Circular No. 123/2007/TT-BTC of October 23, 2007 guiding the implementation of tax policy and tax incentives for programs and projects funded with official development assistance (ODA) đã được thay thế bởi Circular No. 181/2013/TT-BTC guiding tax policies incentives programs projects ODA capital concessional loans và được áp dụng kể từ ngày 17/01/2014.

Nội dung toàn văn Circular No. 123/2007/TT-BTC of October 23, 2007 guiding the implementation of tax policy and tax incentives for programs and projects funded with official development assistance (ODA)

|

THE

MINISTRY OF FINANCE |

OF VIET |

|

No. 123/2007/TT-BTC |

, October 23, 2007 |

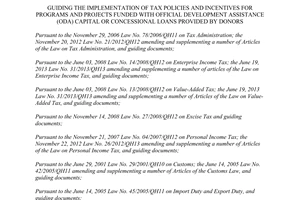

CIRCULAR

GUIDING THE IMPLEMENTATION OF TAX POLICY AND TAX INCENTIVES FOR PROGRAMS AND PROJECTS FUNDED WITH OFFICIAL DEVELOPMENT ASSISTANCE (ODA)

Pursuant to the current tax

laws and ordinances of the Socialist Republic of Vietnam and the Government’s decrees

detailing the implementation thereof;

Pursuant to Article 28 of the Regulation on the management and use of official

development assistance, issued together with the Government’s Decree No.

131/2006/ND-CP of November 9, 2006;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the tasks, powers and organizational structure of the Ministry of Finance;

The Ministry of Finance guides the implementation of tax policy for programs

and projects funded with official development assistance as follows:

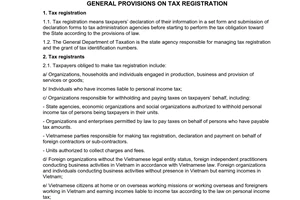

I. GENERAL PROVISIONS

1. This Circular applies to programs and projects funded with official development assistance (below collectively referred to as ODA projects) approved by competent authorities.

2. The terms defined at Point 2, Article 1, and in Article 4 of the Regulation on the management and use of official development assistance, issued together with Decree No. 131/2006/ND-CP which are used in this Circular, have the same meanings as defined at Point 2, Article 1, and in Article 4 of the said Regulation. In addition, in this Circular, the terms below are construed as follows:

- “Main contractor” is an organization or individual directly signing a contract with the ODA project owner or the ODA project donor for construction and installation of works or provision of goods and services for the ODA project. Main contractor includes foreign main contractor and Vietnamese main contractor.

- “Subcontractor” is an organization or individual signing a contract with the main contractor for performing a portion of the work under the contract signed between the main contractor and the ODA project owner or donor. Subcontractor includes foreign subcontractor and Vietnamese subcontractor.

3. Taxes imposed on ODA projects under the guidance in this Circular include import duty, export duty, special consumption tax, value added tax, income tax on high-income earners, business income tax, charges and fees.

II. TAX POLICY AND TAX INCENTIVES FOR NON-REFUNDABLE ODA PROJECTS

1. Import duty, value-added tax (VAT), special consumption tax on imported goods:

Non-refundable ODA project owners and main contractors executing non-refundable ODA projects do not have to pay import duty, special consumption tax (if any) and VAT for goods they directly import or import through entrustment for executing non-refundable ODA projects.

A dossier to be produced to the customs office in the place where the goods are imported comprises:

- The customs dossier;

- The declaration of aid with the finance agency’s certification, made according to the Finance Ministry’s Circular No. 82/2007/TT-BTC of July 12, 2007, guiding the regime of financial state management of foreign non-refundable aid belonging to the state budget;

- A copy of the contract-winning notice, attached with the goods provision contract, showing the successful bid exclusive of import duty (for the case in which the contract winner imports goods or entrusts the import of goods).

Customs offices do not collect import duty, special consumption tax (if any) and/or VAT on the goods imported for executing non-refundable ODA projects.

2. VAT on goods and services purchased in :

2.1. Non-refundable ODA project owners shall be refunded VAT amounts they have paid for goods and services bought in if their approved contracts signed with main contractors cover VAT and the project owners are not provided with state funds for paying VAT. The VAT refund is effected under the guidance at Point 4, Section V of this Circular.

Example: Non-refundable ODA project owner A has a contract, which has been approved by competent authorities, on construction of a pediatrics hospital with a total value of VND 4.4 billion, including the VAT-exclusive price of VND 4 billion and a VAT amount of 400 million (VAT rate of 10%). In addition, the project owner also has another contract, which has been approved by competent authorities, on purchase of goods and services with a total value of VND 110 million, including the VAT-exclusive price of VND 100 million and a VAT amount of 10 million. The project owner was not allocated state budget funds for paying VAT-inclusive prices.

