Decision No.1117/2004/QD-NHNN of September 8, 2004 on the issuance of the regulation on credit information activity đã được thay thế bởi Decision No. 51/2007/QD-NHNN of December 31, 2007, on the issuance of regulation on the credit information activity và được áp dụng kể từ ngày 01/07/2008.

Nội dung toàn văn Decision No.1117/2004/QD-NHNN of September 8, 2004 on the issuance of the regulation on credit information activity

|

THE

STATE BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 1117/2004/QD-NHNN |

Hanoi, September 08, 2004 |

DECISION

ON THE ISSUANCE OF THE REGULATION ON CREDIT INFORMATION ACTIVITY

THE GOVERNOR OF THE STATE BANK

- Pursuant to the Law on the

State Bank of Vietnam dated 12 December 1997 and the Law on the amendment,

supplement of several Articles of the Law on the State Bank of Vietnam dated 17

June 2003;

- Pursuant to the Law on Credit Institutions dated 12 December 1997 and the Law

on the amendment, supplement of several Articles of the Law on Credit

Institutions dated 15 June 2004;

- Pursuant to the Decree No. 52/2003/ND-CP dated 19 May 2003 of the Government

providing for the function, assignment, authority and organizational structure

of the State Bank of Vietnam;

- Upon the proposal of the Director of the Credit Information Center,

DECIDES:

Article 1. To issue in conjunction with this Decision the Regulation on the credit information activity.

Article 2. This Decision shall be effective from 1 January 2005 and replace the Decision No. 415/1999/QD-NHNN23 dated 18 November 1999 of the Governor of the State Bank on the issuance of the Regulation on the credit information activity in banking area.

Article 3. The Director of Administrative Department, Heads of units of the State Bank of Vietnam, the Director of the Credit Information Center, General Managers of the State Bank's branches in provinces, cities under the central Government’s management, the Chief Representative of the Office in Hochiminh city, Chairpersons of the Board of Directors and General Directors (Directors) of Credit Institutions, related organizations and individuals shall be responsible for the implementation of this Decision.

|

|

FOR

THE GOVERNOR OF THE STATE BANK |

REGULATION

ON THE CREDIT INFORMATION ACTIVITY

(issued in conjunction with the Decision No. 1117/2004/QD-NHNN dated 08

September 2004 of the Governor of the State Bank )

Chapter I.

GENERAL PROVISIONS

Article 1. Governing scope

This Regulation shall govern the credit information activity of the State Bank, credit institutions, other organizations in order to contribute to the prudence of banking activities, the managerial work of the State Bank and the prevention, containment of credit risks and the socio-economic development.

Article 2. Subjects of application

1. Units of the State Bank of Vietnam.

a. The Credit Information Center of the State Bank (hereinafter referred to as CIC).

b. Branches of the State Bank (hereinafter referred to as SBV’s branches).

c. Departments and units of the State Banks

2. Credit Institutions (hereinafter referred to as CIs), branches of CIs.

3. Other organizations, which and individuals, who have a demand for the use of credit information service.

Article 3. Interpretation

Terms stated in this Regulation shall be construed as follows:

1. Credit information is information of customers who have credit relation with Credit Institutions or other organizations engaging in banking activities, including: information of legal documentation, finance, outstanding credit, guarantee, loan security and the business performance of customers.

2. Credit information activity is the collection, processing, analysis, classification, forecast, exchange, provision, exploitation and use of credit information.

3. Credit information exchange is the transmission, sending of information of credit risk warnings between CIC, SBV’s branches and CIs, CIs’ branches

4. Credit information service is the provision of credit information products; the support to solutions for credit information administration and credit risk administration; support, consulting, transfer of technology on credit information administration software; consulting, support to the search of credit information.

5. Customers who have credit relation with credit institutions, other organizations engaging in banking activities:

a. Enterprise customer includes: the State owned enterprises, cooperatives, limited liability companies, joint-stock companies, private enterprises, partnership companies, foreign invested enterprises and other organizations, which fully satisfy conditions in accordance with provisions of Civil Code (except for CIs).

General corporations, holding companies, subsidiaries that maintain the independent accounting are considered as a customer.

b. Private customer includes: individuals, family households, and cooperative unions.

