatory quota for disabled labor for a number of occupations and jobs. If a business with these occupations and jobs does not accept this quota, it shall pay a sum proscribed by the Government to the employment fund to help in the creation of employment for the disabled. Any business which employs a number of disabled than the assigned quota shall receive financial support or low-interest loans from the Government in order to create working conditions suitable for disabled employees.

4- The work hours for a disabled employee shall not exceed seven hours per day and 42 hours per week.