Circular No. 124/2009/TT-BTC of June 17, 2009, guiding the Government's Decree No. 05/2009/ND-CP of January 19,2009, which details the Ordinance on royalties and the ordinance amending and supplementing Article 6 of the Ordinance on royalties đã được thay thế bởi Circular No. 105/2010/TT-BTC guiding a number of articles of the law và được áp dụng kể từ ngày 01/07/2010.

Nội dung toàn văn Circular No. 124/2009/TT-BTC of June 17, 2009, guiding the Government's Decree No. 05/2009/ND-CP of January 19,2009, which details the Ordinance on royalties and the ordinance amending and supplementing Article 6 of the Ordinance on royalties

|

THE

MINISTER OF FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM Independence

- Freedom – Happiness |

|

No. 124/2009/TT-BTC |

Hanoi, June 17, 2009 |

CIRCULAR

GUIDING THE GOVERNMENT'S DECREE NO. 05/2009/ND-CP OF JANUARY 19,2009, WHICH DETAILS THE ORDINANCE ON ROYALTIES AND THE ORDINANCE AMENDING AND SUPPLEMENTING ARTICLE 6 OF THE ORDINANCE ON ROYALTIES

THE MINISTER OF FINANCE

Pursuant to November 29, 2006

Law No. 78/ 2006/QH11 on Tax Administration;

Pursuant to the National Assembly's Resolution No. 47/2005/QH11 of November 1,

2005;

Pursuant to the April 10, 1998 Ordinance on Royalties;

Pursuant to the November 22, 2008 Ordinance Amending and Supplementing Article

6 of the Ordinance on Royalties;

Pursuant to the Government's Decree No. 05/ 2009/ND-CP of January 19, 2009,

detailing the Ordinance on Royalties and the Ordinance Amending and

Supplementing Article 6 of the Ordinance on Royalties;

Pursuant to the Government's Decree No. 118/2008/ND-CP of November 27, 2008,

defining the functions, powers, tasks and organizational structure of the

Ministry of Finance;

The Ministry of Finance guides the Government's Decree No. 05/2009/ND-CP of

January 19, 2009, detailing the Ordinance on Royalties and the Ordinance

Amending and Supplementing Article 6 of the Ordinance on Royalties, as follows:

Part I

GENERAL PROVISIONS

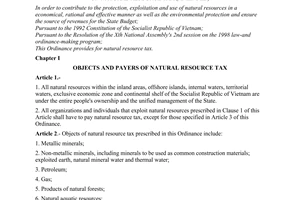

Article 1. Scope of application

This Circular guides royalty payers; royalty-liable objects; royalty bases; royalty rates; royalty exemption and reduction; and the implementation of the Government's Decree No. 05/2009/ND-CP of January 19. 2009, detailing the Ordinance op Royalties and the Ordinance Amending and Supplementing Article 6 of the Ordinance on Royalties (below referred to as Decree No. 05/2009/ND-CP) Particularly, royalties on petroleum, fuel gas and coal gas exploitation comply with the Finance Ministry's specific guidance.

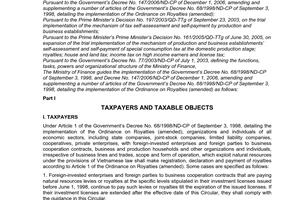

Article 2. Royalty payers

Royalty payers defined in Article 1 of Decree No. 05/2009/ND-CP including state companies, joint-stock companies, limited liability companies, partnerships, cooperatives, private enterprises, foreign-invested enterprises or foreign parties to business cooperation contracts, and other organizations, households and individuals, regardless of their sectors, trades, sizes or forms of operation, that exploit natural resources under Vietnamese law, shall pay royalties under Article 1 of the (amended) Ordinance on Royalties.

For natural resources banned from exploitation which are captured, confiscated and permitted to be sold, their sellers shall pay royalties.

