Nội dung toàn văn Official Dispatch No. 18080/BTC-CST on prices for calculation of excise tax and

|

MINISTRY OF

FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No: 18080/BTC-CST |

Ha Noi, December 30, 2011 |

|

To: |

- Provincial –level Tax Departments |

The Ministry of Finance has received requests of a number of tax and customs offices for guidance on prices for calculation of excise tax and value added tax of goods liable to environmental protection tax since January 1, 2012. Regarding to this matter, the Ministry of Finance guides as follows:

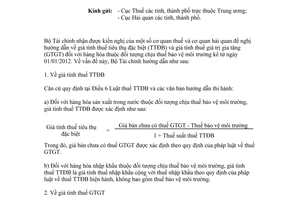

1. Prices for calculation of excise tax

Pursuant to Article 6 of the Law on Excise Tax and guiding documents:

a/ For domestically produced goods liable to environmental protection tax, prices for calculation of excise tax shall be determined as follows:

|

Excise tax calculation price |

= |

selling price exclusive of value added tax |

– |

environmental protection tax |

|

1 + excise tax rate |

||||

In which, the selling price exclusive of value-added tax is calculated under Law on Value Added Tax.

b/ For imported goods liable to environmental protection tax, excise tax calculation price is the import duty calculation price plus import duty under the current Law on Excise Tax, exclusive of environmental protection tax.

2. Value added tax calculation price

Pursuant to Article 7 of the Law on Value Added Tax and Clause 4, Article 7 of the Ministry of Finance’s Circular No. 152/2011/TT-BTC of November 11, 2011, guiding the Government’s No. 67/2011/ND-CP of August 8, 2011, detailing and guiding a number of articles of the Law on Environmental Protection Tax, goods liable to environmental protection tax is the selling price inclusive of environmental protection tax, import duty (if any) and excise tax (if any), but exclusive of value added tax, specifically as follows:

a/ For goods sold by production or trading establishments and liable to environmental protection tax, value-added tax calculation price is the selling price inclusive of excise tax (if any) and environmental protection tax, but exclusive of value added tax.

b/ For imported goods liable to environmental protection tax (except petrol and oil imported for sale), value added tax calculation price is the border-gate import price plus import duty (if any), excise tax (if any) and environmental protection tax. The border-gate import price shall be determined under regulations on prices for calculating import duty.

Above is the guidance provided by the Ministry of Finance to Tax and Customs Departments of cities and provinces, and related organizations and individuals for knowledge and implementation.

|

|

FOR THE

MINISTER OF FINANCE |