The project owner will be refunded an input VAT amount of VND 410 (400 + 10) million already paid for the construction contract and the contract on purchase of domestic goods and services.

2.2. If the donor has a representative office in and directly purchases goods and services for the execution of a non-refundable ODA project or assigns it to the non-refundable ODA project owner, the donor will be refunded the paid VAT amount. The VAT refund is effected under the guidance at Point 4, Section V of this Circular.

2.3. If the non-refundable ODA project owner has been allocated state budget funds for paying VAT in the course of project execution, it is not entitled to VAT refund.

3. Taxes on main contractors and subcontractors executing non-refundable ODA projects:

3.1. Import duty, VAT, special consumption tax on imported goods:

a/ Main contractors and subcontractors importing goods in the course of performing contracts signed with non-refundable ODA project owners shall pay import duty, special consumption tax (if any) and VAT under the laws on import duty and export duty; special consumption tax; and VAT, and current guiding documents (except for goods imported by main contractors stated at Point 1, Section II of this Circular).

b/ Foreign main contractors and foreign subcontractors are exempt from import duty and do not have to pay VAT on machinery, equipment and means of transport imported into Vietnam by the mode of temporary import for re-export serving the construction of work under non-refundable ODA projects, and are exempt from export duty upon re-export.

Dossiers of application for import duty exemption, non-collection of VAT upon import, and export duty exemption upon re-export comply with the guidance in the Finance Ministry’s Circular No. 59/2007/TT-BTC of June 14, 2007, guiding the imposition of import duty and export duty, and tax administration of imports and exports.

Customs offices shall organize import duty exemption, non-collection of VAT upon import, and export duty exemption upon re-export for machinery, equipment and means of transport temporarily imported by foreign main contractors and foreign subcontractors for the execution of non-refundable ODA projects before re-export.

At the end of the work construction or project period, foreign main contractors and foreign subcontractors shall re-export the above goods. They shall obtain prior permission of competent Vietnamese agencies, make declaration and pay import duty and VAT according to current laws when selling these goods in .

Particularly for cars with under 24 seats and cars designed for the transportation of both passengers and cargo equivalent to cars with under 24 seats, they are not entitled to import duty and special consumption tax exemption applicable to the form of temporary import for re-export. Foreign main contractors and foreign subcontractors shall pay import duty and special consumption tax if they import these cars into . Upon completion of work construction or projects, they shall re-export these imported cars and be refunded the paid import duty and special consumption tax amounts according to regulations. Refunded tax amounts and tax refund procedures comply with Finance Ministry’s Circular No. 59/2007/TT-BTC of June 14, 2007, guiding the imposition of import duty and export duty, and tax administration of imports and exports, and Circular No. 119/2003/TT-BTC of December 12, 2003, guiding the implementation of the Government’s Decree No. 149/2003/ND-CP of December 4, 2003, detailing the implementation of the Special Consumption Tax Law and the Law Amending and Supplementing a Number of Articles of the Special Consumption Tax Law.

3.2. VAT, business income tax and other taxes, charges and fees for the provision of goods and services in :

Main contractors providing goods and services for non-refundable ODA project owners shall pay VAT (if the signed contracts cover VAT), business income tax and other taxes, charges and fees according to the provisions of law on taxes, charges and fees.

Subcontractors providing goods and services for main contractors of non-refundable ODA projects shall pay VAT, business income tax and other taxes, charges and fees according to the provisions of law on taxes, charges and fees.

Foreign main contractors and foreign subcontractors that do not apply the Vietnamese accounting system shall, if receiving direct payments from donors, transfer payable tax amounts to ODA project owners or foreign main contractors for the latter to pay taxes on their behalf under the guidance in the Finance Ministry’s Circular No. 05/2005/TT-BTC of January 11, 2005, guiding the tax regime applicable to foreign organizations without Vietnamese legal status and foreign individuals doing business or earning incomes in Vietnam.

3.3. Individuals working for main contractors and subcontractors shall pay personal income tax in accordance with the personal income tax law.

3.4. If a main contractor (regardless of paying VAT by the deduction or direct method) signs a contract with a VAT-exclusive price with the ODA project owner or donor for executing a non-refundable ODA project, the main contractor is entitled to refund of the input VAT amount paid for goods or services purchased for the performance of the signed contract. The VAT refund is effected under the guidance at Point 4, Section V of this Circular.