Article 3. Royalty-liable objects

Royalty-liable objects under this Circular include natural resources in the mainland, islands, internal waters, territorial seas, the exclusive economic zone and continental shelf under the sovereignty and jurisdiction of the Socialist Republic of Vietnam, specifically:

1. Metallic minerals;

2. Non-metallic minerals, including also minerals used as ordinary construction materials and soil used for brick manufacture, soil exploited for ground leveling or work construction or for other purposes; rock, sand, gravel, coal, gems and other non-metallic resources: natural mineral water and thermal water specified in Clause 3. Article 3 of the Law on Minerals;

3. Natural forest products, including plants and animals permitted to be exploited, such as timber (even tree branches and tops, firewood stumps and roots), bamboo and rattan; medicinal herbs, and other plants and animals permitted to be exploited;

4. Natural aquatic resources, including wild animals and plants in the sea, rivers, streams, lakes, lagoons, natural canals and ditches;

5. Natural water, including:

5.1. Surface water, such as water in the sea, lakes, rivers, streams, canals, ditches, ponds, dams and lagoons;

5.2. Ground water, such as water exploited from drilled wells (except natural thermal water and mineral water specified in Clause 2 of this Article);

6. Other natural resources under the law on natural resources.

Part II

ROYALTY BASES AND RATES

Article 4. Royalty bases

Royalty bases include the output of commodity natural resource actually exploited in a period, royalty-liable price of a unit of natural resource, and royalty rate.

The payable royalty amount is calculated as follows:

|

Royalty amount payable in a period |

= |

Output of commodity natural resources actually exploited |

x |

Royalty – liable price of a unit of natural resource |

x |

Royalty rate |

In case a state agency fixes a royalty amount payable on a unit of exploited natural resource, the payable royalty amount is determined as follows:

|

Royalty amount payable in a period in a period |

= |

Output of commodity natural resource actually exploited in a period |

x |

Royalty amount fixed on a unit of exploited natural resource |

Article 5. Actually exploited output of commodity natural resource

The actually exploited output of commodity natural resource under Article 5 of Decree No. 05/2009/ND-CP is the quantity, weight or volume of natural resource actually exploited in a royalty period, regardless of the purposes of exploitation, and in some cases, shall be determined as follows:

1. In case the actually exploited output of a commodity natural resource cannot be determined because this natural resource contains different substances and large amounts of impurities, the output of commodity natural resource used for royalty calculation shall be determined based on the commodity output of each substance obtained from sorting and classification.

Example 1: For coal exploited from a mine which contains impurities, soil and rock and must undergo sorting and classification before sale, the actually exploited output of commodity coal used for royalty calculation is the amount of sorted and classified coal.

In case a large volume of soil and rock (the amount of which cannot be determined) must be sorted to obtain 2 kg of gold nugget and KM) tons of iron ore. royalty shall be calculated on this amount of gold nugget and iron ore. At the same time, the amount of other natural resources exploited and used for mining activities, such as water exploited and used for sorting activities, shall also be determined.

2. For other natural resources which are not sold immediately after exploitation but further used for producing other products or providing other services, if their output cannot be directly determined, the output of natural resource used for royalty calculation shall be based on the output of products produced in a period and the norm of used natural resource per unit of product.

Example 2: To produce 1,000 unbaked bricks, it is necessary to use 1 m3 of clay. In a month, if a clay-exploiting establishment produces 100,000 bricks, the output of exploited clay liable to royalty will be: 100.000 bricks divided by (:) 1,000 bricks = 100 m3.

3. For natural water used for hydropower generation, the output of natural resource used for royalty calculation is the output of delivered electricity shown on the electricity meter, certified by the hydropower generation establishment and the electricity transmission or trading establishment.

4. In case of manual, scattered or mobile, irregular exploitation, if the planned output of exploited natural resource in a year is valued at under VND 200 million and difficult to manage, a fixed output of exploited natural resource may be determined according to seasons or on a regular basis. Tax offices shall collaborate with local administrations and specialized management agencies in determining the fixed output of exploited natural resources.

Also in the above case, if a small-scale exploiter of natural resources signs contracts to sell these natural resources to a certain purchaser that makes a written commitment to declare and pay royalties on behalf of the exploiter, the managing tax office shall issue a decision allowing this purchaser to do so and shall send a copy of such decision to the managing provincial-level Tax Department for statistics and supervision.

Article 6. Royalty-liable prices

The royalty-liable price specified in Article 6 of Decree No. 05/2009/ND-CP is the selling price of a unit of natural resource on the market at the place of exploitation, exclusive of value-added tax. and shall be determined on a case-by-case basis as follows:

1. In case the selling price of a unit of natural resource at the place of exploitation can be determined:

1.1. For a natural resource exploited in a month which is of the same grade and quality and then, is partially sold at the place of exploitation at the market price while the remainder is sold elsewhere or put into production, processing, sorting, classification or selection, the royalty-liable price of the whole output of the exploited natural resource is the value-added tax-exclusive selling price of a unit of such natural resource at the place of exploitation. The selling price of a natural resource is the total turnover (exclusive of value-added tax) of the natural resource sold at the place of exploitation divided by the total output of the natural resource sold in the month.

