Circular No. 158/2011/TT-BTC guiding the implementation of theGovernment's đã được thay thế bởi Circular 66/2016/TT-BTC guidance 12/2016/ND-CP environmental protection fees mineral extraction và được áp dụng kể từ ngày 13/06/2016.

Nội dung toàn văn Circular No. 158/2011/TT-BTC guiding the implementation of theGovernment's

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 158/2011/TT-BTC |

Hanoi, November 16, 2011 |

CIRCULAR

GUIDING THE IMPLEMENTATION OF THE GOVERNMENT'S DECREE NO. 74/2011/ND-CP OF AUGUST 25, 2011, ON ENVIRONMENTAL PROTECTION CHARGE FOR MINERAL EXPLOITATION

Pursuant to August 28, 2001 Ordinance No. 38/2001/PL-UBTVQH10 on Charges and Fees;

Pursuant to the Government's Decree No. 57/2002/ND-CP of June 3, 2002, detailing the Ordinance on Charges and Fees, and Decree No. 24/2006/ND-CP of March 6, 2006, amending and supplementing a number of articles of Decree No. 57/2002/ND-CP;

Pursuant to the Government's Decree No. 118/2008/ND-CP of November 27, 2008, defining the functions, tasks, powers and organizational structure of the Ministry of Finance-Pursuant to the Government's Decree No. 74/2011/ND-CP of August 25, 2011, on environmental protection charge for mineral exploitation;

The Ministry of Finance guides some contents of environmental protection charge for mineral exploitation provided in the Government's Decree No. 74/2011/ND-CP of August 25, 2011, as follows:

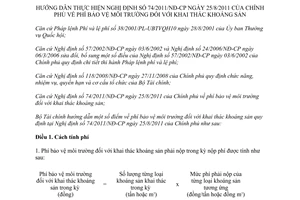

Article 1. Charge calculation method

1. The amount of environmental protection charge for mineral exploitation payable in a charge payment period is calculated as follows:

|

Amount of environmental protection charge for mineral exploitation payable in a period (VND) |

= |

Quantity of exploited mineral of each type (ton or m3) |

x |

Corresponding charge rate(VND/tonor VND/m3) |

2. The quantity of minerals exploited in the period used for determining the payable environmental protection charge amount is:

a/ For non-metal minerals:

The quantity of non-metal minerals exploited in a charge payment period used for determining the payable environmental protection charge amount is the quantity of crude mineral ores actually exploited in the period, regardless of exploitation purposes (for sale, barter, internal consumption or reserve for subsequent production) and exploitation technologies (manual or mechanical) or exploitation areas or conditions (mountainous, midland or delta areas with difficult or complicated conditions). For a mineral which must be screened, sorted or enriched before sale, based on actual mineral exploitation conditions and mineral processing technologies in localities, provincial-level Natural Resources and Environment Departments shall assume the prime responsibility for, and coordinate with local Tax Departments in, proposing provincial-level People's Committees to decide on a ratio for converting the quantity of finished mineral products into the quantity of crude mineral ores to serve as a basis for calculating the amount of environmental protection charge suitable to local realities.

b/ For metal minerals:

The quantity of metal minerals exploited in a charge payment period used for determining the payable environmental protection charge amount is the quantity of crude metal mineral ores actually exploited in the period, regardless of exploitation purposes (for sale, barter, internal consumption or reserve for subsequent production) and exploitation technologies (manual or mechanical) or exploitation areas or conditions (mountainous, midland or delta areas with difficult or complicated conditions). For a mineral which must be screened, sorted or enriched before sale, based on actual mineral exploitation conditions and mineral processing technologies in localities, provincial-level Natural Resources and Environment Departments shall assume the prime responsibility for, and coordinate with local Tax Departments in, proposing provincial-level People's Committees to decide on a ratio for converting the quantity of finished mineral ores into the quantity of crude mineral ores to serve as a basis for calculating of the amount of environmental protection charge suitable to local realities.

3. Environmental protection charge for other minerals additionally obtained in the exploitation process, if any, shall be paid at the charge rate applicable to the mineral exploited under competent state agencies' licenses.

4. Environmental protection charge for granite exploited for use as wall-covering and flooring stones or for making fine-art products shall be paid at the charge rate specified at Point 1, Item II, Clause 2, Article 4 of Decree No. 74/2011/ND-CP For granite exploited for other purposes, the charge rate specified at Point 15, Item II, Clause 2, Article 4 of Decree No. 74/2011/ND-CP applies.

Granite exploiters shall declare and pay charges by themselves according to above regulations. Local tax offices shall coordinate with local natural resources and environment agencies in examining charge declaration and payment according to regulations.