Example: Company A signs with a non-refundable ODA project owner a contract on the construction of a school with the successful VAT-exclusive bid of VND 4 billion. Company A is entitled to refund of the input VAT amount paid for goods and services purchased for the construction of the school under the contract signed with the project owner.

The main contractor shall separately account the input VAT amount paid for the purchased goods and services for the performance of the goods and service provision contract signed with the non-refundable ODA project owner or donor. If unable to do so, the main contractor is not entitled to VAT refund.

4. Personal income tax on individuals working for non-refundable ODA project owners and management units:

Vietnamese and foreign individuals working for ODA projects and ODA project management units shall declare and pay personal income tax in accordance with the current regulations on the personal income tax.

5. Tax incentives for foreign specialists working for non-refundable ODA projects:

Foreigners who possess written certifications of the Ministry of Planning and Investment as foreign specialists engaged in the implementation of ODA programs or projects and eligible for tax and charge incentives according to the Regulation on foreign specialists issued together with the Prime Minister’s Decision No. 211/1998/QD-TTg of October 31, 1998, are entitled to exemption from import duty, special consumption tax, VAT, registration fee and personal income tax under the Finance Ministry’s Circular No. 52/2000/TT-BTC of June 5, 2000, guiding the tax and fee exemption for foreign specialists engaged in the implementation of ODA programs and projects.

III. TAX POLICY AND TAX INCENTIVES APPLICABLE TO PROJECTS FUNDED WITH CONCESSIONAL OR MIXED ODA LOANS (BELOW COLLECTIVELY REFERRED TO AS ODA LOANS)

1. Import duty, VAT and special consumption tax on imported goods:

ODA loan project owners shall comply with import duty, special consumption tax and VAT obligations in accordance with the Law on Import duty and Export duty, the VAT Law, the Special Consumption Tax Law and guiding documents.

2. VAT on goods and services purchased in :

When purchasing goods and services in , ODA loan project owners shall fulfill VAT obligations in accordance with the VAT Law and guiding documents.

3. Tax policy for main contractors and subcontractors executing ODA loan projects:

3.1. Import duty, VAT and special consumption tax on imported goods:

a/ Main contractors and subcontractors importing goods in the course of performing contracts signed with ODA loan project owners shall pay import duty, special consumption tax (if any) and VAT under the Law on Import duty and Export duty; the Special Consumption Tax Law; and the VAT Law, and current guiding documents.

b/ Foreign main contractors and foreign subcontractors are exempt from import duty and do not have to pay VAT on machinery, equipment and means of transport imported into Vietnam by the mode of temporary import for re-export serving the construction of work under ODA loan projects, and are exempt from export duty upon re-export, as guided at Point 3.1.b, Section II of this Circular.

Particularly for cars with under 24 seats and cars designed for the transportation of both passengers and cargo equivalent to cars with under 24 seats, they are not entitled to import duty and special consumption tax exemption applicable to the form of temporary import for re-export. Foreign main contractors and foreign subcontractors shall pay import duty and special consumption tax if they import these cars into . Upon completion of work construction or projects, they shall re-export these imported cars and be refunded the paid import duty and special consumption tax amounts according to regulations. Refunded tax amounts and tax refund procedures comply with Finance Ministry’s Circular No. 59/2007/TT-BTC of June 14, 2007, guiding the imposition of import duty and export duty, and tax administration of imports and exports, and Circular No. 119/2003/TT-BTC of December 12, 2003, guiding the implementation of the Government’s Decree No. 149/2003/ND-CP of December 4, 2003, detailing the implementation of the Special Consumption Tax Law and the Law Amending and Supplementing a Number of Articles of the Special Consumption Tax Law.

3.2. VAT, business income tax and other taxes, charges and fees for the provision of goods and services in

Main contractors providing goods and services for ODA loan project owners shall pay VAT, business income tax and other taxes, charges and fees according to the provisions of law on taxes, charges and fees.

Subcontractors providing goods and services for main contractors of ODA loan projects shall pay VAT, business income tax and other taxes, charges and fees according to the provisions of law on taxes, charges and fees.

Foreign main contractors and foreign subcontractors that do not apply the Vietnamese accounting system shall, if receiving direct payments from donors, transfer payable tax amounts to ODA loan project owners or foreign main contractors for the latter to pay taxes on their behalf under the guidance in the Finance Ministry’s Circular No. 05/2005/TT-BTC of January 11, 2005, guiding the tax regime applicable to foreign organizations without Vietnamese legal status and foreign individuals doing business or earning incomes in Vietnam.