In case the exploited natural resource is not sold in the country but wholly exported, the royalty-liable price is the export price (FOB), exclusive of export duty.

1.2. In a month, if there arises an output of exploited natural resource but it is not sold, the royalty-liable price of a unit of natural resource shall be determined based on that used in the preceding month.

2. When the selling price of a unit of natural resource product cannot be determined under Clause 1 of this Article, the royalty-liable price of a unit of natural resource shall be determined based on any of the following grounds:

2.1 The average market selling price of a unit of exploited natural resource of the same category having a similar price set by the provincial-level People's Committee under Clause 5 of this Article;

2.2. The selling price of a refined product and the content of this substance in the exploited natural resource, or the price of a refined product and the content of each substance in the exploited natural resource;

Example 3: For an establishment exploiting a copper mine under a natural resource exploitation license and according to an exploitation design dossier approved by a competent agency with the verified proportion of each substance in the exploited copper ore as follows: copper: 60%; silver: 0.2%; and zinc: 0.5%, the royalty-liable price of a unit of pure natural resource is set by the provincial-level People's Committee at VND 8,000,000/ton of copper; VND 600,000,000/ton of silver; and VND 40,000.000/ton of zinc;

The royalty-liable price of a unit of each substance shall be determined based on the royalty-liable price of a unit of pure natural resource set by the provincial-level People's Committee and the percentage of each substance. Specifically:

- For copper ore: 60% x VND 8,000,000/ton =VND 4,800,000/ton

- For silver ore: 0.2% x VND 600,000,000/ ton = VND 1,200,000/ton

- For zinc ore: 0.5% x VND 40,000,000/ton = VND 200,000/ton

The applicable royalty rate shall be based on the royalty-liable price of a unit of each ore.

2.3. Percentage of the selling price of a product produced and processed from an exploited natural resource:

In case the output of a natural resource at the stage of exploitation can be determined but it is not sold but put into sorting or selection or used for production or processing (collectively referred to as processing), the royalty-liable price of a unit of natural resource is a percentage (%) of the selling price of a product processed from the exploited natural resource but must not be lower than the royalty-liable price of a unit of natural resource set for such natural resource by the provincial-level People's Committee under Clause 5 of this Article.

The royalty-liable price equals (=) the selling price of a product or goods produced from the exploited natural resource, multiplied by (x) the percentage (%) of the selling price of the product obtained from sorting or processing.

a/ The percentage (%) of the selling price of the product obtained from processing is the percentage (%) of the average cost of a unit of exploited natural resource to the average cost of a product processed from the natural resource exploited in the preceding year.

In case a unit has just started exploiting natural resources, the applicable royalty-liable price is the one set by the provincial-level People's Committee.

Example 4: Company A exploits coal from a mine which must be sorted and classified before sale.

- The average selling price of cabcoal 3 in a month is VND 800,000/ton.

- In the previous year, the cost of exploiting coal at the mine and transporting coal to a warehouse or storing yard within that mine, allocated to one ton of cabcoal 3, is VND 450,000/ton.

- The cost of a product processed from the preceding year's exploited natural resource is VND 480,000/ton (inclusive of expenses at the stage of coal sorting and selection under law).

- The percentage (%) of the selling price of cabcoal 3 used for royalty calculation is:

(VND 450,000 : VND 480,000) x 100 = 93.7%

|

Royalty-liable price of one ton of cabcoal 3 on the selling price |

= |

VND 800,000/ton |

x |

93,7% |

= |

VND 750,957/ton |

The royalty-liable price determined by the company must not be lower than the royalty-liable price of a unit of such natural resource set for such natural resource by the provincial-level People's Committee.

b/ In case the exploited natural resource is. put into processing and after processing, an associated natural resource product is obtained, the applicable royalty-liable price is the selling price of a unit of natural resource under Point 2.1 or 2.2, Clause 2 of this Article.

Example 5: If in the course of iron ore refinement, 0.05 ton of refined copper ore is obtained per one ton of cast iron and sold at VND 9,500,000/ton, the royalty-liable price of 0.05 ton of copper ore will be: 0.05 x VND 9,500,000 = VND 475,000. If such refined copper ore is not sold, the royalty-liable price of a unit of this natural resource set by the provincial-level People's Committee shall be used for calculating the payable royalty amount.