5. Large stone blocks exploited for making fine-art products are subject to the charge rate specified at Point 2, Item II, Clause 2, Article 4 of Decree No. 74/2011/ND-CP.

6. Payment of environmental protection charge for mineral exploitation is not required for cases of exploiting minerals for used as common construction materials within the residential land area under the use right of a household or individual to serve the construction of such household's or individual's works therein; and exploiting earth for leveling grounds or building security and defense works.

7. The currency used for payment of environmental protection charge for mineral exploitation is Vietnam dong.

Article 2. Charge declaration and payment

1. Mineral exploiters shall submit environmental protection charge declaration dossiers to the tax offices at which they declare and pay royalties. In case no environmental protection charge for mineral exploitation arises in a month, charge payers shall still fill in and submit charge declaration forms to tax offices. In case mineral purchasers register to pay environmental protection charge on behalf of mineral exploiters, they shall submit charge declaration dossiers to their managing tax offices. The deadline for making a monthly charge declaration to a tax office is the 20th of the subsequent month. Charge payers shall fully and properly fill in declaration forms and take responsibility for the accuracy of their declaration.

2. Environmental protection charge for mineral exploitation shall be declared on a monthly basis and finalized on an annual basis. Finalization declaration includes annual finalization declaration and finalization declaration upon the termination of mineral exploitation, mineral purchase, business activities or enterprise ownership transformation contracts or the re-organization of enterprises.

3. A dossier of monthly declaration of environmental protection charge for mineral exploitation is declaration form No. 01/BVMT issued together with the Ministry of Finance's Circular No. 28/2011/TT-BTC of February 28, 2011. A dossier of declaration for monthly finalization of environmental protection charge for mineral exploitation is declaration form No. 02/BVMT issued together with the Ministry of Finance's Circular No. 28/2011/TT-BTC of February 28, 2011.

4. Charge payers subject to assessment of payable charge amounts shall comply with the Law on Tax Administration and its guiding documents.

5. Environmental protection charge for crude oil, natural gas and coal gas shall be declared and paid at provincial-level Tax Departments of the localities where charge payers are headquartered.

6. In addition to the above regulations, the declaration, payment and finalization of environmental protection charge for mineral exploitation comply with the Law on Tax Administration and its guiding documents.

Article 3. Full extraction of minerals

1. Those conducting full extraction of minerals shall pay environmental protection charge for these activities. The rates of environmental protection charge for full extraction comply with Article 4 of Decree No.74/2011/ND-CP.

2. Cases subject to the rates of environmental protection charge for full extraction:

a/ Extraction of minerals from dump sites of mines for which mine closure decisions have been issued;

b/ Production and business activities of organizations and individuals for purposes other than mineral exploitation according to their assigned functions and tasks or registered production or business lines (for example, obtaining sand in the process of dredging river beds or stones in the process of building hydropower plants or rifle ranges);

The rates of environmental protection charge for full extraction of minerals do not apply to cases other than those specified at Point a or b, Clause 2 of this Article.

3. The method of calculating environmental protection charge for full extraction of minerals complies with Article 1 of this Circular.

Article 4. Tasks and powers of tax offices

Tax offices have the following tasks and powers:

1. To guide and urge mineral exploiters to register, declare and pay charge according to regulations.

2. To examine and inspect charge declaration and payment and finalization of collected charge amounts. For charge payers who fail to comply or- improperly comply with regulations on accounting documents, invoices and books, to coordinate with local functional agencies in assessing the quantity of exploited minerals and determining the payable charge amounts according to regulations, based on the mineral exploitation operation of each charge payer.

3. To handle administrative violations in environmental protection charge for mineral exploitation according to their competence and law.

4. To keep and use data and documents supplied by mineral exploiters and other entities according to regulations.

5. To coordinate with local natural resources and environment agencies in organizing and managing the collection of environmental protection charge for mineral exploitation under Decree No. 74/2011/ND-CP and the Law on Tax Administration.

Article 5. Organization of implementation

1. This Circular takes effect on January 1, 2012, and replaces the Ministry of Finance's Circular No. 67/2008/TT-BTC of July 21,2008, guiding a number of provisions of the Government's Decree No. 63/2008/ND-CP of May 13,2008, and Circular No. 238/2009/TT-BTC of December 21, 2009, guiding the Government's Decree No. 82/2009/ND-CP of October 12,2009, amending and supplementing a number of articles of Decree No. 63/2008/ND-CP of May 13,2008.

2. Any problems arising in the implementation should be promptly reported to the Ministry of Finance for study and guidance.-

|

|

FOR

THE MINISTER OF FINANCE |