3.3. Main contractors providing goods and services for ODA loan project owners are not entitled to refund of input VAT amounts paid for the goods and services purchased for the performance of contracts signed with ODA loan project owners as guided at Point 4, Section V of this Circular. Main contractors are entitled to input VAT credit and refund applicable to business establishments that pay VAT by the credit method if they meet all conditions and procedures guided in the Finance Ministry’s Circular No. 32/2007/TT-BTC of April 9, 2007, guiding the implementation of the Government’s Decree No. 158/2003/ND-CP of December 10, 2003; Decree No. 148/2004/ND-CP of July 23, 2004; and Decree No. 156/2005/ND-CP of December 15, 2005, detailing the implementation of the VAT Law and the Law Amending and Supplementing a Number of Articles of the VAT Law.

3.4. Individuals working for main contractors and subcontractors shall pay personal income tax in accordance with the current regulations on personal income tax .

4. Personal income tax on Vietnamese and foreign individuals working for ODA loan projects and ODA loan project management units and tax and fee incentives for foreign specialists working for ODA loan projects are applied under the guidance at Points 4 and 5, Section II of this Circular.

5. For projects funded with mixed ODA loans of which non-refundable ODA capital is donated under a separate financing agreement or is disbursed separately for each specific project activity, the taxes applied to project implementation with non-refundable ODA capital shall be regulated by provisions specified in Section II of this Circular.

If no separate financing agreement or no separate disbursement for each specific activity funded with non-refundable ODA capital is made, taxes applied to mixed ODA loan projects is the same as to ODA loan projects specified in Section III of this Circular.

IV. RETROSPECTIVE COLLECTION, PAYMENT OF TAX

If goods, machinery, equipment and means of transport imported for the execution of ODA projects and exempt from import duty, special consumption tax and VAT under Point 1, Section II or Point 1, Section III of this Circular, are used for purposes other than those eligible for import duty, special consumption tax and VAT exemption or sold on the Vietnamese market, prior permission of a competent state agency is required. Project owners, main contractors and subcontractors shall retrospectively pay import duty and special consumption tax already exempted as well as VAT.

Dossiers and procedures for retrospective payment of import duty and special consumption tax and for declaration and payment of VAT comply with the Export duty and Import duty Law, the Special Consumption Tax Law, the VAT Law, and guiding documents.

For ODA project owners being non-business state management agencies, political organizations, socio-political organizations or socio-professional organizations, if permitted to sell goods already purchased for the execution of ODA projects or liquidating their assets on the Vietnamese market, they shall use invoices according to regulations of the Ministry of Finance.

V. ORGANIZATION OF IMPLEMENTATION

1. Responsibilities of ODA project owners for fulfilling tax obligations in the course of execution of ODA projects:

To supply documents in service of administration of ODA project-related taxes: Within 15 working days from the date of signing construction and installation or goods and service provision contracts with foreign main contractors, ODA program or project owners shall send one copy of such a contract (stamped and signed for certification by a competent person of the program or project owner) to the tax offices in the localities where the projects’ executive offices are located and the tax offices in the localities where the ODA projects’ construction works are based (for cases where an ODA project’s construction work and its executive office are located in different localities). For a foreign-language contract, a contract summary in Vietnamese, with the following major details: terms of reference, contractual value (including detailed annexes constituting the contractual value, if any), payment method, contractual term, obligations and responsibilities of the parties to the contract, must be sent. ODA project owners are responsible before law for the accuracy of the information sent to tax offices.

To determine the form of ODA grant and applicable tax policy: The bases for application of tax policy as guided in this Circular include investment decisions or ODA project approval decisions of ODA program or project-managing agencies, and the guidance on forms of ODA grant in the Government’s Decree No. 131/2006/ND-CP of November 9, 2006. In case the investment or ODA project approval decision does not specify whether ODA is non-refundable ODA, concessional ODA loans or mixed ODA loans, the ODA project owner or the main contractor shall supplement a document of the investment decision-issuing ODA program or project-managing agency determining clearly the form of ODA grant for the project. Particularly for projects in which investment is decided by the Prime Minister (important national projects), written certification of the Ministry of Planning and Investment of the form of ODA grant is required.

To fulfill tax, charge and fee obligations in accordance with current tax, charge and fee laws and the guidance in this Circular.

To notify main contractors that sign goods and service provision contracts with ODA project owners of tax policy and tax incentives that these contractors are obliged to implement and entitled to.