2.4. A natural resource exploiter shall register with the tax office the applied method of determining the royalty-liable price of each natural resource under Clause 2 of this Article. For new exploiters, the registration time limit is 30 days from the date of exploitation commencement. Any change in the method of determining the royalty-liable price shall be reregistered with the tax office not later than the first day of the month in which such change occurs.

3. For timber, the royalty-liable price of a unit of natural resource is the selling price at the place of delivery (the selling price at the warehouse or storing yard in the place of exploitation).

4. The royalty-liable price of natural water:

4.1. The royalty-liable price of natural water used for hydropower generation is guided in Clause 1, Article 3 of the Finance Ministry's Circular No. 45/2009/TT-BTC of March 11, 2009, guiding value-added tax. royalties and enterprise income tax applicable to hydropower plants.

4.2. For natural mineral water, thermal water and natural water used for producing products or providing services, the royalty-liable price shall be determined on the principle guided at Point 2.3, Clause 2 of this Article.

5. For exploiters that do not sell exploited natural resources or fail to fully observe regulations on accounting books and documents; payers of royalties according to the assessment method; or the cases in which the output of a natural resource can be determined at the stage of exploitation but there are insufficient grounds for determining the market selling price of such natural resource in the locality of exploitation because it has undergone many sorting and consumption stages, the applicable royalty-liable price of a unit of natural resource is the one set by the provincial-level People's Committee in each period.

Based on local characteristics and requirements of formulating royalty-liable prices, provincial-level People's Committees shall direct and assign provincial-level Finance Departments to assume the prime responsibility for. and collaborate with provincial-level Tax Departments and Natural Resources and Environment Departments in. formulating royalty-liable price plans for submission to provincial-level People's Committees for decision.

The formulation of royalty-liable prices must be based on the content, quality and output of natural resources, the ratio of recovery of natural resources, and market selling prices of natural resources in localities where natural resources are exploited.

When the selling price of a natural resource fluctuates by 20%, royalty-liable prices must be adjusted accordingly. Provincial-level Finance Departments shall assume the prime responsibility for, and collaborate with provincial-level Tax Departments and Natural Resources and Environment Departments in, surveying local market prices of natural resources and formulate plans to adjust royalty-liable prices, then submit them to provincial-level People's Committees for decision and report thereon to the Ministry of Finance (the General Department of Taxation).

Tax offices directly managing royalty collection shall publicly post up royalty-liable prices of natural resources at their headquarters.

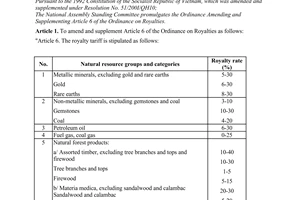

Article 7. Royalty rates

The royalty rate of each exploited natural resource is specified in Article 7 of and the Royalty Tariff in Appendix I to Decree No. 05/2009/ND-CP.

Part III

ROYALTY REGISTRATION. DECLARATION. PAYMENT AND FINALIZATION

Article 8. Royalty registration, declaration, payment and finalization

The royalty registration, declaration, payment and finalization comply with the Law on Tax Administration and guiding documents.

Part IV

ROYALTY EXEMPTION AND REDUCTION

Article 9. Royalty exemption or reduction

The order of and procedures for royalty exemption or reduction declaration and the competence to grant royalty exemption or reduction defined in Articles 9 and 10 of Decree No. 05/2009/ND-CP are guided in Section II. Part F of the Finance Ministry's Circular No. 60/2007/TT-BTC In other cases, royalty exemption or reduction is specified as follows:

1. Exploiters of offshore aquatic resources by high-capacity vessels are exempt from royalties for 5 years after they are granted exploitation licenses, and entitled to a 50% royalty reduction for 5 subsequent years.

High-capacity vessels include aquatic resource-exploiting ships and boats of all kinds installed with main engines of at least 90 horse power (CV).

Tax exemption procedures: Based on offshore aquatic-resource exploitation licenses, exploiters shall themselves determine their royalty exemption or reduction eligibility and notify their managing tax offices of the royalty exemption or reduction duration.

At the end of a royalty period, an offshore aquatic-resource exploiting business establishment paying royalties according to the declaration method shall itself determine the royalty amount exempted or reduced in that period in order to make royalty declaration and bear responsibility for the declared amount. A business establishment which dishonestly determines their royalty exemption or reduction eligibility aiming to declare a higher royalty amount to be exempted or reduced will have the cheated royalty amount retrospectively collected and be handled under current regulations.