Article 4. Compulsory credit information report

Credit institutions shall be responsible for reporting to CIC following compulsory credit information:

1. Information of legal documentation of borrowing customers

a. For enterprise customers as provided for in item a, paragraph 5, Article 3, the report shall be made according to the pro- format K1A.

b. For private customers as provided for in item b, paragraph 5, Article 3, the report shall be made according to the pro- format K1B.

2. Information of financial capacity of borrowing customers

The information of financial capacity of borrowing customers shall be reported in accordance with current information norms that CIs have collected

In case where CIC requires any report, CIs, CIs’ branches shall timely, fully provide it with financial information from annual financial statements provided by borrowing customers (information content shall comply with pro-formats of enterprise’s financial statements stipulated by the Ministry of Finance).

3. Information of the outstanding credit of customers shall be reported according to the pro- format K3

4. Information of loan security assets of customers shall be reported according to the pro- format K4A and K4B

5. Information of the guarantee to customers shall be reported according to the pro- format K6.

6. Information of borrowing customers whose total outstanding loans are equal to or more than 5% of the own capital of the CI shall be reported according to the pro- format K8.

7. In case where CIC requires, CIs shall report the information of overdue debts according to the pro- format K9 and information of amounts that are paid in lieu of customers by the guaranteeing CI, since the guaranteed customers fail to fulfill their obligations upon the maturity date, according to the pro- format K7.

System of reporting pro-formats of compulsory credit information. which includes K1A, K1B, K3, K4A, K4B, K6, K7, K8, K9 is issued in conjunction with this Decision.

On the basis of these reporting pro-formats, the Director of CIC shall be responsible for converting them into electronic report files and providing the unified implementing guidance on the activity of credit information.

Article 5. Reporting mode

CIs shall be responsible for reporting the credit information to CIC in form of electronic files, units that are not able to do so shall submit written reports.

The reporting made in form of electronic files for above-mentioned reports shall have the same validity as written reports.

Chapter II.

RESPONSIBILITIES AND RIGHTS OF ORGANIZATIONS, INDIVIDUALS ENGAGING IN CREDIT INFORMATION ACTIVITY

Article 6. Departments, units of the State Bank

1. Departments, units of the State Bank shall be responsible for coordinating with CIC to deploy the credit information activity; providing CIC with credit information to set up an information data bank in accordance with applicable provisions.

2. Departments, units of the State Bank shall have the right to exploit, use credit information for the State management work.

3. The State Bank’s Inspectorate shall be responsible for organizing the examination of the compliance with this Regulation by credit institutions.

Article 7. The Credit Information Center

1. Responsibility

a. To act as a coordinator in guiding, speeding up the implementation of the credit information activity for subjects provided for in Article 2 according to its competence;

b. To provide guidance on the design of the technical, operational process, the system of key codes and common standards relating to the credit information activity of organizations engaging in the credit information activity

c. To collect, process the credit information and organize, build, manage the national credit information data bank;

d. To make report of the credit information to the State Bank.

e. To provide the credit information service (except for information, which is stipulated as the State confidential one) to credit institutions, other organizations and individuals as stipulated in Article 2.

f. To exchange the credit information with the SBV’s branches, CIs, and CIs’ branches

g. To assist organizations engaging in the credit information activity in the exploitation and use of information

h. To support the training of operational officials of organizations engaging in the credit information activity when required

i. To make monthly report to the SBV’s Governor of the result of the credit information activity.

2. Authority:

a. To request organizations engaging in the credit information activity to fully, accurately and timely provide the information as provided for in Article 4 of this Regulation.

b. To take the lead and cooperate with units of the State Bank, CIs in the implementation of the credit information activity.

c. To charge information fees in accordance with provisions of the Governor of the State Bank.

d. To be permitted to refuse to provide the credit information, credit information service to subjects that do not correctly comply with provisions of this Regulation.

Article 8. The State Bank’s branches in provinces and cities

1. Responsibility:

a. To make necessary personnel and organizational arrangements and create conditions to perform the credit information operation at the branch.

b. To cooperate with CIC in speeding up, examining the implementation of this Regulation by CIs, CIs’ branches in their respective location.

c. To exchange the credit information with the CIC.

2. Authority:

a. To exploit and use the credit information for the managerial work of the SBV in the locality.

b. To be entitled to request the support from the Credit Information Center for the training of officials involved in the credit information operation.

c. To be permitted to organize the provision of the credit information of the CIC to credit institutions and branches of credit institutions in the locality.