To make financial plans: ODA project owners shall fully calculate taxes and duties under the guidance in this Circular which arise in the course of project execution before submitting projects or bidding results to ODA program- or project-managing agencies for approval. They shall identify import duty, special consumption tax and VAT amounts (except for the case of non-payment or refund of VAT) and other payable charges and fees, and make a plan on contributed domestic funds for payment of the above taxes and duties. Such a plan is, however, not required for business income tax amounts payable by contractors and included in the contractual value and personal income tax amounts included in wage expenses.

Financial plans shall be made under written guidelines issued by the Ministry of Finance.

To report to finance offices in charge of financial management of projects on refundable VAT amounts according to written guidelines issued by the Ministry of Finance on the financial management mechanism applicable to ODA projects.

2. Responsibilities of tax administration authorities:

To guide ODA project owners, donors, main contractors and subcontractors to make tax registration, declaration and payment or refund (if any) according to regulations, to notify them of state budget accounts and indexes for tax payment.

To examine tax declarations, accounting records and documents and necessary documents for tax calculation.

To request ODA project owners, main contractors and subcontractors to supply accounting records, invoices and other documents related to tax calculation, payment and refund.

To assess payable tax amounts for ODA project owners, main contractors or subcontractors that fail to make declaration on time or make incomplete and inaccurate declaration or supply insufficient or inaccurate information relating to tax calculation.

To examine and inspect the tax payment, tax finalization and tax refund by ODA project owners, main contractors and subcontractors in accordance with current law.

To make written records of and handle tax-related violations according to their competence prescribed by law.

To take responsibility for enforcing tax laws, ensuring truthfulness, accuracy and objectivity.

To certify paid tax amounts of ODA project owners, main contractors and subcontractors, and take responsibility for the accuracy of certified tax amounts.

3. Implementation of international agreements:

If an international agreement (including international agreement on ODA) which the Vietnamese Government has signed or acceded to contains tax provisions concerning the execution of a specific ODA project which are different from the guidance in this Circular, the application of tax policy to this ODA project complies with the signed international agreement.

4. Procedures and dossiers for VAT refund for non-refundable ODA project owners, donors’ representatives and main contractors entitled to VAT refund stated at Point 2 and Point 3.4, Section II of this Circular:

4.1. Procedures for registration and grant of tax identification numbers to ODA project owners, donors and main contractors comply with the guidance in the Finance Ministry’s Circular No. 85/2007/TT-BTC of July 18, 2007, guiding the implementation of the Tax Administration Law regarding tax registration.

4.2. Dossiers for VAT refund, time limit for input VAT declaration and organizations in charge of receiving dossiers and refunding VAT comply with the guidance in the Finance Ministry’s Circular No. 60/2007/TT-BTC of June 14, 2007, guiding the implementation of a number of articles of the Tax Administration Law and the Government’s Decree No. 85/2007/ND-CP of May 25, 2007, detailing the implementation of a number of articles of the Tax Administration Law.

In VAT refund dossiers sent to tax offices, main contractors shall indicate the ODA project title and the name and postal address of the ODA project owner.

4.3. When issuing VAT refund decisions, apart from original copies of documents circulated under the guidance in the Finance Ministry’s Circular No. 60/2007/TT-BTC of June 14, 2007, guiding the implementation of a number of articles of the Tax Administration Law, and the Government’s Decree No. 85/2007/ND-CP of May 25, 2007, detailing the implementation of a number of articles of the Tax Administration Law, tax offices shall send an additional original copy to ODA project owners, in case of refund of VAT to main contractors.

4.4. If a project owner is allocated state budget funds for VAT payment and carries out VAT refund procedures, when receiving the refunded VAT amount, the project owner shall return to the state budget the refunded VAT amount as guided in the Finance Ministry’s Circular No. 42/2001/TT-BTC of June 12, 2001, guiding the management and accounting of ODA projects’ refunded VAT amounts.

When examining VAT refund dossiers of ODA projects, if detecting any doubtful matters which need to be verified before or after tax refund, tax offices shall take measures in accordance with the VAT Law, the Tax Administration Law, and guiding documents.

VI. IMPLEMENTATION EFFECT

This Circular takes effect 15 days after its publication in “CONG BAO,” replacing the Finance Ministry’s Circular No. 41/2002/TT-BTC of May 3, 2002, guiding the implementation of tax policy for programs and projects funded with official development assistance, and regulations contrary to the guidance in this Circular.

For ODA projects approved by competent authorities before the effective date of this Circular, their tax obligations and tax incentives shall be determined and implemented under the guidance in the Finance Ministry’s Circular No. 41/2002/TT-BTC of May 3, 2002, guiding the implementation of tax policy for programs and projects funded with official development assistance until their completion.

|

|

FOR THE

MINISTER OF FINANCE |