In the course of operation, any change in the conditions for royalty exemption or reduction resulting in the reduction of tax incentives shall be promptly declared by offshore aquatic resource exploiters to the nearest tax office for information and confirmation. Failure to declare the change in order to continue enjoying royalty exemption or reduction will be regarded as royalty evasion or fraud and shall be handled under regulations.

After the above royalty exemption or reduction duration (10 years), if offshore aquatic resource exploiters that pay royalties according to the declaration method suffer losses in their business activities in a year, they will be entitled to royalty reduction corresponding to the loss in their offshore aquatic resource exploitation, which must not exceed the royalty amount payable for aquatic resource exploitation. The royalty reduction duration must not exceed 5 consecutive years following the year of expiration of the above royalty exemption or reduction duration. A royalty reduction declaration dossier enclosed with the royalty finalization declaration dossier comprises:

- Declaration of turnover, expenses and losses of offshore aquatic resource exploitation.

- Calculation table of the to-be-reduced royalty amount.

2. Royalty exemption in 2009 through 2010 for organizations, individuals and households that exploit aquatic resources or make unprocessed salt under Clause 2, Section II of the National Assembly's Resolution No. 47/2005/QH11 of November 1, 2005:

- Royalty exemption procedures for individuals and households: When making royalty books for 2009 and 2010, tax offices will not impose royalties on individuals and households that exploit aquatic resources or make unprocessed salt. Individuals and households having made the 2009 royalty books shall submit these books before June 30, 2009, to tax offices for adjustment.

- Royalty exemption procedures for organizations: Annually, organizations shall themselves determine their eligibility for royalty exemption for aquatic resource exploitation and salt making activities simultaneously with declaring other taxes to tax offices under regulations.

3. Royalty exemption for natural water used for generation of hydropower not to be fed into the national power grid under the Electricity Law:

Royalty exemption procedures: Based on exploiters' requests (with provincial-level Industry and Trade Departments' opinions on non-feeding into the national power grid), directors of managing provincial-level Tax Departments shall decide to exempt royalties in this case.

4. Exploiters of soil for use are exempt from royalties under Clause 5, Article 9 of Decree No. 05/2009/ND-CP The royalty exemption for soil exploited for ground leveling or work construction covers also sand, rock or gravel mixed in the exploited soil, making it impossible to identify each substance, and used in crude forms for ground leveling or work construction.

Exploiters shall send a written request for royalty exemption, enclosed with relevant dossiers, to a competent agency for approval of the construction of a work in the locality, and send the dossier set to the tax office directly managing the place of exploitation for information and royalty exemption monitoring.

Part V

ORGANIZATION OF IMPLEMENTATION ARTICLE 10. EFFECT

1. This Circular takes effect 45 days from the date of its signing; replaces the Finance Ministry's Circular No. 42/2007/TT-BTC of April 27, 2007, guiding the Government's Decree No. 68/1998/ND-CP of September 3, 1998, and the Government's Decree No. 147/2006/ND-CP of December 1, 2006, detailing the (amended) Ordinance on Royalties; and applies from the 2009 royalty finalization period.

2. In some cases of joint venture or cooperation between Vietnamese and foreign parties for exploiting natural resources under previously granted investment licenses:

2.1. Foreign-invested enterprises and business cooperation foreign parties to contracts under which they remit royalty charges or pay royalties at rates specified in investment licenses granted before the effective date of Decree No. 05/2009/ ND-CP may continue doing so until the expiration of the granted licenses. In case their investment licenses are extended after the effective date of this Circular, the guidance of this Circular applies.

2.2. For a joint venture between a Vietnamese and a foreign party operating under the Law on Foreign Investment in Vietnam (now the Investment Law) to which the Vietnamese party contributes natural resources indicated in the investment license under Article 3 of Decree No. 05/2009/ND-CP as the legal capital, the joint venture enterprise is not required to pay royalties on the contributed natural resources. Quarterly or biannually. the Vietnamese party shall declare the volume of contributed natural resources and report it to the Ministry of Finance for recording as state budget capital and capital management under current regulations.

2.3. In case an enterprise is established in the form of joint venture, business cooperation contract or production-sharing contract between a Vietnamese and foreign party, the royalty amount payable by the joint venture enterprise or foreign party must be determined in such contract. If the two parties agree to include the payable royalty amount in the proportion of products to be shared to the Vietnamese party, the Vietnamese party shall, upon product sharing, remit into the state budget the royalty amount calculated on the whole output of exploited natural resources.

Any problems arising in the course of implementation should be reported to the Ministry of Finance for additional guidance.

|

|

FOR

THE MINISTER OF FINANCE |