Article 9. Credit Institutions

1. Responsibility:

a. To design the program of credit information software; to direct, guide, deploy, speed up, examine the implementation of the credit information activity at their operation centers, branches and subsidiaries.

b. To collect, gather, control the credit information from their operation centers, branches, subsidiaries and fully, honestly, timely report to the CIC. The reporting contents and reporting mode of the credit information to the CIC shall be in accordance with provisions in Article 4 and Article 5 of this Regulation.

c. To study, apply and deploy operations of credit risk administration; to exploit, use credit information for the prevention and containment of risks in credit activity.

d. To design the technical, security process, customer codes and to comply with common standards relating to the credit information activity under the guidance of the Credit Information Center for the uniform and safe implementation.

e. The General Directors (Directors) of credit institutions shall be responsible for the sufficiency, honesty, and timeliness of the credit information, which are reported to the State Bank.

f. To exchange credit information with the CIC.

2. Authority:

a. To be entitled to exploit and use credit information;

b. To be entitled to request the CIC to verify the accuracy, timeliness of the credit information provided by the CIC.

c. To be supported by the CIC in training, guiding officials involved in the credit information operation.

Article 10. Other organizations and individuals

Other organizations and individuals provided for in paragraph 3, Article 2 that require the exploitation and use of the credit information shall submit their requirement for the exploitation and use of the credit information to the CIC, to voluntarily take part in the credit information activity in accordance with provisions stated in this Regulation and be entitled to exploit and use the credit information from the CIC.

Article 11. Provisions on the use of the credit information

Organizations, which, individuals, who are entitled to exploit and use the credit information shall comply with following provisions:

1. To use the information for the purpose of the management of the State Bank, for the prevention and containment of credit risks, for the facilitation of the production, business activity and socio-economic development, not to cause any damage to the interests of other organizations and individuals.

2. Not to change, use the credit information of CIC to reproduce to other organizations, individuals.

Article 12. Collection of credit information service fees

Organizations, individuals that use the credit information shall be liable to pay a credit information service fee in accordance with applicable provisions of the State Bank.

Chapter III

REWARD AND DEALING WITH VIOLATION

Article 13. Reward

Annually, the CIC shall report the Governor of the State Bank of the result of the credit information activity for his consideration of reward to organizations, individuals that make achievements in the credit information activity.

Article 14. Dealing with violation

Organizations, individuals that violate provisions in this Regulation shall, depending on the nature, seriousness of violation, be subject to administrative punishment in accordance with current provisions of the Government on the administrative punishment in monetary sector and banking activity.

Chapter IV

IMPLEMENTING PROVISIONS

Article 15. The Director of the Credit Information Center shall be responsible for stipulating code tables, electronic reporting files and providing guidance on the implementation of this Regulation.

Article 16. The amendment, supplement of this Regulation shall be decided upon by the Governor of the State Bank.

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

FORM K1A |

CUSTOMER FILE

(Applicable to enterprise customers)

1. Name of Customer: Code of customer:

- Transaction name:

- Abbreviated name:

2. Address of the Head-office: Head office Code:

Telephone Number: Fax number:

Website: Email:

3. Tax code:

4. Establishment decision number: Date of issue: Issuing agency:

5. The direct management agency:

6. Economic type of customer:

7. Economic sector:

8. Business Registration Certificate number: Date of issue:

9. Business line:

10. Name, Title of members of the Board of Directors, founding member

-

-

-

11. General Director (Director):

12. Total number of labors:

13. Charter Capital:........................................ million VND or............................. USD

|

|

|

…………,

date ………. |

Note:

- Subjects of application: CIs, Operation centers, branches of CIs,

units involved in credit activity subject to the management of CIs

- Reporting time: 3 working days from the date when customer makes the first

credit relation or in the event of changes in information at the latest.

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

FORM K1B |

CUSTOMER FILE

(Applicable to private customers)

1. Name of Customer: Code of customer:

Date of birth: Nationality:

2. Identity card number: Date of issue: Place of issue

3. Address

4. Telephone Number: Fax number:

5. Business Registration Certificate number: Date of issue:

6. Business line:

7. Full name of spouse

|

|

|

…………,

date ………. |

Note:

- Subjects of application: CIs, Operation centers, branches of CIs,

units involved in credit activity subject to the management of CIs

- Reporting time: 3 working days from the date when customer makes the first

credit relation or in the event of changes in information at the latest.

CREDIT INSTITUTION: (CI’S BRANCH)

.................................................................... Code:........................................................... |

FORM K3 |

REPORT OF CUSTOMER’S OUTSTANDING LOANS

(as of.............................)

Unit: VND 1 million, 1 USD

|

Order |

Customer name |

Customer code |

Classification symbols of outstanding loans |

Amount |

|

|

VND |

Foreign currency and gold converted into USD |

||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum |

|

|

|

|

|

|

|

…………,

date ………. |

Note:

- This form shall be commonly applicable to both enterprise customers

and private customers

- Reporting period: Once per 3 days

- Column (4): state the symbols of outstanding loans classification as provided

for in column (2) of the Appendix on the classification of outstanding loans

attached

- Column (5) and (6) shall state the amount corresponding to the balance of

accounts in column (4) and column (5) - charged accounts as provided for in the

appendix on the classification of outstanding loans attached

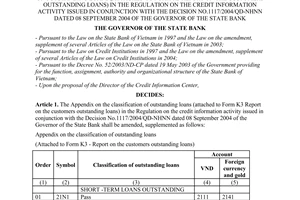

APPENDIX

ON THE CLASSIFICATION OF OUTSTANDING LOANS

(Attached to Form K3 - Report on the customer’s outstanding loans)

|

Order |

Symbol |

Classification of outstanding loans |

Charged accounts |

|

|

VND |

Foreign currency and gold |

|||

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

SHORT -TERM LENDING OUTSTANDING |

||||

|

01 |

21N1 |

Outstanding balance of current debts and debts rescheduled |

2111 |

2141 |

|

02 |

21N2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2112 |

2142 |

|

03 |

21N3 |

Outstanding balance of recoverable debts overdue from 181 days to 360 days |

2113 |

2143 |

|

04 |

21N8 |

Outstanding balance of debts difficult to collect |

2118 |

2148 |

|

MEDIUM -TERM LENDING OUTSTANDING |

||||

|

05 |

21T1 |

Outstanding balance of current debts and debts rescheduled |

2121 |

2151 |

|

06 |

21T2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2122 |

2152 |

|

07 |

21T3 |

Outstanding balance of recoverable debts overdue from 181 days to 360 days |

2123 |

2153 |

|

08 |

21T8 |

Outstanding balance of debts difficult to collect |

2128 |

2158 |

|

LONG -TERM LENDING OUTSTANDING |

||||

|

09 |

21D1 |

Outstanding balance of current debts and debts rescheduled |

2131 |

2151 |

|

10 |

21D2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2132 |

2152 |

|

11 |

21D3 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2133 |

2153 |

|

12 |

21D8 |

Outstanding balance of debts difficult to collect |

2138 |

2158 |

|

OUTSTANDING DEBTS FROM THE DISCOUNT OF COMMERCIAL PAPERS AND VALUABLE PAPERS |

||||

|

13 |

2201 |

Outstanding balance of current debts |

2211 |

2221 |

|

14 |

2208 |

Outstanding balance of overdue debts |

2218 |

2228 |

|

OUTSTANDING BALANCE DEBTS FROM FINANCE LEASING |

||||

|

15 |

2301 |

Outstanding balance of current debts and debts rescheduled |

2311 |

2321 |

|

16 |

2302 |

Outstanding balance of recoverable debts overdue up to 180 days |

2312 |

2322 |

|

17 |

2303 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2313 |

2323 |

|

18 |

2308 |

Outstanding balance of debts difficult to collect |

2318 |

2328 |

|

OUTSTANDING DEBTS FROM AMOUNTS PAID IN LIEU OF CUSTOMERS |

||||

|

19 |

2401 |

Outstanding balance of current debts and debts rescheduled |

2411 |

2421 |

|

20 |

2402 |

Outstanding balance of recoverable debts overdue up to 180 days |

2412 |

2422 |

|

21 |

2403 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2413 |

2423 |

|

22 |

2408 |

Outstanding balance of debts difficult to collect |

2418 |

2428 |

|

OUTSTANDING DEBTS FROM FUNDS DIRECTLY RECEIVED FROM INTERNATIONAL ORGANIZATIONS |

||||

|

23 |

25A1 |

Outstanding balance of current debts and debts rescheduled |

2511 |

25241 |

|

24 |

25A2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2512 |

2542 |

|

25 |

25A3 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2513 |

2543 |

|

26 |

25A8 |

Outstanding balance of debts difficult to collect |

2518 |

2548 |

|

OUTSTANDING DEBTS FROM FUNDS DIRECTLY RECEIVED FROM THE GOVERNMENT |

||||

|

27 |

25B1 |

Outstanding balance of current debts and debts rescheduled |

2521 |

2551 |

|

28 |

25B2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2522 |

2552 |

|

29 |

25B3 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2523 |

2553 |

|

30 |

25B8 |

Outstanding balance of debts difficult to collect |

2528 |

2558 |

|

OUTSTANDING DEBTS FROM FUNDS OF OTHER ORGANIZATIONS |

||||

|

31 |

25C1 |

Outstanding balance of current debts and debts rescheduled |

2531 |

2561 |

|

32 |

25C2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2532 |

2562 |

|

33 |

25C3 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2533 |

2563 |

|

34 |

25C8 |

Outstanding balance of debts difficult to collect |

2538 |

2568 |

|

OUTSTANDING BALANCE DEBTS FROM SPECIAL FUNDS SOURCE |

||||

|

35 |

27A1 |

Outstanding balance of current debts and debts rescheduled |

2711 |

|

|

36 |

27A2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2712 |

|

|

37 |

27A3 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2713 |

|

|

38 |

27A8 |

Outstanding balance of debts difficult to collect |

2718 |

|

|

OUTSTANDING LOANS FOR THE DEBT REPAYMENT |

||||

|

39 |

27B1 |

Outstanding balance of current debts and debts rescheduled |

2721 |

|

|

40 |

27B2 |

Outstanding balance of recoverable debts overdue up to 180 days |

2722 |

|

|

41 |

27B3 |

Outstanding balance of recoverable debts overdue from 180 days to 360 days |

2723 |

|

|

42 |

27B8 |

Outstanding balance of debts difficult to collect |

2728 |

|

|

43 |

2801 |

Outstanding balance of debts pending settlement secured by foreclosed assets |

281 |

|

|

44 |

2802 |

Outstanding balance of debts secured by the pledged assets which are caught in a suitcase pending litigation |

282 |

|

|

45 |

2803 |

Outstanding balance of unsettled debts with assets security |

283 |

|

|

46 |

2804 |

Outstanding balance of unsettled debts without assets security and without debtor for debts recovery |

284 |

|

|

47 |

2805 |

Outstanding balance of unsettled debts without assets security but the debtor still exists and is operating |

285 |

|

|

48 |

2901 |

Outstanding balance of short-term lending debts frozen |

291 |

|

|

49 |

2902 |

Outstanding balance of medium-term lending debts frozen |

292 |

|

|

50 |

2903 |

Outstanding balance of long-term lending debts frozen |

293 |

|

Note: Column (4) and column (5) state accounts charged under the accounts system of credit institutions issued by the Governor of the State Bank in conjunction with the Decision No. 479/2004/QD-NHNN dated 29 April 2004.

|

FORM K4A |

|

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

Registration time: After 3 working days from the arising of loan security assets at the latest |

REGISTRATION OF LOAN SECURITY ASSET

1. Customer name: Customer code:

- Address:

- Related documents No.: Issuing agency: Date of issue

- Tel No.: Fax No.

- Use following assets as the security for the loan stated in the credit contract No. …………. dated ………….. with the credit limit of ………….

2. Types of loan security asset

|

o Land use right o Asset tied to land o Land use right and asset tied to land |

o means of mechanic transport o assets with the ownership, other use right registration o Other assets |

3. Description of loan security assets

3.1. Land use right

3.1.1. Name of the owner of the land use right

3.1.2. Land location

3.1.3. Land area m2 (in words m2)

3.1.4.Land plot number: map Type of land

3.1.5. Certificate of the land use right No. issuing agency date of issue

3.2. Asset tied to land

3.2.1. Type of asset (dwelling - house/residence, construction site, perennial orchard, forest, etc)

3.2.2. Description of asset (address, area, number of the certificate of the ownership, issuing agency, date of issue, etc)

3.3. Means of mechanic transport

3.3.1 Name of the vehicle owner

3.3.2. Name of the vehicle: Brand:

3.3.3. Quality of vehicle: o 100% new o already used: %

3.3.4. Identity of vehicle (number plate, body number, motor number, etc)

3.4. Assets with the ownership, other use right registration

3.4.1. Name of the asset owner:

3.4.2. Name of asset:

3.4.3. Number of ownership, use right registration issuing agency: date of issue:

3.5. Other assets (clearly state the name of asset owner, name of asset, quality, quantity, brand and type of asset, etc).

4. Mode of result receipt of the registration with the CIC

|

o Direct receipt |

o via post |

o on website of CIC |

|

|

|

…………,

date ……….

|

FOR THE REGISTRATION CONFIRMATION OF CIC

Registration code:............................................ Registration time: …….. hour…….. minute

Name of settler.....................................................................................................................

|

FORM K4B |

|

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

Time for registration cancellation: After 3 working days at the latest from the arising of requirement for the cancellation of loan security asset |

REQUEST FOR THE CANCELLATION OF LOAN SECURITY ASSET REGISTRATION

1. Customer name:....................................................... Customer code:................................

2. Address:...........................................................................................................................

3. Number of related document/certificate:........... Issuing agency:............ Date of issue.........

4. Tel No.:.................................................................... Fax No.............................................

5. Name of asset owner:........................................................................................................

6. This asset has been registered with the CIC with No.:...........................................................

Registration time:................................. hour................. minute, day…… month……. year.......

7. Reasons for the registration cancellation

............................................................................................................................................

............................................................................................................................................

............................................................................................................................................

............................................................................................................................................

............................................................................................................................................

8. Time when the loan security asset ceases its effectiveness: day…… month……. year...........

9. Mode of result receipt of the request for the registration cancellation with the CIC

|

o Direct receipt |

o via post |

o on website of CIC |

|

|

|

…………,

date ……….

|

FOR THE REGISTRATION CONFIRMATION OF CIC

Registration code:............................................ Registration time: …….. hour…….. minute......

Name of settler.....................................................................................................................

|

FORM K6 |

|

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

Time for report sending: Report on the guarantee data till the end of the month shall be sent till the 10th of the following month at the latest |

REPORT ON THE GUARANTEE FOR FUNDS BORROWING OF

ENTERPRISES

(as of day………. month……….. year)

Unit: 1 million VND, 1 USD

|

Order |

Name of enterprise |

Customer code |

Address of Head office |

Business Registration No. |

Date of guarantee arising |

Maturity date of guarantee |

Amount |

|

|

VND |

Foreign currency converted under USD |

|||||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

|

|

I. Domestic enterprises |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. Foreign enterprises |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum |

|

|

|

|

|

|

|

|

|

|

…………,

date ………. |

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

FORM K7 |

AMOUNTS PAYABLE IN LIEU OF CUSTOMER WHEN VIOLATING

GUARANTEE

(Data to the date ………………. )

Unit: 1 million VND, 1 USD

|

Order |

Customer name |

Customer code |

Outstanding debt |

Date of debt arising |

Reason |

|

|

VND |

USDS |

|||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

…………,

date ………. |

Note:

- Subjects of application: CIs, Operation centers, CIs’ branches, units

involved in credit activity subject to the management of CIs.

- Other foreign currencies shall be converted into USD under the cross rate at

the reporting time

- Time for report sending: upon the request of CIC

FORM K8

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

Reporting time: Periodically once per 5 working days |

CUSTOMERS WITH LARGE OUTSTANDING LOANS

(Total outstanding loans equal to or larger than 5% of CI’s own capital)

(As of ……………………)

Unit: VND 1 millions

|

Order |

Customer name |

Address of Head office |

Total outstanding loans (converting foreign currency and gold into VND) |

The latest date of in outstanding loans change |

Note |

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum |

|

|

|

|

|

|

|

…………,

date ………. |

Note: For co-financing loans, CI shall only report the amount in which the CI took part, not report the amount of other CIs. The note column shall clearly state loans designated by the Government, entrusted for investment, etc.

|

CREDIT INSTITUTION: (CI’S BRANCH) .................................................................... Code:........................................................... |

FORM K9 |

CUSTOMERS WITH OVERDUE DEBTS

(As of …………….)

Unit: 1million VND, 1 USD

|

Order |

Customer name |

Customer code |

Amount of overdue debt |

Date of overdue debt arising |

Note |

|

|

VND |

USD |

|||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

…………,

date ………. |

Note:

- Subjects of application: CIs, Operation centers, CIs’ branches, units

involved in credit activity subject to the management of CIs.

- Other foreign currencies shall be converted into USD under the cross rate at

the reporting time

- Time for report sending: upon the request of CIC.