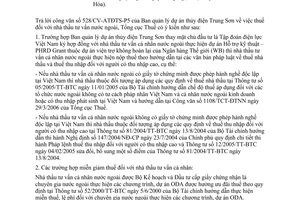

Nội dung toàn văn Official Dispatch No. 3316/TCT-HT, On tax policies for foreign consultants

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 3316/TCT-HT |

Hanoi, September 03, 2008 |

OFFICIAL LETTER

|

To: |

Trung Son Hydro-electric

Project Management Board |

In response to Trung Son Hydro-electric Project Management Board’s Official Letter No. 528/CV-ATDTS-P5 on tax policies for foreign consultants, the General Department of Taxation gives the following opinions:

1. When Trung Son Hydro-Electric Project Management Board signs, on behalf of the investor which is Vietnam Electricity Group, a contract with a foreign individual consultant to implement the technical assistance project - PHRD Grant - under a World Bank (WB) grant project, that foreign consultant shall pay taxes under the guidance of legal documents on tax on contractors and income tax on high income earners, specifically:

- If the foreign consultant can produce papers evidencing his/her right to provide professional services in Vietnam, he/she shall comply with the provisions on tax on contractors in the Finance Ministry's Circular No. 05/2005/TT-BTC of January 11, 2005, guiding the tax regime applicable to foreign organizations without Vietnamese legal person status and foreign individuals doing business or earning incomes in Vietnam, and the guidance of the General Department of Taxation’s Official Letter No. 1108/TCT-DTNN of March 29, 2006.

- If the foreign consultant fails to produce papers evidencing his/her right to provide professional services in Vietnam, he/she shall comply with the provisions on income tax on high income earners in the Finance Ministry's Circulars No. 81/2004/TT-BTC of August 13, 2004, guiding the implementation of the Government's Decree No. 147/2004/ND-CP of July 23, 2004, detailing the implementation of the Ordinance on Income Tax on High Income Earners, and No. 12/2005/TT-BTC of February 4, 2005, amending and supplementing a number of articles of Circular No. 81/2004/TT-BTC of August 13, 2004.

2. Cases of tax exemption and reduction for individual consultants:

A foreign individual consultant who is granted by the Planning and Investment Ministry a certificate of foreign expert implementing ODA programs and projects is entitled to tax incentives under the Finance Ministry's Circular No. 52/2000/TT-BTC of June 5, 2000, guiding the exemption of taxes and fees for foreign experts implementing ODA programs and projects.

A foreign individual consultant who is a resident of a country or territory with which Vietnam has effected a double taxation avoidance agreement and who earns incomes in Vietnam entitled to tax exemption or reduction under this agreement may enjoy tax exemption or reduction according to the agreement.

The General Department of Taxation informs Trung Son Hydro-Electric Project Management Board thereof and advises the Board to contact the local provincial tax office for specific guidance.

|

|

FOR

THE GENERAL DIRECTOR OF TAXATION |