Circular No. 157/2013/TT-BTC amending export tax rates for commodities of rubber under heading 40.01 40.02 40.05 đã được thay thế bởi Circular No. 164/2013/TT-BTC export tariff schedule and preferential import tariff schedule và được áp dụng kể từ ngày 01/01/2014.

Nội dung toàn văn Circular No. 157/2013/TT-BTC amending export tax rates for commodities of rubber under heading 40.01 40.02 40.05

|

THE MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 157/2013/TT-BTC |

Hanoi, November 11, 2013 |

CIRCULAR

AMENDING EXPORT TAX RATES FOR COMMODITIES OF RUBBER UNDER HEADING 40.01, 40.02, 40.05 IN THE EXPORT TARIFF PROMULGATED TOGETHER WITH THE CIRCULAR No. 193/2012/TT-BTC DATED NOVEMBER 15, 2012

Pursuant to the Law on Export and Import Duties dated 14/6/2005;

Pursuant to the Resolution No.710/2008/NQ-UBTVQH12 dated 22/11/2008 of the Standing Committee of the National Assembly on the amendment of the Resolution No.295/2007/NQ-UBTVQH12 dated 28/9/2007 promulgating Export Tariff on the list of dutiable commodity headings and tax rate bracket for each commodity heading, preferential import tariff by the list of dutiable commodity headings and the preferential tax rate bracket for each commodity heading;

Pursuant to the Decree No.87/2010/ND-CP dated 13/8/2010 of the Government detailing the implementation of a number of Articles of the Law on Export and Import Duties;

Pursuant to the Decree No.118/2008/ND-CP dated 27/11/2008 of the Government defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

At the request of the Director of Department of Tax Policy;

The Minister of Finance promulgated Circular amending export tax rates for some commodities of rubber under heading 40.01, 40.02, 40.05 as follows:

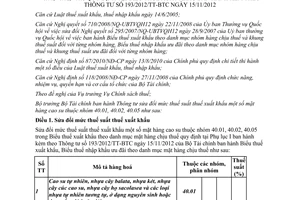

Article 1. To amend export tax rates

Amending export tax rates for some commodities of rubber under heading 40.01, 40.02, 40.05 in the export tariff according to the list of dutiable commodity groups specified in the Annex I promulgated together with the Circular No.193/2012/TT-BTC dated November 15, 2012 of the Ministry of Finance promulgating the preferential import and export tariff according to the list of taxable products as follows:

|

No. |

Goods description |

Under headings, sub-headings |

T ax rates (%) |

||

|

1 |

Natural rubber, balata, gutta-percha, guayule, chicle and similar natural gums, in primary forms or in plates, sheets or strip |

40.01 |

|

|

|

|

|

- Natural rubber latex, whether or not pre-vulcanised |

4001 |

10 |

|

1 |

|

|

- Latex crepes |

4001 |

29 |

20 |

1 |

|

|

- Other |

4001 |

|

|

0 |

|

|

|

|

|

|

|

|

2 |

Synthetic rubber and factice derived from oils, in primary forms or in plates, sheets or strip; mixtures of any product of heading 40.01 with any product of this heading, in primary forms or in plates, sheets or strip. |

|

|

|

|

|

|

- Synthetic rubber |

4002 |

|

|

1 |

|

|

- Other |

4002 |

|

|

0 |

|

|

|

|

|

|

|

|

3 |

Compound rubber, unvulcanised, in primary forms or in plates, sheets or strip. |

4005 |

|

|

1 |

|

|

|

|

|

|

|

Article 2. Effect

This Circular takes effect on December 26, 2013./.

|

|

FOR THE

MINISTER OF FINANCE |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments