Decision No. 51/2007/QD-NHNN of December 31, 2007, on the issuance of regulation on the credit information activity đã được thay thế bởi Circular No. 03/2013/TT-NHNN providing on credit information activity và được áp dụng kể từ ngày 01/07/2013.

Nội dung toàn văn Decision No. 51/2007/QD-NHNN of December 31, 2007, on the issuance of regulation on the credit information activity

|

THE

STATE BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 51/2007/QD-NHNN |

Hanoi, December 31, 2007 |

DECISION

ON THE ISSUANCE OF REGULATION ON THE CREDIT INFORMATION ACTIVITY

THE GOVERNOR OF THE STATE BANK

- Pursuant to the Law on the

State Bank of Vietnam issued in 1997 and the Law on the amendment, supplement

of several articles of the Law on the State Bank of Vietnam issued in 2003;

- Pursuant to the Law on Credit Institutions issued in 1997 and the Law on the

amendment, supplement of several articles of the Law on Credit Institutions

issued in 2004;

- Pursuant to the Decree No. 52/2003/ND-CP dated 19/5/2003 of the Government

providing for the function, assignment, authority and organizational structure

of the State Bank of Vietnam;

- Upon the proposal of Director of Credit Information Center,

DECIDES:

Article 1. To issue in conjunction with this Decision the Regulation on the credit information activity.

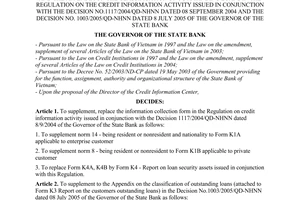

Article 2. This Decision shall be effective from 1 July 2008 and replace the following Decisions:

- Decision No. 1117/2004/QD-NHNN dated 8 September 2004 of the Governor of the State Bank on the issuance of Regulation on the credit information activity;

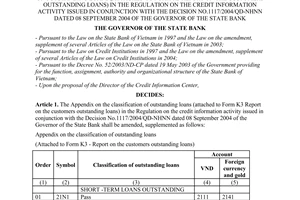

- Decision No. 1003/2005/QD-NHNN dated 8 July 2005 of the Governor of the State Bank on the adjustment, supplement of the Appendix on the classification of outstanding loans (attached to Form K3 - Report on the customers outstanding loans) in the Regulation on the credit information activity issued in conjunction with the Decision No. 1117/2004/QD-NHNN dated 8 September 2004 of the Governor of the State Bank;

- Decision No. 50/2006/QD-NHNN dated 2 October 2006 of the Governor of the State Bank on the supplement, replacement of the Form on information collection and Appendix on the classification of outstanding loans in the Regulation on the credit information activity issued in conjunction with the Decision No. 1117/2004/QD-NHNN dated 8 September 2004 and the Decision No. 1003/2005/QD-NHNN dated 8 July 2005 of the Governor of the State Bank;

- Decision No. 987/2001/QD-NHNN dated 2 August 2001 of the Governor of the State Bank on the issuance of the Regulation on the management, supply and exploitation, use of electronic credit information.

Article 3. The Director of Administrative Department, Heads of units of the State Bank of Vietnam, the Director of the Credit Information Center, General Managers of the State Bank's branches in provinces, cities under the central Governments management, the Chief Representative of the State Bank in Hochiminh city, Chairmen of the Board of Directors and General Directors (Directors) of Credit Institutions, other organizations engaging in banking activity, related organizations and individuals shall be responsible for the implementation of this Decision.

|

|

FOR

THE GOVERNOR OF THE STATE BANK OF VIETNAM |

REGULATION

ON THE CREDIT INFORMATION ACTIVITY

(issued in conjunction with the Decision No. 51/2007/QD-NHNN dated 31

December 2007 of the Governor of the State Bank )

Chapter I

GENERAL PROVISIONS

Article 1. Governing scope

This Regulation shall govern the credit information activity of the State Bank, credit institutions, other organizations engaging in banking activity, organizations and individuals using credit information service, in order to serve the management activity of the State Bank, prevent, limit credit risks making contribution to ensuring the security of banking activity and the socio-economic development.

Article 2. Subjects of application

1. Units of the State Bank of Vietnam.

a) The Credit Information Center.

b) Departments and units of the State Bank.

c) The State Bank's branches in provinces, cities under the central Governments management.

2. Credit Institutions, other organizations engaging in banking activity.

3. Other organizations, which and individuals, who use the credit information service.

Article 3. Interpretation

Terms stated in this Regulation shall be construed as follows:

1. Credit information is information of customer who has credit relation with a Credit Institution or another organization engaging in banking activity and other information relating to customer in the credit relation with the Credit Institution or another organization engaging in banking activity.

2. Credit information activity is the collection, processing, keeping and provision, exploitation and use of credit information.

3. Credit information product is periodical, unexpected credit information reports, publications made by the Credit Information Center on the basis of analyzing, synthesizing, assessing information of customers who have credit relation with Credit Institutions or other organizations engaging in banking activity.

4. Credit information service is the provision of credit information products; giving support to solutions of credit information administration and credit risk administration; giving support, providing advice, transfer of technology on credit information administration software; providing advice and giving support to the search of credit information.

5. Customers who have credit relation with credit institutions, other organizations engaging in banking activity including:

a) Customer being organizations: the State owned enterprises, cooperatives, limited liability companies, joint-stock companies, private enterprises, partnership companies, foreign invested enterprises and other organizations (except for subjects stipulated in point 2, Article 2 of this Regulation).

Groups, corporations, holding companies and subsidiaries that perform the independent accounting are considered as a customer.

b) Customer being individuals, family households, and cooperative groups.

c) Customer being credit card holder (individuals or organizations whose credit cards are supplied by credit institutions, other organization engaging in banking activity) including main cardholder and secondary cardholder.

Article 4. Report on norms of credit information

1. Credit institutions, other organizations engaging in banking activity shall have to make report on norms of credit information to the Credit Information Center The State Bank of Vietnam according to the Appendix on reporting norms System of credit information attached to this Regulation.

2. Content, time of report

2.1 Information of legal documents of customers who have credit relation with Credit Institutions, other organizations engaging in banking activity, shall be reported within 3 working days at the latest since the appearance of the first credit relation or variation, change in information of legal document. Specially as follows:

a) For customers being organizations: including general information norms of borrowers (who have ordinal number from 01 to 18) and particular information for customers being organizations;

b) For customers being individuals, family households, cooperative groups: including general information norms of borrowers (who have ordinal number from 01 to 18) and particular information for customers being individuals, family households, cooperative groups (that have ordinal number of 26 and from 34 to 39);

c) For customers being credit cardholders: including general information norms of borrowers (who have ordinal number from 01 to 18) and particular information for customers being credit cardholders, including information of loan security asset, credit limit of credit card (who have ordinal number from 34 to 47 and from 233 to 236, 246, 247, 267, 296);

2.2. Information of financial capacity of customers being organization includes: balance sheet, profit/loss statement and cash flow statement (if any) in accordance with the sample form stipulated by the Ministry of Finance. The deadline for the sending of above reports to the Information Center is after 03 working days at the latest since the first credit relation of customer or on April 15th of the following year of the reporting year at the latest for customers having credit relation.

2.3. Information of outstanding loans of customers (to report in case of any change in outstanding loans), shall be periodically reported each 3 working days and at the last working day of each month, including such norms as customer ID, customer name, information of outstanding loan of customers (who have ordinal number of 01, 02, from 48 to 232), and details of each loan that is classified in accordance with provisions. Customers being individuals, family households, cooperative groups (that have ordinal number from 290 to 295) shall make report on further information of consumer loan;

2.4. Information of loan security of customers shall be reported within 3 working days at the latest since the appearance of the first borrowing relation of customers or the change of information.

a) In case of loans pledged by trust, to report such norms as customer ID, customer names address of customers and information of loan security (with the ordinal number of 01, 02, 06 and from 233 to 237).

b) In case of loans with security asset, to report such norms as customer ID, customers names, customer addresses and information of loan security (with ordinal number of 01, 02, 06 and from 238 to 239). Borrowers using security asset of the third party shall make report on further norms of holder of assets (ordinal number of 270) including name, address, peoples identity card or passport of the holder (having ordinal number of 02, 06 and from 35 to 38);

2.5. Information of the guarantee to customers shall be reported on the 10th, at the latest, of the following month for the information at the end of last month (in case of any change), including such norms as customer ID, customer names, customer addresses and information of guarantee to customers (having ordinal number of 01, 02, 06 and from 271 to 289);

2.6. Information of outstanding of credit card (to report in case of any change) shall be reported monthly, on the last working day of each month, including such norms as customer ID, customer names and information of outstanding of credit card (having ordinal number of 01, 02 and from 48 to 59) ;

2.7. Information of customer whose total outstanding loans are equal to or more than 15% of the own capital of the credit institution, other organization engaging in banking activity, shall be reported periodically each 5 working days and on the last working day of each month, including such norms as customer ID, customer name, customer addresses and information of customer whose total outstanding loans are equal to or more than 15% of the own capital of the credit institution, other organization engaging in banking activity (having ordinal number of 01, 02, 06 and from 299 to 307);

2.8. Information of breach of provisions on credit card shall be reported monthly, on the last working day of each month, including such norms as customer ID, customer name and information of credit card (having ordinal number of 01, 02, 297 and 298);

3. The mode of reporting is performed in the form of electronic file in accordance with detailed guidance of the Credit Information Center. Except for information of financial capacity of customer, it shall be reported in written form.

Article 5. Processing, keeping and provision, exploitation and use of information

1. The processing of credit information shall be made at the Credit Information Center through the examination, selection, ensuring the reliability of input information and analyses, synthesis of information, including analyses for enterprise credit ratings, credit scoring to consumer individual in order to establish credit information product.

2. Keeping of credit information

a) Credit information shall be kept, managed safely, confidentially and conveniently for the exploitation and use at the Credit Information Center and standby unit.

b) Duration for the keeping of credit information of one customer is 5 years since the last supplement, update of credit information.

3. Credit Information Center shall provide credit information products and shall be entitled to collect service fee in accordance with provisions of the Governor of the State Bank.

4. Exploitation and use of credit information

4.1. Credit Information Center shall facilitate the exploitation and use of credit information product.

4.2. Organizations which and individuals who exploit and use credit information product shall be obliged to respect the following provisions:

a) To use credit information product in accordance with the purposes stipulated in Article 1 of this Regulation.

b) Not to use credit information product of the Credit Information Center for providing to other organizations, individuals.

Chapter II

RESPONSIBILITIES AND AUTHORITIES OF ORGANIZATIONS, INDIVIDUALS ENGAGING IN CREDIT INFORMATION ACTIVITY

Article 6. Credit Information Center

1. Responsibilities

a) To act as a coordinator in managing, guiding, speeding up the implementation of the credit information activity according to its competence;

b) To establish and provide guidance on codes system, information norms, electronic file forms and common standards relating to the credit information activity of organizations, individuals engaging in the credit information activity.

c) To collect, process the credit information and organize, build, manage the national credit information data bank;

d) To provide Board of Management of the State Bank and units of the State Bank with credit information in accordance with applicable provisions.

e) To provide subjects stipulated in paragraph 2 and 3, Article 2 of this Regulation with credit information services.

g) To support the training of credit information officers of organizations engaging in the credit information activity when required.

2. Authorities

a) To request organizations engaging in the credit information activity to fully, accurately and timely provide the reporting norms of credit information as provided for in Article 4 of this Regulation.

b) To take the lead and cooperate with units of the State Bank, credit institutions, other organizations engaging in banking activity in the implementation of the credit information activity.

c) To examine the reporting and quality of credit information of credit institutions, other organizations engaging in banking activity in accordance with provisions of this Regulation.

d) To be permitted to refuse to provide the credit information services to subjects that do not correctly comply with provisions of this Regulation.

Article 7. Departments, units of the State Bank

1. To be responsible for coordinating with, providing the Credit Information Center with related information within their management scope in order to deploy the implementation of activity and build up a national credit information data bank in accordance with applicable provisions.

2. To be entitled to exploit, use credit information product for the State management work.

3. The State Banks Inspectorate shall be responsible for organizing the inspection of the compliance with this Regulation by credit institutions, other organizations engaging in banking activity.

Article 8. State Bank's branches in provinces, cities under the central Governments management

1. Responsibilities

a) To arrange organization, personnel and related conditions for the implementation of credit information operation in their units.

b) To speed up, examine the implementation of this Regulation by local credit institutions, branches of credit institutions, other organizations engaging in banking activity.

2. Authorities

a) To be permitted to exploit, use credit information products for the management work of the State Bank in the locality.

b) To be permitted to organize the exploitation and provision of the credit information products in accordance with guidance of the Credit Information Center to credit institution, branches of credit institutions, other organizations engaging in banking activity in the locality.

c) To be entitled to receive the support from the Credit Information Center for the training of officers involved in credit information operation.

Article 9. Credit Institutions, other organizations engaging in banking activity

1. Responsibilities

a) To be responsible for the sufficiency, honesty, accuracy and timeliness of credit information norms reported to the Credit Information Center.

b) To design the technical, security process, customer ID and to comply with common standards relating to the credit information activity under the guidance of the Credit Information Center for the unified safe implementation.

c) To exploit and use credit information products in order to prevent, limit risks, improve credit quality.

2. Authorities

a) To be entitled to exploit and use credit information;

b) To be entitled to request the Credit Information Center to verify the accuracy, timeliness of the credit information provided by the Credit Information Center.

c) To be supported by the Credit Information Center in training, guiding officers involved in the credit information operation.

Article 10. Other organizations which and individuals who use credit information

Other organizations and individuals that have a demand for the exploitation and use of the credit information product shall submit their requirement for the exploitation and use of the credit information to the Credit Information Center and comply with provisions on the use of credit information as provided for in this Regulation.

Chapter III

REWARD AND DEALING WITH VIOLATION

Article 11. Reward

Annually, the Credit Information Center shall make report to the Governor of the State Bank on the result of the credit information activity for his consideration of reward to organizations, individuals that make achievements in the credit information activity.

Article 12. Dealing with violation

Organizations, individuals that violate provisions in this Regulation shall be, depending on the nature, seriousness of violation, subject to administrative punishment in accordance with current provisions.

Chapter VII

IMPLEMENTING PROVISIONS

Article 15. The Director of the Credit Information Center shall be responsible for providing guidance on the implementation of this Regulation.

APPENDIX

ON REPORT INDICES OF CREDIT INFORMATION

Applied to the Credit Information Center and credit institutions, other

organizations engaging in banking activity

|

Ordinal number |

Norm code |

Norm name |

Note |

|

I. INFORMATION OF LEGAL DOCUMENT OF CUSTOMERS |

|||

|

1. General information of borrowers |

|||

|

01 |

K101 |

Customer ID |

|

|

02 |

K102 |

Customer name |

|

|

03 |

K103 |

Trading name |

|

|

04 |

K104 |

Abbreviated name |

|

|

05 |

K105 |

Contact/Transaction information |

|

|

06 |

K1051 |

Address of head office |

|

|

07 |

K1052 |

Code of head office |

As provided for in Decision No. 23/2007/QD-NHNN |

|

08 |

K1053 |

Telephone number |

|

|

09 |

K1054 |

Fax number |

|

|

10 |

K1055 |

Website address |

|

|

11 |

K1056 |

Email address |

|

|

12 |

K106 |

Nationality and residence |

|

|

13 |

K1061 |

Nationality |

|

|

14 |

K1062 |

Residence |

|

|

15 |

K107 |

Tax code |

|

|

16 |

K108 |

Business registration certificate |

|

|

17 |

K1081 |

Number of business registration certificate |

|

|

18 |

K1082 |

Date of issue |

|

|

2. Particular information for customers being organizations |

|||

|

19 |

K130 |

Decision on establishment |

State-owned enterprise |

|

20 |

K1301 |

Number of decision on establishment |

|

|

21 |

K1302 |

Issue date of decision on establishment |

|

|

22 |

K1303 |

Agency issuing the decision on establishment |

|

|

23 |

K131 |

Direct management agency |

|

|

24 |

K132 |

Economic type |

|

|

25 |

K133 |

Economic sector |

|

|

26 |

K134 |

Business line |

Stating according to business registration certificate |

|

27 |

K135 |

Name, title of Boar of Directors members |

|

|

28 |

K136 |

General Director (Director) |

|

|

29 |

K137 |

Total number of existing employees |

|

|

30 |

K138 |

Chapter capital |

|

|

31 |

K1381 |

VND |

|

|

32 |

K1382 |

Foreign currency converted into USD |

|

|

33 |

K139 |

Branches, subsidiaries, affiliates |

|

|

3. Particular information for customers being individuals, family households, cooperative groups and credit cardholders |

|||

|

34 |

K160 |

Date of birth |

|

|

35 |

K161 |

Identity card/Passport |

|

|

36 |

K1611 |

Number of identity card/Passport |

|

|

37 |

K1612 |

Date of issue |

|

|

38 |

K1613 |

Place of issue |

|

|

39 |

K162 |

Name of wife or husband |

|

|

40 |

K163 |

Remaining duration in Vietnam |

For card holder being foreigner (month) |

|

41 |

K164 |

Credit card |

|

|

42 |

K1641 |

Card type |

|

|

43 |

K1642 |

Issuing date of card |

|

|

44 |

K1643 |

Expiry date of card |

|

|

45 |

K1644 |

Secondary card |

|

|

46 |

K16441 |

Full name of card holder |

|

|

47 |

K16442 |

Relationship with main cardholder |

|

|

II. INFORMATION OF OUTSTANDING LOANS OF CUSTOMERS |

|||

|

48 |

K3 |

Outstanding loans of customer |

|

|

49 |

K301 |

Outstanding short term loans |

|

|

50 |

K30101 |

Outstanding short term loans in VND standard |

|

|

51 |

K30102 |

Outstanding short term loans in foreign currency standard |

|

|

52 |

K30103 |

Outstanding short term loans in VND that need special mention |

|

|

53 |

K30104 |

Outstanding short term loans in foreign currency that need special mention |

|

|

54 |

K30105 |

Outstanding short term loans in VND - substandard |

|

|

55 |

K30106 |

Outstanding short term loans in foreign currency - substandard |

|

|

56 |

K30107 |

Outstanding short term loans in VND doubtful |

|

|

57 |

K30108 |

Outstanding short term loans in foreign currency doubtful |

|

|

58 |

K30109 |

Outstanding short term loans in VND potentially irrecoverable |

|

|

59 |

K30110 |

Outstanding short term loans in foreign currency potentially irrecoverable |

|

|

60 |

K302 |

Outstanding medium term loans |

|

|

61 |

K30201 |

Outstanding medium term loans in VND standard |

|

|

62 |

K30202 |

Outstanding medium term loans in foreign currency standard |

|

|

63 |

K30203 |

Outstanding medium term loans in VND that need special mention |

|

|

64 |

K30204 |

Outstanding medium term loans in foreign currency that need special mention |

|

|

65 |

K30205 |

Outstanding medium term loans in VND - substandard |

|

|

66 |

K30206 |

Outstanding medium term loans in foreign currency - substandard |

|

|

67 |

K30207 |

Outstanding medium term loans in VND doubtful |

|

|

68 |

K30208 |

Outstanding medium term loans in foreign currency doubtful |

|

|

39 |

K30209 |

Outstanding medium term loans in VND potentially irrecoverable |

|

|

70 |

K30210 |

Outstanding medium term loans in foreign currency potentially irrecoverable |

|

|

71 |

K303 |

Outstanding long term loans |

|

|

72 |

K30301 |

Outstanding long term loans in VND standard |

|

|

73 |

K30302 |

Outstanding long term loans in foreign currency standard |

|

|

74 |

K30303 |

Outstanding long term loans in VND that need special mention |

|

|

75 |

K30304 |

Outstanding long term loans in foreign currency that need special mention |

|

|

76 |

K30305 |

Outstanding long term loans in VND - substandard |

|

|

77 |

K30306 |

Outstanding long term loans in foreign currency - substandard |

|

|

78 |

K30307 |

Outstanding long term loans in VND doubtful |

|

|

79 |

K30308 |

Outstanding long term loans in foreign currency doubtful |

|

|

80 |

K30309 |

Outstanding long term loans in VND potentially irrecoverable |

|

|

81 |

K30310 |

Outstanding long term loans in foreign currency potentially irrecoverable |

|

|

82 |

K304 |

Outstanding debts from the discount of commercial papers and valuable papers |

|

|

83 |

K30401 |

Outstanding debts from the discount of commercial papers and valuable papers in VND standard |

|

|

84 |

K30402 |

Outstanding debts from the discount of commercial papers and valuable papers in foreign currency standard |

|

|

85 |

K30403 |

Outstanding debts from the discount of commercial papers and valuable papers in VND that need special mention |

|

|

86 |

K30404 |

Outstanding debts from the discount of commercial papers and valuable papers in foreign currency that need special mention |

|

|

87 |

K30405 |

Outstanding debts from the discount of commercial papers and valuable papers in VND - substandard |

|

|

88 |

K30406 |

Outstanding debts from the discount of commercial papers and valuable papers in foreign currency - substandard |

|

|

89 |

K30407 |

Outstanding debts from the discount of commercial papers and valuable papers in VND - doubtful |

|

|

90 |

K30408 |

Outstanding debts from the discount of commercial papers and valuable papers in foreign currency - doubtful |

|

|

91 |

K30409 |

Outstanding debts from the discount of commercial papers and valuable papers in VND potentially irrecoverable |

|

|

92 |

K30410 |

Outstanding debts from the discount of commercial papers and valuable papers in foreign currency potentially irrecoverable |

|

|

93 |

K305 |

Outstanding debts from finance leasing |

|

|

94 |

K30501 |

Outstanding debts from finance leasing in VND standard |

|

|

95 |

K30502 |

Outstanding debts from finance leasing in foreign currency standard |

|

|

96 |

K30503 |

Outstanding debts from finance leasing in VND that need special mention |

|

|

97 |

K30504 |

Outstanding debts from finance leasing in foreign currency that need special mention |

|

|

98 |

K30505 |

Outstanding debts from finance leasing in VND - substandard |

|

|

99 |

K30506 |

Outstanding debts from finance leasing in foreign currency - substandard |

|

|

100 |

K30507 |

Outstanding debts from finance leasing in VND - doubtful |

|

|

101 |

K30508 |

Outstanding debts from finance leasing in foreign currency doubtful |

|

|

102 |

K30509 |

Outstanding debts from finance leasing in VND potentially irrecoverable |

|

|

103 |

K30510 |

Outstanding debts from finance leasing in foreign currency potentially irrecoverable |

|

|

104 |

K306 |

Outstanding debts from payables in lieu of customers |

|

|

105 |

K30603 |

Outstanding debts from payables in lieu of customers in VND that need special mention |

|

|

106 |

K30604 |

Outstanding debts from payables in lieu of customers in foreign currency that special mention |

|

|

107 |

K30605 |

Outstanding debts from payables in lieu of customers in VND substandard |

|

|

108 |

K30606 |

Outstanding debts from payables in lieu of customers in foreign currency substandard |

|

|

109 |

K30607 |

Outstanding debts from payables in lieu of customers in VND doubtful |

|

|

110 |

K30608 |

Outstanding debts from payables in lieu of customers in foreign currency doubtful |

|

|

111 |

K30609 |

Outstanding debts from payables in lieu of customers in VND potentially irrecoverable |

|

|

112 |

K30610 |

Outstanding debts from payables in lieu of customers in foreign currency potentially irrecoverable |

|

|

113 |

K307 |

Outstanding loans for funds directly received from international organizations |

|

|

114 |

K30701 |

Outstanding loans for funds directly received from international organizations in VND standard |

|

|

115 |

K30702 |

Outstanding loans for funds directly received from international organizations in foreign currency standard |

|

|

116 |

K30703 |

Outstanding loans for funds directly received from international organizations in VND that need special mention |

|

|

117 |

K30704 |

Outstanding loans for funds directly received from international organizations in foreign currency that need special mention |

|

|

118 |

K30705 |

Outstanding loans for funds directly received from international organizations in VND substandard |

|

|

119 |

K30706 |

Outstanding loans for funds directly received from international organizations in foreign currency substandard |

|

|

120 |

K30707 |

Outstanding loans for funds directly received from international organizations in VND doubtful |

|

|

121 |

K30708 |

Outstanding loans for funds directly received from international organizations in foreign currency doubtful |

|

|

122 |

K30709 |

Outstanding loans for funds directly received from international organizations in VND potentially irrecoverable |

|

|

123 |

K30710 |

Outstanding loans for funds directly received from international organizations in foreign currency potentially irrecoverable |

|

|

124 |

K308 |

Outstanding loans for funds received from the Government |

|

|

125 |

K30801 |

Outstanding loans for funds directly received from the Government in VND Standard |

|

|

126 |

K30802 |

Outstanding loans for funds received from the Government in foreign currency standard |

|

|

127 |

K30803 |

Outstanding loans for funds directly received from the Government in VND that need special mention |

|

|

128 |

K30804 |

Outstanding loans for funds directly received from the Government in foreign currency that need special mention |

|

|

129 |

K30805 |

Outstanding loans for funds directly received from the Government in VND substandard |

|

|

130 |

K30806 |

Outstanding loans for funds directly received from the Government in foreign currency substandard |

|

|

131 |

K30807 |

Outstanding loans for funds directly received from the Government in VND doubtful |

|

|

132 |

K30808 |

Outstanding loans for funds directly received from the Government in foreign currency doubtful |

|

|

133 |

K30809 |

Outstanding loans for funds directly received from the Government in VND potentially irrecoverable |

|

|

134 |

K30810 |

Outstanding loans for funds directly received from the Government in foreign currency potentially irrecoverable |

|

|

135 |

K309 |

Outstanding loans for funds received from other organizations, individuals |

|

|

136 |

K30901 |

Outstanding loans for funds received from other organizations, individuals in VND standard |

|

|

137 |

K30902 |

Outstanding loans for funds received from other organizations, individuals in foreign currency standard |

|

|

138 |

K30903 |

Outstanding loans for funds received from other organizations, individuals in VND that need special mention |

|

|

139 |

K30904 |

Outstanding loans for funds received from other organizations, individuals in foreign currency that need special mention |

|

|

140 |

K30905 |

Outstanding loans for funds received from other organizations, individuals in VND substandard |

|

|

141 |

K30906 |

Outstanding loans for funds received from other organizations, individuals in foreign currency substandard |

|

|

142 |

K30907 |

Outstanding loans for funds received from other organizations, individuals in VND doubtful |

|

|

143 |

K30908 |

Outstanding loans for funds received from other organizations, individuals in foreign currency doubtful |

|

|

144 |

K30909 |

Outstanding loans for funds received from other organizations, individuals in VND potentially irrecoverable |

|

|

145 |

K30910 |

Outstanding loans for funds received from other organizations, individuals in foreign currency potentially irrecoverable |

|

|

146 |

K310 |

Outstanding loans for special purpose |

|

|

147 |

K31001 |

Outstanding loans for special purpose in VND standard |

|

|

148 |

K31002 |

Outstanding loans for special purpose in foreign currency standard |

|

|

149 |

K31003 |

Outstanding loans for special purpose in VND that need special mention |

|

|

150 |

K31004 |

Outstanding loans for special purpose in foreign currency that need special mention |

|

|

151 |

K31005 |

Outstanding loans for special purpose in VND substandard |

|

|

152 |

K31006 |

Outstanding loans for special purpose in foreign currency substandard |

|

|

153 |

K31007 |

Outstanding loans for special purpose in VND doubtful |

|

|

154 |

K31008 |

Outstanding loans for special purpose in foreign currency doubtful |

|

|

155 |

K31009 |

Outstanding loans for special purpose in VND potentially irrecoverable |

|

|

156 |

K31010 |

Outstanding loans for special purpose in foreign currency potentially irrecoverable |

|

|

157 |

K311 |

Outstanding loans for debt repayment |

|

|

158 |

K31101 |

Outstanding loans for debt repayment in VND standard |

|

|

159 |

K31102 |

Outstanding loans for debt repayment in foreign currency standard |

|

|

160 |

K31103 |

Outstanding loans for debt repayment in VND that need special mention |

|

|

161 |

K31104 |

Outstanding loans for debt repayment in foreign currency that need special mention |

|

|

162 |

K31105 |

Outstanding loans for debt repayment in VND substandard |

|

|

163 |

K31106 |

Outstanding loans for debt repayment in foreign currency substandard |

|

|

164 |

K31107 |

Outstanding loans for debt repayment in VND doubtful |

|

|

165 |

K31108 |

Outstanding loans for debt repayment in foreign currency doubtful |

|

|

166 |

K31109 |

Outstanding loans for debt repayment in VND potentially irrecoverable |

|

|

167 |

K31110 |

Outstanding loans for debt repayment in foreign currency potentially irrecoverable |

|

|

168 |

K312 |

Outstanding loans for investment in capital construction under the State plan |

|

|

169 |

K31201 |

Outstanding loans for investment in capital construction under the State plan in VND standard |

|

|

170 |

K31202 |

Outstanding loans for investment in capital construction under the State plan in foreign currency standard |

|

|

171 |

K31203 |

Outstanding loans for investment in capital construction under the State plan in VND that need special mention |

|

|

172 |

K31204 |

Outstanding loans for investment in capital construction under the State plan in foreign currency that need special mention |

|

|

173 |

K31205 |

Outstanding loans for investment in capital construction under the State plan in VND substandard |

|

|

174 |

K31206 |

Outstanding loans for investment in capital construction under the State plan in foreign currency substandard |

|

|

175 |

K31207 |

Outstanding loans for investment in capital construction under the State plan in VND doubtful |

|

|

176 |

K31208 |

Outstanding loans for investment in capital construction under the State plan in foreign currency doubtful |

|

|

177 |

K31209 |

Outstanding loans for investment in capital construction under the State plan in VND potentially irrecoverable |

|

|

178 |

K31210 |

Outstanding loans for investment in capital construction under the State plan in foreign currency potentially irrecoverable |

|

|

179 |

K313 |

Other outstanding loans |

|

|

180 |

K31301 |

Other outstanding loans in VND standard |

|

|

181 |

K31302 |

Other outstanding loans in foreign currency standard |

|

|

182 |

K31303 |

Other outstanding loans in VND that need special mention |

|

|

183 |

K31304 |

Other outstanding loans in foreign currency that need special mention |

|

|

184 |

K31305 |

Other outstanding loans in VND substandard |

|

|

185 |

K31306 |

Other outstanding loans in foreign currency substandard |

|

|

186 |

K31307 |

Other outstanding loans in VND doubtful |

|

|

187 |

K31308 |

Other outstanding loans in foreign currency doubtful |

|

|

188 |

K31309 |

Other outstanding loans in VND potentially irrecoverable |

|

|

189 |

K31310 |

Other outstanding loans in foreign currency potentially irrecoverable |

|

|

190 |

K314 |

Outstanding debts pending settlement |

|

|

191 |

K31401 |

Outstanding debts pending settlement in VND secured by foreclosed assets |

|

|

192 |

K31402 |

Outstanding debts pending settlement in foreign currency secured by foreclosed assets |

|

|

193 |

K31403 |

Outstanding debts in VND secured by the pledged assets which are related to a case pending litigation |

|

|

194 |

K31404 |

Outstanding debts in foreign currency secured by the pledged assets which are related to a case pending litigation |

|

|

195 |

K31405 |

Outstanding of unsettled debts in VND with security assets |

|

|

196 |

K31406 |

Outstanding of unsettled debts in foreign currency with security assets |

|

|

197 |

K31407 |

Outstanding of unsettled debts in VND without security assets and without debtor for debts recovery |

|

|

198 |

K31408 |

Outstanding of unsettled debts in foreign currency without security assets and without debtor for debts recovery |

|

|

199 |

K31409 |

Outstanding of unsettled debts in VND without security assets, but the debtor still exists and is operating |

|

|

200 |

K31410 |

Outstanding of unsettled debts in foreign currency without security assets, but the debtor still exists and is operating |

|

|

201 |

K315 |

Outstanding of frozen debts |

|

|

202 |

K31501 |

Outstanding short-term loans in VND frozen |

|

|

203 |

K31502 |

Outstanding short-term loans in foreign currency frozen |

|

|

204 |

K31503 |

Outstanding medium-term loans in VND frozen |

|

|

205 |

K31504 |

Outstanding medium-term loans in foreign currency frozen |

|

|

206 |

K31505 |

Outstanding long-term loans in VND frozen |

|

|

207 |

K31506 |

Outstanding long-term loans in foreign currency frozen |

|

|

208 |

K316 |

Outstanding loans for investment under trust undertaking contract |

|

|

209 |

K31601 |

Outstanding loans for investment under trust undertaking contract in VND standard |

|

|

210 |

K31602 |

Outstanding loans for investment under trust undertaking contract in foreign currency standard |

|

|

211 |

K31603 |

Outstanding loans for investment under trust undertaking contract in VND that need special mention |

|

|

212 |

K31604 |

Outstanding loans for investment under trust undertaking contract in foreign currency that need special mention |

|

|

213 |

K31605 |

Outstanding loans for investment under trust undertaking contract in VND substandard |

|

|

214 |

K31606 |

Outstanding loans for investment under trust undertaking contract in foreign currency substandard |

|

|

215 |

K31607 |

Outstanding loans for investment under trust undertaking contract in VND doubtful |

|

|

216 |

K31608 |

Outstanding loans for investment under trust undertaking contract in foreign currency doubtful |

|

|

217 |

K31609 |

Outstanding loans for investment under trust undertaking contract in VND potentially irrecoverable |

|

|

218 |

K31610 |

Outstanding loans for investment under trust undertaking contract in foreign currency potentially irrecoverable |

|

|

219 |

K317 |

Outstanding loans under financing contract |

|

|

220 |

K31701 |

Outstanding loans under financing contract in VND - standard |

|

|

221 |

K31702 |

Outstanding loans under financing contract in foreign currency standard |

|

|

222 |

K31703 |

Outstanding loans under financing contract in VND that need special mention |

|

|

223 |

K31704 |

Outstanding loans under financing contract in foreign currency that need special mention |

|

|

224 |

K31705 |

Outstanding loans under financing contract in VND substandard |

|

|

225 |

K31706 |

Outstanding loans under financing contract in foreign currency substandard |

|

|

226 |

K31707 |

Outstanding loans under financing contract in VND doubtful |

|

|

227 |

K31708 |

Outstanding loans under financing contract in foreign currency doubtful |

|

|

228 |

K31709 |

Outstanding loans under financing contract in VND potentially irrecoverable |

|

|

229 |

K31710 |

Outstanding loans under financing contract in foreign currency potentially irrecoverable |

|

|

230 |

K318 |

Settled outstanding loans of customer |

|

|

231 |

K31801 |

Loss of loans in VND being under supervision |

|

|

232 |

K31802 |

Loss of loans in foreign currency being under supervision |

|

|

III. INFORMATION OF LOAN SECURITY OF CUSTOMERS |

|||

|

233 |

K41 |

Pledge of trust |

|

|

234 |

K411 |

Working duration/number of working years |

|

|

235 |

K412 |

Position |

|

|

236 |

K413 |

Monthly average income |

|

|

237 |

K414 |

Credit limit |

|

|

238 |

K42 |

With security asset |

|

|

239 |

K4221 |

Asset code |

Being unique, no identical |

|

240 |

K422 |

Right of land use and assets tied to land |

|

|

241 |

K423 |

Means of transportation |

|

|

242 |

K424 |

Valuable papers |

|

|

243 |

K4241 |

Bond |

|

|

244 |

K4242 |

Share |

|

|

245 |

K4243 |

Bill |

|

|

246 |

K4244 |

Promissory note |

|

|

247 |

K4245 |

Deposit certificate |

|

|

248 |

K4246 |

Commercial paper |

|

|

249 |

K4249 |

Other paper valuated as money |

|

|

250 |

K425 |

Metal, precious stone |

|

|

251 |

K426 |

Machines, equipments, raw materials, goods |

|

|

252 |

K4261 |

Machines, equipments |

|

|

253 |

K4262 |

Production line |

|

|

254 |

K4263 |

Raw materials |

|

|

255 |

K4264 |

Consumer product |

|

|

256 |

K4269 |

Other goods |

|

|

257 |

K427 |

Other assets that have registered proprietary right and use right |

|

|

258 |

K4271 |

Asset right arising from copyright |

|

|

259 |

K4272 |

Industrial proprietary right |

|

|

260 |

K4273 |

Right of debt collection |

|

|

261 |

K4274 |

Right to be insured |

|

|

262 |

K4275 |

Right of capital contribution to enterprise |

|

|

263 |

K4276 |

Right of natural resource exploitation |

|

|

264 |

K4277 |

Income and rights arising from pledged asset |

|

|

265 |

K4279 |

Other right of assets |

|

|

266 |

K428 |

Other assets |

|

|

267 |

K429 |

Asset description |

|

|

268 |

K43 |

Date of pledge, mortgage |

|

|

269 |

K44 |

Actual date of release of mortgage |

making report after release of mortgage |

|

270 |

K45 |

Owner of asset |

In case of using asset of the third party for pledge, mortgage |

|

IV. INFORMATION OF THE GUARANTEE TO CUSTOMERS |

|||

|

271 |

K601 |

Guarantee code |

|

|

272 |

K602 |

Domestic customers |

Enterprise |

|

273 |

K6021 |

Arising date of guarantee |

|

|

274 |

K6022 |

Maturity date of guarantee |

|

|

275 |

K6023 |

Guaranteed amount |

|

|

276 |

K60231 |

VND |

|

|

277 |

K60232 |

Foreign currency converted into USD |

|

|

278 |

K603 |

International customers |

Enterprise |

|

279 |

K6031 |

Arising date of guarantee |

|

|

280 |

K6032 |

Maturity date of guarantee |

|

|

281 |

K6033 |

Guaranteed amount |

|

|

282 |

K60331 |

VND |

|

|

283 |

K60332 |

Foreign currency converted into USD |

|

|

284 |

K604 |

Payables in lieu of customers upon violating guarantee |

|

|

285 |

K6041 |

Arising date of debt |

|

|

286 |

K6042 |

Outstanding debts |

|

|

287 |

K60421 |

VND |

|

|

288 |

K60422 |

Foreign currency converted into USD |

|

|

289 |

K6043 |

Reason |

|

|

V. INFORMATION OF CONSUMER LOANS |

|||

|

290 |

K801 |

Purpose of loan capital use |

|

|

291 |

K80101 |

Purchase, repair, building of house |

|

|

292 |

K80102 |

Purchase, repair of means of transportation |

|

|

293 |

K80103 |

Study, tourism, disease treatment, |

|

|

294 |

K80104 |

Purchase of utensils |

|

|

295 |

K80199 |

Other consumer demands that do not violate applicable laws |

|

|

VI. INFORMATION OF CREDIT CARDS |

|||

|

296 |

K802 |

Credit limit of credit card |

|

|

297 |

K803 |

Violation of provisions on credit cards |

|

|

298 |

K804 |

Measures to deal with violation |

|

|

VII. INFORMATION OF CUSTOMER WHOSE TOTAL OUTSTANDING LOANS ARE EQUAL TO OR MORE THAN 15% OF THE OWN CAPITAL OF THE CREDIT INSTITUTION, OTHER ORGANIZATION ENGAGING IN BANKING ACTIVITY |

|||

|

299 |

K901 |

Own capital of CI |

As provided for in Decision No. 457/2005/QD-NHNN |

|

300 |

K902 |

Total outstanding loans (converted into VND) |

|

|

301 |

K903 |

Latest date of change in outstanding loans |

|

|

302 |

K904 |

Reason for overdraft |

|

|

303 |

K9041 |

Co-financing |

Making report on the part of attendant CI |

|

304 |

K9042 |

Designation by government |

|

|

305 |

K9043 |

Permission by the Governor of the State Bank |

|

|

306 |

K9044 |

Investment trust |

|

|

307 |

K9099 |

Other |

Cleary state the reason |

Note: Unit for VND is VND million and 1 USD for converted foreign currency.